After weeks dominated by geopolitics, interest rates, and monetary policy uncertainty, the focus shifts back to fundamentals this week: consumer confidence, spending, and inflation. The central question now is whether consumers can remain resilient in the face of mounting headwinds — or if the foundation of the global economy is beginning to weaken.

Europe – Inflation falls, but U.S. risks loom

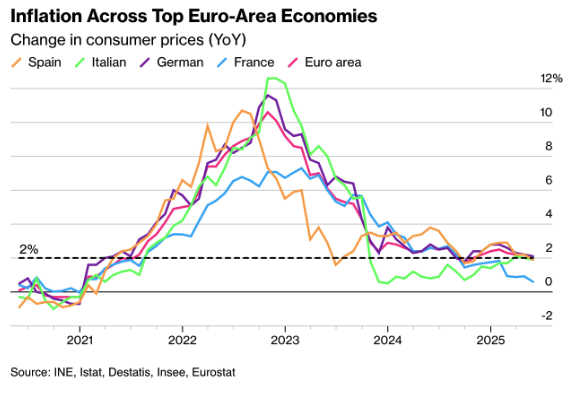

ECB President Christine Lagarde reiterated on Monday that the central bank remains on track for a rate cut on June 6, while cautioning that the U.S. interest rate outlook remains “a factor of concern.” This week’s inflation figures support the case for easing: Germany came in at 2.1%, Spain and Italy both at 1.9%, and France at just 0.6%. For the first time since 2021, all four major eurozone economies are seeing inflation below the 2% target.

At the same time, it’s becoming clear that the ECB won’t be enjoying a quiet summer. The eurozone economy is barely growing (May PMI: 49.5), and Germany faces the prospect of its third consecutive year of economic contraction. A potential 50% tariff from Donald Trump would hit Germany particularly hard— Capital Economics estimates it could reduce German GDP by 1.7% over three years.

There is some good news: wage inflation in the eurozone dropped to 2.4% in Q1, down from 4.1% in Q4 last year. ECB Chief Economist Philip Lane noted “clear signs of easing wage pressures.” Still, the Lithuanian central bank has warned of the risk of inflation falling below target.

The ECB must remain vigilant. While the easing cycle has begun, future rate cuts will depend heavily on geopolitical developments and the behavior of the euro — which strengthened slightly last week on the back of weaker U.S. economic data.

United States – Consumers rebound, businesses stay cautious

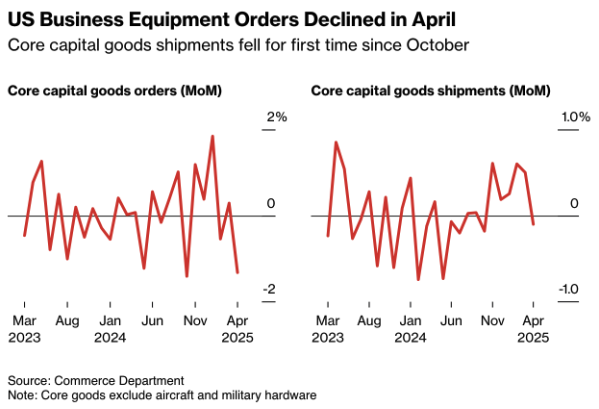

Durable goods orders dropped 6.3% in April, driven largely by a steep 51.5% plunge in aircraft orders. But the key takeaway lies in core capital goods orders (excluding defense and aviation), which fell by 1.3% — the sharpest decline since October. This suggests that business investment confidence is weakening, likely due to growing uncertainty surrounding Trump’s trade policies and potential changes to tax laws.

PCE inflation rose by 0.2% month-over-month in May, matching expectations but offering little evidence of easing price pressures. Personal spending also slowed to +0.2%, following a strong +0.7% gain in March—signaling that consumers are becoming more cautious.

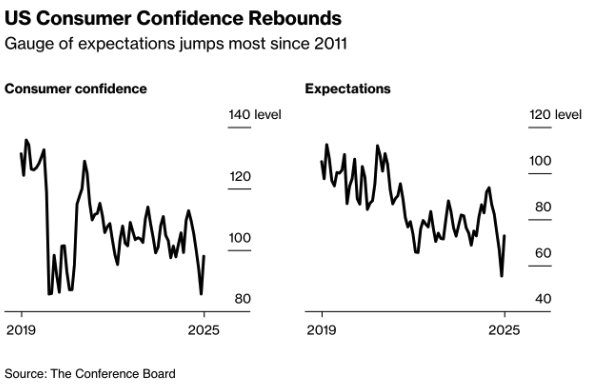

However, consumer confidence surprised to the upside. The Conference Board’s index jumped to 98, the highest level in a year, with the sharpest rise in expectations since 2011. The main catalyst: a trade truce with China and a retreat from the most aggressive tariff threats. The confidence boost was especially notable among Republican households.

United States – GDP revised down, Fed stays on hold

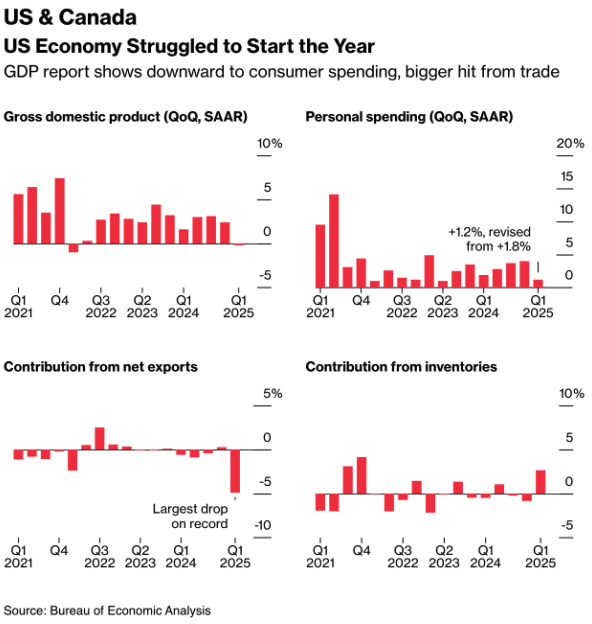

First-quarter GDP was revised down to just +1.3% growth, driven by weaker consumer spending (+1.2%) and a historically large drag from net trade (-4.9%). AI-related investment provided a partial offset, with the information technology sector contributing +1 percentage point to GDP growth—the highest on record.

Federal Reserve policy remains unchanged. The latest meeting minutes revealed internal divisions, and officials like John Williams and Neel Kashkari emphasized the need for more time to assess the full impact of higher interest rates. Jerome Powell’s speech at Princeton struck a neutral tone.

Asia – Deflation fears intensify

In China, industrial production grew 6.1% in April, beating expectations. However, consumer spending disappointed, with retail sales up just 5.1%, and the unemployment rate holding steady at 5.1%. Investment growth slowed to 4% (January through April), and housing prices continued to decline.

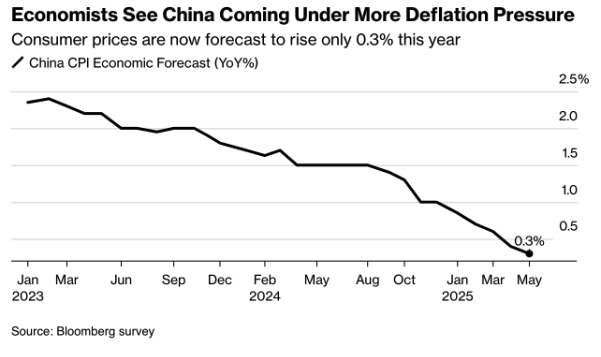

Deflation remains the dominant concern: consumer prices have been in negative territory for three consecutive months, and Bloomberg now forecasts inflation of just +0.3% in 2025—the lowest since 2009. Producer prices fell by 2%, and both wages and corporate profit margins are under increasing pressure.

Asia – Limited policy space in China, rate cuts elsewhere

The People’s Bank of China is expected to lower interest rates by just 10 basis points and cut the reserve requirement ratio by 50 basis points in the fourth quarter—highlighting the limited room for policy support. In a sign of intensifying competition, EV maker BYD slashed prices by 34% this week, signaling an escalating price war.

Elsewhere in the region, South Korea and New Zealand both cut their policy rates by 25 basis points to bolster growth. In Japan, inflation in Tokyo remained steady at 2.3%, while consumer confidence showed a modest rebound. However, retail sales remained weak, and the Bank of Japan continues to tread cautiously amid export pressures and subdued domestic demand.

Other – Canada surprises, India surges

Canada’s economy posted a stronger-than-expected Q1 growth rate of +2.7%, driven largely by a surge in exports ahead of the implementation of higher U.S. tariffs. India also exceeded expectations, growing by +7.4% in the first quarter—underscoring the country’s strong economic momentum.

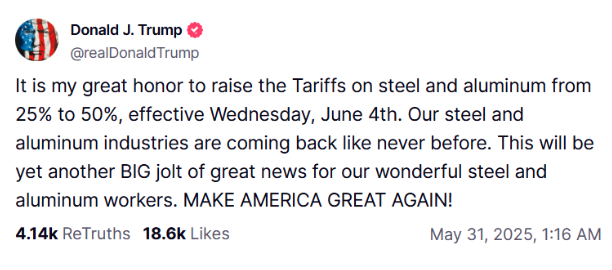

Finally, Donald Trump made headlines again on Friday afternoon, announcing a surprise move to double trade tariffs on steel and aluminum from 25% to 50%. Speaking at a rally at a U.S. Steel plant in Wisconsin, he once again caught markets off guard. For now, the EU has voiced its disapproval, and all eyes are on how markets will react after the weekend.

Conclusion

While inflation shows signs of easing, the foundations of global growth are under strain. Business investment is shrinking, consumers are becoming more cautious, and deflation risks—especially in China—are mounting. The ECB finds itself caught between structural economic weakness and growing geopolitical uncertainty. The Fed remains on hold, but markets are once again pricing in possible rate cuts later this year. Meanwhile, Donald Trump continues to dominate headlines with his headline-grabbing policy moves.

For next week:

The first week of June is shaping up to be anything but quiet. With the ECB meeting, U.S. jobs data, ISM indicators, and inflation reports from both Europe and Asia, this week could tip the balance of interest rate expectations. While rate speculation continues in the background, it’s the underlying fundamentals that will ultimately determine whether central banks can follow through on their rhetoric.

Europe – ECB cuts and sets the tone

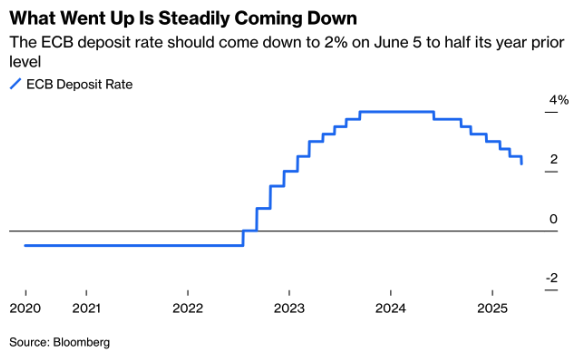

Thursday will be all about the ECB’s interest rate decision. Markets are fully pricing in a 25 basis point cut, which would lower the deposit rate to 2%—half the level it was just a year ago. The spotlight, however, is on the forward guidance: will this be a one-off move, or will President Lagarde leave the door open for further easing?

The ECB will also release updated growth projections, including scenarios that factor in a weakening global economy under potential Trump-era trade tariffs. On Friday, attention shifts to German trade data—closely watched for insights into sentiment around Europe’s struggling export engine.

United States – Jobs in focus, policy in the balance

The week starts with Monday’s ISM Manufacturing PMI. A slight uptick is expected, though the index is still forecast to remain below the 50 mark that separates expansion from contraction. Wednesday brings the ISM Services Index, which is critical for gauging the broader state of the U.S. economy.

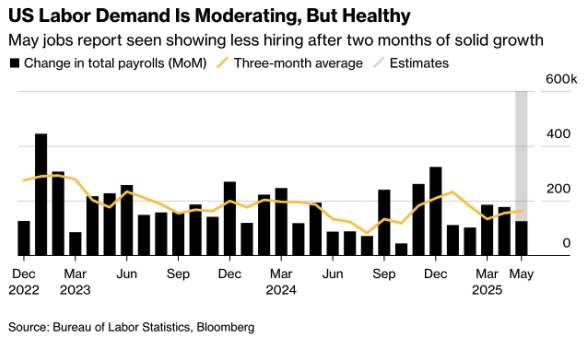

On Friday, all eyes will be on the U.S. jobs report. Economists expect around 125,000 new jobs, with the unemployment rate holding steady at 4.2%. Bloomberg warns of potential downside risks, particularly in the leisure and hospitality sector, raising the odds of a negative surprise.

In addition, the Fed will receive fresh input from Tuesday’s JOLTs report and its Beige Book release on Wednesday. Speeches from Fed officials Waller, Cook, and Kugler throughout the week could also help shape the policy narrative. Investors will be watching closely for any hints regarding the upcoming June 12 FOMC meeting.

Asia – Searching for growth momentum

Asia begins June with a wave of critical data on inflation, trade, and manufacturing. Reports from Japan, India, and China will shed light on how the region is navigating an environment of weakening price pressures and fragmented global demand.

China leads off on Tuesday with the Caixin Manufacturing PMI, followed by the Services and Composite PMIs on Thursday. After months of a fragile recovery, the key question is whether domestic momentum can be sustained—or whether deflationary pressures will make a return.

Trade and manufacturing data are also in focus. On Sunday, South Korea—often viewed as a bellwether for global demand—reported a 1.3% year-over-year decline in export value for May. This may signal that the brief rebound following tariff adjustments is already beginning to fade.

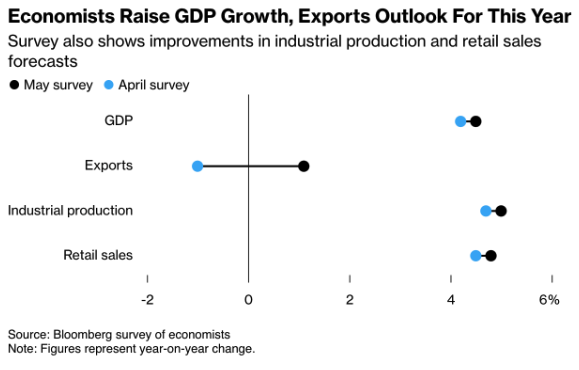

Meanwhile, economists are cautiously revising up their 2025 growth forecasts. Recent Bloomberg surveys show upgrades to projections for exports, industrial output, and retail sales across the region. Still, these improvements come against the backdrop of persistent deflation concerns.

Australia kicks off the week with the release of RBA meeting minutes on Tuesday, followed by Q1 GDP data on Wednesday and trade figures on Thursday. Growth is expected to be flat at around 0.2%, adding pressure on the central bank to respond.

In India, a rate cut is anticipated on Friday as inflation continues to ease. Japan will publish unemployment and trade data, but is expected to stay on the sidelines in terms of policy action—as long as the yen remains weak and domestic demand subdued.

Macroeconomic Calendar – Week Ahead

Monday

- United States: ISM Manufacturing PMI

Tuesday

- Australia: RBA Meeting Minutes

- China: Caixin Manufacturing PMI

- Eurozone: Flash Inflation Rate (YoY)

- United States: JOLTs Job Openings

Wednesday

- Australia: Q1 GDP Growth Rate (QoQ)

- United States: ISM Services PMI

Thursday

- Australia: Balance of Trade

- Eurozone: ECB Deposit Rate Decision, Interest Rate Decision, Press Conference

Friday

- Germany: Trade Balance

- United States: Non-Farm Payrolls, Unemployment Rate