Eurozone

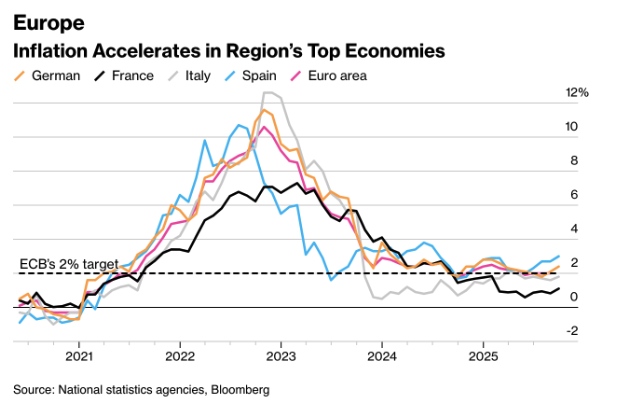

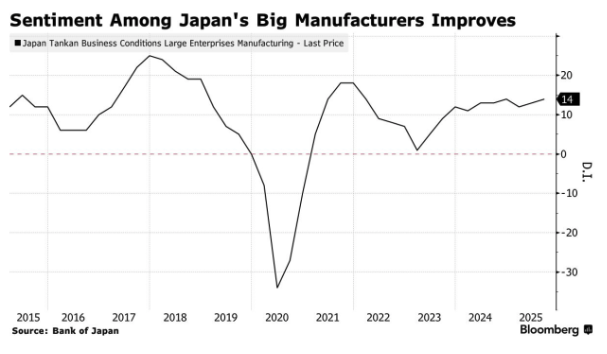

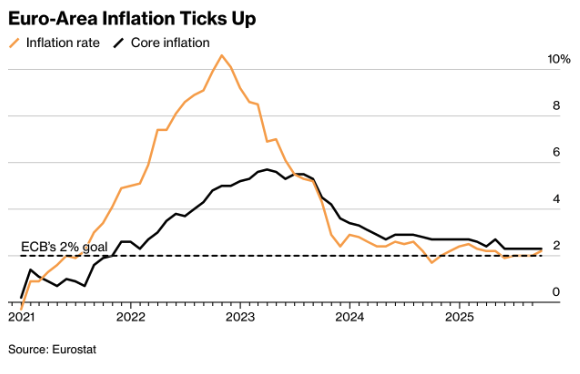

Inflation has accelerated again across Europe’s four largest economies. In Germany, the figure rose more sharply than expected, while France, Italy, and Spain also posted higher monthly readings. The broad-based rebound reinforces the ECB’s conviction to keep rates steady at 2% for now, despite weak growth. The pattern points to persistent price pressures in services and energy, reducing the likelihood of further cuts in the near term.

(chart: Eurozone Inflation Accelerates Across Major Economies)

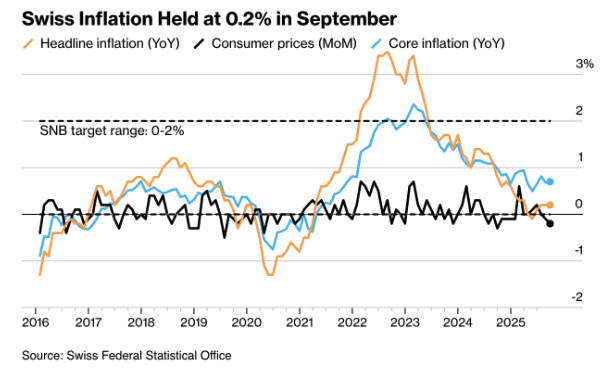

In Switzerland, inflation remained unchanged at 0.2% in September – far below levels in the eurozone. Persistently weak price pressures, combined with the impact of high US tariffs on exports and industry, are putting renewed pressure on the SNB to consider further easing. The central bank recently kept rates at 0%, but economists do not rule out a move toward negative rates in December.

(chart: Swiss Inflation Holds Near Zero as Tariffs Bite)

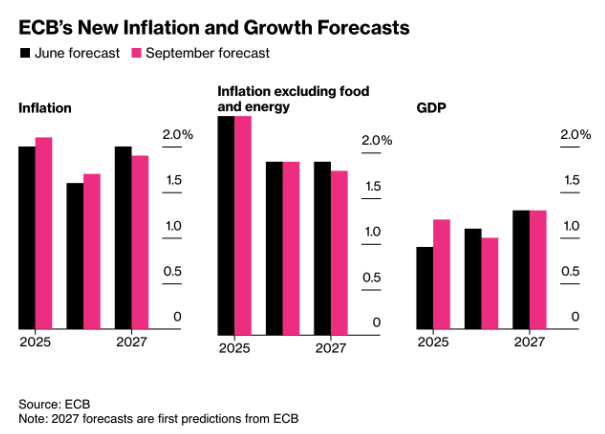

Christine Lagarde stressed that inflation risks are “fairly limited” and that the current policy rate of 2% leaves the ECB “in a good position” to respond should new shocks emerge. For now, the central bank sees little reason for additional cuts: higher US tariffs have barely filtered through to prices, while the economy has shown surprising resilience. Lagarde did caution, however, that this balance is not fixed and that policy must be adjusted “with agility and humility” in line with incoming data.

The September flash confirmed the inflation rebound: HICP rose to 2.2% y/y, driven by services while energy turned less negative. In Germany, inflation climbed to 2.4%, marking a second consecutive increase – a detail that carries more weight in the rate debate than many admit, as it fits neatly into the narrative of “sticky services inflation, weak growth.”

Markets reacted immediately: implied ECB rate cuts for the next six months were pared back, and the euro found tactical support, though the soft growth backdrop limits upside potential. This week, attention shifts to communication. Lagarde will speak in Finland on Tuesday and in Amsterdam on Friday, while more than half of the Governing Council members are also scheduled to appear. The core question is no longer whether the current rate is appropriate, but how long that stance will remain defensible.

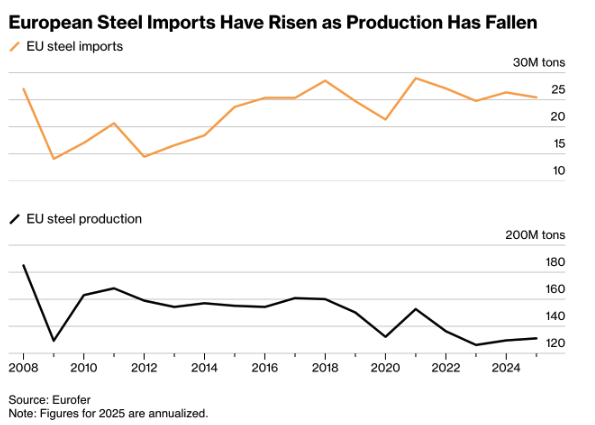

The European Union is also preparing a major tightening of its steel import tariffs. According to a leaked proposal, the European Commission plans to double the current 25% ceiling to 50%, while cutting the import volume allowed before that higher rate by roughly 40%. The new regime, set to take effect next year, would replace the temporary safeguard mechanism expiring in June.

With this increase, Brussels aims to prevent cheap steel from China and other Asian countries from being redirected to the European market. The EU thereby mirrors the United States, where President Trump earlier this year raised tariffs on steel and aluminum to the same 50% level. European producers, grouped under Eurofer, have welcomed the plan, warning that without stronger protection “the core of Europe’s manufacturing base – from cars to wind turbines – risks being eroded.”

United States

The ISM Manufacturing Index for September recovered slightly to 49.1 (from 48.7) but remained below the growth threshold. New orders stayed weak, reinforcing the picture of a cooling industrial sector. Normally, Friday’s jobs report would set the tone, but the looming government shutdown has clouded the data flow. Economists are therefore shifting their focus to surveys and high-frequency indicators – a shift that increases volatility in bond markets and forces the Federal Reserve to navigate by intuition rather than data.

Markets still price in one more rate cut for October, but policymakers remain cautious as long as core inflation hovers around 2.9%. A soft ISM Services print on Friday could temporarily weigh on the dollar, though a flight to safety may partially offset that move.

The U.S. government shutdown has entered its second week and is escalating into a power struggle between the White House and Congress. President Donald Trump has said he intends to cut “thousands of federal jobs” to increase pressure on Democrats, mainly in agencies the administration deems “misaligned with its priorities.” Around 750,000 federal employees have already been furloughed without pay, costing the economy an estimated $400 million per day, according to the Congressional Budget Office.

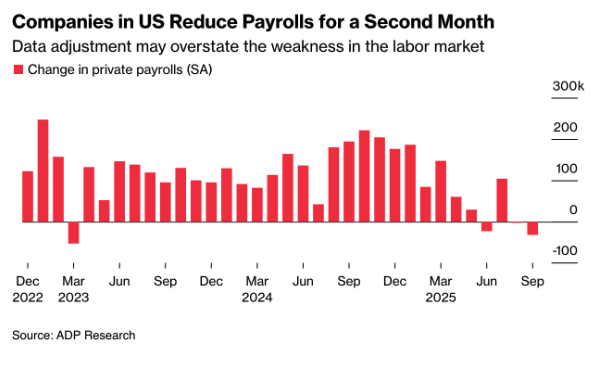

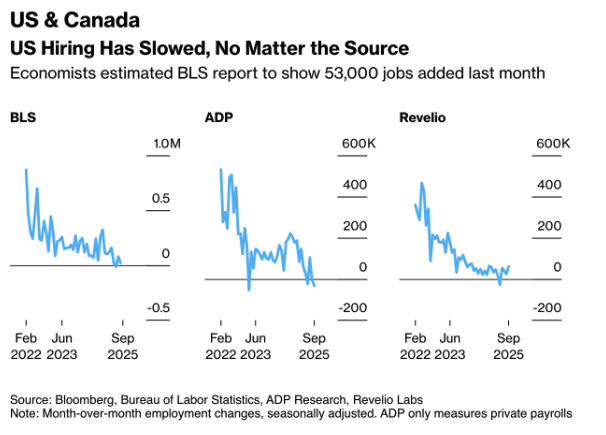

The shutdown is eroding not only confidence but also the data the Fed relies on. Key releases are being delayed, leaving policymakers without a full picture of the labor market ahead of the next meeting. The ADP report already showed a loss of 32,000 private-sector jobs this week – the weakest outcome since early 2023.

Politically, the risk of the crisis becoming entrenched is rising. A Washington Post poll shows that a majority of Americans blame Republicans for the shutdown — a pattern consistent with previous episodes. If the stalemate persists, a repeat of 2019 looms, when consumer confidence and investment expectations temporarily collapsed.

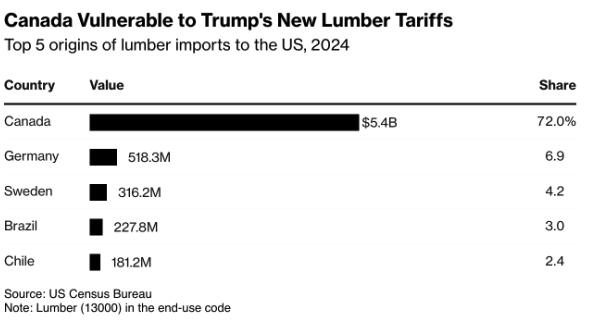

At the same time, Trump’s trade policy is expanding northward. The president announced new tariffs of 10% on lumber and 25% on wooden furniture products to protect domestic manufacturing. Canada, which supplies more than half of U.S. lumber, is the hardest hit – already facing existing duties of 35.2% over alleged subsidies. The move risks reopening tensions between Washington and Ottawa and is set to push up construction costs in the United States.

(chart: Canada Faces Steeper U.S. Lumber Tariffs – Main Sources of U.S. Timber Imports)

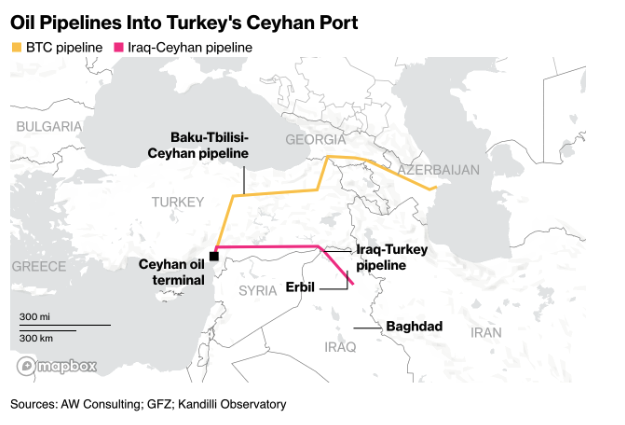

The United States has also played a key role in restarting oil exports from Iraqi Kurdistan after a two-year halt. The agreement – brokered with Washington’s mediation – allows crude to flow again through the pipeline to Turkey’s Ceyhan port and is expected to be transformed into a long-term deal. According to the State Department, the aim is to support Iraq’s economy while curbing Iran’s influence. The current agreement runs until the end of this year, but the U.S. is pushing for an extension to safeguard the interests of American energy companies.

Asia

In Japan, confidence among major manufacturers improved for the second consecutive quarter. The Tankan index rose to +14 (from +13), confirming that industrial sentiment remains solid despite U.S. tariffs. The ceramics and shipbuilding sectors showed the strongest gains, while sentiment among large service providers held steady at +34 – the highest level since the 1990s.

The figures reinforce expectations that the Bank of Japan may raise rates as early as this month. Corporates lifted their investment plans to +12.5% for the current fiscal year, while five-year inflation expectations edged up to 2.4% – a record since the survey began. The yen briefly weakened to ¥148.2 per dollar, as the outcome was largely in line with market expectations.

China and Australia

In China, the gap between the official and private PMIs remained striking. The state survey came in at 49.8 – still signaling contraction – while the private Caixin/Ratingdog index rose to 51.2, showing clear improvement driven by new export orders. The industrial floor appears close, but domestic demand remains too weak to support a broad recovery.

In Australia, the trade surplus fell sharply in August to A$1.8 billion from A$6.6 billion in July. The Reserve Bank of Australia kept rates unchanged at 3.6%, but signaled that further cuts are possible if growth continues to slow. The tone shifted toward “pausing longer but staying alert,” leaving the Australian dollar vulnerable to renewed weakness in Asian exports.

Global Outlook – Fiscal Pressures in Focus

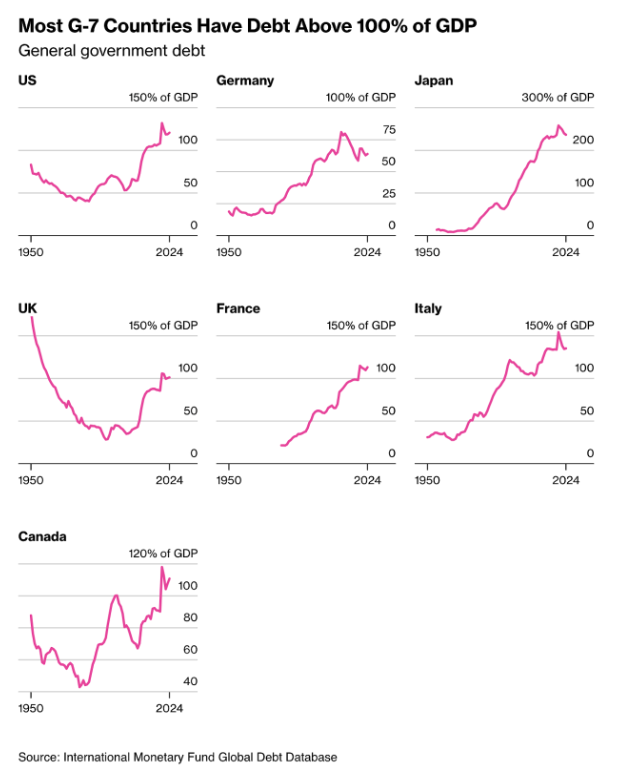

Political tension over public finances is set to dominate the global narrative this week. In the U.S., the budget standoff between Trump and Congress continues to escalate, with the risk that further layoffs could deepen the shutdown. France is struggling to submit a new budget plan without a stable government, while in Japan, newly appointed Prime Minister Sanae Takaichi takes charge of the world’s largest debt burden. The U.K. is also approaching a critical phase ahead of its November budget, with an S&P review due later this week.

With debt levels above 100% of GDP across nearly all G7 economies, the pressure is mounting on policymakers to present credible fiscal consolidation plans. Italy stands out as an exception: the country recently received its first credit rating upgrade since 2021 and appears poised to exit the EU’s list of excessive deficit procedures.

(chart: G7 Public Debt Ratios – Fiscal Pressures Mount Across Advanced Economies)

Eurozone

This week in Europe centers on fresh industrial data and the tone of central bankers. In Germany, factory orders are due Tuesday, followed by industrial production on Wednesday – key to assessing whether July’s rebound has held up. Spain releases its production figures on Monday, France publishes its trade balance on Tuesday, and Italy wraps up the week with industrial data on Friday.

On Monday, Christine Lagarde will testify before the European Parliament in a hearing on monetary policy and the role of the euro. With inflation recently at a five-month high, the discussion will likely focus on whether the ECB intends to keep rates at 2% for much longer. Vice President Luis de Guindos and Chief Economist Philip Lane are also scheduled to speak that day, followed by several national governors later in the week. Additionally, minutes from the ECB’s September 11 meeting will be released on Thursday.

In the United Kingdom, speeches by Andrew Bailey, Huw Pill, and Catherine Mann will draw attention. The Bank of England is expected to stress that its recent rate cut does not mark the start of an aggressive easing cycle, but rather a temporary adjustment as long as inflation remains above target.

United States

The focus this week will be on the August trade balance and a series of Federal Reserve speeches. Analysts expect a deficit of around $67 billion – slightly wider than in July due to lower export volumes and the impact of recent tariffs. The tone of Fed officials will be closely watched, as markets look for confirmation that a rate cut in November remains on the table despite the ongoing data blackout caused by the shutdown.

On Wednesday, minutes from the FOMC meeting will be released, with investors paying particular attention to signs of internal division within the committee. Any hint of concern about a cooling labor market or falling inflation expectations could push short-term yields lower.

The week concludes with the preliminary University of Michigan consumer sentiment index, where a slight decline is expected. Confidence remains resilient, but the combination of political uncertainty and higher energy prices could upset that balance.

Australia and New Zealand

The week begins with Australia’s Westpac Consumer Confidence Index, where a modest improvement is anticipated following recent stabilization in unemployment and the RBA’s pause in rate cuts. Still, the index remains well below its historical average, underscoring that households remain cautious with spending despite lower mortgage rates.

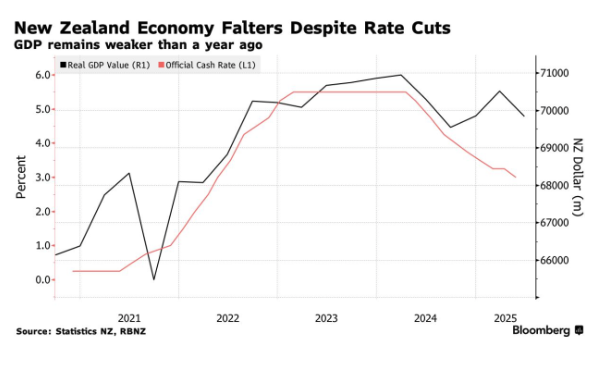

In New Zealand, the Reserve Bank will announce its policy decision early Wednesday. Economists are split on the size of the move: a 25-basis-point cut appears the base case, though a larger reduction to 2.5% cannot be ruled out as the labor market weakens and overall activity slows. The central bank faces the challenge of supporting growth without undermining confidence in its inflation target.

Macro-economic agenda for upcoming week:

Monday

EU – Retails Sales MoM

Tueday

AUS – Westpac Consumer Confidence Change

US – Balance of Trade, Fed Speeches

EU – ECB Lagarde Speech

Wednesday

US – FOMC Minutes

Thursday

DE – Balance of Trade

US – Fed Speeches

Friday

US – Michigan Consumer Sentiment Prel