The past week painted a clearer picture of the global economy: inflation is easing, but not convincingly; growth is holding up, yet unevenly distributed. Central banks are walking the line between easing and caution – with the Fed and the Bank of England setting the tone for a broader transition phase.

United States

The legal battle over Trump’s trade policy reached a pivotal moment this week. The Supreme Court is examining whether the president exceeded his constitutional authority by using the International Emergency Economic Powers Act (IEEPA) to impose import tariffs worldwide.

The stakes are high: the U.S. currently collects about $556 million per day in IEEPA tariffs, accounting for three-quarters of this year’s additional customs revenue. In total, proceeds could surpass $140 billion in 2025 – double the level of his first term. (Chart: “Trump Tariff Take Rose in First Term, Soared in Second” – source: U.S. Treasury)

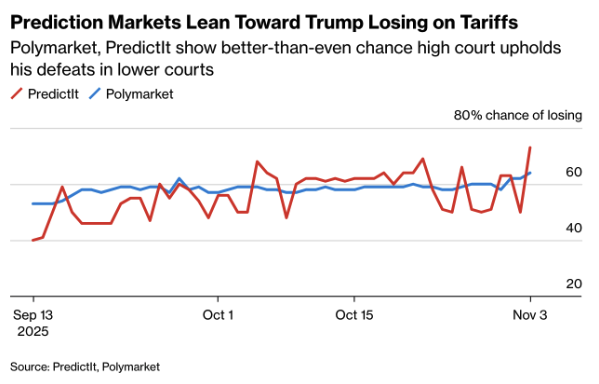

Investors are pricing in a real chance (60%) that Trump will lose the case – a scenario that could trigger billions in potential refunds for affected companies. (Chart: “Prediction Markets Lean Toward Trump Losing on Tariffs” – source: PredictIt, Polymarket)

A defeat would undermine the core of Trump’s trade policy, but experts warn that he still has other legal avenues to impose new tariffs – keeping market uncertainty alive for now.

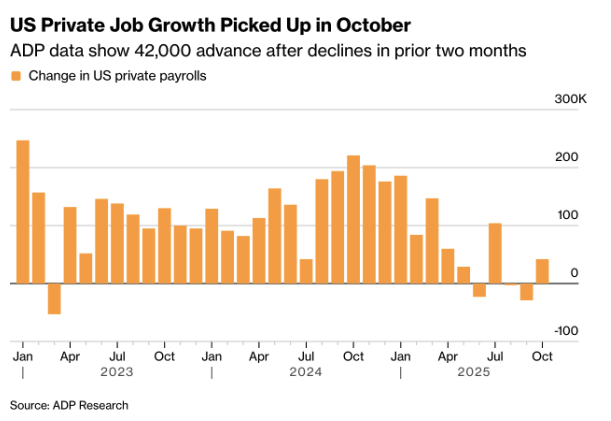

The U.S. labor market stabilized in October after two months of contraction. According to ADP Research, private-sector employment rose by 42,000, slightly above expectations. The gains came mainly from large firms, while small and mid-sized businesses again shed jobs – a sign that smaller companies continue to feel the impact of higher financing costs.

Wage growth remained flat: job changers earned +6.7% on average, while job stayers gained +4.5%. According to ADP chief economist Nela Richardson, this points to a “more balanced labor market.” The figures suggest a gradual cooling, increasing the likelihood of another Fed rate cut in December.

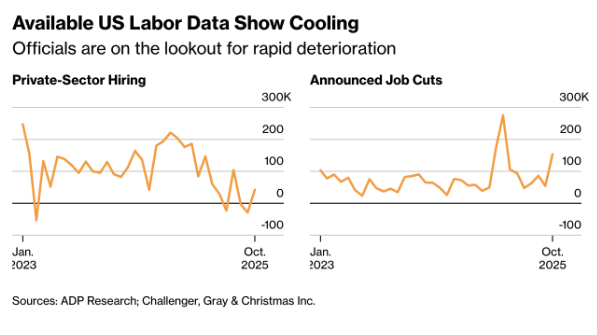

The Federal Reserve continues to operate in uncertainty as the prolonged government shutdown blocks key economic statistics. For the second month in a row, official employment data are missing, forcing policymakers to rely on fragmented indicators.

The available figures – including data from ADP Research and Challenger, Gray & Christmas – point to a cooling labor market, but not a collapse. This deepens the divide within the Fed over whether another rate cut in December is still warranted. (Chart: “Available US Labor Data Show Cooling” – source: ADP Research; Challenger, Gray & Christmas Inc.)

Chair Jerome Powell warned that the upcoming decision will be more difficult than the last: the data are incomplete, inflation remains uncertain, and patience within the FOMC is wearing thin.

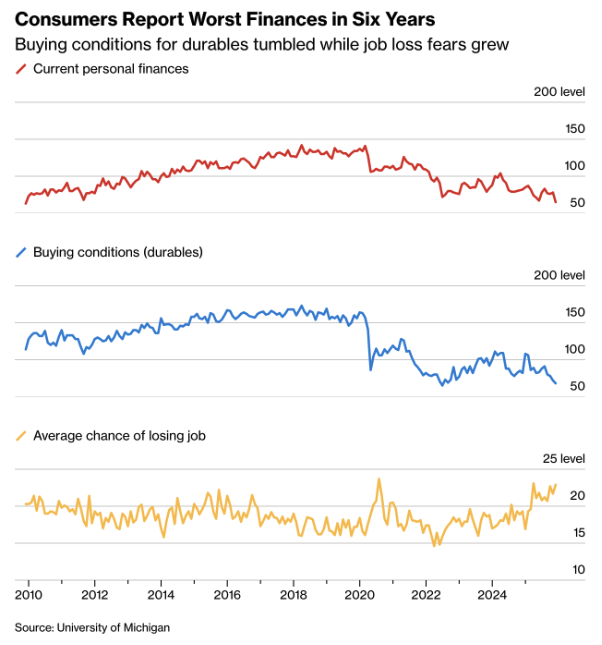

U.S. consumer confidence fell sharply in November to 50.3 – the lowest level since mid-2022. The prolonged government shutdown and persistently high prices have significantly eroded confidence in both the economy and personal finances.

The index for current economic conditions dropped to a record low of 52.3, driven mainly by rising concerns about income stability and employment. (Chart: “US Consumer Sentiment Drops to Lowest Since June 2022” – source: University of Michigan)

The same survey shows that 71% of Americans expect unemployment to rise next year, while willingness to purchase durable goods has fallen to its weakest level in three years. (Chart: “Consumers Report Worst Finances in Six Years” – source: University of Michigan)

Despite the pessimistic tone, economists expect consumer spending to hold up for now, though they warn that the link between sentiment and actual expenditures is weakening.

United Kingdom

The Bank of England kept interest rates unchanged at 4% this week, in a narrow vote that leaves the door open for a rate cut in December. Governor Andrew Bailey cast the deciding vote as five members favored holding and four supported a reduction to 3.75%.

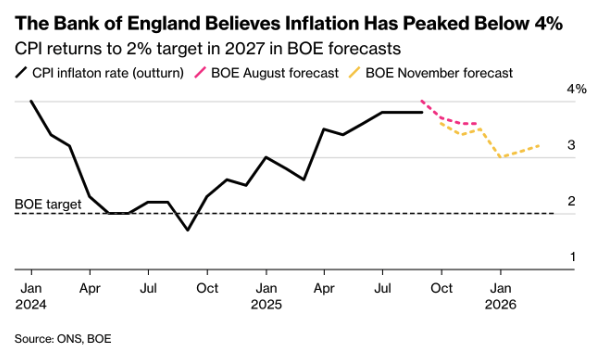

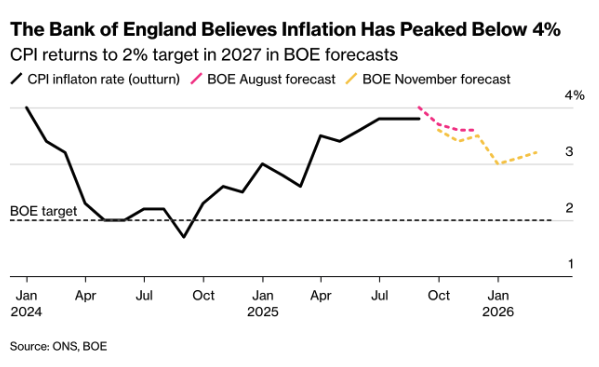

According to the Bank’s new projections, inflation in the UK has definitively passed its peak and is expected to gradually fall toward the 2% target by 2027. (Chart: “The Bank of England Believes Inflation Has Peaked Below 4%” – source: ONS, BOE)

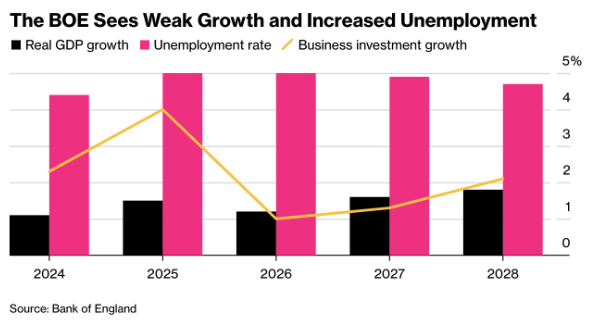

Still, the broader macro picture remains bleak: the Bank of England’s business survey shows weakening growth and investment, alongside a rise in unemployment. This increases political pressure on Chancellor Rachel Reeves, who is set to present her budget later this month. (Chart: “The BOE Sees Weak Growth and Increased Unemployment” – source: Bank of England)

China

Premier Li Qiang emphasized this week that China expects a stable growth path of around 4% annually in the coming years, which would bring GDP to over 170 trillion yuan ($23.9 trillion) by 2030. Speaking at the China International Import Expo in Shanghai, Li again positioned the country as an attractive market for foreign investors and pledged greater emphasis on domestic consumption.

The message is clear: Beijing wants to make the economy less dependent on exports and industry, and more driven by household spending. That is also necessary – domestic demand remains weak, under structural pressure from deflation and sluggish wage growth.

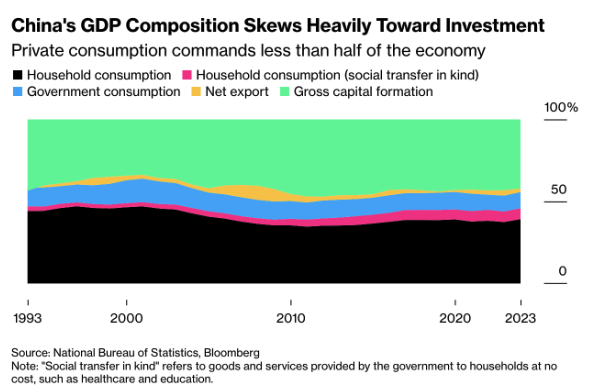

China aims to restore consumer confidence through targeted support measures, higher social spending, and efforts to curb destructive price competition (“anti-involution”). Yet the share of consumption in GDP remains low by international standards – households account for less than half of total output, compared with over 60% in developed economies.

(Chart: “China’s Household Consumption Is Weak” – source: World Bank)

The Caixin Manufacturing PMI edged down slightly to 50.6, remaining just above the expansion threshold. Exports fell again in October (-1.1% y/y), while imports were flat. The trade surplus stayed comfortably positive, but momentum is fading.

The contrast remains stark: exports are providing temporary support, while domestic consumption and private investment remain weak. The structural imbalance in China’s economy – with investment still accounting for nearly 45% of GDP – underscores Beijing’s struggle to shift toward a sustainable, consumption-driven growth model.

Eurozone

The euro area economy grew by 0.2% quarter-on-quarter in the third quarter, slightly above expectations. France and Spain led the expansion, while Germany and Italy stagnated. The ECB kept its policy rate unchanged at 2%, describing the current stance as a “solid starting point” to stabilize inflation over the medium term.

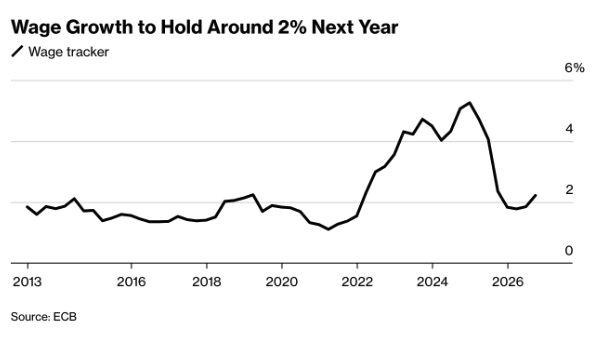

Wage growth across the eurozone appears to be stabilizing around 2% by 2026, reinforcing the ECB’s view that inflation is durably under control. According to the ECB wage tracker, pay is expected to rise by 1.8% in Q2 and 2.2% in Q3 next year – a sharp contrast with the 5.3% peak seen at the end of 2024.

(Chart: “Wage Growth to Hold Around 2% Next Year” – source: ECB)

The cooling in wage growth supports the ECB’s recent decision to leave interest rates unchanged for a third consecutive meeting. President Christine Lagarde emphasized that the central bank is “in a good position,” while cautioning that wage dynamics remain key to assessing underlying inflation pressure.

With services inflation rising to 3.4% and core inflation steady at 2.4%, the Governing Council remains vigilant. Still, the downward trend in wages suggests that further rate cuts could come into view in 2026.

Lagarde remains cautious about additional easing, but upcoming wage data will be decisive. Divergences within the euro area are widening: southern Europe continues to grow, while German industry is once again contracting. Markets expect the ECB to stay on hold until March 2026, unless wage pressures ease faster than anticipated.

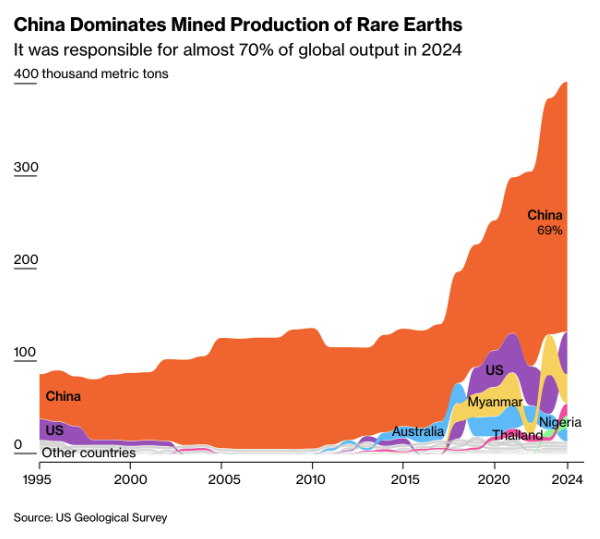

In the aftermath of the U.S.–China trade summit, Europe continues to struggle with the fallout from Beijing’s tightened export restrictions. While Washington managed to secure a temporary pause on new measures during the Trump–Xi talks, the European Union did not. For European industries -0 from carmakers to defense firms – the result is severe disruption in the supply of rare earth elements, critical materials for batteries, semiconductors, and weapons technology.

The EU has warned internally that it has limited short-term leverage to push China into relaxing its export curbs. According to sources, talks with Beijing have stalled despite pressure from Brussels to simplify export procedures and ensure supply security. The restrictions China imposed in April remain in effect, even though the country agreed during the recent Trump–Xi summit to temporarily delay new controls.

China accounts for nearly 70% of global rare earth production, laying bare Europe’s vulnerability. (Chart: “China Dominates Mined Production of Rare Earths” – source: U.S. Geological Survey)

According to insiders, the European Commission is considering emergency measures to cushion sudden supply disruptions, alongside plans to diversify strategic reserves of critical materials. But as long as Beijing controls export licenses, the EU remains “trapped in a system where economic power has become political leverage.”

Looking ahead to the coming week:

The focus will be squarely on inflation, growth, and consumer sentiment, with new data from the U.S., U.K., Germany, Australia, and China set to guide central bank decisions.

United States

The longest government shutdown in U.S. history is deepening a growing data vacuum – just as the Federal Reserve remains divided over its next policy step. The shutdown has already delayed two jobs reports, and the October inflation update is now also at risk.

The Bureau of Labor Statistics may be unable to publish any CPI figures for October, as data collection has been halted. This deprives the Fed of crucial information needed to determine whether another rate cut in December is justified. Even if the government reopens soon, much of the data will be reconstructed retroactively and with limited reliability.

The uncertainty is widening the policy divide within the Fed: some members point to cooling labor-market indicators, while others warn that the lack of inflation data heightens the risk of easing too soon.

Eurozone

In the United Kingdom, attention this week shifts to labor and growth data following the Bank of England’s decision to keep rates at 4%. Labor-market figures due Tuesday are expected to show a slight moderation in wage growth during the third quarter. Two days later, GDP data will likely confirm a modest slowdown – consistent with the weaker investment and rising unemployment flagged earlier by the central bank.

Comments from policymakers such as Clare Lombardelli, Megan Greene, and Huw Pill will shape market expectations for a potential rate cut in December, as inflation is now seen peaking below 4% and only returning to the 2% target by 2027.

(Chart: “The Bank of England Believes Inflation Has Peaked Below 4%” – source: ONS, BOE)

In the eurozone, the data calendar is relatively quiet. Germany’s ZEW index (Tuesday) will offer further insight into investor sentiment, while industrial production data for the currency bloc will be released on Thursday. Meanwhile, ECB officials Isabel Schnabel and Luis de Guindos are scheduled to speak, potentially offering more guidance on the policy outlook heading into 2025.

Australia

The Westpac Consumer Confidence and NAB Business Confidence surveys (Tuesday) are expected to confirm that sentiment remains under pressure from high interest rates and rising costs. As a result, the Reserve Bank of Australia is likely to remain cautious – further rate cuts are not expected before February.

China

China remains heavily dependent on investment as its main growth engine, while domestic consumption continues to lag. Recent data show that private consumption accounts for less than half of GDP – a structural weakness Beijing is now trying to address.

The government is aiming for a shift toward consumption-driven growth through wage increases, tax relief, and support for the services sector. Yet investment remains the dominant driver, particularly in infrastructure, real estate, and high-tech manufacturing. Local governments continue to play a key role through special bonds and state-backed funds.

The coming months will reveal whether these policies can genuinely strengthen domestic demand. As long as income growth remains subdued and urban employment fragile, China’s growth will stay unbalanced – strong on paper, but fragile at its core.

(Chart: “China’s GDP Composition Skews Heavily Toward Investment” – source: National Bureau of Statistics, Bloomberg)

The week concludes with key data on retail sales and industrial production (Friday). Analysts expect retail sales to have risen by 4.8% year-on-year in October (down from 5.5% in September), while industrial output is seen slowing slightly to 4.2%. These figures will be crucial in assessing whether recent fiscal stimulus is starting to take effect or if additional measures will be needed to counter deflation risks.

Macro-economic agenda for upcoming week:

Monday

–

Tuesday

AUS – Westpac Consumer Confidence, NAB Business Confidence

UK – Unemployment Rate

DE – ZEW Economic Sentiment Index

Wednesday

US – Fed speeches

Thursday

UK – GDP Growth Rate QoQ/YoY Prel, GDP MoM

US – Inflation Rate MoM/YoY Prel, Core Inflation Rate MoM/YoY

Friday

CH – Retail Sales YoY, Industrial Production YoY

US – Retail Sales MoM, PPI MoM