United States

US growth data surprised on the upside. The second estimate of Q2 GDP showed the economy expanding by 3.3% year-on-year, up from the initial 3%. The revision reflected resilient private consumption, a strong rise in AI-related investment and intellectual property (software and R&D), and a sharp fall in imports. Despite the stronger quarter, average growth in H1 2025 stands at just 1.4%, well below the 2.5% pace of H2 2024.

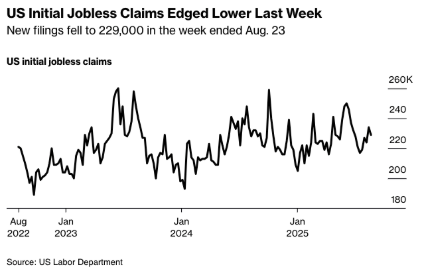

Meanwhile, labor market signals were more subdued. Initial jobless claims fell slightly to 229,000, undershooting forecasts, but the four-week average rose to 228,500, pointing to a gradual upward drift. Continuing claims stayed elevated at 1.95 million, suggesting job seekers are taking longer to find work (chart: US Initial Jobless Claims Edged Lower Last Week).

The latest figures highlight a dual dynamic: companies are reluctant to carry out large-scale layoffs, yet they are also hiring less aggressively. For the Fed this is a crucial signal. At Jackson Hole, Powell acknowledged rising risks for employment, noting that this leaves the door open to a rate cut in September.

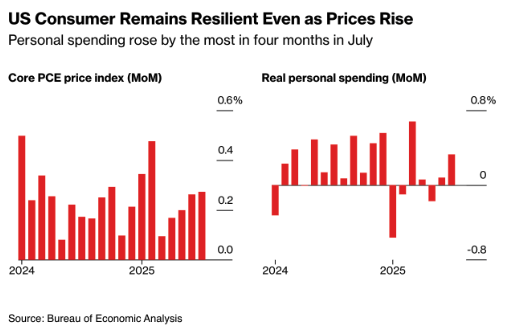

Core PCE inflation, the Fed’s preferred gauge, rose by 0.3% month-on-month in July and accelerated to 2.9% year-on-year, the highest since February. The increase was driven mainly by higher services prices. Economists expect additional pressure from goods prices once Trump’s tariffs fully feed through.

Meanwhile, US households showed surprising resilience. Personal spending increased by 0.5%, the strongest rise in four months (chart: US Consumer Remains Resilient Even as Prices Rise).

US consumer confidence eased in August, slipping to 97.4 after a 1.3-point drop from the upwardly revised July level. The decline was mainly driven by weaker expectations for the next six months and softer assessments of current conditions, which fell to their lowest since April (chart: US Consumer Confidence in Holding Pattern).

The labor market appears to be the main concern. The share of consumers who find jobs “hard to get” rose to its highest point since 2021, while the group describing jobs as “plentiful” remained stable. This difference, a key indicator for economists, has been narrowing for three years, pointing to a gradual weakening in labor dynamics.

Trade Tariffs

The US Federal Court of Appeals ruled that President Trump exceeded his authority by imposing most global tariffs under the IEEPA emergency law. The judges concluded that the law does not explicitly grant the president the power to impose tariffs or taxes, thereby upholding an earlier ruling by the Court of International Trade.

For now, the tariffs remain in force while the appeal is pending, leaving billions of dollars in global trade in limbo. Trump denounced the ruling as “a total disaster for the country.” The case could ultimately reach the Supreme Court. A permanent overturn would undermine Trump’s trade agenda and raise pressure for refunds on duties already collected. For markets, this keeps legal uncertainty around US trade policy high and volatility elevated in tariff-sensitive sectors such as autos, technology, and commodities.

Eurozone

The publication of the ECB’s July minutes confirmed that the Governing Council currently assesses inflation risks as “broadly balanced.” Most policymakers stressed that keeping the deposit facility at 2%, after eight rate cuts in nine meetings, is the most robust approach to deal with two-sided risks. While some members argued for further easing given downside risks to growth and inflation, the majority preferred to wait. The reasoning: the current rate is in a neutral zone, financial conditions are stable, and inflation is “in a good place” around the 2% target.

The minutes outline a cautious policy path. The ECB emphasized the “option value of waiting,” with policymakers keen to preserve flexibility and avoid sending overly explicit signals about future moves. This suggests that rates will almost certainly remain unchanged in September, with the next cut unlikely before December.

On inflation, the message was mixed. Headline inflation is expected to hover around current levels for the rest of 2025, partly due to higher energy prices, before dipping toward 1.5% in Q1 2026. At the same time, core inflation fell to 2.3% in July, the lowest in more than three years, and is projected to cool further to around 2% by early 2026. Some members still see risks skewed to the downside, while others warn of medium-term upside pressures.

The euro also came under discussion. Recent exchange rate developments were described as structural and “unlikely to reverse quickly,” with potential implications for the eurozone’s external competitiveness in the medium term. This is particularly relevant in light of the recent trade agreement with the US, which locked in a 15% tariff on most European exports.

The minutes confirm that the ECB is opting for a policy pause and maximum optionality. Lagarde and her colleagues see the economy as resilient enough to maintain current rates, while keeping the door open to further cuts should growth and inflation risks shift. For markets, this dampens expectations of a rapid sequence of new rate reductions, offering some short-term support to the euro – though structural pressure from tariffs and policy divergence with the US remains strong.

EU–US Trade

The European Commission aims to fast-track legislation this week to eliminate all tariffs on US industrial goods, in exchange for a reduction of the US levy on European cars. This move addresses President Trump’s demand: while he already imposed a 15% tariff on most European exports, cars had been excluded.

For the EU, this represents a politically uncomfortable concession but one deemed necessary to provide certainty for businesses. Germany is especially exposed, having exported $34.9 billion worth of cars and parts to the US in 2024. European vehicles are currently subject to a 27.5% tariff (chart: Top 10 Importers of Cars Into the US).

If the Commission submits the legislation in time, the tariff reduction would be applied retroactively from August 1. This would immediately ease export pressure on the European auto industry, while at the same time underscoring the EU’s dependence on US policy decisions.

Germany

German inflation rose to 2.2% year-on-year in July, up from 2.0% in June and slightly above expectations. Consumer confidence weakened further, with the GfK index falling from –21.7 in August to –23.7 in September, reflecting concerns over job security and cautious household spending. The Ifo business climate index improved modestly from 88.6 to 89.0 in August, suggesting some optimism in the corporate sector despite ongoing weakness.

Canada

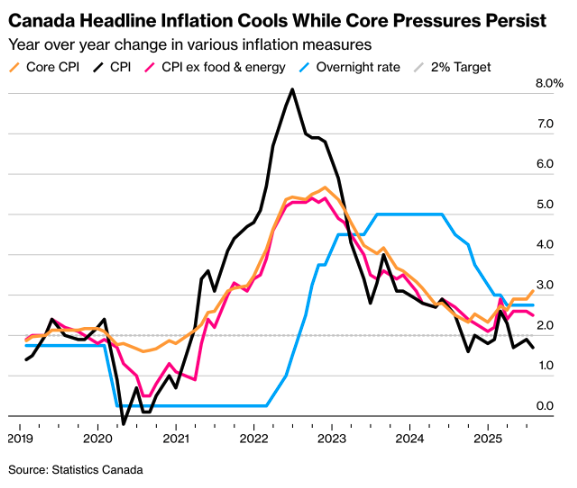

The Bank of Canada remains committed to its 2% inflation target but is reviewing how core inflation should be measured and how housing costs ought to be incorporated into policy. Speaking in Mexico City, Governor Macklem noted that interest rates feed directly into the housing market, and that measures such as the trim and median core indicators are under reassessment.

Headline inflation cooled to 1.7% in July, while core measures stayed around 3% (chart: Canada Headline Inflation Cools While Core Pressures Persist). The gap keeps policymakers cautious. The policy rate has now been held at 2.75% for three consecutive meetings, and markets expect no change at the next meeting on September 17.

Asia / Australia

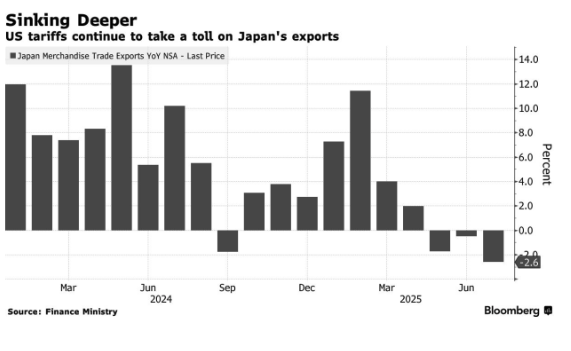

In Japan, Tokyo-area inflation eased slightly in August, with overall prices rising 2.6% year-on-year and core inflation at 2.5%, both in line with expectations. Household consumer confidence improved to 34.9 in August from 33.7 in July – still low, but moving upward.

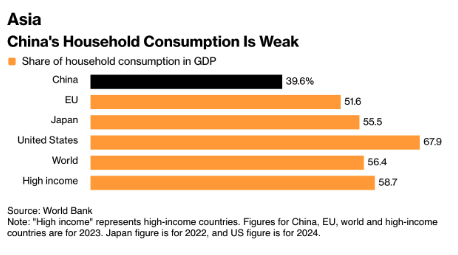

In China, household consumption remains structurally weak compared to other major economies. While consumption accounts for more than half of GDP in the US and other high-income countries, China’s share is significantly lower (chart: China’s Household Consumption Is Weak).

In China, policy advisers are increasingly calling for a shift of investment and production toward public services and income support to strengthen domestic demand. Without such reorientation, the Chinese economy remains heavily reliant on investment and exports, with the consumer playing only a limited role as a growth engine.

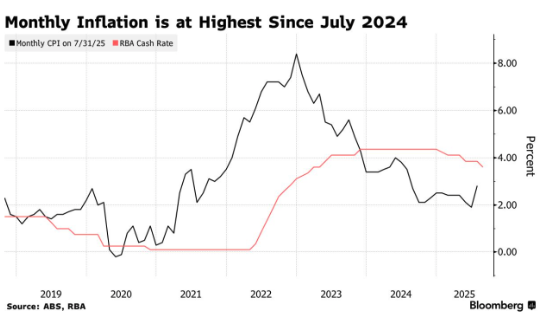

In Australia, consumer confidence jumped to 98.5 in August, up 5.7% from July and reaching its highest level since early 2022. The improvement was largely driven by the Reserve Bank of Australia’s third rate cut this year, which lowered the cash rate to 3.6%. While inflation remains within the 2–3% target range, the RBA has signaled that further easing may still be warranted.

Australian inflation also accelerated more strongly than expected in July. The monthly CPI rose to 2.8% year-on-year, up from 1.9% in June and the highest since July 2024. The trimmed mean climbed to 2.7% Housing costs (+3.6%), driven by higher electricity prices, were a major contributor to the increase.

In Japan, slightly lower inflation and a modest improvement in consumer confidence point to ongoing caution, reinforcing the BoJ’s stance to keep policy unchanged for now. In Australia, stronger confidence and rate cuts are creating upward momentum, though inflation pressures — particularly from energy and housing costs — remain a concern.

For the coming week

Eurozone

On Tuesday, inflation figures will be released. Following recent tariff hikes and higher energy prices, a slight acceleration is expected, though inflation will likely remain close to the ECB’s 2% target. For markets, the key point is whether core inflation stays under control, which would make a new rate cut in September unlikely.

In addition, Christine Lagarde speaks on Monday. Her tone will likely be cautious: emphasizing that the economy remains resilient, but that policy space is limited. Any sign of concern about slowing growth could have an immediate impact on EUR/USD.

United States

On Tuesday, the ISM manufacturing PMI is due, with a slight uptick expected but still near recession levels. This would confirm the fragility of the industrial sector under pressure from Trump’s tariffs.

On Wednesday, JOLTS job openings follow, with expectations of a further decline, confirming the weakening labor market.

On Thursday, the ISM services PMI will be published, likely remaining above 50 but showing some slowdown. As the services sector forms the backbone of US growth, this is a crucial datapoint.

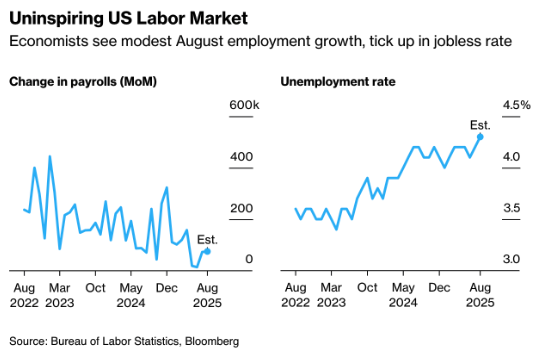

All eyes this week are on the August jobs report. Economists expect job growth of around +75,000, which would mark the fourth consecutive month below 100,000 — the weakest stretch since the pandemic. The unemployment rate is projected at 4.3%, a near four-year high (chart: Uninspiring US Labor Market).

The weaker payroll trend aligns with other signals, including the decline in job openings and a lower participation rate. According to Bloomberg Economics, a modest rebound toward +93,000 jobs could mainly come from sectors such as local government, leisure & hospitality, and construction.

Australia / Asia

In Australia, Q2 GDP on Wednesday is expected to show a slight acceleration, preceded by data on inventories and building approvals (Monday) and followed later in the week by figures on exports and consumption. South Korea is likely to report flat growth, weaker exports, and lower inflation.

Data from China on Sunday showed factory activity remained in contraction in August, despite support from the trade deal with the US. In Japan, reports are due on business investment, wages, and household spending, while inflation figures from Southeast Asia are expected to confirm further cooling.

United Kingdom

On Thursday, the S&P Global Construction PMI will be released, which is expected to remain in negative territory. On Friday, retail sales follow, with a weak outcome anticipated due to pressure on household purchasing power. This would give the BoE more room to shift its tone toward future rate cuts.

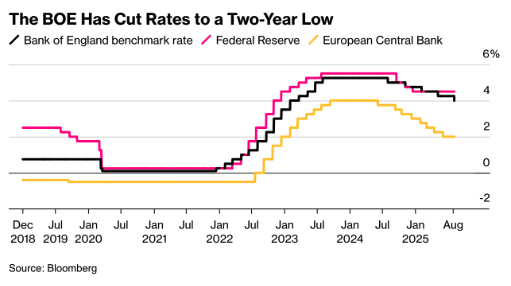

The Bank of England has lowered interest rates to their lowest level in two years (chart: The BOE Has Cut Rates to a Two-Year Low). On Wednesday, a key parliamentary hearing will take place, with Governor Bailey and other policymakers providing further explanation of the committee’s unprecedented split vote. Friday’s retail sales will offer additional insight into domestic demand.

Macro-economic agenda for upcoming week:

Monday

CH – Caixin Manufacturing PMI

EU – Lagarde Speech

Tuesday

EU – Inflation Rate YoY Flash

US – ISM manufacturing PMI

Wednesday

AUS – GDP Growth Rate QoQ

US – Jolts Job Openings

Thursday

AUS – Balance of Trade

US – ISM Services PMI

UK – S&P Global Construction PMI

Friday

UK – Retails Sales MoM

US – Non Farm Payrolls, Unemployment Rate