The final week of October confirmed the image of a global economy caught in the danger zone between cooling inflation and slowing growth. While inflation rates worldwide are moving closer to target, the data show that the interest rate hikes of recent years are still reverberating.

United States

The Federal Reserve cut its policy rate by 25 basis points to 3.75–4.00% on Wednesday and announced that balance sheet reduction (QT) will be temporarily suspended starting in December. Jerome Powell emphasized that the priority has now shifted toward preserving employment: “The risks are no longer one-sided toward inflation.”

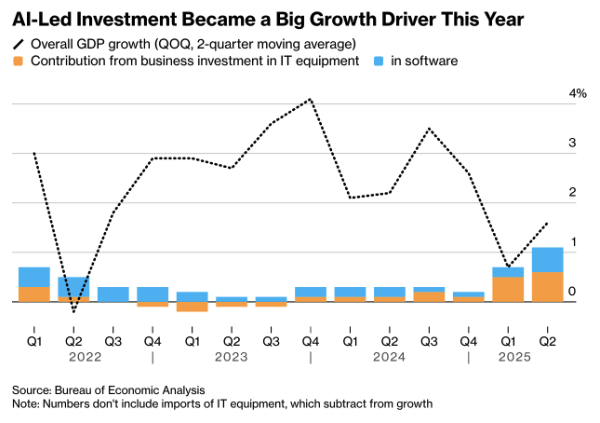

The absence of official GDP figures due to the ongoing government shutdown hides little: U.S. growth remains surprisingly resilient, largely driven by the AI boom. While the labor market is slowing and the housing sector is stagnating, investments in software, data centers, and IT equipment continue to power the expansion. Bloomberg Economics estimates that AI-related spending accounted for roughly one percentage point of total growth in the first half of 2025 and could rise to as much as 1.5 points in 2026.

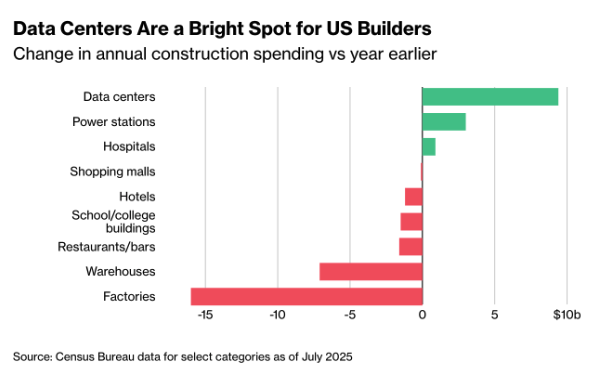

The physical backbone of that boom lies in the construction of data centers, which, at more than $41 billion in annual investment this year, represent a rare bright spot within an otherwise weakening construction sector. (Graph: “Data Centers Are a Bright Spot for US Builders” – source: Census Bureau)

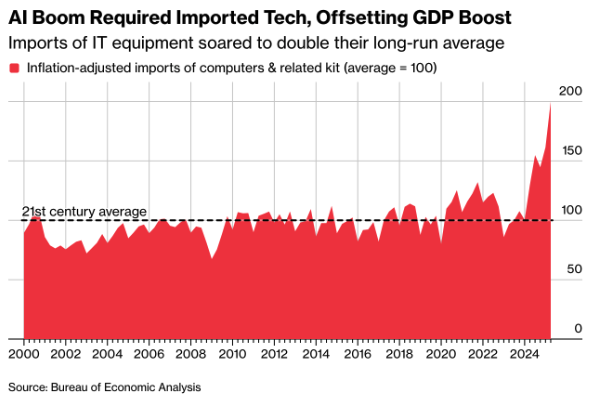

At the same time, a surge in IT imports offset part of that growth. Demand for servers and chips doubled compared with the long-term average, but thanks to exemptions for AI-related hardware, the impact of Trump’s tariffs remained limited.

(Graph: “AI Boom Required Imported Tech, Offsetting GDP Boost” – source: Bureau of Economic Analysis)

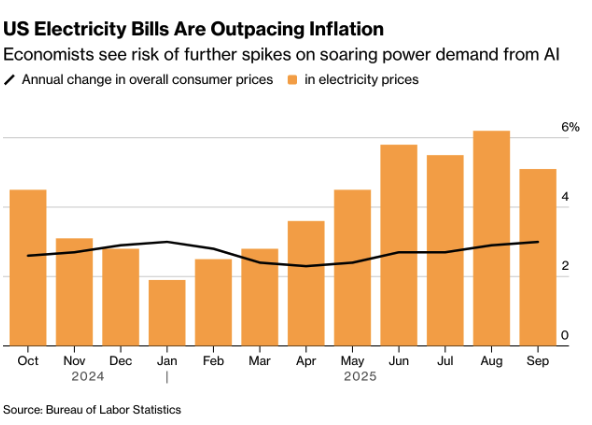

A new risk is emerging in the energy sector. Data centers are driving electricity demand sharply higher, causing power prices to rise faster than inflation. Analysts warn that capacity growth may lag behind demand in the coming years, creating risks for both inflation and economic growth.

(Graph: “US Electricity Bills Are Outpacing Inflation” – source: Bureau of Labor Statistics)

Finally, the AI wave is also fueling consumption through the wealth effects of rising stock prices. A basket of thirty AI-related stocks has generated more than $5 trillion in new wealth, according to JPMorgan, which is estimated to have added $180 billion in extra spending, accounting for roughly one-sixth of consumption growth over the past year.

In addition, President Donald Trump signed new trade agreements with Malaysia, Cambodia, and Thailand, under which these countries pledged not to impose digital services taxes or trade restrictions on U.S. tech companies. With these deals, Washington aims to maintain its dominant position in global digital trade and to press for a permanent extension of the WTO moratorium on digital import duties.

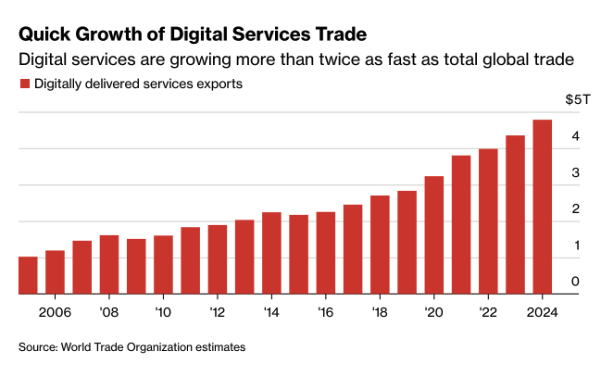

Digital trade is expanding at a remarkable pace: according to the WTO, exports of digitally delivered services reached $4.77 trillion last year, growing more than twice as fast as total world trade.

(Graph: “Quick Growth of Digital Services Trade” – source: WTO Estimates)

Lastly, U.S. consumer confidence declined in October for the third consecutive month, falling to 94.6, the lowest level since April. Expectations for the economy and labor market weakened notably, while assessments of the current situation improved slightly.

(Graph: “US Consumer Confidence Falls for a Third Month” – source: The Conference Board)

Persistent uncertainty about inflation, tariffs, and the government shutdown is weighing on sentiment. More Americans now expect fewer job opportunities ahead, while their willingness to make major purchases is declining. Yet consumption remains remarkably resilient, suggesting that the current weakness is reflected more in confidence than in actual spending.

Eurozone

Eurozone inflation slowed to 2.1% year-on-year in October, down from 2.2% in September and perfectly in line with expectations. However, core inflation held steady at 2.4%, while the services component rose to 3.4%, a sign that underlying price pressures have not yet fully subsided.

(Graph: “Headline Inflation Slows, Core Holds, Services Tick Up” – source: Eurostat)

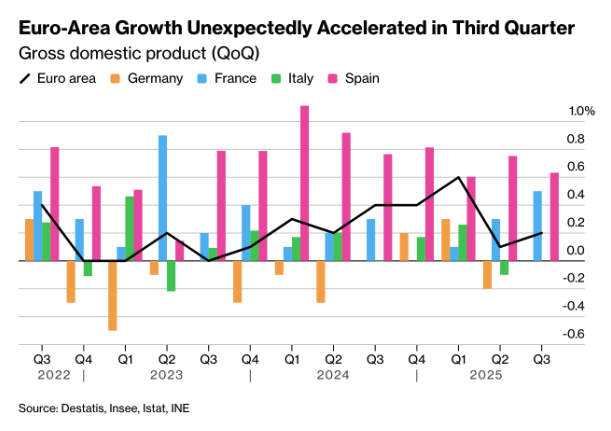

The figures support the ECB’s decision to keep interest rates unchanged at 2 percent. Christine Lagarde described the stance as “a good balance,” though uncertainty around the inflation outlook remains high. GDP growth in the third quarter rose by 0.2 percent quarter-on-quarter, showing some resilience within the monetary union, mainly driven by France, while Germany and Italy narrowly avoided recession.

Eurozone GDP growth stabilized at 0.2 percent quarter-on-quarter, better than feared, but momentum remains weak. In Germany, growth stagnated at 0.0 percent in Q3 while inflation fell to 2.3 percent. However, the GfK consumer confidence index declined to -24.1, indicating that households remain cautious despite an improvement in purchasing power.

Japan

The Bank of Japan left interest rates unchanged on Thursday, keeping the short-term rate at 0.1 percent. The new prime minister, Sanae Takaichi, known for her support of loose monetary policy, reduces the likelihood of a rapid tightening cycle. Inflation, however, remains persistent: core CPI rose to 2.8 percent year-on-year in September, marking the first acceleration in four months.

Consumer confidence improved slightly to 35.8, but domestic demand remains fragile. The yen weakened further to 152 per USD, supporting exporters but fueling import inflation. The BoJ is trying to maintain a delicate balance between growth and price stability, with a cautious path toward normalization.

Australia

The Reserve Bank of Australia (RBA) signaled this week that the pace of further easing is slowing as the labor market remains tight and inflation stubbornly high. Governor Michele Bullock described monetary policy as “cautious” and stressed that the central bank wants to see more data on employment and prices before taking additional steps.

The remarks triggered a strong market reaction: the probability of a November rate cut fell from 60 to below 40 percent, while the Australian dollar posted its strongest three-week gain. The RBA has already lowered its policy rate three times this year, but Bullock warned that “the last stretch toward the 2 percent target” will be difficult.

Economists expect core inflation to hold at 2.7 percent in the third quarter, defying the RBA’s forecast for a slight decline to 2.6 percent. A stronger inflation print would likely mean the central bank will extend its pause into the new year.

(Graph: “RBA’s Window of Further Easing Narrows” – source: RBA, Federal Reserve, RBNZ, Bank of Canada)

China

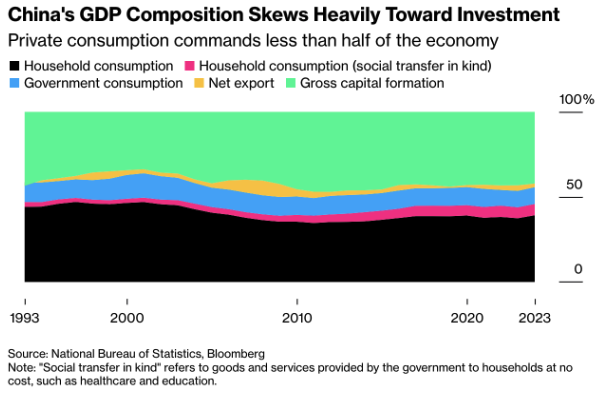

During the fourth Party Plenum in Beijing, China announced plans to significantly boost domestic consumption over the next five years in order to reduce its reliance on exports. The Party acknowledged that the Chinese economy still depends heavily on investment, which accounts for more than half of GDP, while private consumption remains below 50 percent.

(Graph: “China’s GDP Composition Skews Heavily Toward Investment” – source: NBS, Bloomberg)

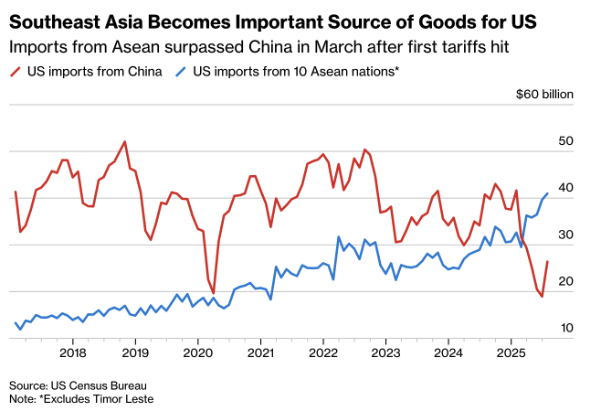

The shift comes at a time when Southeast Asia is rapidly gaining ground in global trade. Since the first U.S. tariffs took effect, imports from ASEAN countries have for the first time surpassed those from China. New trade deals signed by President Trump with Malaysia, Cambodia, Thailand, and Vietnam reinforce this trend and give U.S. exporters greater access to the region.

(Graph: “Southeast Asia Becomes Important Source of Goods for US” – source: US Census Bureau)

Looking ahead:

The coming week will be dominated by new interest rate and labor market data, with key updates from the United States, Australia, the United Kingdom, and China.

China

China opens the week with the Caixin Manufacturing PMI, followed by trade data on Friday. Analysts expect a modest improvement in exports, up 2.1 percent year-on-year, supported by the temporary easing of U.S. tariffs, while imports are likely to grow only marginally at 0.5 percent. The trade surplus remains large but is structurally weakening due to lower commodity prices and subdued domestic demand.

Australia

The Reserve Bank of Australia (RBA) meets on Tuesday, with broad expectations that the policy rate will remain at 3.6 percent. New figures on building approvals, housing prices, and household spending paint a mixed picture: the labor market is cooling gradually, but inflation remains more persistent than hoped.

Underlying price pressure stagnated over the past quarter, limiting the near-term scope for further easing. Governor Michele Bullock stresses that policy remains “cautious and data-dependent” as the bank seeks balance between price stability and economic growth.

(Graph: “Australia’s Disinflation Progress Stalled Last Quarter” – source: ABS, Bureau of Economic Analysis, STCA, ONS, Stats NZ)

United Kingdom

The Bank of England is expected to pause its rate-cutting cycle this week and keep the policy rate at 4 percent, halting the series of quarterly quarter-point reductions for now. Inflation remains close to 4 percent, still well above target, while the Reeves government prepares for its late-November budget.

Markets are currently pricing in nearly a 60 percent chance of a rate cut in December, following a series of weaker readings on inflation, employment, and GDP. Governor Andrew Bailey stressed that the exact timing will depend on fiscal policy developments and the continued easing of price pressures.

(Graph: “Bank of England Is Set to Pause Quarterly Easing Cycle” – source: Bank of England)

United States

It will be a data-heavy week in the U.S. with the ISM Manufacturing PMI on Monday, JOLTS job openings on Tuesday, and the ISM Services PMI on Wednesday. Attention will peak on Friday with the Non-Farm Payrolls report, where job growth of around 125,000 is expected—the lowest level since early this year. Unemployment is projected to edge up to 4.2 percent, which could strengthen expectations for an additional rate cut in December.

The combination of declining job openings and easing wage growth indicates that the U.S. labor market continues to cool. The Fed will watch this closely, especially after the recent softer-than-expected CPI reading.

Europe

The eurozone economy grew by 0.2 percent quarter-on-quarter in the third quarter, better than expected, supported by strong performances in France and Spain while Germany and Italy stagnated. The figures confirm that the European economy is more resilient than feared, although growth remains fragile and uneven.

Following the ECB’s latest policy decision, officials continue to tread carefully. This week will feature speeches by Christine Lagarde on Tuesday and Isabel Schnabel and Philip Lane on Thursday, while on Wednesday the new ECB wage tracker will be released—a key input for inflation prospects heading into 2026.

(Graph: “Euro-Area Growth Unexpectedly Accelerated in Third Quarter” – source: Destatis, Insee, Istat, INE)

Macro-economic agenda for upcoming week:

Monday

CH – Ratingdog Manufacturing PMI

US – ISM Manufacturing PMI

Tuesdat

AUS – RBA Interest Rate Decision

US – Jolts Job Openings

Wednesday

US – ISM Services PMI

Thursday

AUS – Balance of Trade

UK – BoE Interest Rate Decision

Friday

CH – Imports YoY, Balance of Trade, Exports YoY

DE – Balance of Trade

US – Non Farm Payrolls, Unemployment Rate, Michigan Consumer Sentiment Prel