United States

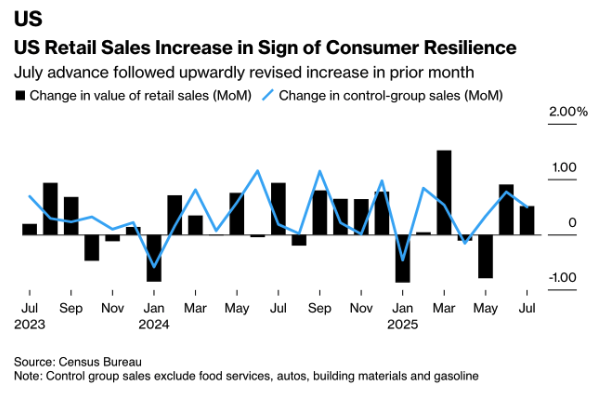

American consumers proved resilient in July, with retail sales rising once again and June figures revised higher. This marked the first time this year that the U.S. has seen two straight months of solid retail growth (graph: US Retail Sales Increase in Sign of Consumer Resilience). The gains were broad-based, though questions remain about the sustainability of this pace as the labor market shows signs of cooling and consumer confidence continues to weaken.

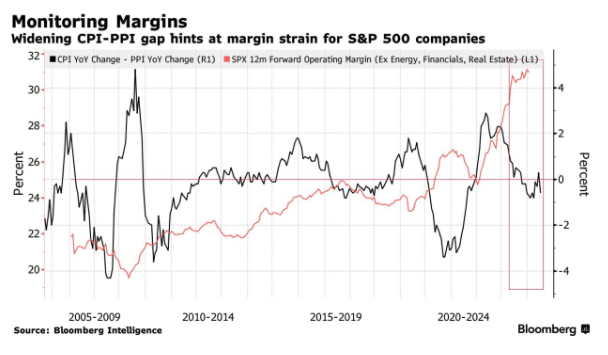

Margins Under Pressure from Negative CPI-PPI Spread

The latest inflation data highlight a growing challenge for Corporate America. In July, producer prices (PPI) rose at their fastest pace in three years, while consumer prices (CPI) increased far more moderately. This divergence produced a negative CPI-PPI spread of -0.6% (graph: CPI-PPI Spread Turns Negative). Historically, such a negative gap has signaled shrinking margins and weaker stock market performance: S&P 500 margins grew by an average of 4.2% when the spread was neutral or positive, but only 1.1% when producer prices outpaced consumer prices.

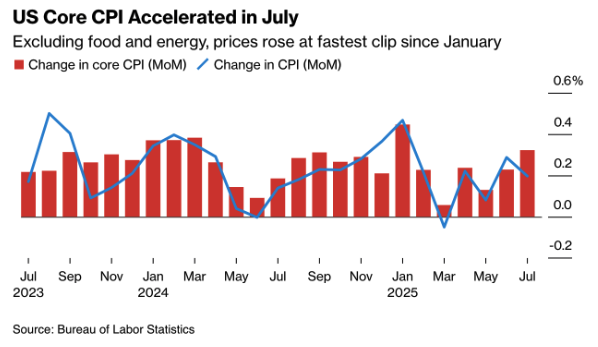

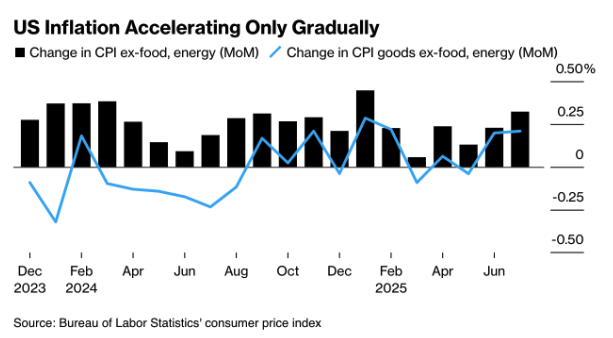

This trend is already visible in the market. Rising costs are squeezing profit margins, while the limited impact on consumer prices indicates that companies are not fully passing on higher costs. Core inflation rose 0.3% month-on-month in July – the sharpest increase since January – driven largely by higher service prices such as airline fares (chart: US Core CPI Accelerated in July). Goods prices, meanwhile, were little changed, suggesting that the feared broad-based, tariff-driven inflation has yet to materialize.

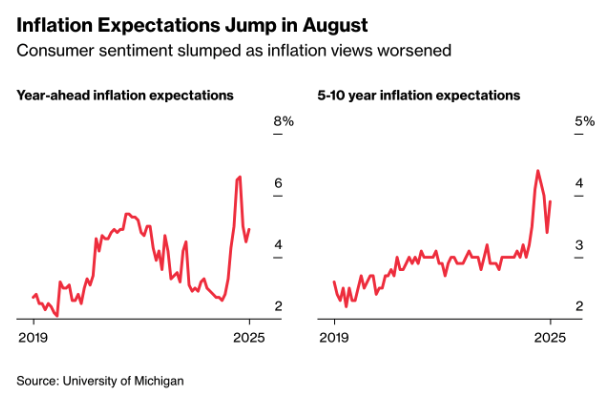

At the same time, consumption remains resilient: retail sales rose again in July, supported by a sharp upward revision to June. Still, cracks in sentiment are becoming visible. Consumer confidence fell in August, while inflation expectations for the year ahead climbed to 4.9%. Households appear to be turning more cautious, even as spending has held up so far.

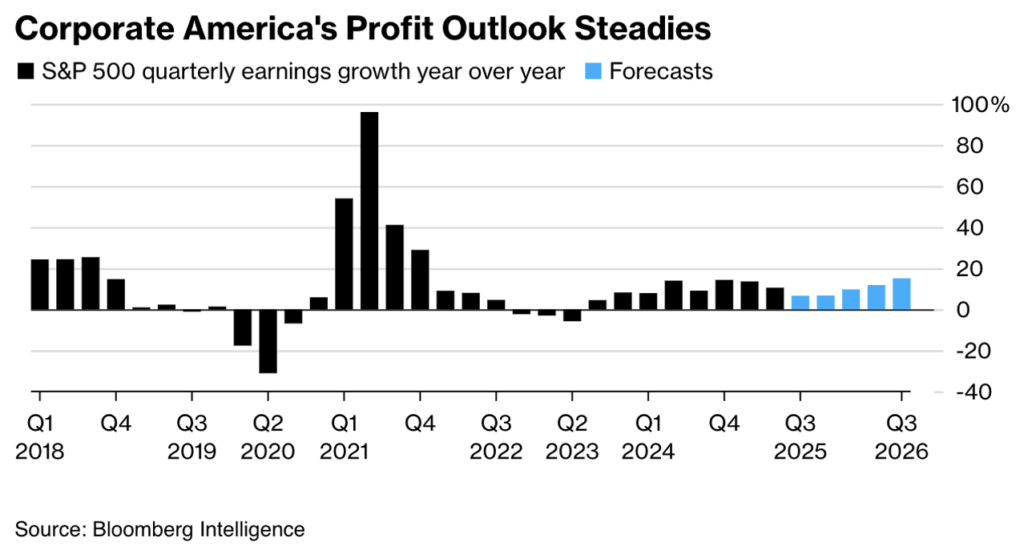

For companies, the spotlight has shifted to margin management. With more than 90% of S&P 500 firms having reported, earnings growth stands at nearly 11% – well above expectations (chart: Corporate America’s Profit Outlook Steadies). Yet the upcoming results from key retailers such as Walmart, Target, and Home Depot will be pivotal in gauging whether consumer spending can withstand rising prices and ongoing tariff uncertainty.

Conclusion: The pattern is clear – producer prices are rising faster than consumer prices, leaving businesses to absorb the higher costs instead of passing them on. This is compressing margins and posing a serious test for the durability of the recent market rally.

United Kingdom

The latest labor market report highlighted easing wage pressures. Unemployment held steady at 4.7%, while job vacancies fell to their lowest level since 2021. At the same time, private-sector wage growth continued to slow. Coupled with Q2 GDP figures confirming a sharp deceleration in growth, the Bank of England finds itself with limited room to maneuver: the economy is cooling, yet inflation risks remain.

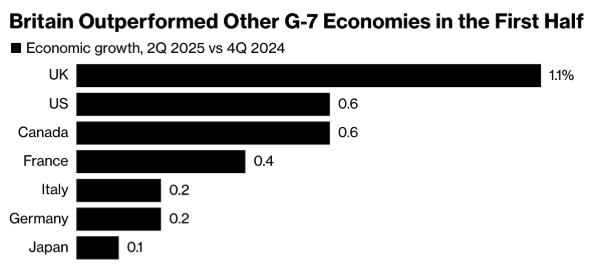

Despite this, the UK economy outperformed most other G7 peers in the first half of the year. Growth in Q2 exceeded expectations, further constraining the Bank of England’s ability to continue cutting interest rates (chart: Britain Outperformed Other G-7 Economies in the First Half).

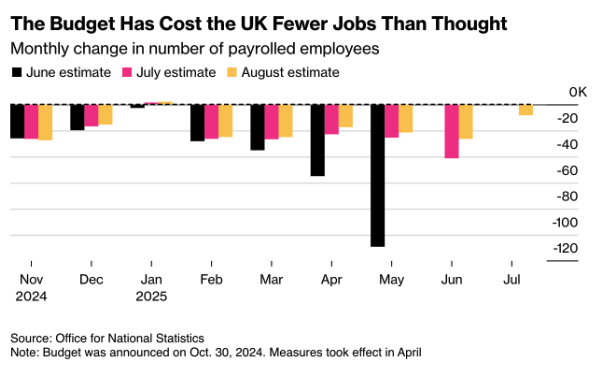

At the same time, the labor market shows signs of stabilizing. Payroll employment fell by just 8,353 in July – the smallest decline since January (graph: The Budget Has Cost the UK Fewer Jobs Than Thought). This points to a slowdown that is less severe than initially feared, but it also adds to the complexity of the Bank of England’s policy decisions.

Eurozone

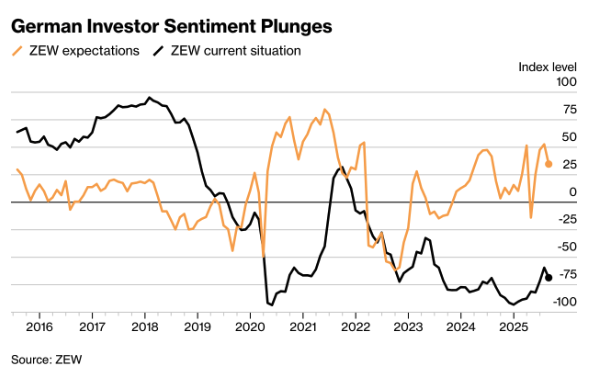

The German ZEW index tumbled to 34.7, with the current situation indicator plunging to -68.6 – signaling investor expectations of a deeper industrial downturn. Meanwhile, eurozone inflation is hovering around 2% on average, but wide divergences persist: major economies such as Germany, France, and Italy are running clearly below target, while peripheral countries face significantly higher rates. This divergence is making it increasingly difficult for the ECB to craft a policy stance that fits all member states.

Austrian central banker Robert Holzmann – the ECB’s most outspoken hawk – will step down this month after six years on the Governing Council. In his parting remarks, he urged the ECB to increase transparency on interest rate expectations and internal divisions. Holzmann called for an instrument akin to the Federal Reserve’s dot plot, where policymakers anonymously publish their rate projections. He also suggested that the ECB release summaries of dissenting views rather than solely presenting President Christine Lagarde’s line. “Dissenting views contain information for the market,” Holzmann emphasized.

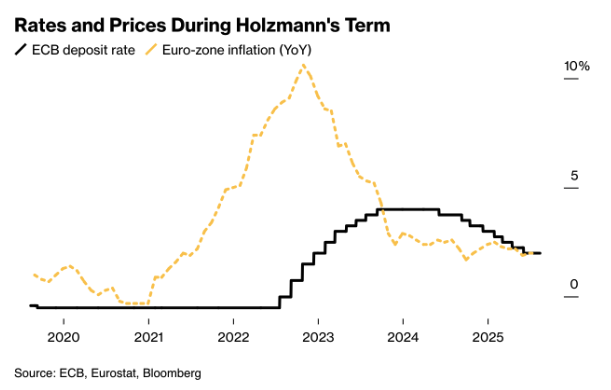

During his tenure, Holzmann consistently pushed for aggressive rate hikes to combat record eurozone inflation. He opposed the June rate cut, which returned borrowing costs to their previous level. The chart Rates and Prices During Holzmann’s Term shows how interest rates climbed rapidly from 2022 in step with the inflation surge, before recently easing back toward the 2% target.

Holzmann’s frequent dissent occasionally caused friction, though he stresses it never led to conflict with President Lagarde. His departure removes one of the ECB’s most prominent hawkish voices, though German policymakers such as Joachim Nagel and Isabel Schnabel remain influential.

Russia

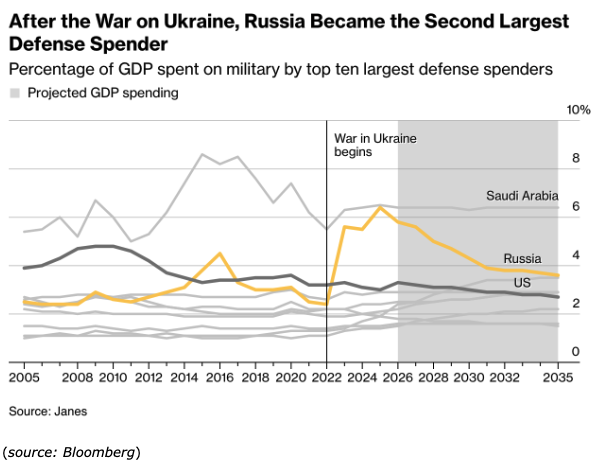

Economic resilience is coming under increasing strain. Defense spending has surged to its highest level since the Cold War, making Russia the world’s second-largest military spender (graph: After the War on Ukraine, Russia Became the Second Largest Defense Spender). Yet growth is stagnating, oil revenues are falling, and the budget deficit has widened to its highest point in more than three decades. Within the financial sector, concerns are mounting over a potential debt crisis.

China

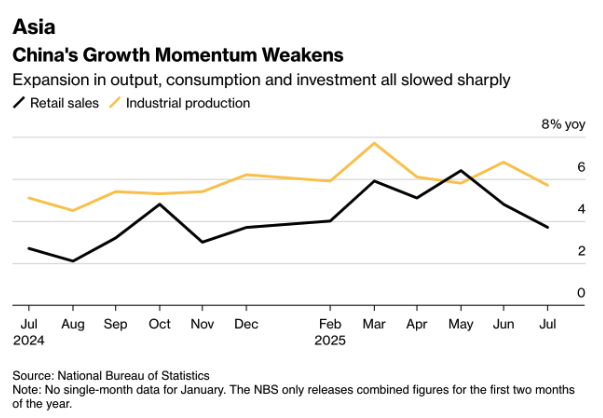

China’s economy slowed broadly in July, with industrial production, consumption, and investment all growing more weakly than expected. Urban unemployment edged up to 5.2% (graph: China’s Growth Momentum Weakens). Despite a series of stimulus measures, confidence has yet to recover, as both households and businesses remain cautious.

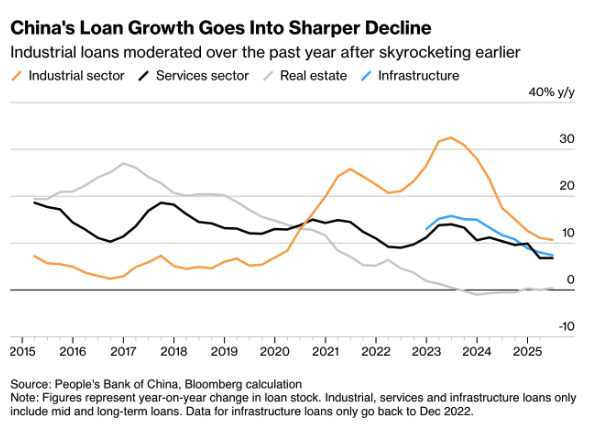

This was accompanied by a worrying milestone: total outstanding lending fell for the first time since 2005. The sharpest declines were in industrial and infrastructure loans (graph: China’s Loan Growth Goes Into Sharper Decline). This highlights the structural weakness in credit demand and heightens concerns over a prolonged downward spiral in growth and confidence.

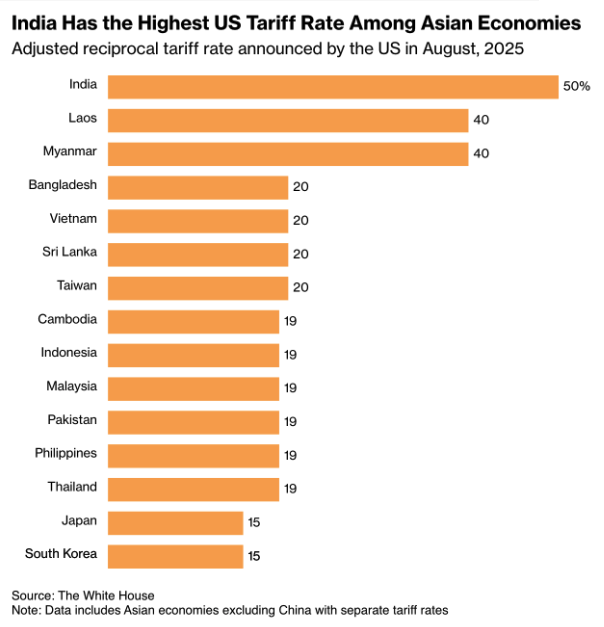

India is also coming under pressure in the region. Under the new U.S. tariff regime, import duties on Indian goods have doubled to 50% – the highest among Asian economies (graph: India Has the Highest US Tariff Rate Among Asian Economies). This presents a direct challenge to Modi’s “Make in India” strategy, which was designed to expand the industrial sector but has seen limited progress over the past decade.

Industrial production rose just 5.7% year-on-year in July, the slowest pace in eight months. Retail sales were even weaker at +3.7% year-on-year, the lowest since December, while fixed-asset investment also slowed. The data underscore that consumers remain cautious and companies are holding back on spending, adding pressure on Beijing to introduce additional fiscal support.

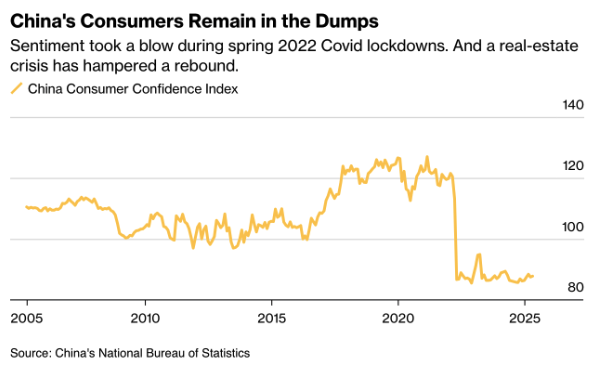

The real estate sector continues to deteriorate: new-home prices have been falling steadily since 2021, and property investment is contracting at the fastest rate since the Covid shock. Evergrande is even being delisted from the stock exchange. Consumer confidence remains fragile, reflected in the first decline in bank lending in two decades, as households choose to pay down debt rather than take on new loans (graph: China’s Consumers Remain in the Dumps).

Retail sales rose 3.7% y/y in July but declined for a second straight month on a sequential basis. Credit growth is also weakening, with more than half of new loans used for interest refinancing, leaving “real” growth at just 3.5% y/y.

This weak domestic performance contrasts with unexpectedly strong exports, which grew 7.2% y/y in July to $322 billion, led by shipments to the EU and ASEAN (chart: Chinese Export Growth Picks Up in July). This strength is temporarily offsetting the sharp drop in exports to the U.S.

However, nominal GDP grew by just 3.9% – the lowest pace since 1993 (excluding the Covid period) – limiting the scope for additional stimulus. Without a rebound in confidence and consumption, growth is likely to remain fragile.

Japan

Japan delivered a positive surprise: GDP expanded 0.3% q/q in Q2, equivalent to 1.0% y/y. While modest on the surface, this is a strong signal of resilience given weak global trade and pressure on exports. Domestic consumption and investment provided the key support. The outcome gives the Bank of Japan slightly more scope to reassess its ultra-loose policy, though caution will remain the guiding principle.

Australia

Australia’s labor market showed continued strength in July, adding 24,500 jobs with particularly robust growth in full-time positions. Unemployment fell to 4.2%, while female labor force participation hit a record high. Retail sales also surprised to the upside with a 1.2% m/m increase, the strongest since 2021. For the Reserve Bank of Australia, this resilience reduces the urgency for further rate cuts.

Europe

The week opens with the eurozone trade balance (Monday), where attention will center on whether the weakening export engine faces further strain from soft German demand and rising U.S. tariffs. On Thursday, the HCOB flash PMI data for Germany and the eurozone will be released. Industry remains fragile, and another contraction would reinforce the picture of stagnation across the bloc.

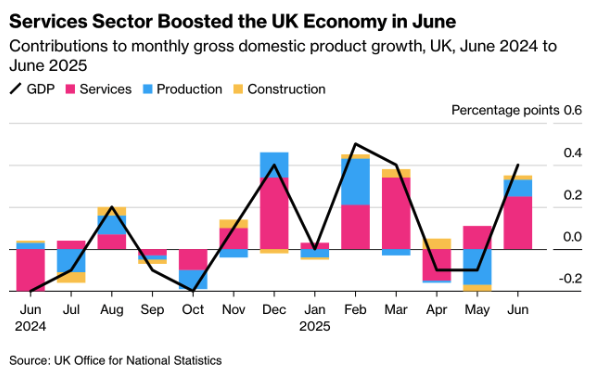

The spotlight in Europe will be on the United Kingdom, where July inflation figures are due. The Bank of England expects price growth to peak at 4% in September, while Bloomberg Economics projects a smaller uptick to 3.7%, led by services – the very segment that drove GDP growth in June (chart: Services Sector Boosted the UK Economy in June).

Later in the week, UK retail sales figures will be released, while the PMI surveys will offer a broader snapshot of private-sector activity. European readings remain only slightly above the critical 50 threshold. In Germany, investor sentiment has dropped sharply (graph: German Investor Sentiment Plunges), reflecting mounting uncertainty around the tariff negotiations with Washington.

In Switzerland, upcoming export figures will shed light on the impact of U.S. tariffs, which have hit the country harder than any other developed economy. Markets will also focus on Christine Lagarde’s speech in Geneva and on eurozone wage data, both key for gauging the pace of future ECB rate cuts.

Asia

On Tuesday, Australia releases the Westpac Consumer Confidence Index, offering insight into whether easing inflation expectations and a more stable housing market are bolstering sentiment. Japan follows with trade data on Wednesday and CPI figures on Friday. With the yen still under pressure, the Bank of Japan is closely watching for evidence that price stability is moving sustainably toward the 2% target.

United States

It will be a busy week in the U.S. On Tuesday, housing starts and building permits are due, offering a fresh read on a housing market still highly sensitive to interest rate moves. On Wednesday, the FOMC minutes will be released, shedding light on divisions within the Fed over the pace of rate cuts. Thursday brings existing home sales, where a modest cooling is expected after recent strength.

The main focus, however, will be Jerome Powell’s speech at the annual Jackson Hole symposium on Friday. The Fed chair is set to outline the central bank’s updated policy framework for steering inflation and employment. His remarks carry extra weight at a time when rates have been held steady all year and Trump’s tariffs continue to filter through the economy.

The key question: will there be room for rate cuts as early as September? The labor market is cooling and political pressure from Washington is intensifying, yet inflation is easing only gradually. Core inflation rose in July at its fastest pace since the start of the year (graph: US Inflation Accelerating Only Gradually), driven in particular by services, while tariff-sensitive goods prices showed less strain than feared.

Powell’s message could therefore set the tone for markets: either signaling a continued focus on fighting inflation with restrictive policy, or opening the door to easing if growth and the labor market weaken further.

U.S. consumer confidence unexpectedly fell to 58.6 in August – the first decline since April (chart: Inflation Expectations Jump in August). At the same time, inflation expectations rose sharply, with consumers now anticipating a 4.9% increase over the next twelve months and 3.9% over the longer term.

According to the University of Michigan, the drop in sentiment reflects growing concerns over tariffs, inflation, and a softening labor market. Some 62% of consumers now expect unemployment to rise over the next year, while 58% say they plan to cut back on spending – particularly on durable goods such as cars and household appliances.

What stands out is that this caution comes alongside still-robust retail sales in July, reinforcing the picture of consumers who continue to spend but are becoming more selective and price-sensitive. For the Fed, this highlights the delicate balancing act: inflation remains persistent, while households are beginning to show signs of fatigue.

Macro-economic agenda for upcoming week:

Monday

EU- balance of Trade

Tueday

AUS – Westpac Consumer Confidence Change

US – Housing Starts, Building Permits Prel

Wednesday

JPN – Balance of Trade

UK – Inflation Rate YoY

US – FOMC Minutes

Thursday

DE – HCOB Manufacturing PMI Flash

UK – S&P Global Services PMI Flash, Global Manufacturing PMI Flash

US – Existing Home Sales

Friday

JPN – Inflation Rate YoY

UK – Retail Sales MoM

US – Fed Chair Powell Speech