We started last week with markets in a wait-and-see mode, anticipating the extent to which Trump would impose import tariffs. By the weekend, we had clarity:

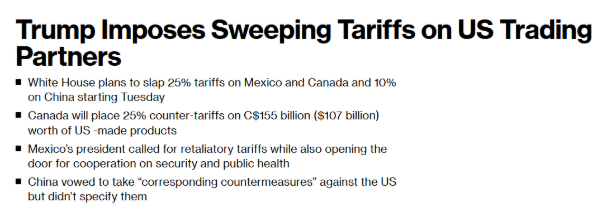

Starting Tuesday, new import tariffs will be applied—25% on Mexico and Canada, and 10% on China.

The initial market reaction suggests that investors are giving the dollar the benefit of the doubt, while equities are being sold off due to concerns about potential backlash. On Friday, EUR/USD futures showed a sharp dollar rally, pushing the exchange rate above 1.02.

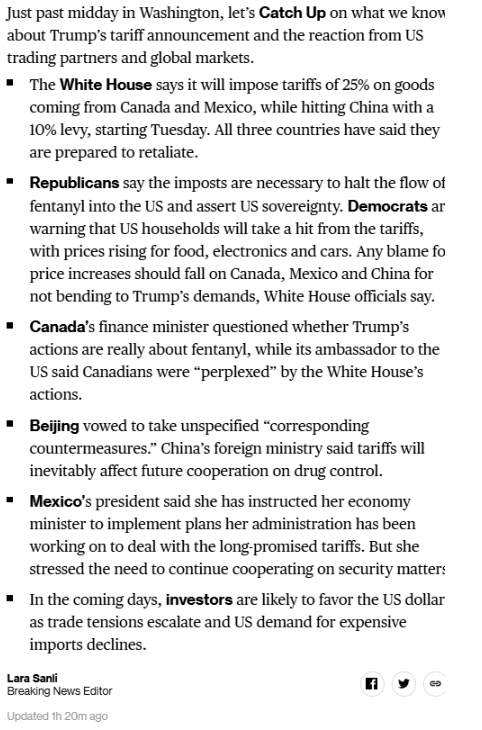

A brief summary for those interested:

Here, we see markets shifting their focus to the details of implementation—both the “how” and the “what.”

The “what” in this case refers to the potential benefits for the U.S. What does the U.S. stand to gain from these tariffs? Looking at the American economy, the primary goal appears to be stimulating economic growth.

Or, as LVMH CEO Bernard Arnault highlighted in his open letter, the key difference between the U.S. and the EU:

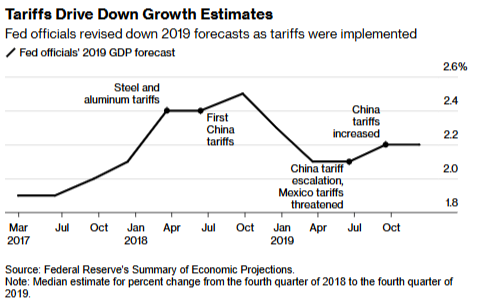

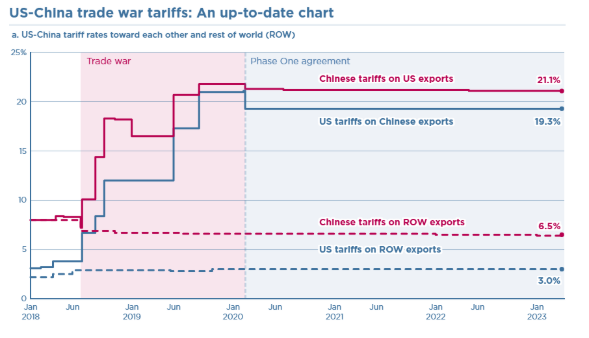

And this is exactly why tariffs seem to contradict Trump’s own objectives. In 2019, the Trump administration implemented targeted tariffs, unlike the broad measures currently being discussed. Beyond driving up prices, the main impact was slower economic growth.

Chart: Effects of 2019 Tariffs on Economic Growth

And from the end of 2019, when the “Phase One” trade tariffs were introduced:

Immediately following the China tariff increase, markets reacted.

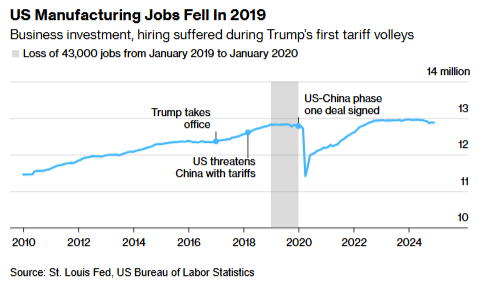

Here, too, we saw a significant impact on the U.S. manufacturing industry in 2019—the very sector Trump claims to be supporting.

In Brief: Trump’s tariffs negatively affected the U.S. economy by increasing import costs, triggering retaliatory tariffs, and creating trade policy uncertainty—though the impact was later overshadowed by the COVID-19 pandemic.

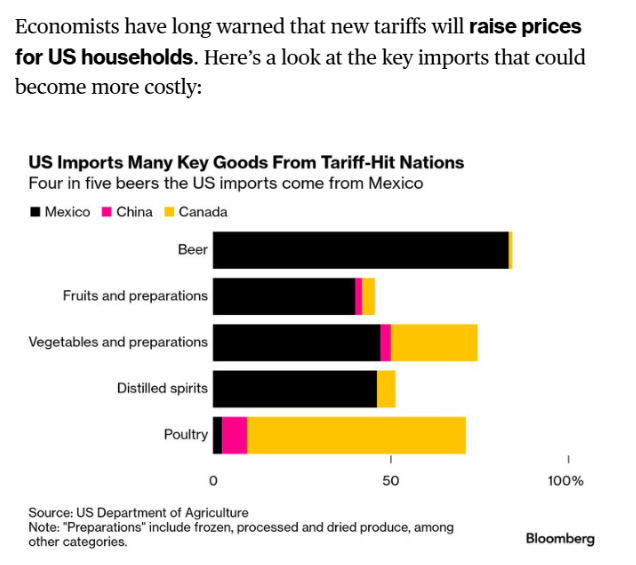

Fed officials had already warned of these effects in 2019, with economic analyses linking the tariffs to job losses and rising prices. Research estimated billions in lost income and additional costs for consumers and importers. Now, as Trump once again threatens broader tariffs, economists anticipate further inflation and higher interest rates, complicating the Fed’s policy response—especially given past miscalculations in forecasting inflation.

Early indications suggest that price increases in the U.S. are already taking hold.

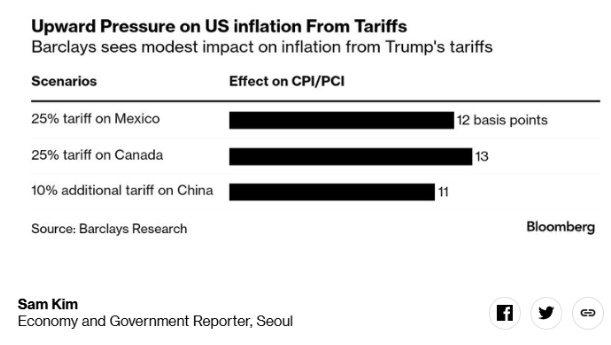

Earlier projections from Barclays Bank analyzed the impact on the Consumer Price Index (CPI), indicating that this round of tariffs could add a total of 36 basis points to inflation—equivalent to nearly 0.5%.

The negative impact on GDP could also reach as much as 0.5%.

It was announced in advance that certain restrictions would be in place if the tariffs were implemented.

Last week also kicked off with a “shocking” Monday when Trump announced a “spending freeze,” halting billions in funds to federal states pending a review to determine whether they align with his principles.

In the United States, attention turned to the interest rate decision. The Federal Reserve maintained its stance, keeping interest rates unchanged. Notably, there was no indication of potential future rate cuts. We interpret this as a “wait and see” approach, suggesting that the Fed may first want to observe the impact of Trump’s policy decisions and any resulting effects on inflation. There has been previous speculation that tariffs could naturally drive inflation, which would justify the Fed’s decision to hold off on rate cuts.

In summary, we categorize such policy changes as “risks” to inflation trends, prompting the Fed’s cautious wait-and-see approach. The recently strong GDP figures, a robust labor market, and positive domestic developments provide the Fed with room to remain patient—and possibly maintain this stance for an extended period.

However, a word of caution: any sharply disappointing data could trigger a market reaction, causing the dollar to weaken significantly. We’ve seen this happen before when a negative labor market report shook sentiment. That said, such poor numbers would need to materialize first—and so far, U.S. figures have generally outperformed those of the EU.

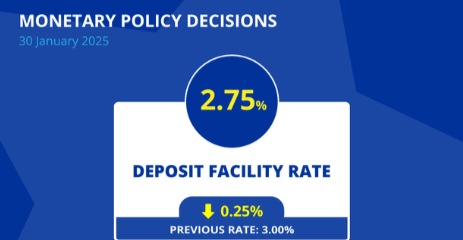

Meanwhile, Europe also made an interest rate decision, announcing a 25-basis-point cut.

The key takeaway from the ECB’s recent decision was its explicit acknowledgment of economic headwinds, which aligns with incoming data, such as Germany’s recent 0.2% economic contraction. Current interest rate levels are still viewed as restrictive to economic growth, but the ECB continues to adopt a “data-dependent approach,” essentially meaning it will cautiously lower rates while closely monitoring inflation developments.

Looking ahead, the focus shifts to March when new forecasts will be released—the data that the ECB has emphasized as a key factor guiding its policies.

This Week’s Outlook:

Although last week’s macroeconomic developments are difficult to overshadow, a few noteworthy events remain on the agenda.

Monday: A package of EU inflation indicators is due, where downside risks remain. More importantly, attention turns to France, where a budget deal appears to have been reached with some lawmakers. If confirmed, this would involve an additional 5 billion euros in adjustments, pushing the country toward a projected 5.4% deficit—well above the 3% norm. A potential escalation with the opposition, however, could bring a no-confidence vote closer, posing a political risk. Notably, France has made a clear call for lower ECB interest rates.

Early Week: The U.S. will release its PMI (Purchasing Managers’ Index) report on the manufacturing sector, providing insight into industry performance. Additionally, the JOLTS job openings report will serve as another key labor market indicator, while Thursday’s services sector data will round out the updates.

End of the Week: The focus shifts to the release of the Non-Farm Payrolls and U.S. unemployment data. Historically, deviations in this data have triggered strong dollar reactions.

However, given the ongoing developments surrounding tariffs and the expected responses from various countries, these data points may have limited influence on interest rate trends.

We’ll be closely monitoring media reports to assess how these initial tariffs are absorbed by the market. As always, feel free to reach out if you have any questions.

Economic Calendar:

Monday

- China: Caixin Manufacturing PMI

- EU: Inflation Rate (Flash Estimate)

- US: ISM Manufacturing PMI

Tuesday

- US: JOLTS Job Openings

Wednesday

- US: ISM Services PMI

Thursday

- UK: Bank of England (BoE) Interest Rate Decision

Friday

- Germany: Trade Balance

- US: Non-Farm Payrolls, Unemployment Rate, Michigan Consumer Sentiment (Preliminary)