Germany and the euro area

The German Ifo index rose slightly, though less than expected. Business sentiment shows a modest improvement but remains at levels consistent with an economy operating close to stagnation. Within the subcomponents, the most notable element was that expectations for the next six months have barely improved.

Toward the end of the week, preliminary inflation estimates for Germany point to a mild acceleration, mainly driven by energy and a few services categories. Inflation differentials within the euro area remain wide, which argues for caution rather than acceleration in ECB policy. Lagarde’s remarks in Bratislava underscored that the Governing Council is committed to the current path and sees the recent stabilisation in core inflation as sufficient reason to wait longer.

The ECB warns in its semi-annual Financial Stability Review that financial vulnerabilities in the euro area are rising again. It highlights stretched valuations, an increasing risk of sudden repricing and fiscal stress in countries such as France, where concerns over the widening budget deficit are becoming more visible.

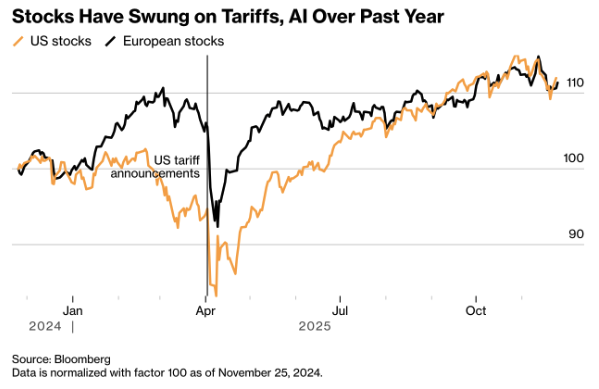

The chart Stocks Have Swung on Tariffs, AI Over Past Year illustrates how sensitive markets have been over the past year to tariff headlines and AI-related news. According to the ECB, this combination of elevated valuations and growing concentration in AI equities increases the risk of abrupt market corrections.

The ECB also warns that open ended funds with liquidity mismatches, pockets of elevated hedge fund leverage and limited transparency in private markets can amplify any shock. Sovereign bond markets face similar vulnerabilities. A potential repricing of sovereign risk would be harder to absorb than in the past because the investor base has become more sensitive to price moves.

Overall, financial stability in the euro area remains fragile even though trade uncertainty has eased since April. The ECB stresses that the risk of renewed volatility persists as long as growth slows, fiscal concerns intensify and doubts remain over the scale of AI related investment.

Asia

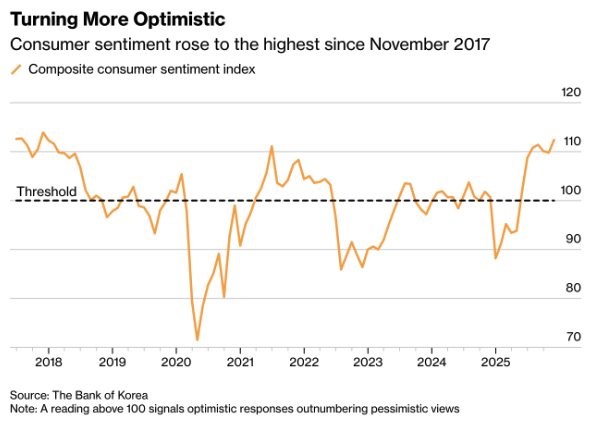

Inflation in Asia remained mixed. Singapore reported slightly stronger price gains than expected, while Taiwan showed stable unemployment and weak industrial production that highlights the continued softness in external demand. Signals across Northeast Asia diverged, with marginally improved consumer confidence in South Korea and Japan set against subdued retail spending.

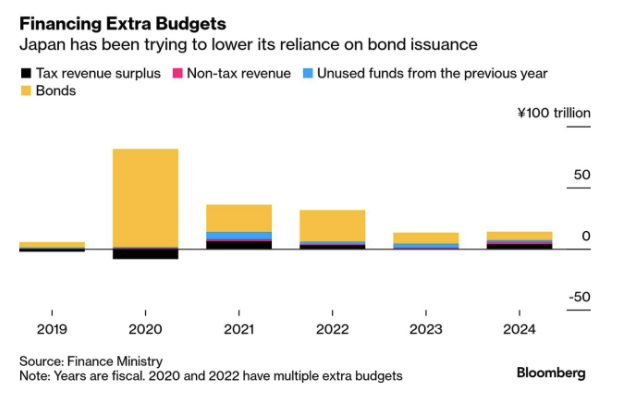

Japan’s new stimulus package underlines how difficult it remains for Prime Minister Takaichi to pair her supportive policy stance with fiscal discipline. The programme, the largest since the removal of pandemic restrictions, aims to offset weak growth but increases pressure on public finances at the same time.

In South Korea, sentiment is moving in the right direction. The chart Turning More Optimistic shows that consumer confidence rose in November to its highest level since 2017. A recent trade agreement with the United States and stronger growth during the summer months have given households more confidence that the export engine is regaining traction.

United States

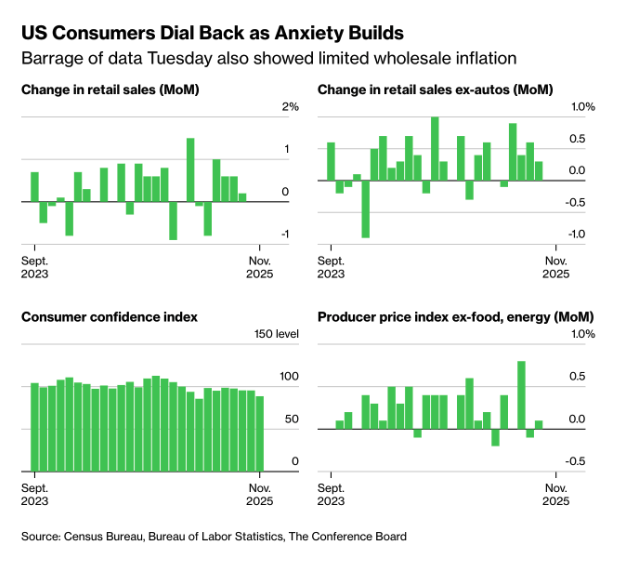

US data shaped global sentiment this week. Producer price inflation came in slightly higher, driven by transportation and several energy related categories, indicating that producer prices have not yet fully stabilised. Retail sales offered a softer surprise, posting a modest increase that fell short of earlier months and points to a more cautious consumer.

The focus was on Wednesday. The first estimate of third quarter GDP was broadly in line with expectations but revealed a weaker domestic demand profile than earlier projections suggested. Durable goods orders fell more sharply than expected, driven largely by declining investment in transportation equipment and machinery.

Income and spending data painted a mixed picture, with real consumption beginning to cool. Core PCE, the Fed’s key inflation gauge, matched expectations at 0.2 percent month on month. The disinflation path therefore remains intact, but the combination of weaker orders and softening consumption increases the likelihood that the Fed will need to reconsider further easing in early 2025.

JPMorgan has shifted its view. After briefly expecting a pause until January, chief economist Michael Feroli now projects a rate cut at the Fed meeting on 9–10 December. Statements from influential policymakers, particularly New York Fed President John Williams, have pushed the balance toward a near term cut in JPMorgan’s assessment.

Markets are moving in the same direction. As the chart Swaps Traders Are Pricing Fed Cut in December shows, the probability of a quarter point cut in OIS markets has risen to around 80 percent, up from less than 30 percent a week ago. JPMorgan also expects the Fed to follow through with a second cut in January.

The tone of recent Fedspeak makes the December meeting a finely balanced scenario again, leaning slightly to the dovish side.

United Kingdom

The Office for Budget Responsibility saw its reputation take a hit this week after the Autumn Budget projections were published online an hour early. The incident triggered market volatility and fuelled criticism within Labour that the watchdog has too much influence over the budget process. Some members even argue for its abolition, while others want to curb its authority without risking market instability.

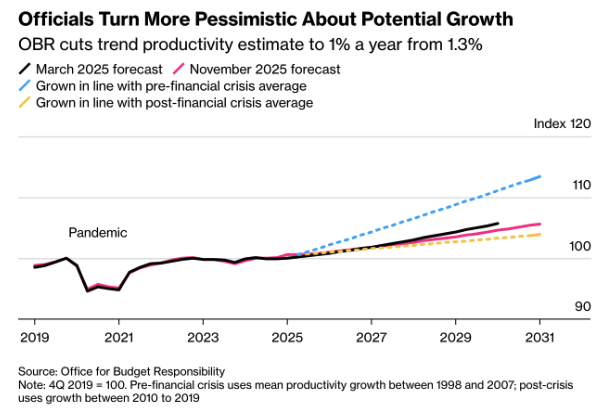

The core frustration lies in the new growth assumptions. As the chart Officials Turn More Pessimistic About Potential Growth shows, the OBR has lowered its structural productivity estimate from 1.3 to 1 percent per year. This downward revision reduced Reeves’s fiscal buffer by 5.7 billion pounds and forces higher taxes and spending cuts to remain within the fiscal rules.

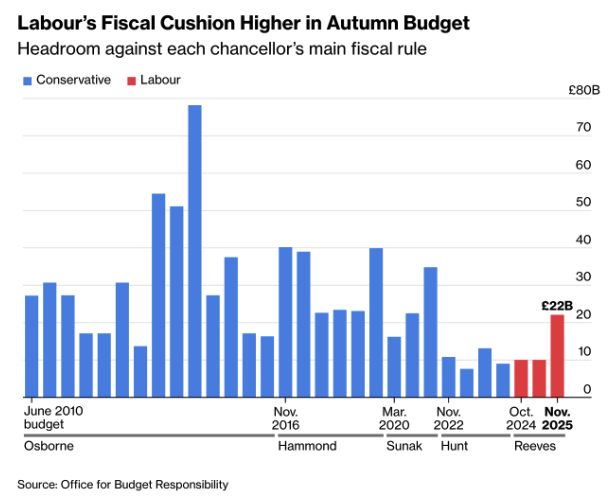

Economists note that this is exactly the role of the OBR: preventing ministers from shaping their own numbers, as the debacle around Truss’s unfunded tax cuts in 2022 already demonstrated. The chart Labour’s Fiscal Cushion Higher in Autumn Budget shows that Reeves has created more room than her predecessors, but the margin remains narrow.

The political dilemma is clear. Reforming the OBR is possible, but any weakening of its independence would immediately undermine its credibility in financial markets. For now, Reeves is sticking with the institution, though the watchdog’s role is set to be scaled back visibly.

Looking ahead to next week

The first week of December will revolve around fresh signals on the pace of the global slowdown. In the United States, the ISM indices and core PCE inflation will help shape expectations for the Fed. In Europe, flash inflation is the main focus, while Australia and Japan provide insight into growth momentum and confidence across Asia.

United States

The Fed will finally receive the long delayed September PCE inflation report this week, just ahead of the 9–10 December meeting. Expectations are again for a 0.2 percent month on month increase in core PCE, keeping year on year inflation just below three percent. That remains stable but stubbornly above target, maintaining tension within the Fed’s policy debate, particularly as labour market signals stay mixed.

The chart US Initial Jobless Claims Fall to the Lowest Since April shows that initial claims have recently fallen, while continuing claims have climbed toward their highest level since 2021. This two track pattern adds to the uncertainty. Hiring is cooling, but broad based layoffs have not yet materialised.

With additional data this week including ADP employment, the ISM indices and the delayed industrial production report, the central question will be whether a third consecutive rate cut in December is justified. Markets see that as the base case.

In Canada, November data point to continued labour market softness linked to US trade tariffs. The central bank is therefore holding at 2.25 percent and expects weak wage and demand pressures toward year end.

Euro area

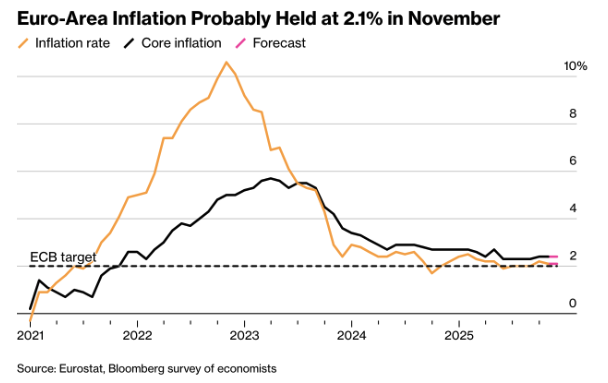

Euro area inflation remains the key data release this week. The preliminary November figures are expected to come in close to two percent again. Economists forecast 2.1 percent year on year, while core inflation likely stays at 2.4 percent.

The chart Euro Area Inflation Probably Held at 2.1 Percent in November shows that disinflation remains broad enough for the ECB to stay comfortably on hold.

This makes the 18 December meeting mainly a forward-looking moment. With new projections extending to 2028, the Governing Council will assess whether the current path is sustainable, especially as national inflation prints diverge. Germany and Spain surprised to the upside, while France and Italy showed weaker momentum. It highlights a euro area that still lacks a uniform inflation profile.

The bias within the Council remains cautious. Lagarde continues to emphasise that the current rate level is sufficiently restrictive, while De Guindos warns primarily about the risk of renewed price pressure. Bloomberg Economics, by contrast, sees scope for additional cooling in December, which could strengthen the case for rate cuts early next year.

With new US CPI data and the OECD outlook due later this week, inflation remains the dominant global theme. The ECB has little incentive to move in December, but pressure will build into 2025 if the downward trend in prices continues.

Asia Pacific

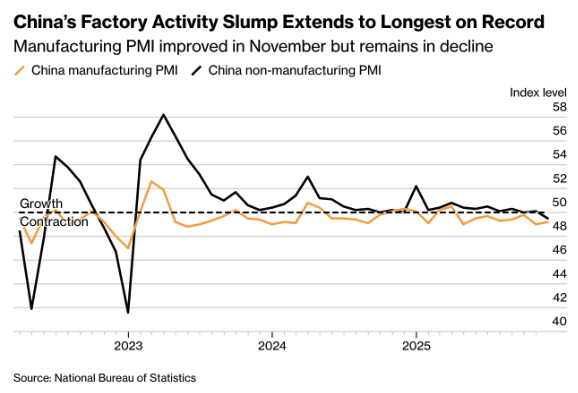

Asia enters December with a full calendar focused on industrial momentum and price dynamics heading into year end. The first signal came from China, where the manufacturing PMI remained below 50 and extended the longest contraction period on record. The chart China’s Factory Activity Slump Extends to Longest on Record illustrates how persistent the weakness in the manufacturing sector remains, despite a slight improvement in November.

Sentiment will also be shaped by Bank of Japan Governor Ueda, who may hint on Monday at the likelihood of a December rate increase. Australia opens the week with a set of third quarter figures ranging from housing to corporate profits, setting the stage for Wednesday’s GDP release. Japan will publish broad quarterly data on investment and profitability, which will feed into the upcoming GDP revision.

Macro-economic agenda for upcoming week:

Monday

CH – Ratingdog Manufacturing PMI

US – ISM Manufacturing PMI

Tuesday

JPN – Consumer Confidence

EU – Inflation Rate YoY Flash

Wednesday

AUS – GDP Growth Rate QoQ

US – ISM Services PMI

Thursday

AUS – Balance of Trade

Friday

US – Unemployment Rate, Personal Income/Spending MoM, Core PCE Price Index MoM, Michigan Consumer Sentiment Prel