After an eventful week, the EUR/USD surged by an impressive 4 cents, climbing from 1.045 on Monday to close near 1.085.

The first key driver, in our view, was Donald Trump. In his speech to Congress, he highlighted the “phenomenal” achievements of his administration. However, what stood out even more was the emerging narrative of “first the pain, then the reward.” The fact that the president himself acknowledged that “the economy will face some disruptions” was hardly encouraging for the currency.

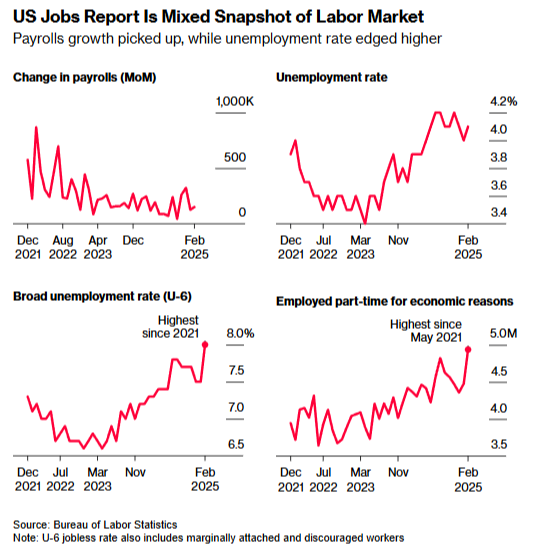

Next came a series of economic data releases that pushed the dollar lower. Disappointing Private Payrolls figures, followed by slightly weaker-than-expected Non-Farm Payrolls on Friday, signaled a cooling labor market. This slowdown could bring forward expectations of a Federal Reserve rate cut—an outlook that typically weakens the dollar. Additionally, Tuesday marked the implementation of tighter tariffs on Canada, Mexico, and China, further weighing on the USD

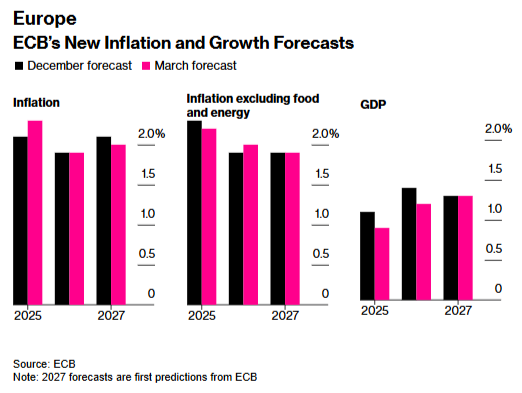

Meanwhile, in Europe, the ECB cut interest rates as expected, lowering them to 2.5%. However, the central bank indicated that it may take “slightly longer” to reach its 2% inflation target. A recalibration of inflation and growth forecasts also revealed that projections for 2025 are slightly higher than previously assumed.

In terms of economic growth, it was notable that while overall levels remain low, the outlook has improved slightly compared to previous expectations.

The biggest driver of Euro strength, however, came from Germany, where the CDU and SPD have begun initial steps toward forming a coalition. A key development was the announcement of planned changes to the country’s strict “debt brake,” which currently caps debt growth at 0.35% per year—a rule uniquely enshrined in the German constitution.

These adjustments are set to free up nearly €1.5 trillion, with defense spending excluded from the limits and €500 billion allocated to infrastructure investment.

This large-scale “spending spree” could have a significant impact on the economy, potentially driving growth and giving a strong boost to the Euro. However, we see inflation risks associated with such massive expenditures—but that remains to be seen.

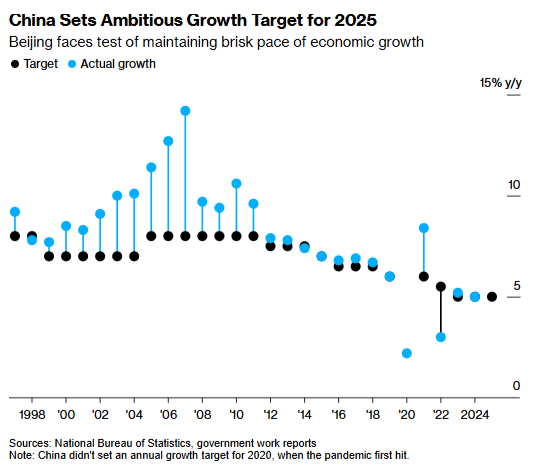

Lastly, in China, Xi Jinping announced economic growth plans for 2025, targeting 5% growth. Analysts generally believe that if further aggressive tariffs from Trump materialize, China will need to implement substantial stimulus measures to achieve this target

This Week:

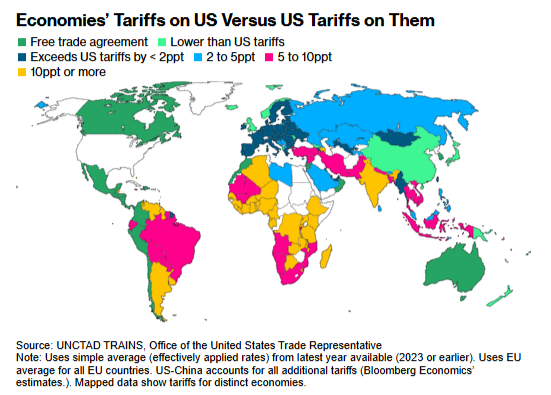

Toward the end of last week, Trump hinted that the U.S. will impose reciprocal tariffs on other countries. The principle? If a country has tariffs on the U.S., the U.S. will respond in kind. He specifically mentioned Canada, citing the lumber and dairy sectors, where action could come as soon as Friday.

What’s particularly noteworthy is that most countries already impose higher tariffs than the U.S. does. If Trump follows through, this could lead to widespread tariff hikes on nearly all countries with higher duties than the U.S.

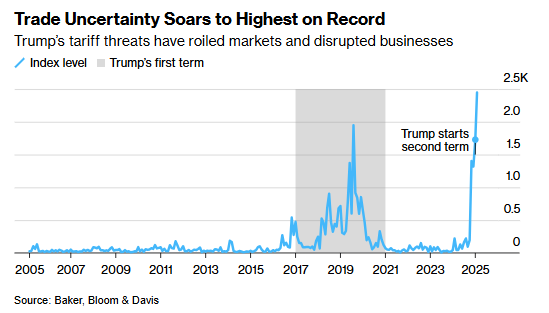

In short, anyone expecting calm to return after Tuesday’s tariff measures took effect will be disappointed. Trade uncertainty is reaching record highs, and further turbulence seems inevitable.

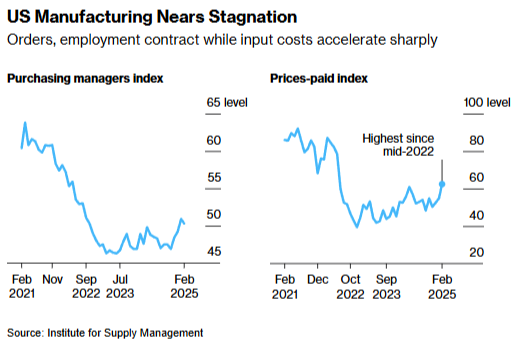

On Tuesday, we’ll be watching the JOLTS job openings report. According to Trump, while government jobs are declining, they should be replaced by high-quality manufacturing jobs.

However, based on the data, we remain cautious. So far, we see no signs of significant positive developments in the manufacturing sector. What is clear, however, is that manufacturing costs are rising—unsurprising given the current high inflation.

The Euro this week:

On Monday, we’ll be watching speeches from ECB Member Nagel, who is also scheduled to speak on Wednesday and Thursday. Lane (Wednesday), as well as Gahau and Quintos (Thursday), will also be making statements. With ongoing tensions in Ukraine, the recent ECB rate decision, and uncertainty surrounding Trump, there will be plenty of key topics to address.

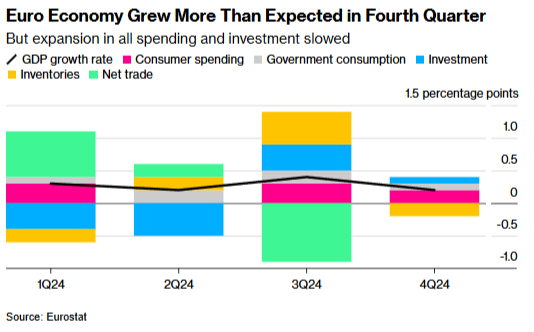

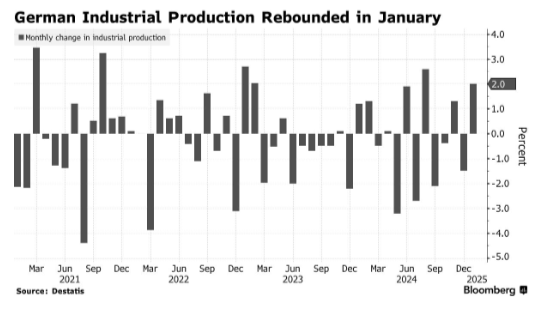

Monday also brings a fresh set of German economic data, including industrial production, trade balance, and export figures—setting the tone for the week. Later in the week, we’ll get German trade price and inflation data. On a broader European level, industrial production figures will be in focus, where we hope to see a small uptick following a weak economic quarter.

The headline German industrial production data kicked off on a positive note, showing 2% growth—beating expectations of 1.5%. Additionally, with the German government announcing a €500 billion infrastructure investment, the long-term outlook for the industrial sector has improved significantly. While the short-term impact may remain moderate, the medium- and long-term prospects look increasingly optimistic.

Final thoughts & upcoming events:

On Wednesday, we’ll get the U.S. inflation figures. With the labor market already showing signs of cooling, we hope to see a drop in inflation, which would provide the Fed with more flexibility to implement stimulus. However, given the numerous price increases across various sectors, there is the potential for a backlash.

From the UK, we’re particularly focused on Friday’s GDP figures and trade balance report, especially the trade relationship with the U.S.

To summarize: we’ll be watching German data, U.S. inflation, and speeches from several ECB members. On Wednesday, ECB President Lagarde will also speak. Friday brings UK economic data, including GDP and trade balance figures, along with insights into U.S. consumer sentiment and GDP growth.

There’s no shortage of developments to track! We’ll stay on top of things, and as always, feel free to reach out if you have any questions.

Key Events:

Monday

- DE: Trade balance, industrial production, export figures

- EUR: ECB Member Nagel speech

Tuesday

- US: JOLT job openings

Wednesday

- EUR: ECB Lagarde speech, ECB members Nagel & Lane

- US: Inflation rate, core inflation, PPI

Thursday

- EUR: ECB de Quintos, Galhau, Nagel

- EUR: Industrial production

Friday

- DE: Wholesale prices, inflation rate

- US: Michigan Consumer Sentiment Preliminary

- US: GDP development, trade balance (and UK <> EU trade)