Following a week dominated by inflation data and geopolitical tensions, markets are entering a period with a more moderate macro agenda. Still, several key data releases, central bank moments, and the looming tariff deadline set by former President Trump on July 10 continue to shape market sentiment.

United States

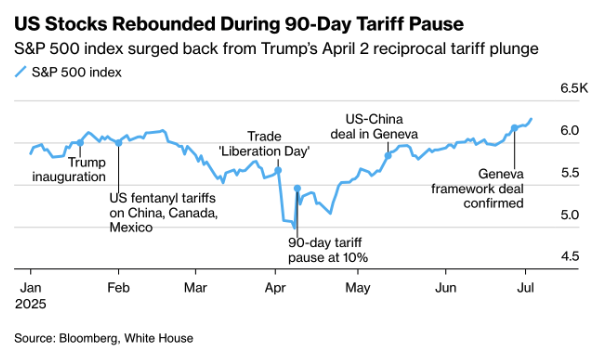

Markets had been on edge in the lead-up to July 10, marking the end of the 90-day reprieve on Trump’s proposed “reciprocal” tariffs. Without a deal, tariffs on EU exports to the U.S. would rise to an average of 20%-up from around 3% when Trump first took office. As Trump put it: “The money will start to come into the United States on August 1.”

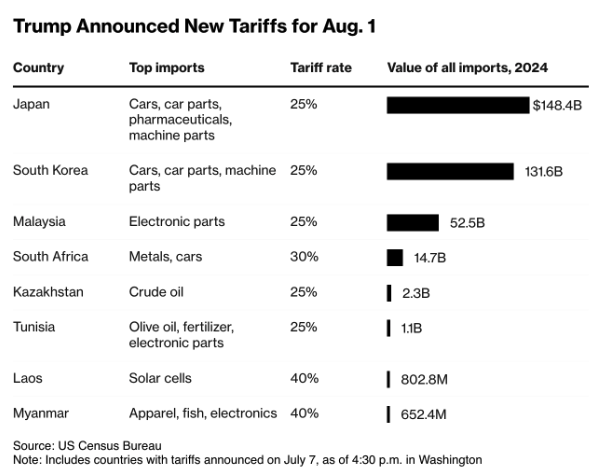

However, the July 10 deadline now appears to have been extended. Trump has given countries until August 1 to reach an agreement, offering markets a brief window of relief. Still, he stated on Sunday that “tariff letters and/or deals” will be announced on Monday, increasing pressure on 18 key trading partners. The threat of tariffs remains very real.

The S&P 500 rebounded strongly during the initial 90-day reprieve, but futures declined by 0.5% on Monday amid renewed warnings. Adding to uncertainty, Trump is reportedly considering a blanket 10% tax on imports from countries he believes are aligned with anti-American BRICS policies. This is heightening geopolitical tensions and creating further uncertainty for global businesses.

These tariffs are intended to help finance the growing U.S. budget deficit—driven in part by Trump’s so-called “Big Beautiful Bill”, a $3.4 trillion tax-and-spending package. In practice, however, the effects are quite different: higher costs for importers, disrupted supply chains, and increased pressure on consumer prices. As Bloomberg notes, without a deal, U.S. tariff levels would rise to their highest point since the 1930s.

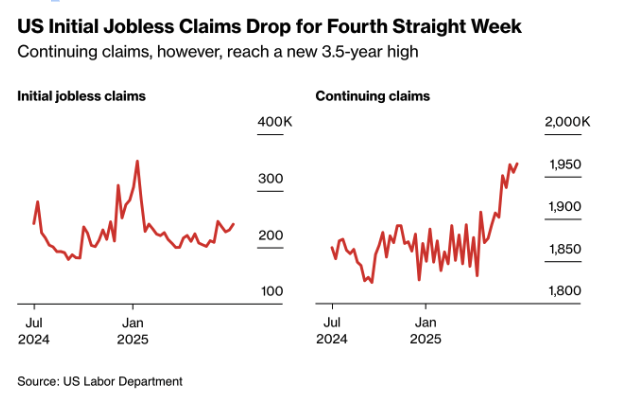

Meanwhile, unemployment data is sending mixed signals:

- Initial jobless claims fell for the fourth consecutive week to 227,000 (vs. 235,000 expected), marking the lowest level in two months.

- Continuing claims, however, climbed to 1.97 million—the highest since 2021—suggesting that laid-off workers are taking longer to find new jobs.

This combination suggests that while companies are hesitant to lay off workers, those who do lose their jobs are increasingly struggling to find new ones. According to Bloomberg Economics, the real signal lies in the persistently high level of continuing claims—an indication that the labor market is losing its resilience. As a result, the probability of a Fed rate cut in July remains steady at around 74%.

Meanwhile, Trump has postponed the implementation of his new tariffs until August 1. According to UBS Chief Economist Paul Donovan, this delay reduces the short-term inflationary impact during the holiday season, as many Christmas goods have already been shipped. However, the structural impact remains significant: the general 10% tariff is expected to drive up inflation in July and August, and the targeted tariffs on specific countries are unlikely to ease before 2026.

Donovan cautions that the delayed tariff impact will still hit American households. “This is a big tax burden on consumers,” he said, warning that real wages are likely to decline again by the end of 2025.

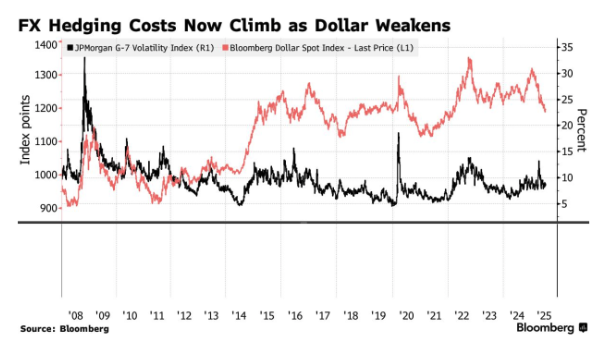

At the same time, the U.S. dollar’s status as a safe-haven asset is facing increasing strain. Goldman Sachs notes that the dollar is starting to behave more like a “risk asset”: its correlation with global risk volatility has fallen to the lowest level in seven years. Investors are now more frequently selling the dollar alongside U.S. stocks and bonds—an alarming sign that confidence in U.S. assets is weakening.

According to Goldman, several factors are contributing to this shift: Trump’s trade tariffs, growing doubts about the Federal Reserve’s independence, and ongoing structural de-dollarization. While a full structural shift is not yet expected, the probability of short-term volatility in the dollar has risen significantly.

Eurozone

Germany’s trade balance, released Tuesday, showed a modest rebound after falling to just €3.5 billion in April. While the improvement is welcome, the surplus remains historically low. The ECB acknowledged last week that “higher interest rates and the appreciation of the euro are putting pressure on exports.” The euro has already strengthened by over 14% against the U.S. dollar this year and, according to the ECB, is increasingly seen as a “safe haven.” As a result, interest rates are holding steady for now – but there is growing recognition that both inflation and growth remain fragile.

Within the ECB, divisions are deepening over the next steps for monetary policy. On Wednesday, Bundesbank President Joachim Nagel stated that the ECB “should not rule out any options” amid continued uncertainty. While inflation has settled around 2%, he warned of persistent risks – especially from the services sector and ongoing geopolitical tensions. A rate cut in September remains possible but is far from guaranteed. Nagel emphasized that decisions should be taken “meeting by meeting and based on data,” and he explicitly cautioned against conceding too much in trade negotiations with Trump: “With this kind of tariff policy, there are only losers.”

China

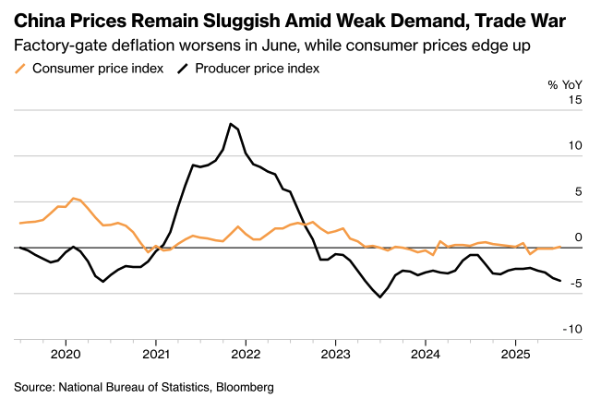

China’s producer prices fell by -3.6% year-on-year in June – the steepest decline in nearly two years and worse than expected. This marks the 33rd consecutive month of negative factory-gate inflation. On the consumer side, the CPI rose slightly by +0.1% year-on-year, ending a four-month streak of deflation. However, analysts attribute the uptick largely to temporary government subsidies.

Export-driven industries remain under pressure, with notable price drops in electronics and machinery. Ongoing uncertainty around Trump’s tariff plans continues to weigh on foreign demand, while domestic consumption shows little momentum. Notably, producer prices in the coal sector plunged by -22% year-on-year – the sharpest fall since 2007 – driven in part by the growing dominance of renewable energy sources.

Beijing continues to pursue a cautious, data-dependent policy approach. Yet with the CPI – excluding gold prices – likely still negative, calls are mounting for more decisive, structural stimulus. A new Bloomberg index shows that consumer confidence has barely improved, despite a series of support measures rolled out since late 2024.

Fears of a “Japan-style” scenario are mounting in China: persistently low interest rates, weak growth, and structural overcapacity are driving continued downward pressure on prices. The government’s official growth target of 5% is now at risk of being missed in real terms. According to the National Development and Reform Commission (NDRC), nominal GDP growth currently stands at just 3.8%, implying that the GDP deflator has fallen to around 1.2% – a clear signal of deepening, broad-based deflation. As such, further stimulus measures appear increasingly inevitable.

United Kingdom

The cost of shipping goods from China to the UK has surged by roughly 60% over the past three months, reaching $3,305 per container, according to freight analytics firm Xeneta. The spike is largely due to soaring U.S. demand ahead of Trump’s upcoming tariff rounds, which has absorbed global shipping capacity and pushed up costs on alternative routes. This dynamic is reigniting inflationary pressures in the UK, even as the broader economy struggles with sluggish growth – leaving policymakers caught between conflicting priorities.

For the UK, this surge in shipping costs adds fresh fuel to import-driven inflation. Economists estimate that higher freight rates could raise the Consumer Price Index (CPI) by 0.3 percentage points in Q3, pushing it toward 3.6%. Retailers – already under pressure from rising labor costs and squeezed profit margins – are expected to pass on at least part of these additional costs to consumers.

This presents a growing dilemma for the Bank of England. Although economic activity is slowing, inflation remains persistently high. Governor Andrew Bailey has previously acknowledged that Labour’s payroll tax policy is complicating the inflation outlook. Now, with this supply-side shock layered on top, the BoE faces increased difficulty in justifying rate cuts – right at the moment markets are beginning to price in the first easing moves.

The UK’s highly open economy makes it particularly vulnerable to external price shocks. A similar spike in freight rates during 2021–2022 triggered broad-based inflationary pressure. That dynamic now risks repeating itself – albeit in a somewhat milder form.

This Week

Following a week dominated by geopolitical tensions and central bank developments, market attention now shifts to fresh inflation data, retail sales figures, and new economic signals from both the U.S. and China. Trump’s tariff threats continue to pose a significant risk to the global economic outlook.

United States – Inflation Accelerates, July Rate Cut Still Uncertain

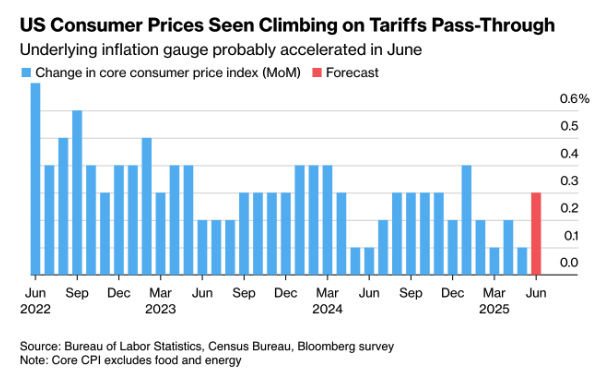

On Tuesday, the U.S. will release its latest inflation figures. Core CPI is expected to rise by +0.3% month-over-month in June (up from +0.1% in May), pushing the year-over-year rate to +2.9% – marking the first acceleration since January. This increase is partly attributed to the early pass-through effects of import tariffs. Headline CPI is forecast to come in at +0.2% MoM and +3.1% YoY.

This inflation report is critical for the Federal Reserve, especially with the next FOMC meeting not scheduled until late July. A hotter-than-expected print could delay or complicate the timeline for any potential rate cuts.

The economic picture will be further clarified this week with the release of the Producer Price Index (PPI) on Wednesday and retail sales data on Thursday. Retail sales are expected to show only a modest +0.1% month-over-month increase, following two consecutive months of contraction. The combination of subdued consumer spending and rising input costs is squeezing corporate margins.

The Federal Reserve will publish its Beige Book on Wednesday, providing qualitative insights into regional economic conditions. Additional clarity may come from scheduled speeches by Fed officials Waller, Kugler, and Cook on Thursday.

Meanwhile, Trump has postponed the tariff deadline to August 1. However, the risk of new duties on EU and BRICS exports remains a key source of market volatility. As Bloomberg Economics notes, “By the end of this year, real inflation-adjusted wages are going down, not up”—especially if retailers begin passing on higher costs to consumers. The S&P 500 responded to rising uncertainty last week with a pullback, highlighting market sensitivity to both inflation dynamics and geopolitical risk.

Eurozone

On Tuesday, Germany’s ZEW index will be released, with expectations pointing to a rise to 50.0 (previous: 47.5), indicating growing optimism among analysts and investors. However, the risk of an economic slowdown remains tangible: Eurozone industrial production fell by -1.4% last month, and export figures are weakening amid renewed threats of U.S. tariffs.

The European Central Bank remains cautious. ECB board member Joachim Nagel remarked that it would be “unwise to chart a path of interest rate cuts at this point,” citing elevated uncertainty. At the same time, he acknowledged that inflation is “in calmer waters.” Markets currently price in one additional rate cut this year, but the longer-term trajectory remains uncertain.

United Kingdom

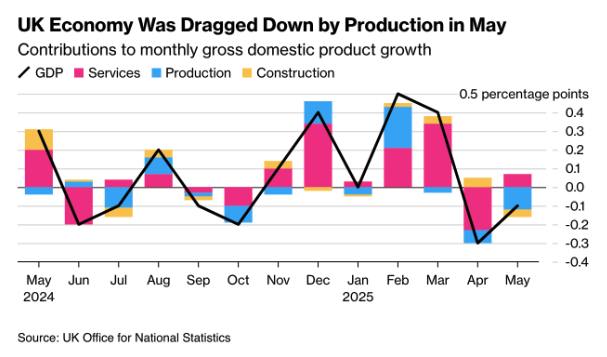

The UK economy grew by just +0.2% month-over-month in May, with industrial production once again underperforming. This reinforces the picture of a fragile economic environment in which the Bank of England continues to walk a tightrope – caught between persistently high inflation and weakening growth momentum.

The combination of rising input costs – such as elevated shipping rates from China – weak demand, and limited fiscal space is placing additional strain on monetary policy. Key inflation data due Wednesday, along with labor market figures on Thursday, will be pivotal in shaping the Bank of England’s pace and timing of rate cuts this fall.

China

China’s economy is expected to grow by +4.5% year-on-year in Q2, falling short of the government’s official 5% annual target. Retail sales remain subdued, with a +2.9% YoY increase expected, while industrial production is forecast to grow by +4.4%. Producer prices declined by -3.6% YoY – the sharpest deflation since July 2023 – while consumer prices edged up only +0.1%, underscoring weak domestic demand and persistent structural overcapacity.

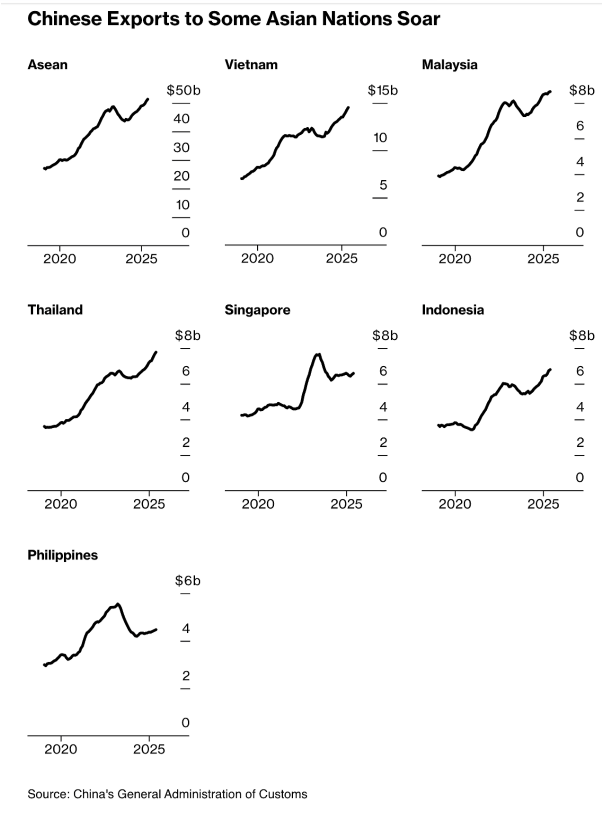

Despite these headwinds, export patterns are beginning to shift. Shipments to several Asian countries have risen notably, suggesting that China is increasingly pivoting toward regional markets as U.S. demand is dampened by tariff threats.

Macroeconomic Calendar – Week Ahead

Monday

- China – Imports (YoY), Balance of Trade, Exports (YoY)

Tuesday

- China – GDP Growth Rate (YoY), Retail Sales (YoY), Industrial Production (YoY)

- Germany – ZEW Economic Sentiment Index

- United States – Inflation Rate (MoM), Core Inflation Rate (YoY), Inflation Rate (YoY), Core Inflation Rate (MoM)

Wednesday

- United Kingdom – Inflation Rate (YoY)

- United States – Producer Price Index (MoM)

Thursday

- Japan – Balance of Trade

- United Kingdom – Unemployment Rate

- United States – Retail Sales (MoM)

Friday

- Japan – Inflation Rate (YoY)

- United States – Housing Starts, Building Permits (Preliminary), Michigan Consumer Sentiment (Preliminary)