Good morning,

The coming week is set to be decisive for both markets and policy. Following a week in which the ECB kept interest rates unchanged and Trump’s trade agreements dominated the tone, the focus now shifts to hard data on growth, inflation, and central bank responses. With GDP releases from the US and the eurozone, key inflation figures, and interest rate decisions from the Fed and the BoJ, investors will get a clearer picture of how resilient the global economy remains under tariff pressures. Trade talks in Scotland and the first indications from July’s labor market will add further weight to a week driven by data and policy.

United States

Jerome Powell reiterated on Tuesday that the Federal Reserve will continue to set policy “meeting by meeting.” The committee remains divided: while Waller and Bowman have openly called for swift rate cuts, the majority prefers to wait for more clarity on how current rates are affecting inflation and growth.

The effects of tariffs are becoming increasingly visible. June inflation data show clear price pressures in import-sensitive categories such as furniture, toys, and appliances, even as overall core inflation stayed contained. Retail sales strengthened broadly, but orders for durable goods saw only a modest uptick, and existing home sales declined.

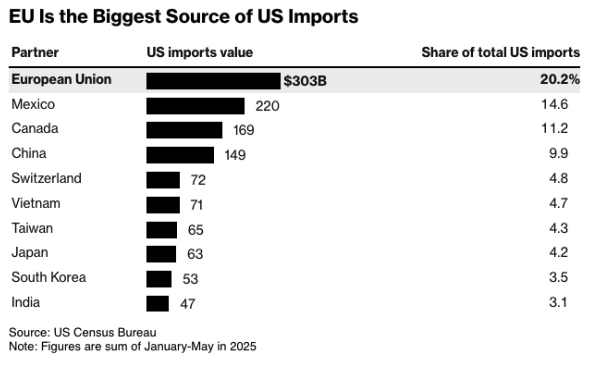

Even so, these data are overshadowed by the trade agenda. With the August 1 deadline approaching—when 30% U.S. import tariffs on nearly all EU goods are scheduled to take effect—Trump said the odds of a deal are “50-50, maybe less,” while also describing a successful agreement as “the biggest trade deal of all.”

US–EU Trade

After months of intense negotiations in Scotland, the United States and the European Union struck a last-minute deal last night, narrowly averting a full-blown trade war. Under the new pact, a 15% tariff will be imposed on nearly all European exports to the U.S. – including cars and pharmaceuticals – starting August 1. This replaces the previously announced 30% hike and eliminates the threat of tariffs rising to 50%. In exchange, the EU has opted for stability and predictability, albeit at a steep cost: asymmetric access to the U.S. market.

Trump and European Commission President Ursula von der Leyen presented the deal on Sunday evening at Trump’s Turnberry golf resort. While European leaders hailed the agreement as “sustainable,” German and French industry groups stressed that it represents a major concession. Beyond tariffs, the deal also commits the EU to significant investments in the U.S. in areas such as energy, defense, and technology.

For markets, the agreement brings immediate relief: the risk of an escalation threatening $1.7 trillion in transatlantic trade flows has been removed for now. Futures in both the U.S. and Europe rose in response, and the euro strengthened overnight. Still, relations remain fragile, with structural imbalances in market access unresolved and the 50% tariffs on steel and aluminum only temporarily put on hold.

Eurozone

The ECB left its key interest rate unchanged at 2.00% and reiterated that risks to the outlook remain tilted to the downside. President Christine Lagarde cautioned about the economic impact of U.S. tariffs and the strength of the euro, noting that updated projections in September will be decisive for the future policy path.

Following last week’s meeting, several ECB policymakers signaled that the hurdle for additional rate cuts has risen considerably. Latvian central bank chief Martins Kazaks stressed that, with inflation at 2% and the economy largely tracking recent forecasts, the eurozone would benefit from a “steady-hand policy.”

Echoing Lagarde, Schnabel, and Nagel, Kazaks said there is “no reason to react nervously” as long as the outlook does not deteriorate materially. As a result, markets have scaled back expectations for a September cut.

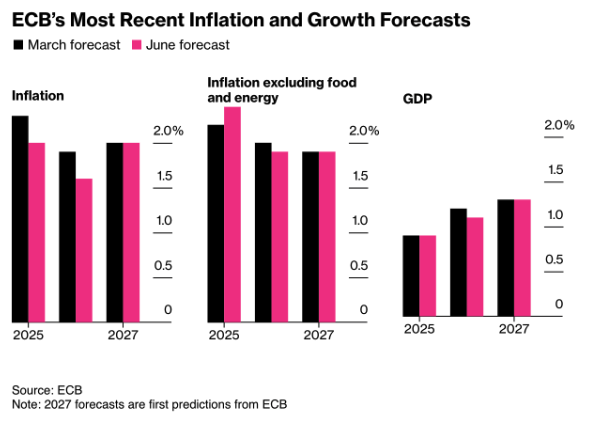

While trade tensions and a strong euro continue to pose risks, the Governing Council believes that previous rate cuts are still working their way through the economy. In the ECB’s latest survey, inflation expectations for 2025 and 2026 were revised slightly lower – to 2.0% and 1.8%, respectively – reinforcing the view that price pressures remain stable for now, even as the Council stays alert to the potential drag from new U.S. tariffs on business confidence.

The ECB left interest rates unchanged for the first time in over a year, firmly adopting a “wait-and-see” stance. Lagarde underscored that inflation is now at the 2% target and that the economy has, so far, shown resilience in the face of trade turmoil.

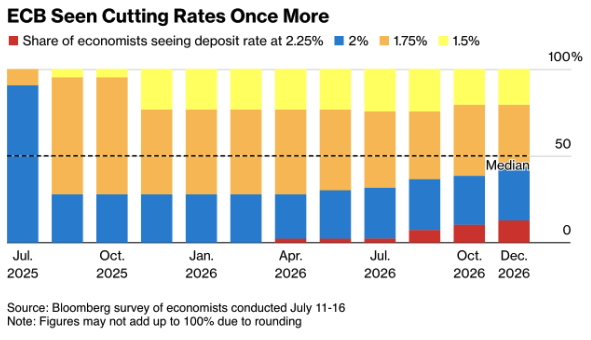

This stance has further lowered the probability of another rate cut in September: markets now assign only a 25% chance, down from 40% before the meeting. A Bloomberg survey conducted from July 11 to 16 (see chart) also shows a growing camp that believes the easing cycle has run its course:

- 47% expect one more cut in September,

- 21% anticipate that step will be delayed until December,

- and 25% expect rates to remain at 2%.

The stronger euro – up 13% since the start of the year – and ongoing uncertainty over U.S. tariffs are making companies more cautious. For now, however, the Governing Council sees a high bar for further monetary easing. As Lagarde put it: “We are in a good place now to hold and to watch how these risks develop over the course of the next few months.”

A swift trade agreement between Scotland and the U.S. could lift sentiment and spur investment. But if tensions escalate, the risks to growth clearly remain tilted to the downside.

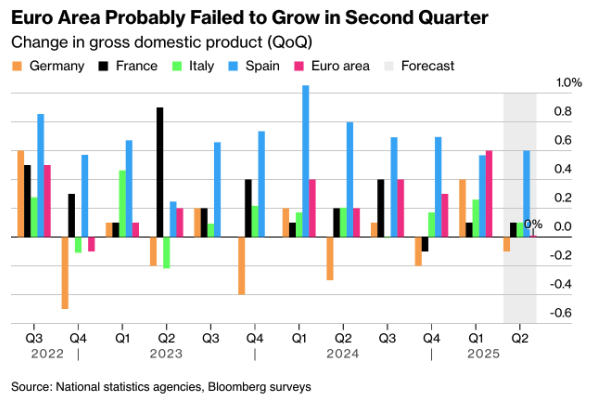

Meanwhile, the eurozone economy appears to have stalled in the second quarter. Preliminary estimates suggest that the temporary boost seen at the start of the year – driven by front-loaded trade ahead of Trump’s tariffs – has now faded. According to Bloomberg’s consensus, GDP was flat in Q2, following 0.6% growth in the first quarter.

There are marked divergences within the monetary union: Germany is expected to contract by 0.1% quarter-on-quarter, while Spain (+0.6%) and, to a lesser extent, France and Italy are still showing modest growth. The overall picture is shaped by weakening domestic demand and rising uncertainty around trade and investment.

ECB President Christine Lagarde acknowledged that the strong start to the year was partly driven by frontloading ahead of tariffs but also highlighted improvements in consumption and investment. Looking ahead, the outcome of the EU–US tariff negotiations will be critical for the rest of 2025: German exporters describe a 15% tariff as “manageable,” but any move toward higher tariffs would quickly erode growth momentum.

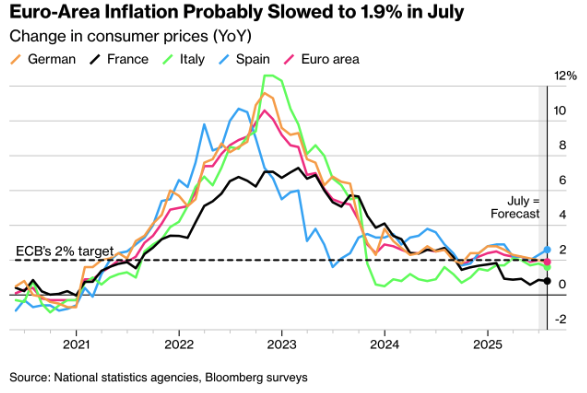

Meanwhile, the July inflation data confirm a picture of stabilizing price pressures. Headline inflation, due Friday, is expected at 1.9% year-on-year, just below June’s 2%, while core inflation remains steady at around 2.3%.

These figures give the ECB room, for now, to keep rates at 2% and wait for the updated projections in September. The main risks remain the strong euro and the trade relationship with the United States – both of which could dampen inflation and weigh on investment in the near term.

Global Central Banks

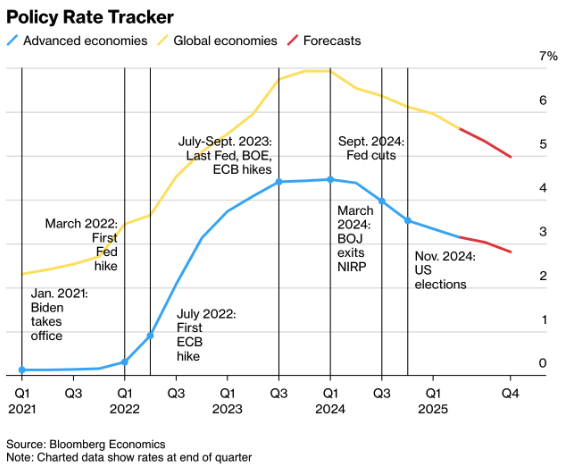

While the Federal Reserve – under political pressure from Trump – remains hesitant to cut interest rates, other central banks are already moving toward easier policy. Bloomberg Economics projects that the average policy rate in advanced economies will decline by more than 70 basis points this year, with even steeper cuts expected across emerging markets (see chart).

The driver behind this global shift is the slowdown in growth caused by U.S. tariff pressures. Central banks see Trump’s push to repatriate production and rebalance trade flows primarily as a drag on growth rather than as a source of lasting inflation.

As IMF Managing Director Gita Gopinath noted: “Cooling demand and falling energy prices point to a continued decline in inflation, while downside risks continue to dominate the outlook.”

In the U.S., the Federal Reserve is holding its ground for now. Bloomberg Economics expects only a single 25-basis-point cut in the fourth quarter, once the combination of weaker growth and cooling inflation creates the room to act. Elsewhere, however, the policy bias has clearly shifted toward easing.

United Kingdom

The British economy continues to face headwinds, with inflation still at 3.6%, employment declining, and PMIs weakening. The Bank of England looks poised to cut rates on August 7, although the scope for additional easing beyond that remains limited.

China

China’s economy expanded by 5.2% year-on-year in the second quarter, but nominal growth of just 3.9% highlights persistent structural deflationary pressures. The PBoC kept its Loan Prime Rate unchanged and continues to rely on targeted support measures rather than broad-based stimulus.

Japan

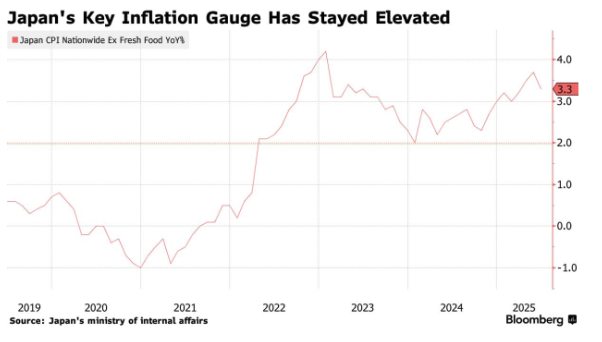

The surprise of the week came from Japan. Following the trade agreement reached earlier this week—under which the U.S. lowered tariffs on autos and other goods to 15% from 25% and scaled back a broader 30% tariff—the Bank of Japan is once again considering an additional rate hike later this year.

With much of the trade uncertainty removed, the BoJ has greater scope to focus on domestic economic data. According to insiders, the central bank could have enough information by year-end to decide on another hike. Market expectations for a hike in October or January have therefore risen to around 80%. The yen briefly strengthened to 146.8 per dollar on the news, and Japanese government bonds declined. While no change is expected at the upcoming policy meeting on July 31, the likelihood of a hike later this year has increased significantly.

Inflation in Japan has remained above the 2% target for more than three years, driven in part by sharply higher food prices. Recent data confirm a persistent pattern, which is likely to prompt the BoJ to revise its inflation forecasts higher again in its July quarterly outlook.

Looking ahead to this week

After a week in which the ECB left interest rates unchanged for the first time in over a year and Trump’s new trade agreements set the tone, the focus now turns to hard data on growth, inflation, and central bank responses. The coming days will be pivotal in shaping the direction of the third quarter.

United States

The Federal Reserve meets on Tuesday and Wednesday in a week dominated by three key data releases: GDP, inflation, and jobs. Markets expect the Fed to hold rates steady, but political pressure on Powell is intensifying as Trump continues to push openly for a rate cut.

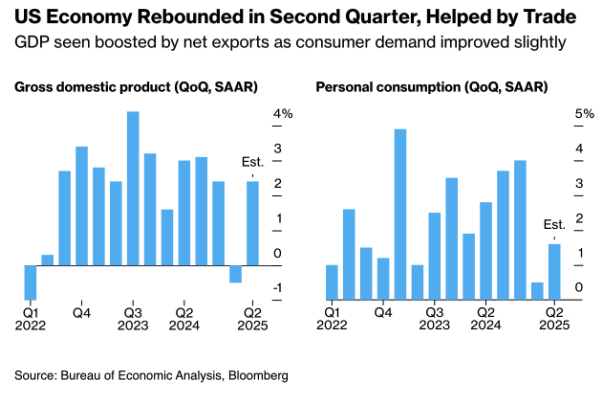

Preliminary second-quarter GDP figures, due Wednesday, are expected (according to Bloomberg estimates) to show annualized growth of 2.4% – a sharp rebound from the 0.5% contraction in Q1. The recovery is being driven largely by exports: a narrower trade deficit has offset weaker domestic demand. The chart “US Economy Rebounded in Second Quarter, Helped by Trade” highlights this dynamic, showing that net trade masked underlying fragility in consumer spending, which grew by just 1.5% – the weakest back-to-back quarters since 2020.

Yet the underlying dynamics remain mixed. The housing market continues to weigh on growth, and business investment shows little momentum. The labor market – which the Fed closely monitors – will be in the spotlight again on Friday: employment is expected to have increased by only 100,000 jobs in July, with the unemployment rate edging up to 4.2%. The JOLTS report, due Tuesday, is also expected to show a further decline in job openings.

Powell therefore faces a delicate balance between rising political pressure from the White House and the economic reality of slowing domestic demand. Friday’s PCE inflation data are likely to show a slight uptick, which will reinforce the policy committee’s cautious stance. With the trade-driven rebound in Q2 now behind us, the outlook for the second half of the year will hinge largely on whether the labor market cools further and whether tariffs exert greater upward pressure on inflation.

Eurozone

Eurozone GDP figures will be released on Wednesday. After 0.6% growth in Q1, the economy is expected to have stagnated in Q2, with Germany likely contracting by 0.1%.

Inflation data due Friday are forecast to show headline CPI at 1.9% and core at 2.3%.

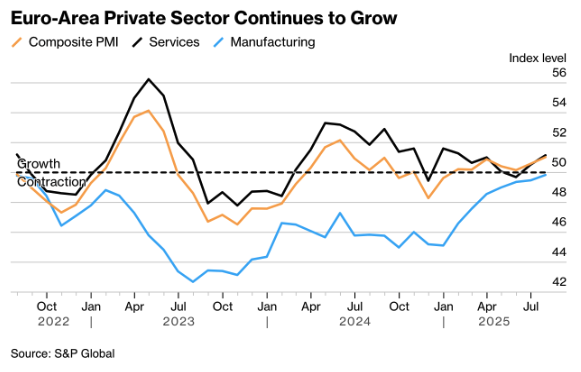

Meanwhile, the private sector continues to expand (see chart “Euro-Area Private Sector Continues to Grow”), but the latest Bank Lending Survey points to persistently weak demand for corporate loans. Companies are delaying investments amid ongoing trade tensions with the United States.

Trade Tensions – Europe and Asia Under Pressure

Trump continues to turn up the heat. While he reached an agreement with Japan this week to cap tariffs at 15% – and struck similar deals with the Philippines (19%), Indonesia (19%), and Vietnam (20%) – the threat of 30% tariffs on EU goods from August 1 still looms large. Diplomats are racing to secure a compromise that would limit tariffs to 15%.

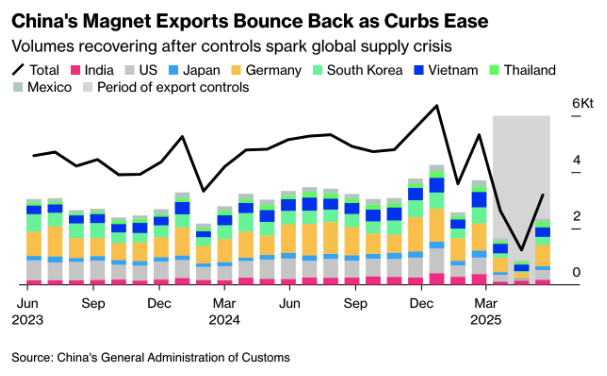

At the same time, China has resumed shipments of rare earth magnets to the U.S., with exports surging from 46 tons in May to 353 tons in June, providing a temporary reprieve for supply chains. This rebound comes after months of tight restrictions on strategic raw materials and highlights how Beijing is using export controls as a bargaining chip. The risk of renewed curbs remains high. Domestically, China is also pressing ahead with major infrastructure projects, including a massive new mega-dam in Tibet, to support growth.

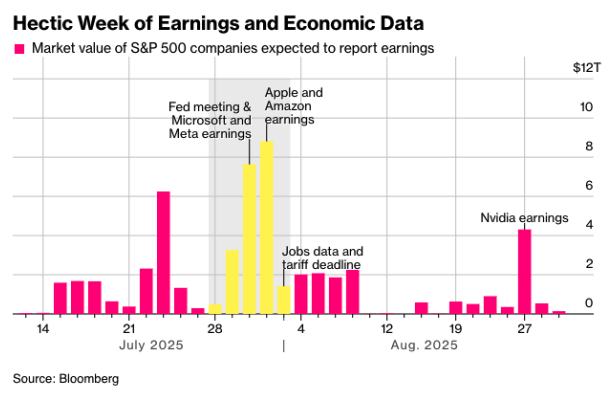

Wall Street sees the coming week as a pivotal moment for the remainder of the year, with a packed agenda of economic data, corporate earnings, and policy decisions likely to set the tone. The spotlight is on Wednesday’s Fed meeting: while rates are widely expected to remain unchanged, markets will scrutinize Powell and his colleagues’ guidance on the path ahead.

Adding to the pressure, four of the “Magnificent Seven” – Amazon, Apple, Meta, and Microsoft – will report quarterly results, offering a key test of investor sentiment after months of strong equity gains. On the macro front, the advance Q2 GDP reading, PCE inflation data, and Friday’s jobs report will provide a comprehensive check on the U.S. economy’s resilience as tariff effects deepen.

The chart titled “Hectic Week of Earnings and Economic Data” captures the stakes: trade negotiations, the FOMC, Big Tech results, and labor market data converge to make this a defining week for market direction.

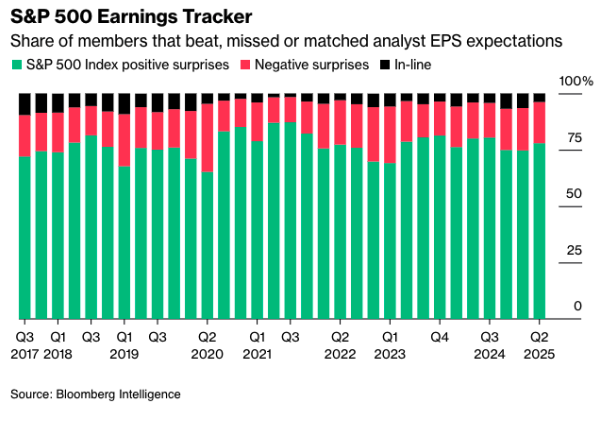

Meanwhile, the data show that corporate earnings have remained surprisingly resilient. As the chart below illustrates, a majority of companies are beating profit expectations, with overall earnings up roughly 4.5% compared to a year ago.

A clear divide is emerging across sectors: airlines and luxury goods are benefiting from robust demand, while lower-income households are pulling back on spending as higher costs – partly driven by tariffs – take their toll.

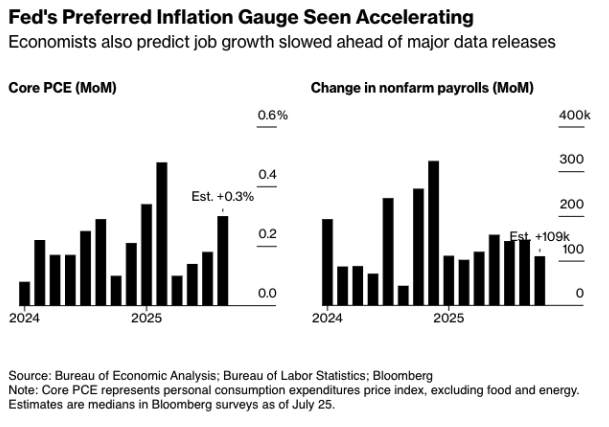

The broader economic picture remains mixed. Bloomberg’s consensus points to a Q2 growth rebound, largely due to a narrower trade deficit. However, the chart “Fed’s Preferred Inflation Gauge Seen Accelerating” shows a slight pickup in PCE inflation alongside a cooling labor market. Consumer demand is expanding only marginally, raising the question of whether the GDP rebound is more a statistical artifact than a sign of underlying strength.

In short, this week is not just about what the Fed decides, but above all about the signals coming from the data and corporate earnings. Confirmation of resilience could further support markets, but disappointments in employment figures or a stronger-than-expected PCE reading could once again put the debate over rate cuts back under pressure in the months ahead.

Macro-economic agenda:

Monday

–

Tuesday

US – Jolts Job openings

Wednesday

DE – GDP Growth Rate QoQ/YoY Flash

EU – GDP Growth Rate QoQ/YoY Flash

US – GDP Growth Rate QoQ Adv, Fed interest rate decision, Fed Press Conference

Thursday

CH – NBS Manufacturing PMI

JPN – BoJ Interest rate Decision, Consumer Confidence

DE – Inflation Rate YoY Prel

US – Personal Income MoM, Personal Spending MoM, Core PCE Price Index MoM

Friday

CH – Caizin Manufacturing PMI

EU – Inflation Rate YoY Flash

US – Unemployment Rate, Non-Farm Payrolls, ISM Manufacturing PMI