US: Softer Inflation Data Further Lowers Rate Expectations

US inflation came in below expectations again in June, reinforcing market expectations for rate cuts. Core CPI (which excludes food and energy) rose just 0.1% month-on-month, compared to the 0.3% that had been forecast. On a year-over-year basis, core inflation slowed to 2.8%, slightly below the expected 2.9%, while headline inflation held steady at 2.4%.

A key detail: prices for core goods (excluding food and energy) were unchanged, while services prices excluding energy rose by just 0.2%.

Markets reacted swiftly—Treasury yields fell, the dollar weakened, and the likelihood of a Fed rate cut in September jumped to 75%. Interest rate swaps now imply a total of 62 basis points in cuts by the end of 2025.

Fed Faces Mounting Pressure as Political Undercurrents Stir Uncertainty

During his congressional testimony, Fed Chair Jerome Powell struck a cautious tone, stating, “Inflation is cooling, but we don’t want to take any hasty steps.” Nonetheless, the pressure for rate cuts is building. Other Fed officials, including Michelle Bowman and Christopher Waller, have become increasingly open to the possibility of easing as early as July or September.

Adding to the tension are reports that Donald Trump is considering announcing Powell’s successor before September. Potential names being floated include Waller, Kevin Hassett, and David Malpass. The idea of a “shadow Fed chairman” threatens to undermine the central bank’s independence and is fueling speculation about a more politically driven path toward faster rate cuts.

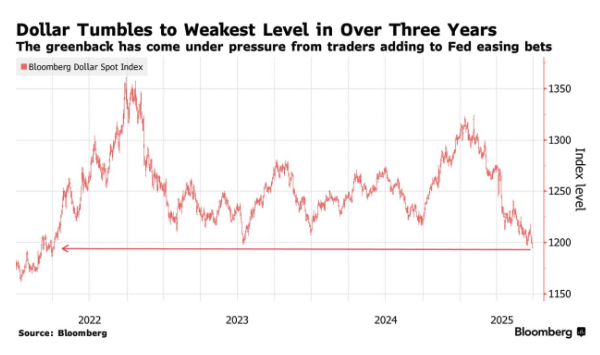

Markets are reacting accordingly. The 2-year Treasury yield dropped 20 basis points last week to 3.75%—its lowest level in seven weeks. Meanwhile, the Bloomberg Dollar Spot Index fell 0.6%, hitting its lowest point in over three years.

The combination of soft inflation data, rising political pressure, and growing uncertainty around monetary policy is weighing heavily on the dollar. The key question now is whether the currency can reclaim its safe-haven appeal should tensions in the Middle East escalate further.

Europe: ECB Strikes a Cautious Tone Amid Lingering Uncertainty

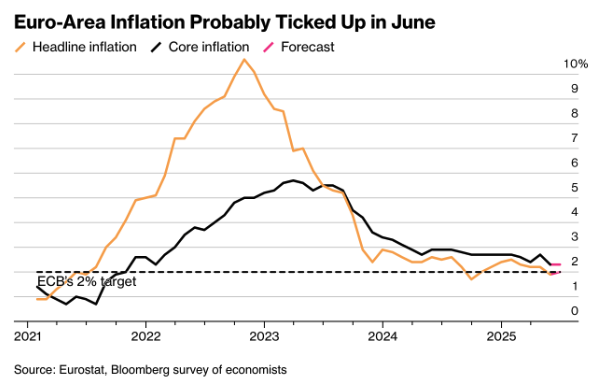

The European Central Bank maintained a notably cautious stance this week. In an interview with the Financial Times, ECB Governing Council member Klaas Knot emphasized that the central bank may need to keep policy tight “for an extended period.” While he didn’t rule out another rate cut, he stressed that “much more clarity” is needed on how trade tensions and energy prices are feeding through to inflation before any further steps can be taken.

Similarly, Vice President Luis de Guindos noted in a speech in Spain that recent geopolitical tensions with Iran do not yet justify a reassessment of the inflation outlook. The ECB still views the disinflation process as “on track” toward the 2% target.

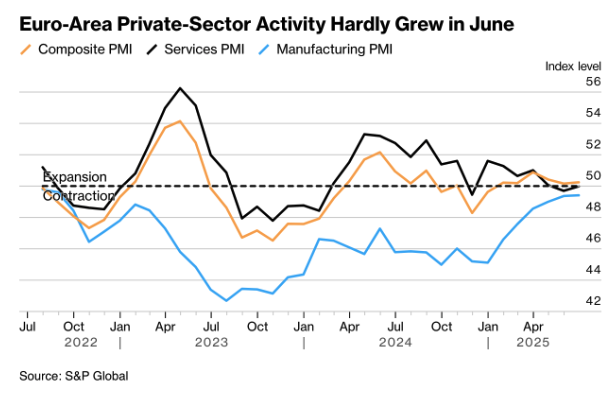

Recent economic data provide little urgency for additional easing. The eurozone’s composite PMI came in at 50.2, just below the 50.5 forecast. The services sector returned to the neutral 50 mark, up from 48.9 in May, while manufacturing remained weak at 49.4—marking the 36th consecutive month of contraction.

Country-level dynamics remain mixed. Germany showed a positive surprise with signs of accelerating growth, while France continues to lag below the 50 threshold.

The eurozone economy is barely expanding, but inflation appears to be under control for now. Further rate cuts are unlikely before the fall—assuming oil prices remain stable and geopolitical risks don’t escalate.

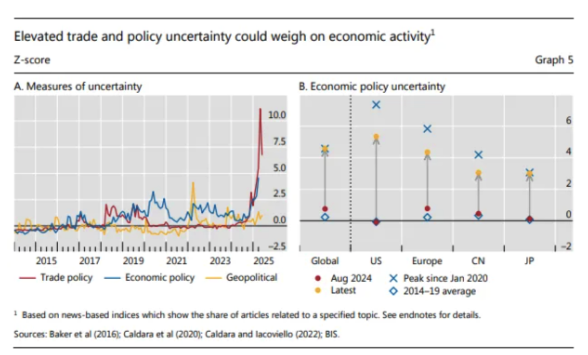

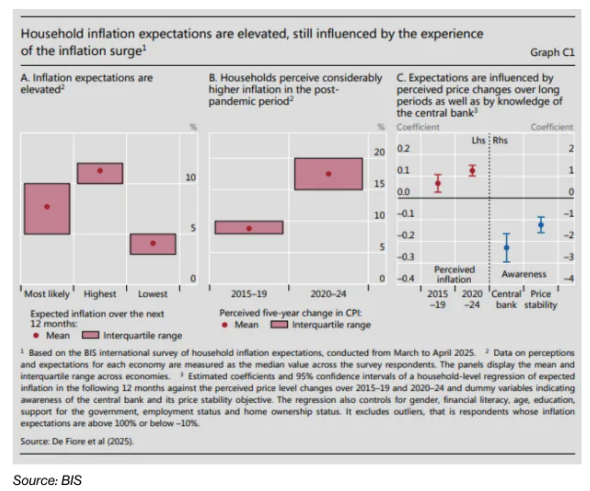

According to the Bank for International Settlements (BIS), however, a new chapter of inflation may be on the horizon—driven in large part by Trump’s protectionist policies. In its annual report, the BIS warns of a scenario marked by higher inflation combined with weaker economic growth.

Outgoing BIS General Manager Agustín Carstens warned that rising global debt levels and growing political pressure on central banks could undermine market “confidence.”

UK: Political Turmoil Fuels Market Uncertainty

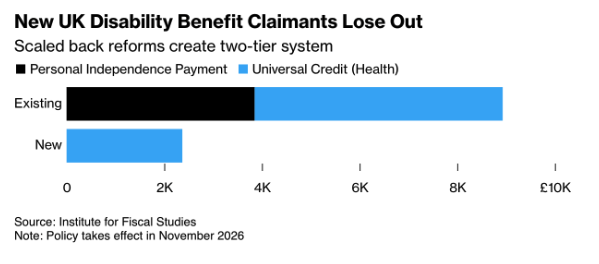

The Labour government faced renewed challenges this week as Prime Minister Keir Starmer was forced to scrap a planned £3 billion cut to disability benefits following pressure from over 120 party members. This marks the second major policy reversal in a short span—earlier, the government abandoned plans to reform the winter fuel allowance for pensioners, forfeiting an estimated £1.25 billion in potential savings. The setbacks are raising concerns over the government’s fiscal credibility and fuelling broader market unease.

UK: Fiscal Credibility at Risk as Pressure Mounts on Chancellor Reeves

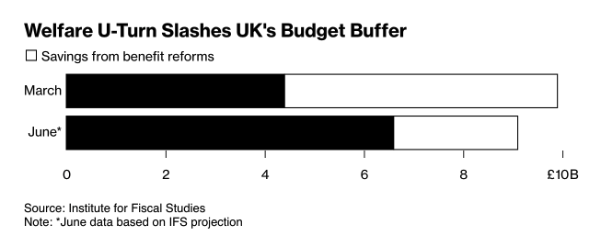

Chancellor Rachel Reeves has seen nearly half of her £9.9 billion fiscal buffer disappear following recent policy U-turns. Growing unrest within the Labour Party is now casting doubt on her political future. According to a LabourList poll, 40% of party members support her resignation.

While markets have remained relatively stable—10-year gilt yields edged down just 1 basis point to 4.46%—concerns are rising beneath the surface. Panmure Gordon’s Simon French and others warn that Reeves could become a political scapegoat if Prime Minister Starmer suffers another fiscal misstep.

Political pressure on Chancellor Rachel Reeves is intensifying, even as her options remain severely limited. Bound by campaign pledges not to raise income tax, VAT, or payroll taxes, her room for maneuver is shrinking rapidly. With internal party tensions rising and fiscal space eroding, doubts about her long-term viability are mounting.

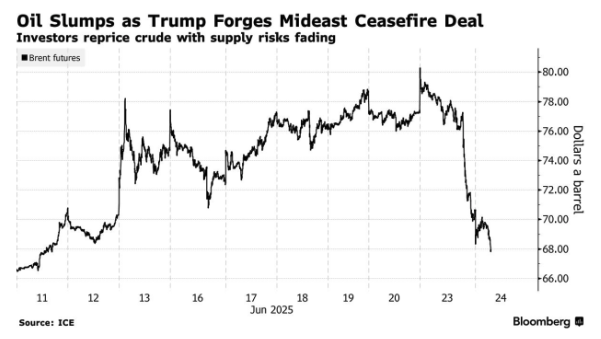

Middle East & Oil: Persistent Geopolitical Risks

While oil prices held steady this week, underlying geopolitical tensions—particularly between the US, Iran, and Israel—continue to shape market sentiment. Several ECB officials, including Peter Kazimir, warned that caution remains essential. As Kazimir put it, “I would not touch interest rates until we have a clear view of US trade policy.” The fragile energy outlook remains a key variable in the inflation and monetary policy equation.

BIS: Crisis-Like Uncertainty Could Reignite Inflation Risks

In its latest report, the Bank for International Settlements warned that current levels of uncertainty are “typical of crisis situations.” The BIS cautioned that any renewed spike in energy or commodity prices could once again derail inflation expectations and unsettle markets.

Outlook: Calm on the Surface, Turbulence Ahead?

With inflation cooling in the U.S., political instability rattling the U.K., and economic stagnation weighing on Europe, global monetary policy appears to be entering a period of pause. Yet beneath the surface, geopolitical tensions and structural vulnerabilities continue to simmer, threatening to trigger renewed market volatility.

The key question for the weeks ahead: Will the dollar retain its safe-haven status, or has confidence in the Fed and U.S. fiscal policy eroded enough for investors to shift toward alternative assets?

This Week: China’s Manufacturing and Deflation in Focus

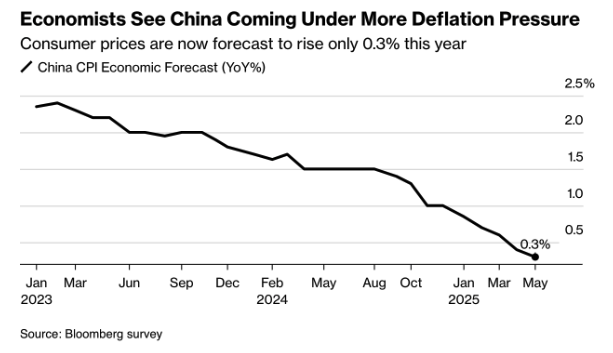

The week begins in Asia with fresh insights into the health of China’s industrial sector. On Monday, the official NBS Manufacturing PMI is due, with expectations hovering between 49.5 and 50.0. A reading below 50 would mark the third consecutive month of contraction, despite signs of slight stabilization.

On Tuesday, the Caixin Manufacturing PMI is expected to come in slightly higher, around 50.4, but ongoing weakness in export demand continues to weigh heavily on momentum. Deflationary pressures remain a persistent theme in the Chinese economy.

China: Domestic Weakness and Deflation Persist Amid Geopolitical Strains

China continues to grapple with sluggish domestic demand, persistent deflationary pressures—evident in ongoing declines in factory gate prices—and growing geopolitical uncertainty tied to Trump’s tariff threats. Weakening economic data may increase pressure on Beijing to roll out fiscal and monetary stimulus, though authorities have remained cautious so far.

Germany & Eurozone: Inflation Data to Shape Rate Expectations

This week, all eyes turn to inflation data from Germany and the eurozone, which will help guide interest rate expectations. On Monday, Germany releases its preliminary CPI figures, with year-on-year inflation expected at 2.3%, slightly down from 2.4% in the previous month.

On Tuesday, flash inflation data for the eurozone is due. Headline CPI is expected to ease to 2.4% from 2.6%, while core inflation is likely to remain steady at around 2.8%. These figures will be closely watched by the ECB as it weighs the timing of any future rate cuts.

Eurozone: Inflation Cooling, But ECB Signals a Summer Pause

Although inflation in the eurozone continues to ease, the pace of decline remains gradual. The ECB has delivered eight rate cuts so far, but is signaling a likely pause in July. Markets will be watching closely as President Christine Lagarde speaks on both Wednesday and Friday. Any remarks highlighting lingering uncertainties—such as volatile energy prices, rising tariffs, or wage dynamics—could influence expectations for the ECB’s next move, particularly with eyes already turning toward the September meeting.

US: Labor Market in the Spotlight—Is Job Growth Losing Momentum?

The most important macro data this week comes from the United States, where the focus is firmly on the labor market.

Tuesday:

- ISM Manufacturing PMI is forecast to come in at 48.5, remaining below the 50 threshold that separates expansion from contraction—indicating continued weakness in the manufacturing sector.

- JOLTS Job Openings (May) are expected to decline to 7.9 million, signaling a potential softening in labor demand.

Thursday:

- Non-Farm Payrolls (June) are expected to show job gains of 185,000, a notable slowdown from May’s 272,000 increase.

- Unemployment Rate is forecast to tick up slightly to 4.0%, from 3.9%.

- ISM Services PMI is projected to rise modestly to 52.5 from 52.1, pointing to tentative recovery in the services sector.

These figures arrive at a critical juncture. Markets are now pricing in 62 basis points of rate cuts by the end of 2025, driven not only by economic data but also by political developments—including pressure from Donald Trump on the Fed and rumors that he may seek to replace Jerome Powell before September. A softer-than-expected payroll report or a rise in unemployment could accelerate the timeline for rate cuts.

Japan & Australia: Limited Market Impact, but Key Regional Signals

In the Asia-Pacific region, two data releases offer insight into broader economic trends, even if their direct market impact is limited.

- Japan – Tankan Survey (Tuesday): Sentiment among large manufacturers is expected to improve slightly compared to Q1, yet it remains well below pre-COVID levels—highlighting the persistent challenges facing Japan’s export-driven economy.

- Australia – Trade Balance (Thursday): The trade surplus is forecast to shrink to around AUD 4.5 billion, as lower commodity prices weigh on export revenues.

Together, these figures reinforce the theme of softening global demand and continued pressure on major exporters.

Summary: A Week Anchored by Inflation and Jobs

This week’s macro agenda revolves around two key themes:

- Inflation in Europe – Will the disinflation trend continue fast enough to justify further ECB rate cuts?

- Labor Market in the US – Is the slowdown in job growth sufficient to clear the way for the Fed’s first rate cut, potentially as early as July?

At the same time, geopolitical risks remain a constant undercurrent:

- Trump’s protectionist trade stance is creating structural uncertainty in global supply chains and inflation expectations.

- Ongoing tensions between Iran and Israel continue to inject volatility into global oil markets.

A major focal point will be the Sintra central bank forum, where Fed Chair Powell, ECB President Lagarde, BoJ Governor Ueda, BoE Governor Bailey, and BOK Governor Rhee will all speak publicly—a rare and highly anticipated moment of joint communication on global monetary policy.

Monday – July 1

- China: NBS Manufacturing PMI (June)

- Germany: Inflation Rate YoY (Preliminary, June)

Tuesday – July 2

- Japan: Tankan Large Manufacturing Index (Q2), Consumer Confidence

- China: Caixin Manufacturing PMI (June)

- Eurozone: Inflation Rate YoY (Flash, June)

- United States: ISM Manufacturing PMI (June), JOLTS Job Openings (May)

Wednesday – July 3

- Eurozone: ECB President Lagarde Speech (Sintra Forum)

Thursday – July 4

- Australia: Balance of Trade (May)

- United States: Unemployment Rate (June), Non-Farm Payrolls (June), ISM Services PMI (June)

Friday – July 5

- Eurozone: ECB President Lagarde Speech (Sintra Forum)