As last week’s turmoil over tariffs and associated risks triggered by Donald Trump continued, a glimmer of hope emerged from Europe in the form of Germany’s stimulus package. A significant injection into Germany’s economy could also have a positive effect on the Euro. Additionally, a potential peace agreement in Ukraine could provide further momentum.

The German plan includes a €500 billion investment in infrastructure and an adjustment to the fiscal restrictions (the “debt brake”) currently enshrined in law.

A crucial date to watch is March 18, when the package will be put to a vote. Support from the Greens will be essential for its approval. This date was strategically chosen, as after March 25, the newly elected government will include more representatives from the AfD and other opposition parties, making it harder to secure the necessary two-thirds majority.

Current State of Affairs

According to the latest reports from last Friday, Merx has reached an agreement with the Greens. In exchange for allocating €100 billion to existing green and climate funds, the deal now appears to be finalized.

Other news from the U.S.

It was striking to see how the turmoil in U.S. equity markets resulted in an unprecedented wave of sell-offs. The current administration’s belief that import tariffs can stimulate local production and reform the domestic economy is facing increasing global skepticism.

Meanwhile, Elon Musk’s aggressive “DOGE policy” aimed at restructuring the government apparatus appears to be causing him significant trouble. His Tesla stock has plummeted by several dozen percentage points.

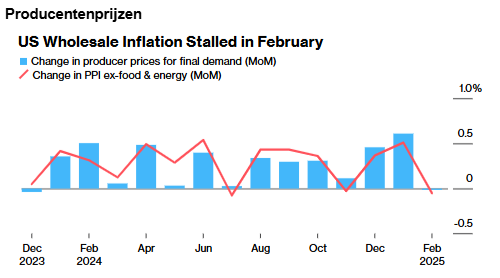

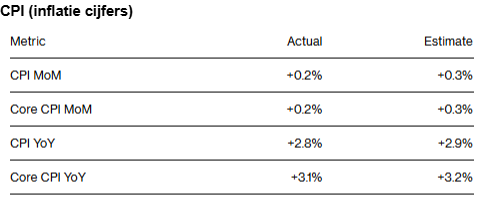

However, there were also some positive developments from the U.S. On Wednesday, inflation figures came in lower than expected—a welcome surprise given widespread concerns about tariff-induced price increases. Additionally, on Thursday, producer price data—a key leading indicator of inflation—showed 0% growth, despite analysts predicting a 0.3% increase. This suggests some relief from inflationary pressures.

In the details, food prices continued to rise, and categories affected by the 10% tariff on Chinese imports—such as steel, appliances, and household goods—saw significant price increases. However, the impact of these rising costs was somewhat offset by declining energy prices.

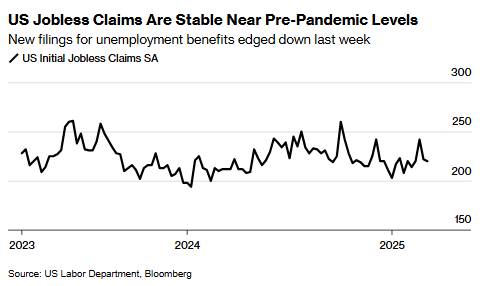

Additionally, the latest indicators suggest that the U.S. labor market remains largely unaffected by both the trade war and DOGE-related activities. Jobless claims came in lower than expected and have now returned to pre-COVID levels.

It is widely expected that the large-scale layoffs from DOGE will result in a significant influx of federal civil servants into the unemployment system. However, the timing of these layoffs remains uncertain, and it is unclear to what extent these displaced workers will transition into vacancies in the broader labor market.

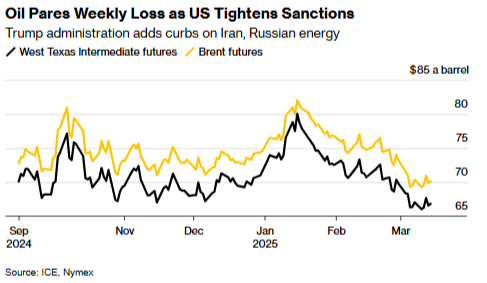

From our perspective, one key factor influencing price movements is market stabilization. After a period of economic uncertainty that weighed on oil prices, the oil markets now appear to be finding a stable footing. This is largely due to a new round of restrictions imposed by the U.S. on producers such as Iran and Russia.

This week ahead:

Today, we kick off with a data package from China, covering retail sales, industrial production, and an estimate of price trends in the real estate market. The latter remains a key concern for China’s economy following the Evergrande crisis, while sales data will also be closely watched. Xi Jinping has been pushing aggressively toward ambitious growth targets, and weaker-than-expected numbers could increase the likelihood of further stimulus measures.

In Europe, this week’s agenda is relatively light. On Tuesday, Germany’s ZEW institute will release a set of surveys and estimates providing insight into economic sentiment for both Germany and the broader EU. Toward the end of the week, we’ll get a flash estimate of European consumer confidence.

Meanwhile, attention will remain on the German parliament, where the government will attempt on March 18 to push through the fiscal adjustments needed to lift the budget brake. If the measure fails to pass, it will become significantly more difficult after March 25, when the newly elected government takes office. A potential failure of the plan could weigh on the EUR/USD, as the euro has recently been supported by expectations of these investments.

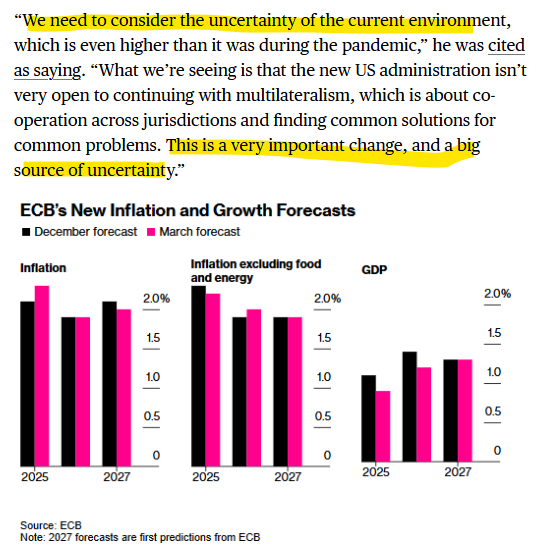

From the ECB, the forecast for economic growth this year stands at 0.9%. However, over the weekend, ECB board member De Quintos noted that consumer spending remains weak, likely due to rising economic uncertainty.

The main focus this week will be on Thursday’s Federal Reserve meeting. While we’ll receive a broad set of economic data on Monday and Tuesday—including key figures from the real estate market, retail sales, and trade prices—the Fed’s decision and economic outlook will be the highlight.

Although no immediate interest rate changes are expected, the meeting will also include the FOMC’s economic projections, and we will be closely watching the press conference. Of particular interest is the Fed’s assessment of the economic turmoil triggered by Donald Trump’s tariff policies and the expected impact in the coming quarters.

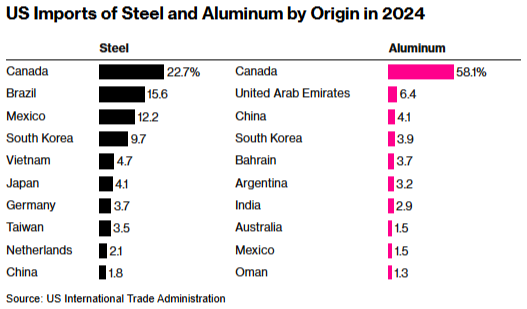

The first round of tariffs on steel and aluminum appears to have hit certain sectors particularly hard. The industries most affected so far include:

Furthermore, the tariffs appear to be specifically targeting product categories where the U.S. runs a trade deficit. These include well-known sectors such as smartphones and automobiles from Asia, as well as oil and raw materials from Canada, among others.

For a complete overview of the affected categories, you can refer to this report:

Bloomberg – U.S. Tariffs & Trade Deficit Overview

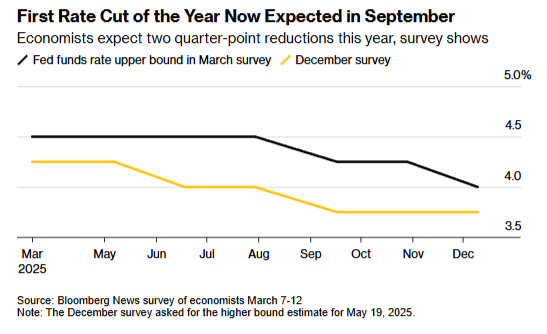

Based on recent surveys, the current expectation is for two interest rate cuts by the Fed this year—assuming economic conditions evolve as anticipated.

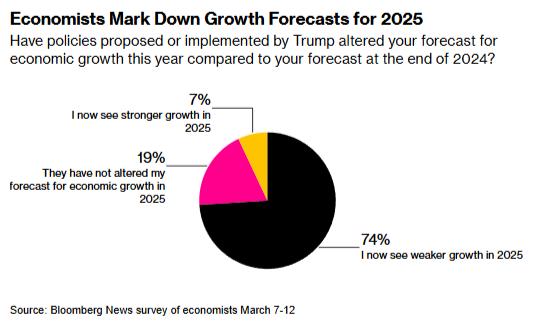

It is also interesting to note that, as a result of the trade tariffs, most analysts surveyed have revised their growth expectations downward while adjusting their inflation forecasts upward.

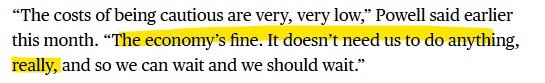

Jerome Powell’s statements were particularly telling, as they best encapsulated the Fed’s current stance: they don’t have to act just yet. The economy remains strong, and as long as inflation doesn’t rise significantly or clear warning signs emerge, the Fed will continue its wait-and-see approach to assess the impact of Trump’s policies.

Finally, the United Kingdom will also announce an interest rate decision on Thursday (no change expected), and we will closely follow all relevant information regarding the state of the economy there. From Japan, an interest rate decision and inflation figures (on Friday) will complete the economic data package. An interesting point here is how the low interest rate (0.5%) aligns with rising inflation (4%) and whether this upward trend will continue. A country that has faced historically low inflation for decades now seems to be experiencing a significant shift, with core inflation (excluding food, energy, etc.) reaching 3.2%

For now, our focus shifts to U.S. data and the all-important Fed interest rate decision on Thursday.

We’ll be keeping a close eye on developments—if you have any questions, feel free to reach out!

Economic Calendar for the Week

Monday

- China: Retail Sales, Industrial Production, House Price Index

- U.S.: Retail Sales, Business Inventories & NY Empire State Manufacturing Index

Tuesday

- Germany, EU: ZEW Economic Sentiment Index

- U.S.: Building Permits (preliminary), Housing Starts, Import & Export Prices, Industrial Production

Wednesday

- Japan: Trade Balance, Interest Rate Decision

- U.S.: FED Interest Rate Decision, FOMC Economic Projections, Press Conference

Thursday

- UK: Unemployment Rate, BOE Interest Rate Decision

- U.S.: Existing Home Sales

Friday

- Japan: Inflation Rate (4%?)

- UK: GfK Consumer Confidence

- EU: Consumer Confidence (flash)