United States

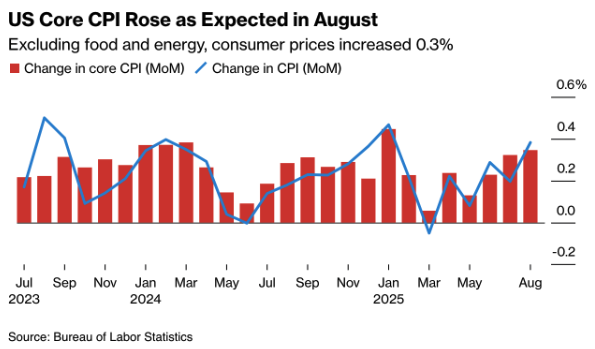

US data confirm the picture of an economy losing traction. Core CPI rose by 0.3% m/m and 3.5% y/y in August, unchanged from July. Headline inflation came in at 3.1% y/y, only marginally lower than the previous month. Progress toward the 2% target has stalled, leaving inflation stubbornly elevated.

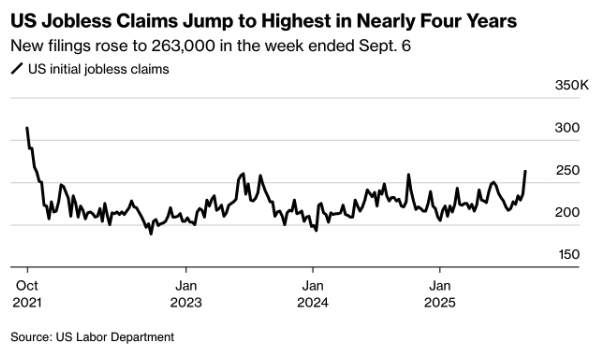

At the same time, the labor market showed renewed weakness. Initial jobless claims increased by 27,000 in the week ending September 6 to 263,000 – the highest since October 2021 and well above the forecast of 235,000. The four-week moving average rose to 240,500, also the highest since June (chart: US Jobless Claims Jump to Highest in Nearly Four Years).

The increase was largely driven by Texas (+15,304, not seasonally adjusted), while most states reported declines. Still, the figures reinforce the picture of a labor market losing ground, following the weak job growth of just 22,000 in August.

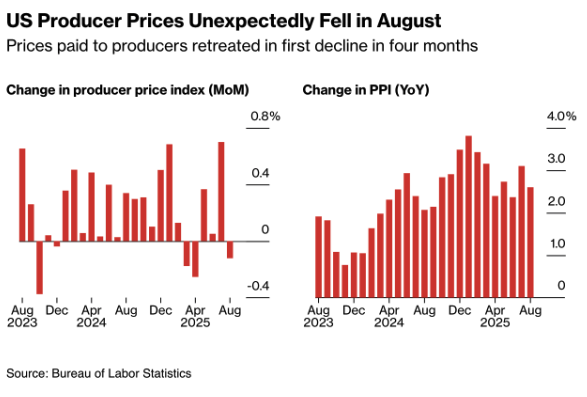

US producer prices fell by –0.1% m/m in August, the first decline in four months. On an annual basis, PPI rose by 2.6%, but this undershot expectations and fueled the view that price pressures are easing. The softer figures eased concerns that tariffs would quickly pass through to consumer prices and boosted market confidence that the Fed will cut rates next week (chart: US Producer Prices Unexpectedly Fell in August).

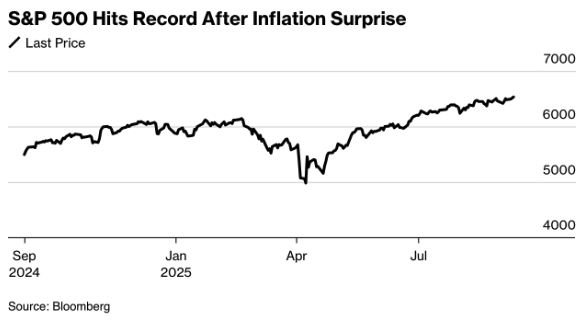

The market reaction was immediate: the S&P 500 hit fresh record highs, led by AI-related stocks, while the two-year yield dropped to 3.54%. Investors are now almost fully pricing in a cycle of three rate cuts this year.

In addition, US inflation data for August confirmed that price pressures remain in place despite a weakening labor market. Core CPI rose by 0.3% m/m, fully in line with expectations, while headline CPI increased by 0.4% – the strongest monthly gain since early this year (chart: US Core CPI Rose as Expected in August). On an annual basis, headline inflation stood at 2.9% and core inflation at 3.1%.

Prices for goods such as cars, clothing, and appliances rose, partly under the influence of Trump’s import tariffs, while services like airfares and hotels also became significantly more expensive. Shelter costs climbed 0.4%, marking the largest increase this year.

For the Fed, this does little to change expectations of an initial 25 basis point rate cut next week, following months of weak job growth and rising unemployment. However, the persistence of inflation may limit the scope for further cuts later this year.

Trump Links New Tariffs to Pressure on Russia

President Donald Trump increased pressure on Europe by announcing that the US is prepared to impose broad new tariffs on India and China, provided the EU does the same. The proposal emerged during talks with European officials in Washington and is intended to push Vladimir Putin to the negotiating table.

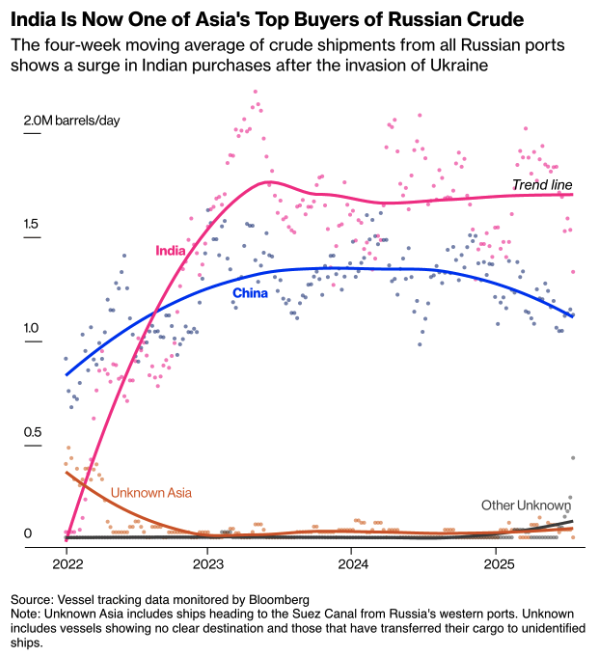

The timing is notable: India has become one of Asia’s largest buyers of Russian crude, with imports rising sharply since the invasion of Ukraine (chart: India Is Now One of Asia’s Top Buyers of Russian Crude). For Trump, this represents a strategic vulnerability, as he had already doubled import duties on India to 50%.

The EU responded cautiously: coordinated action requires unanimity, and earlier attempts to push through tougher sanctions on Russia faced resistance, notably from Hungary. At the same time, Trump is seeking to soften his tone toward China in the hope of securing a summit with Xi Jinping and a trade deal.

Strategically, this risks becoming a double-edged sword: more pressure on India and China could indirectly weaken Russia, but also undermine already fragile trade relations with Beijing. Markets are watching developments closely, especially as geopolitical tensions and energy flows once again move to the forefront.

Eurozone – ECB Holds Steady, France Raises Concerns

The ECB left the deposit rate unchanged at 2% on Thursday, as widely expected. Lagarde stressed that inflation is stabilizing around target and that the economy remains resilient. New projections pointed to a modest growth path, with no major revisions compared to June.

Yet the meeting was overshadowed by France’s political crisis. Prime Minister Bayrou lost the confidence of parliament, triggering a deadlock over fiscal consolidation. With the debt ratio climbing further, pressure on French government bonds is intensifying. For the ECB, this means its role as ultimate backstop could return to the spotlight if the French situation escalates.

China – Exports Decline, Inflation Slips Into Disinflation

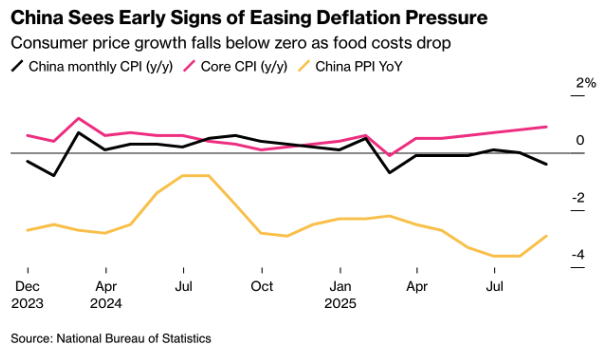

China’s August inflation figures painted a mixed picture. Producer prices fell –2.9% y/y, a smaller drop than July’s –3.6%, marking the first easing of factory deflation in six months. At the same time, consumer prices slipped back below zero at –0.4% y/y, driven entirely by falling food costs such as vegetables (–15%). This left CPI well below expectations (chart: China Sees Early Signs of Easing Deflation Pressure).

Although core inflation rose to 0.9% – the highest level in a year and a half – this mainly underlines how fragile the recovery remains. Demand-side weakness persists, while overcapacity in sectors such as steel and copper continues to squeeze margins. For markets, Beijing’s anti-involution campaign will only gain credibility once structural measures follow.

ECB Holds Rates, Markets See End of Cuts

The European Central Bank left the deposit rate unchanged at 2% on Thursday, signaling that the cycle of rate cuts has likely run its course. President Christine Lagarde stressed that inflation “is where we want it to be,” but pointed to exceptional uncertainty stemming from geopolitical tensions and trade tariffs.

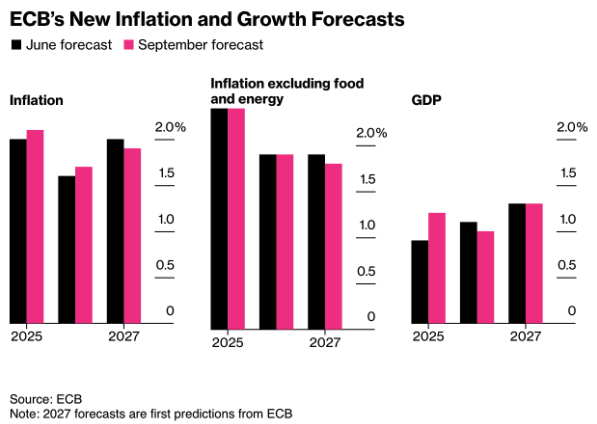

The ECB’s new projections show inflation at 1.7% in 2026 and 1.9% in 2027, close to the 2% target (chart: ECB’s New Inflation and Growth Forecasts). Growth forecasts were also revised slightly higher, with 1.2% expected this year.

Markets responded by pricing out the prospect of further cuts: German 10-year yields rose to 2.69% and the euro climbed to $1.174. This puts the eurozone out of step with the US, where the Fed is expected to start cutting rates next week.

France’s political crisis meanwhile casts a shadow over the ECB’s upbeat tone. With the Bayrou government stepping down, the eurozone’s vulnerability remains visible. Still, Lagarde presented the ECB as “in a good place” and declared the disinflation process complete. For now, the central bank appears to have reached a plateau.

United Kingdom

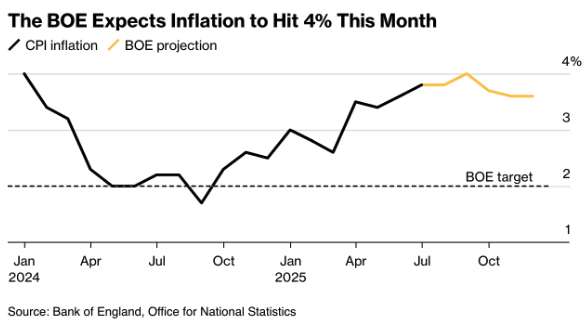

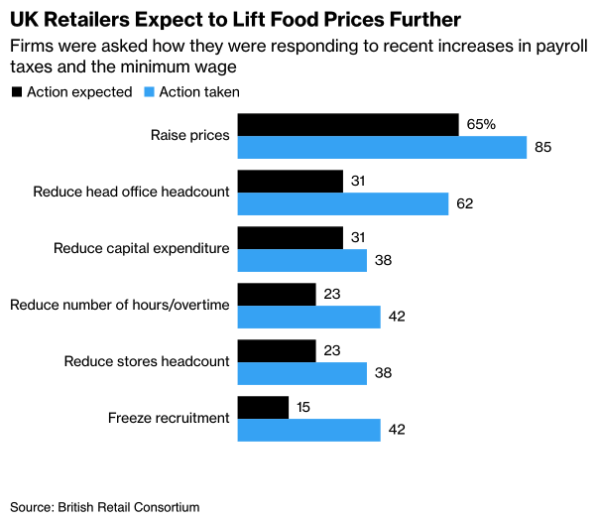

Chancellor Rachel Reeves’ first budget has contributed to a persistent inflation problem, and her second budget in November risks repeating the pattern. Businesses warn that higher employer costs, a sharp minimum wage increase, and new regulations will add billions in expenses. With margins already tight, much of this burden is expected to be passed on to consumers.

The Bank of England shares these concerns: inflation rose to 3.8% in July and is projected to peak around 4% in September (chart: The BOE Expects Inflation to Hit 4% This Month). This has fueled calls within the MPC to slow the pace of rate cuts.

In addition to higher wage and tax burdens, new levies such as the packaging tax threaten to push food prices up by more than 0.5%. Industry groups like UKHospitality already warn of a potential wage–price spiral. Meanwhile, the British Retail Consortium notes that more than half of retailers expect to pass the extra costs on in full (chart: UK Retailers Expect to Lift Food Prices Further).

China – Retail and Industry

China kicks off Monday with a barrage of macro data on retail sales, industrial production, investment, and unemployment, which should reveal whether targeted support measures are truly shoring up demand after July’s broad-based slowdown. Property statistics released at the same time will shed light on the depth of the ongoing housing crisis. Last week’s inflation figures already showed the first signs of easing deflationary pressure, but the durability of that trend depends heavily on a rebound in consumption and investment.

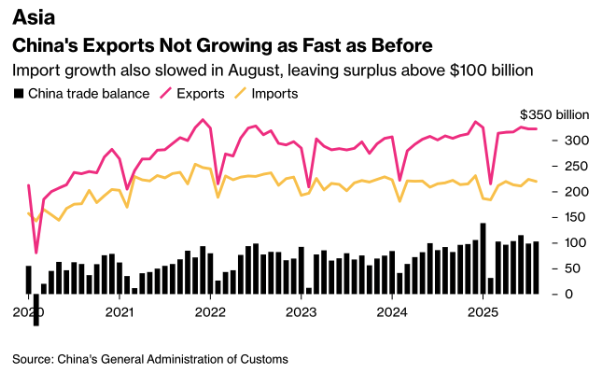

Export growth weakened in August to the slowest pace in six months, as shipments to the US fell more sharply again. At the same time, sales to other markets held up, keeping Beijing on track for a record trade surplus of over $1.2 trillion this year (chart: China’s Exports Not Growing as Fast as Before).

China – Imports and Trade Balance

Import growth also slowed, keeping the monthly surplus above $100 billion. This underscores fragile domestic demand and highlights the asymmetry in trade flows: China remains heavily reliant on foreign earnings while domestic consumption stays weak. For policymakers, it is a clear signal that the balance between external and internal growth is still missing.

Eurozone – Lagarde Speaks

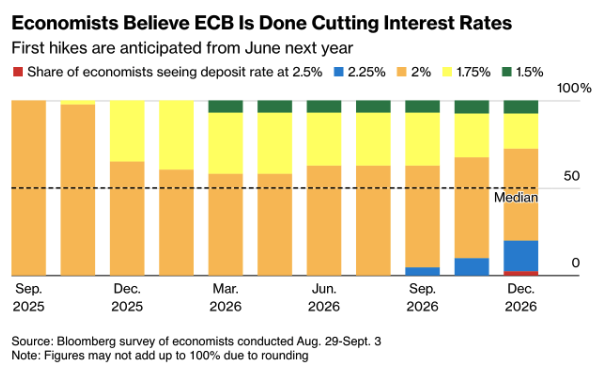

After eight consecutive rate cuts, the ECB in July left the deposit rate unchanged at 2% for the first time in a year. This suggests the bank has reached a plateau: policymakers view the rate as neither restrictive nor stimulative. The timing coincides with preparations at the Federal Reserve, which is expected to lower rates next week for the first time since December in response to US labor market weakness.

According to a Bloomberg survey, most economists expect the ECB to hold rates at this level, with the first potential hikes not coming until mid-2026 (chart: Economists Believe ECB Is Done Cutting Interest Rates). Eurozone inflation is hovering around 2%, suggesting price stability has broadly been restored.

Eurozone – Diverging Views Within the Council

Differences remain within the Governing Council. Isabel Schnabel warns of upside risks from higher defense spending and trade tensions, while Lithuania’s central bank governor Simkus fears a prolonged undershoot of the inflation target.

The economy meanwhile appears resilient, with improving confidence and an end to years of industrial decline. Still, analysts caution that the full impact of Trump’s tariffs will only become visible later this year. Additional uncertainty comes from France, where the government’s collapse is undermining political stability and weighing on sentiment in European bond markets.

Thursday’s outlook is therefore crucial: at the ECB’s rate decision and Lagarde’s press conference, investors will be watching closely for signals on whether policy truly remains in a “good place,” or if emerging risks around trade and French political turmoil could still open the door to one last easing move toward December.

United Kingdom – Labor Market, Inflation and Rates

Tuesday brings the unemployment rate, expected to hold at 4.2%, pointing to a cooling but still tight labor market. On Wednesday, inflation data are due, with consensus at 3.6% y/y — slightly below the previous month but still uncomfortably high. On Thursday, the BoE meets, with expectations for rates to remain unchanged at 4.75%, though the split among MPC members keeps the decision in play. Friday’s retail sales are forecast to fall again (–0.3% m/m), reflecting weak purchasing power and higher taxes.

United States – Retail, Housing and Above All the Fed

The Federal Reserve is expected to cut rates for the first time this year by 25 bp, bringing the target range to 4.75–5.00%. At the same time, new economic projections and the dot plot will be released. Markets are focused on whether the median outlook shifts toward three cuts in 2025.

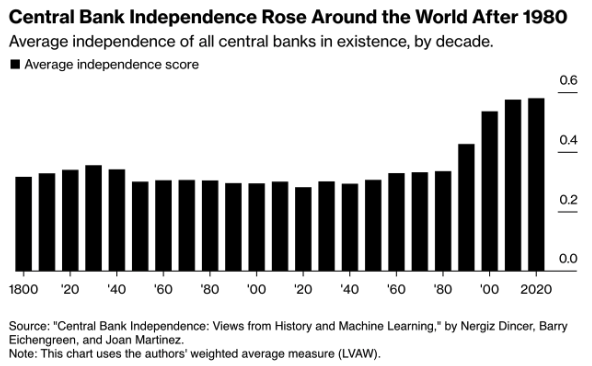

The coming week is not only about the anticipated Fed rate cut but also about how firmly the central bank can preserve its independence. Since the 1980s, central bank independence has increased worldwide (chart: Central Bank Independence Rose Around the World After 1980) and is generally associated with lower inflation. Yet political pressure is mounting: economists warn that Fed decisions risk being shaped increasingly by loyalty to the White House.

Confidence in the Fed has eroded: only 37% of Americans say they trust Powell “to do the right thing,” while more voters now view Trump as more reliable on economic policy. This poses a risk of higher risk premiums on US Treasuries and could structurally undermine the Fed’s independence.

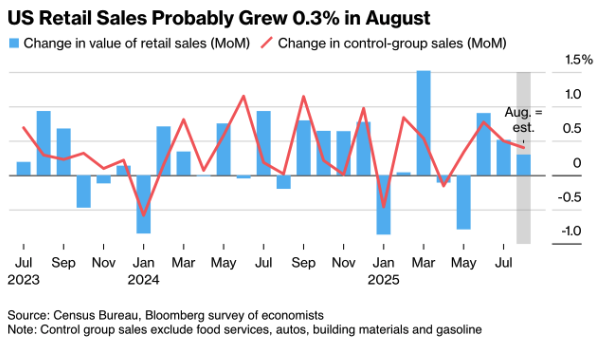

One last key data point arrives Tuesday: retail sales, expected at +0.3% m/m (chart: US Retail Sales Probably Grew 0.3% in August). This figure will be a litmus test for consumer resilience as unemployment rises and prices remain high. Jobless claims on Thursday will then provide further clarity on whether the recent increase is becoming structural.

Japan

On Wednesday, Japan releases its trade balance, with the surplus expected to come under pressure from higher energy imports and weak exports to China. Friday brings inflation data, with headline inflation forecast at 2.7% y/y and core around 2.5%, keeping the BoJ on track for a gradual exit from its ultra-loose policy. Also on Friday, the Bank of Japan announces its rate decision: the policy rate is expected to remain unchanged at 0–0.1%, but with a more hawkish tone on the persistence of inflation.

Macro-economic agenda for upcoming week:

Monday

CH – Retail Sales YoY, Industrial Production YoY

EU – ECB Lagarde Speech

Tueday

UK – Unemployment Rate

DE – ZEW Economic Sentiment Index

US – Retail Sales MoM

Wednesday

JPN – Balance of Trade

UK – Inflation Rate YoY

US – Housing Starts, Building Permits Prel, FOMC Economic Projections, Fed Interest Rate decision, Fed Press conference

Thursday

UK – BoE Interest Rate Decision

Friday

JPN – Inflation Rate YoY, BoJ Interest Rate Decision

UK – Retail Sales MoM