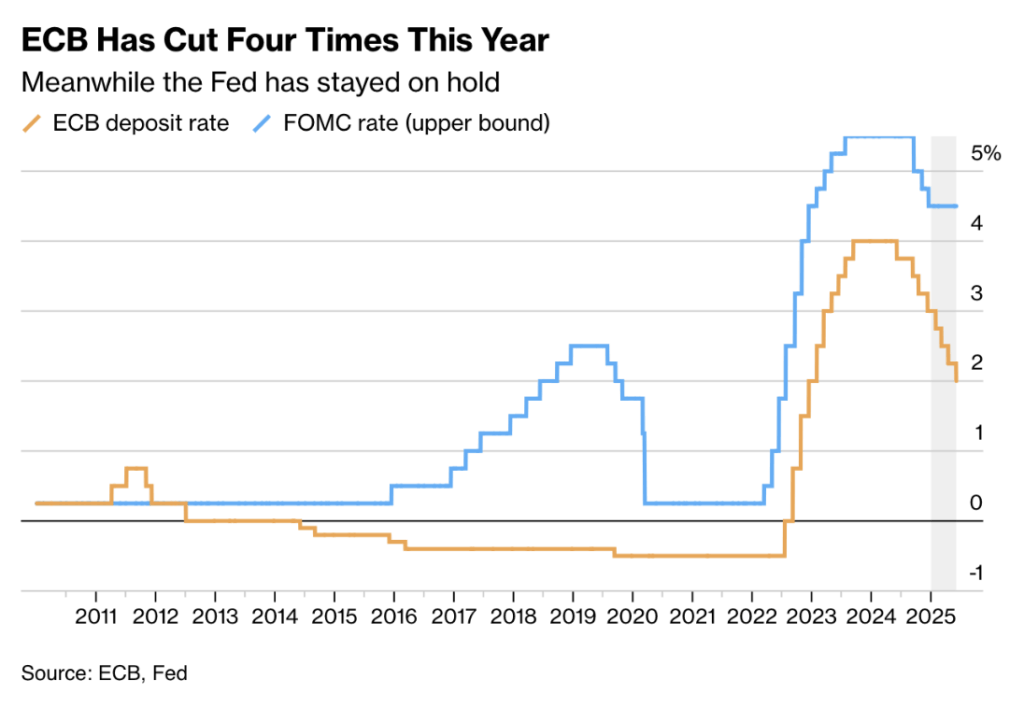

The first week of June was marked by central bank decisions, labor market surprises, and rising geopolitical tensions. The ECB moved ahead with a rate cut, while the Fed held steady.

In the U.S., the labor market delivered a strong upside surprise with solid job gains, in contrast to Europe’s fragile growth trajectory. At the same time, the euro’s international standing is on the rise — a reflection of both domestic resilience and waning global confidence in U.S. policy.

Europe – ECB cuts rates, signals the cycle may be near its end

As widely anticipated, the European Central Bank cut its deposit rate by 25 basis points to 2%. This marks the first reduction since rates peaked at 4% in 2023 — and the eighth cut in the current easing cycle. However, the ECB struck a cautious tone, suggesting that further cuts are far from guaranteed.

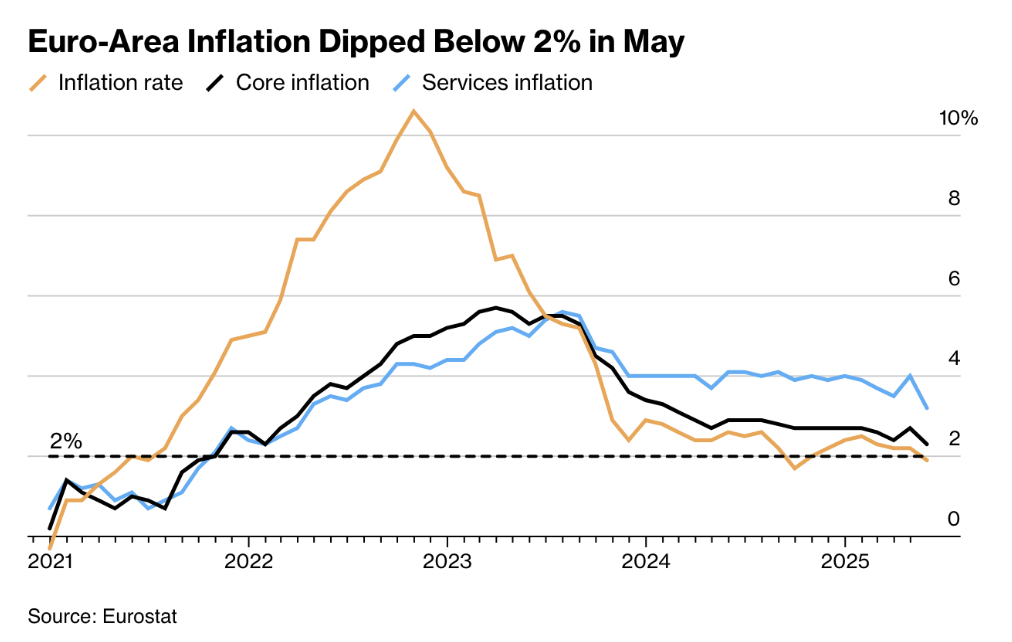

Eurozone inflation fell to 1.9% in May, dipping below the ECB’s 2% target for the first time since 2021. While this gave policymakers the confidence to move ahead with a rate cut, it wasn’t enough to prompt any firm commitments on future actions.

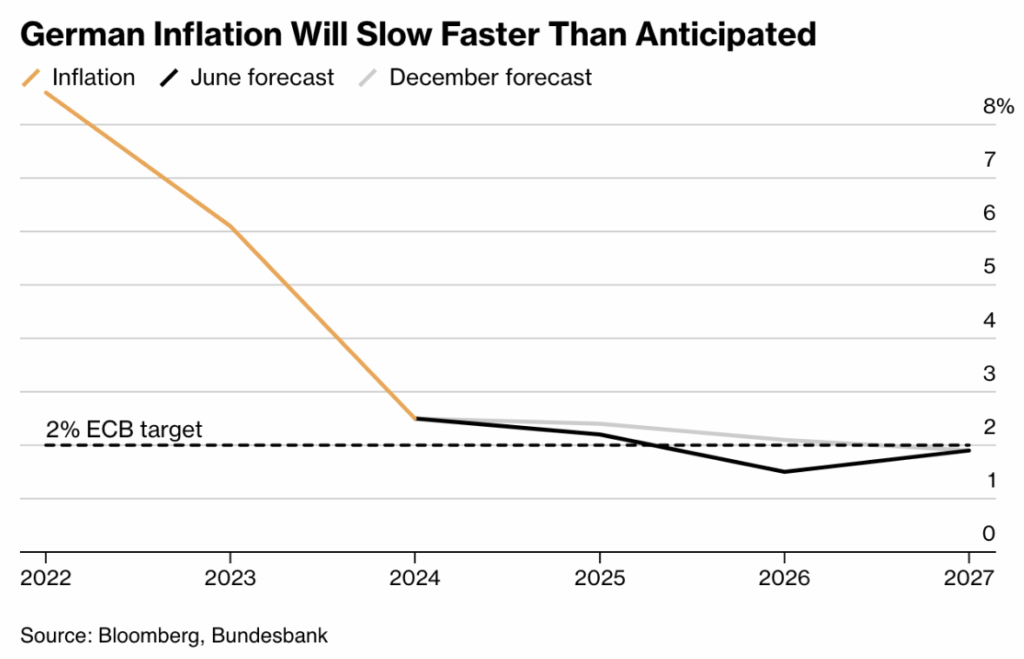

The ECB’s new projections show inflation declining to 1.6% in 2026 before returning to the 2% target in 2027. Growth is expected to pick up gradually, though it remains vulnerable to external shocks.

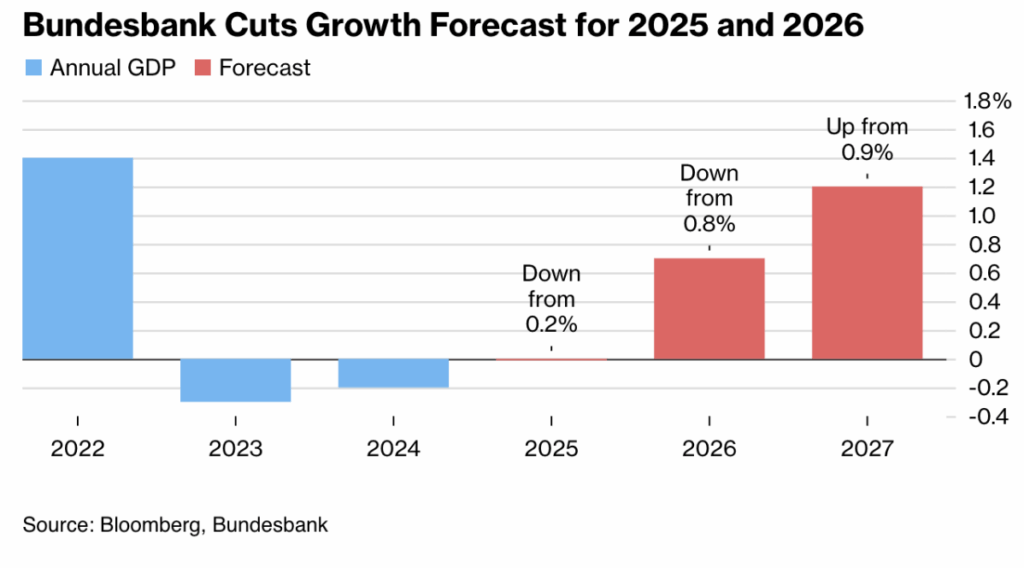

Bundesbank President Joachim Nagel cautioned that proposed U.S. tariffs under a potential second Trump administration could severely impact German exporters. The Bundesbank now forecasts economic stagnation in 2025, revising its previous projection of +0.2% growth. This would mark a potential third consecutive year without economic expansion, with downside risks increasing if trade tensions escalate. A rebound in 2026 hinges largely on infrastructure investment and higher defense spending.

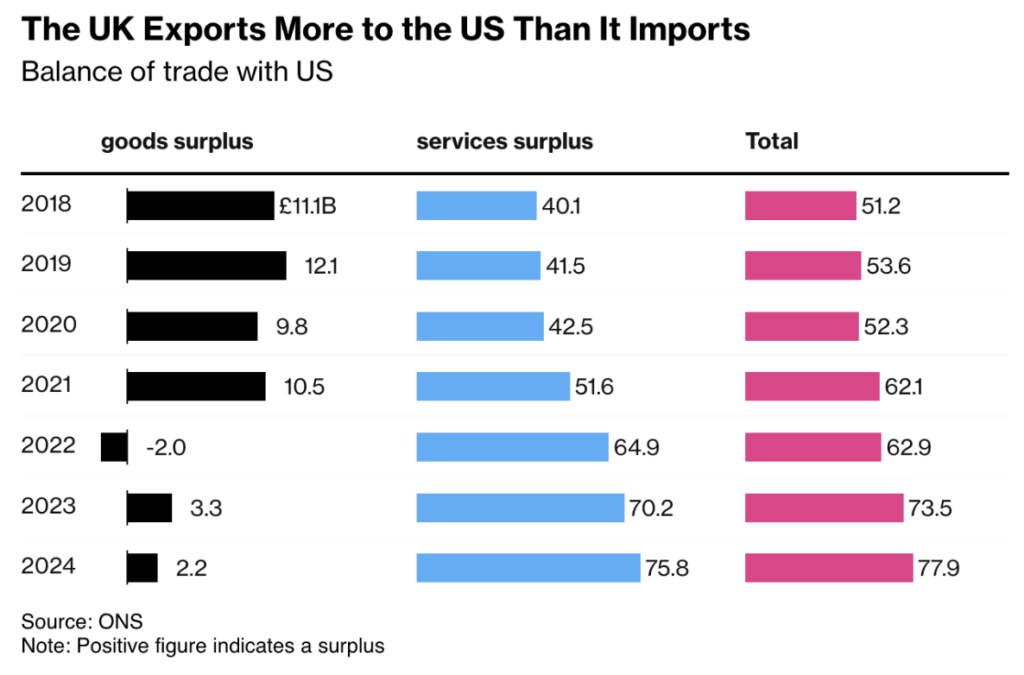

UK – Trade Surplus Under Threat

The UK consistently runs a trade surplus with the U.S., exporting more than it imports — heightening the urgency for a trade agreement. Labour leader Keir Starmer’s push to secure a deal with Donald Trump within two weeks, under the proposed “Economic Prosperity Framework,” is facing mounting pressure. Trump has threatened to double tariffs on British steel and aluminum to 50% starting July 9.

UK – Trade Risks Mount Amid U.S. Tariff Threats

Tata Steel UK is unable to meet U.S. rules of origin due to the closure of its blast furnaces, putting its exports at risk. British industry leaders and trade unions are warning of potential production losses and job cuts if a trade deal isn’t reached.

Despite the UK’s trade surplus with the U.S., it remains highly exposed to Trump’s unilateral trade approach. Without an agreement, the UK would face significant disadvantages. Starmer’s negotiating position is further weakened by the absence of a unified European stance.

United States – Jobs Surprise, But the Fed Stays Cautious

The U.S. labor market outperformed expectations in May, adding 139,000 jobs compared to the forecast of 125,000. However, the headline figure masked a more mixed picture: previous months were revised downward, and job creation in sectors like leisure and hospitality stalled. The unemployment rate held steady at 4.2%, while monthly wage growth remained modest at 0.3%. The overall message: the economy is not stalling, but growth remains fragile.

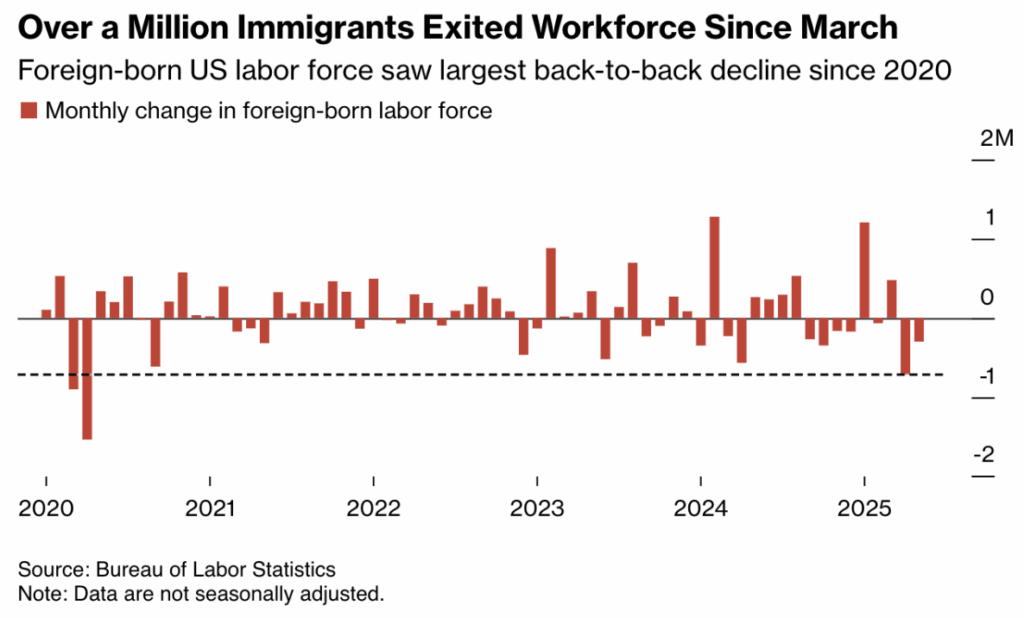

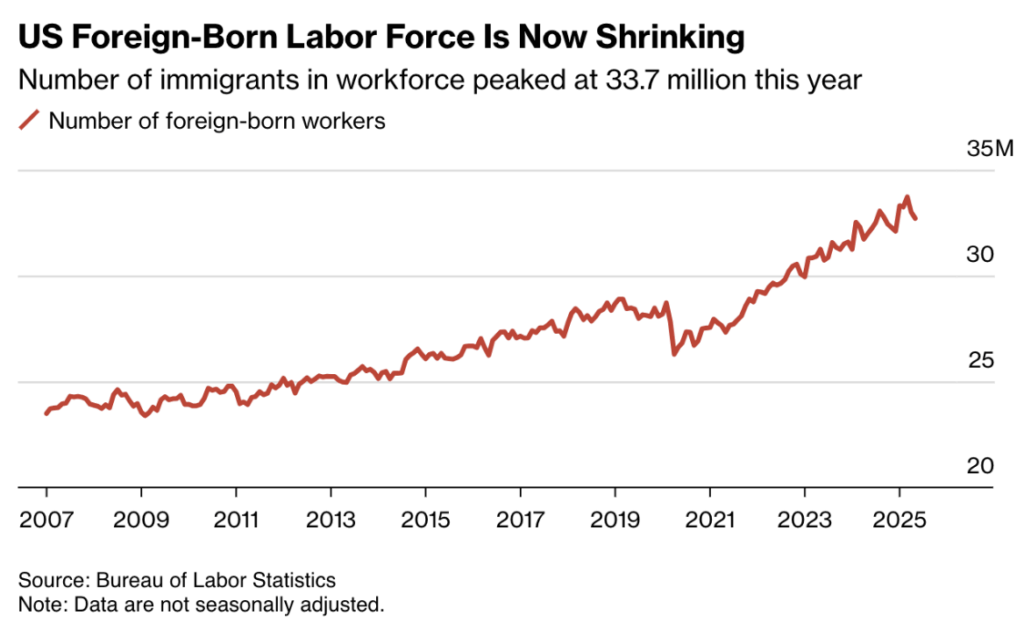

Beneath the stable unemployment rate lies a deeper trend — the U.S. labor force contracted in May, driven in part by the steepest two-month drop in foreign workers since 2020. Since March, more than a million immigrants have exited the labor market. With Trump’s intensified deportation efforts and stricter border policies, this trend appears likely to persist.

This shift is reducing the so-called breakeven level — the number of jobs needed each month to keep unemployment stable. According to Morgan Stanley, that figure has now fallen to around 90,000 and could approach zero if deportations continue to rise. While this helps keep the unemployment rate low even amid modest job growth, it also distorts the labor market picture for policymakers.

This places the Fed in a difficult position: slowing job growth and a shrinking labor force on one hand, and rising price pressures from tariffs and wages on the other. It’s a classic dilemma between the Fed’s dual mandates — maintaining price stability and ensuring full employment.

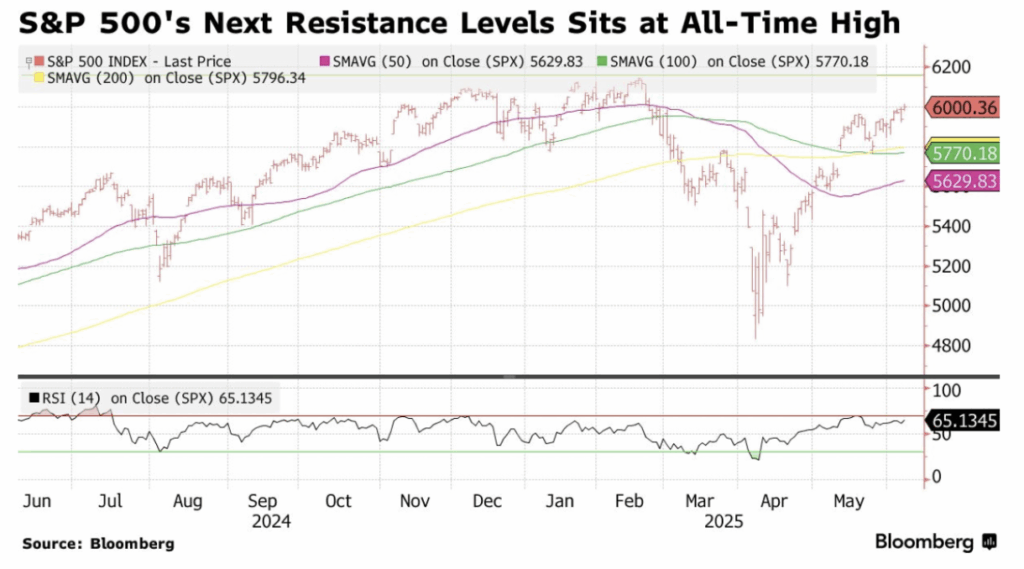

Still, the news was enough to reassure investors. The S&P 500 closed above 6,000 on Friday for the first time since February, buoyed by a combination of solid economic data and renewed optimism over U.S.-China relations. Trump announced that trade talks with China will resume in London on June 9, raising hopes for a potential delay or softening of his latest tariff measures.

“Payrolls beat expectations and the unemployment rate held steady — that’s bullish for the day,” said Kevin Brocks of 22V Research.

Technical momentum is also playing a role. The S&P 500 is moving toward its all-time high of 6,150, with cyclical stocks and semiconductors leading the charge. Tesla gained 3.8% on Friday, rebounding from earlier losses triggered by a public clash between Elon Musk and President Trump. Meanwhile, the Nasdaq 100, Dow Jones, and Russell 2000 all posted gains of around 1%.

Why does this matter for the currency market?

Because stronger data is once again pushing back expectations for rate cuts. Markets are now pricing in a “later rather than sooner” approach from the Fed.

That said, signs of economic cooling are emerging:

- JOLTs: Job openings dropped to 8.06 million, the lowest level since 2021

- ISM manufacturing remained in contraction territory at 48.7

- ISM services fell more sharply than expected to 53.8

The Fed meets on June 12 and is likely to remain in wait-and-see mode. Uncertainty around Trump’s trade, tax, and immigration agenda complicates the outlook. The mix of solid wage growth and a shrinking labor supply adds to the policy challenge, making the Fed’s next move harder to predict.

Currency & Euro Outlook – Geopolitics Shifting in Europe’s Favor

The euro found unexpected support last week from geopolitical dynamics and central bank commentary. ECB board member Isabel Schnabel spoke of a “window of opportunity” to strengthen the euro’s international role. Christine Lagarde echoed that sentiment, suggesting that Trump’s protectionist stance could actually boost the euro’s appeal as a reserve currency. Both the Bundesbank and the Bank of Spain also signaled that the euro could increasingly rival the dollar — provided Europe maintains both political stability and economic strength.

ECB Explores Joint EU Debt Issuance

The ECB is also considering further joint EU debt issuance as a way to reinforce the euro’s global position.

Outlook

All eyes now turn to the June 12 FOMC meeting. The Fed is widely expected to keep interest rates unchanged, but the tone of Jerome Powell’s remarks will be key for market direction. Meanwhile, upcoming European data — including the German ZEW index and French inflation — will shape the ECB’s outlook. The EUR/USD continues to be pulled between diverging monetary policy paths and shifting geopolitical dynamics.

Looking Ahead – Inflation Expectations and Central Bank Patience in Focus

Following a week dominated by central banks, the spotlight now shifts to a key question: how are global inflation expectations evolving, and can the Federal Reserve afford to remain patient? Upcoming data from the U.S., UK, China, and Australia will offer a broad picture of the global economic landscape shaping both policy decisions and market sentiment. Eurozone and UK wage data, central bank commentary, and geopolitical developments — particularly tariff risks — will also be closely watched.

Europe – UK GDP, Wage Pressures, and Manufacturing Under Scrutiny

In the UK, markets will focus on Tuesday’s unemployment figures and Thursday’s monthly GDP release. After the jobless rate rose to 4.4% in April, expectations are for it to stabilize this week. Meanwhile, wage growth is drawing increased attention, as it will play a crucial role in determining the Bank of England’s policy stance at its August meeting.

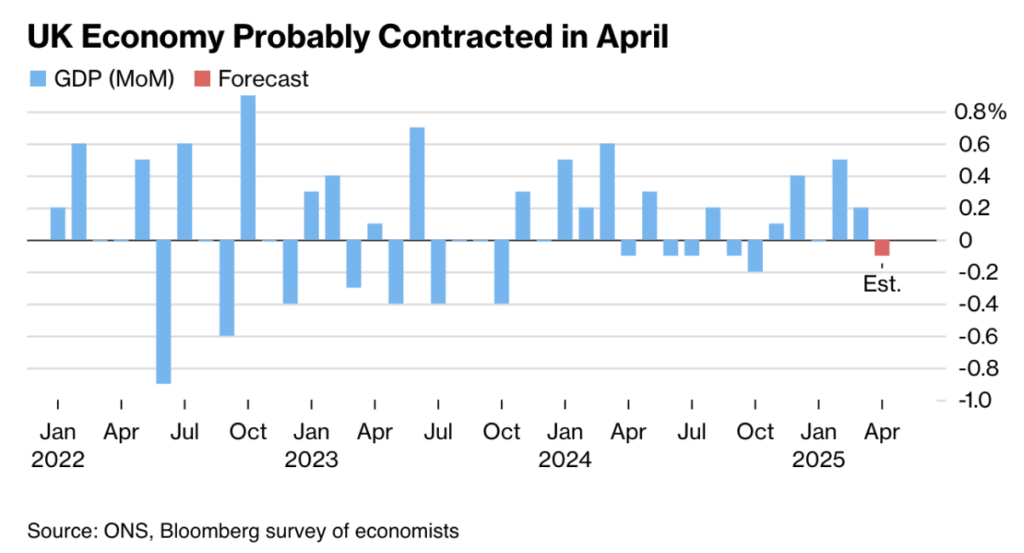

Prime Minister Starmer’s government is aiming to regain economic momentum through an ambitious investment agenda. However, the data may not be on his side — a 0.1% GDP contraction is expected for April, raising questions about the underlying strength of the recovery.

Eurozone – Wages, Trade, and ECB Communication in the Spotlight

On Wednesday, the eurozone will release an updated version of the ECB’s wage indicator — a key input following the recent rate cut. Markets will be watching closely to assess whether wage trends support further easing or warrant caution.

Manufacturing and trade data arrive on Friday, offering a first glimpse into whether Trump’s tariff announcements have already impacted eurozone exports in April.

Throughout the week, several ECB officials — including Isabel Schnabel, Philip Lane, and Luis de Guindos — are scheduled to speak, as the central bank looks to clarify its policy path after delivering its first rate cut of 2025.

United States – CPI Marks a Crucial Test for Fed Policy

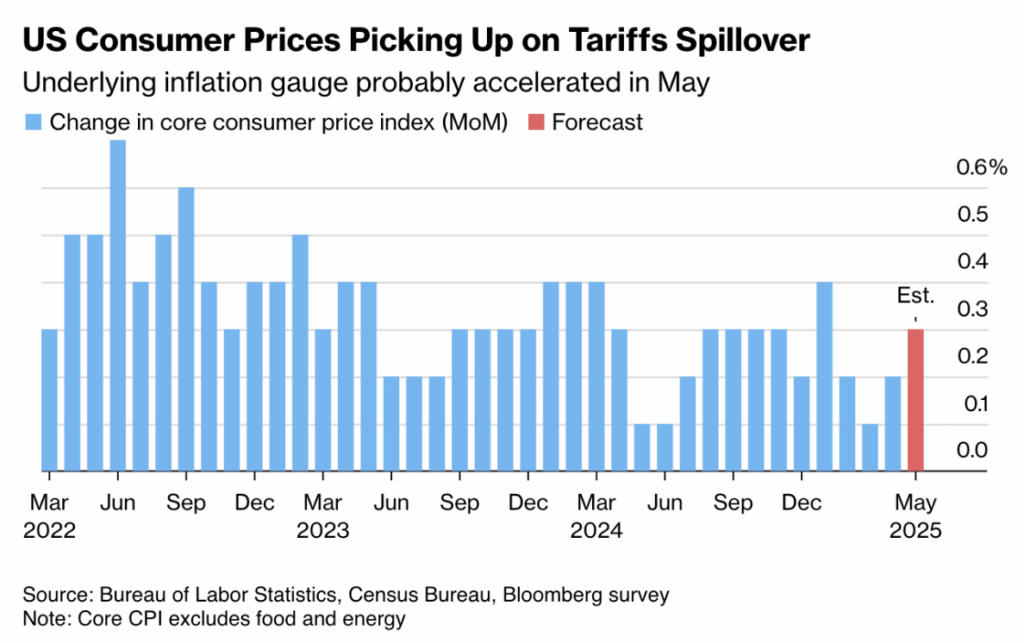

U.S. inflation data, due Wednesday, will be the centerpiece of the week. Core CPI is expected to rise by 0.3% month-over-month and 2.9% year-over-year — the first annual uptick in 2025, driven in part by rising import prices. Headline CPI is projected to increase by just 0.1% MoM and 3.2% YoY, helped by declining energy costs.

The figures will be pivotal in shaping the Fed’s stance heading into the June 12 FOMC meeting.

Bloomberg notes a “partial pass-through of tariffs” in categories like clothing, furniture, and auto parts. In contrast, price pressures are easing in discretionary services such as air travel and recreation. Key data later this week includes producer prices (PPI) and weekly jobless claims on Thursday, followed by the preliminary University of Michigan Consumer Sentiment Index on Friday. The Fed will be particularly focused on household inflation expectations in that report.

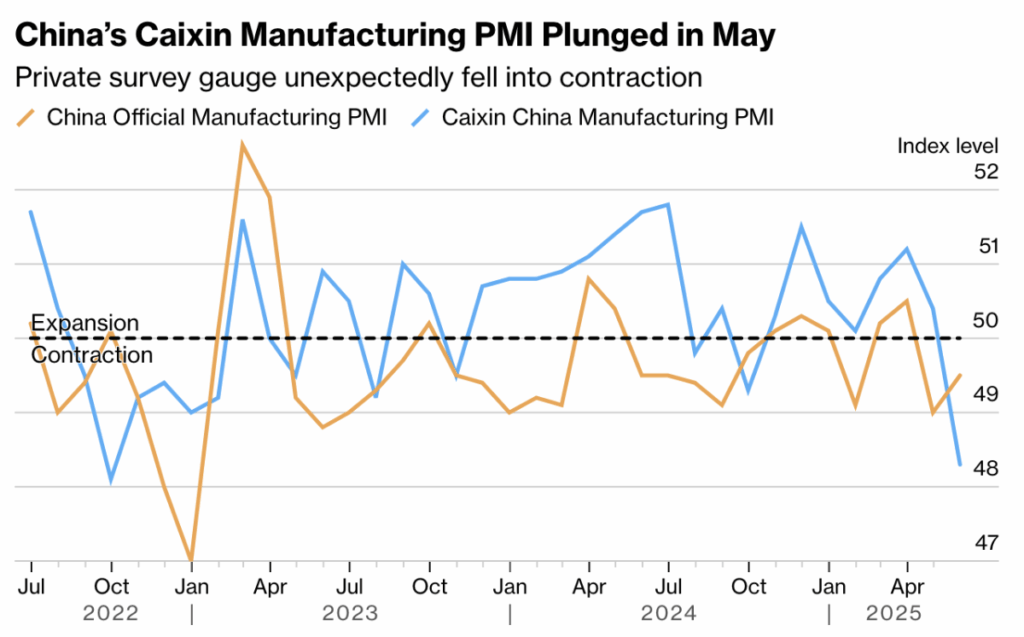

China – deflation risk and export tensions

On Monday, China will release data on inflation, exports, imports, and the trade balance. After months of deflationary concerns, consumer prices (CPI) are expected to rise slightly to +0.4% year-over-year in May. However, factory gate prices (PPI) are likely to remain under pressure, with another decline of around -3% anticipated.

Export growth is expected to slow to around +6%, with particular attention on trade with the United States, which dropped by 21% in April. At the same time, domestic demand in China remains fragile, and there is growing concern that the stimulus measures introduced in the first quarter may not gain sufficient traction.

Australia – Confidence Under Pressure

Australia will release Westpac consumer confidence and NAB business sentiment data on Tuesday. Weak first-quarter GDP growth of just +0.1%, combined with declining consumer spending, is weighing on sentiment. A further deterioration in confidence could push the Reserve Bank of Australia toward policy easing—especially if global inflationary pressures continue to decline.

Macroeconomic Calendar – Upcoming Week

Monday

- China: Inflation rate (YoY), Exports (YoY), Imports (YoY), Trade balance

Tuesday

- Australia: Westpac Consumer Confidence, NAB Business Confidence

- United Kingdom: Unemployment rate

Wednesday

- United States: Core Inflation (MoM, YoY), Headline Inflation (MoM, YoY)

Thursday

- United Kingdom: GDP (MoM)

- United States: Producer Price Index (MoM)

Friday

- United States: Preliminary Michigan Consumer Sentiment