The week following the trade agreement between the US and the EU underscored the fragility of the economic foundation. While the deal offers temporary relief, recent hard data reveal persistent vulnerabilities in both industry and growth.

United States

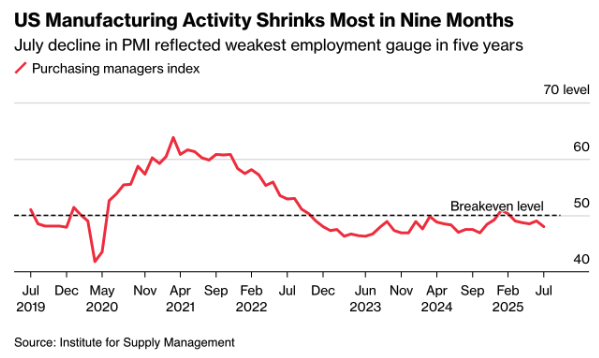

Second-quarter figures paint a mixed picture: although exports have picked up, signs of a slowing domestic economy are becoming more apparent. The ISM Manufacturing Index declined further in July, falling to 48—the lowest reading in nine months.

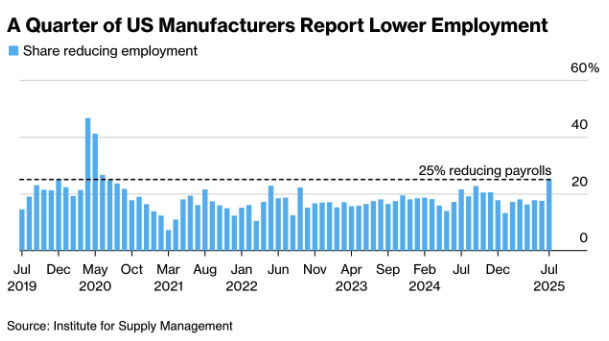

The employment component saw a particularly sharp decline, marking its weakest level in over five years and extending a three-month streak of job losses in the manufacturing sector. Both new orders and export orders continued to contract, while order backlogs thinned further. Production was the only area still showing a positive trend.

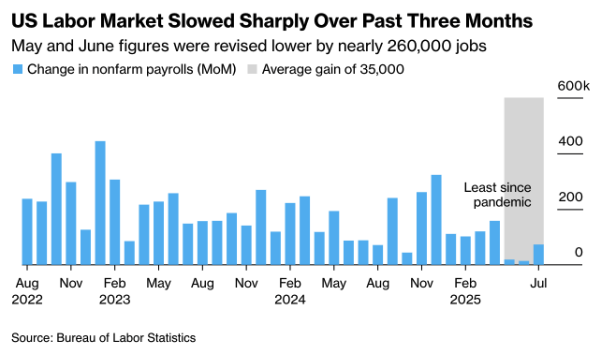

The U.S. labor market showed clear signs of slowing in July. Payrolls rose by just 73,000, while job gains for May and June were revised down by nearly 260,000. This brings the average job growth over the past three months to only 35,000 – the slowest pace since the pandemic. Unemployment rose to 4.2%, and the number of long-term unemployed climbed to its highest level since 2021.

The chart US Labor Market Slowed Sharply Over Past Three Months illustrates the steep drop in job creation. Industrial sectors, business services, and the public sector were the main drags on the numbers, while only a few areas – such as healthcare and social assistance – continued to add jobs.

These figures confirm that labor demand is weakening more rapidly than supply, increasing pressure on the Federal Reserve to consider interest rate cuts later this year. Markets reacted swiftly: interest rates fell, the dollar weakened, and the White House renewed its calls for looser monetary policy.

Just hours after the disappointing jobs report – highlighting the growing weakness in the labor market – President Trump dismissed BLS Director Erika McEntarfer. Simultaneously, Fed Governor Adriana Kugler announced her resignation, opening the door for Trump to appoint a new policymaker before year-end. This dual development – political interference in both economic data and central bank composition – is stoking market anxiety. Confidence in the independence of U.S. statistics and monetary policy, long considered a bedrock of U.S. markets, is beginning to visibly erode.

The bleak employment figures were accompanied by a weaker dollar. Investors saw the data as a signal that the Fed might begin cutting rates as early as September. On Friday, the Bloomberg Dollar Spot Index dropped 0.9% – its steepest one-day fall in months.

However, the University of Michigan consumer confidence index showed a modest uptick to 61.7, driven mainly by rising stock prices. Yet the underlying sentiment remains cautious: 57% of respondents expect unemployment to increase. Inflation expectations declined to 4.5% for the one-year outlook and 3.4% over the longer term.

The overall picture is clear: the Q2 recovery is largely driven by exports, while domestic demand and investment remain fragile.

US–Mexico: Tariff Hike Postponed, 25% Rate Maintained for Now

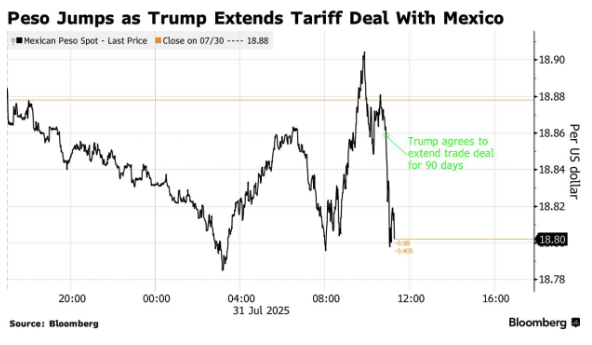

At the last minute, President Trump postponed the planned increase in import tariffs on Mexican goods. The current 25% rate will remain in place for the next 90 days, deferring the scheduled hike to 30% that was set to take effect on August 1. The decision followed a phone call with President Sheinbaum and allows more time for negotiations on border security, investment, and intellectual property rights.

A key exception remains intact: goods covered under the USMCA are still largely exempt from tariffs, which significantly limits the overall pressure on Mexican exports.

The Mexican peso responded positively to the tariff postponement, rebounding to 18.82 per dollar. However, structural pressure persists due to the ongoing 25% tariff on cars and 50% on steel and aluminum. A final trade agreement will be crucial to provide clarity on the future trade relationship with the U.S. – Mexico’s largest trading partner – before the 90-day window expires.

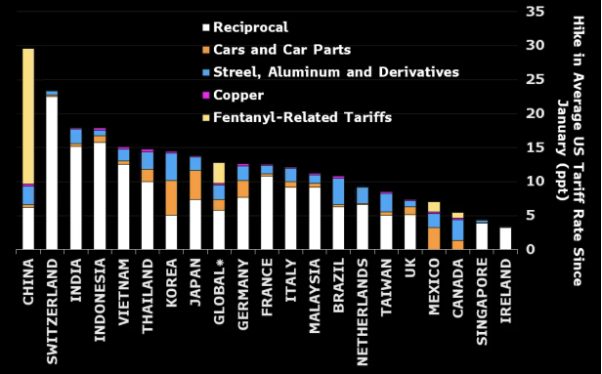

Meanwhile, Trump’s newly announced round of “reciprocal levies” on Friday is casting a shadow over the global economy. According to Bloomberg Economics, the average U.S. import tariff is now projected to rise from 2.3% in 2024 to 15.2% – the highest level since World War II.

The economic impact is substantial: over the next two to three years, U.S. GDP is expected to decline by approximately 1.8%, while core inflation is projected to rise by 1.1%. These effects are not confined to the U.S. Higher tariffs are suppressing global demand and are likely to weigh on growth in key trading partners as well.

China and Switzerland are expected to be hit hardest, facing average tariffs of 20% and 39% respectively. The coming week will be critical, as countries still have a narrow window to negotiate exemptions or reductions before the new measures come into force.

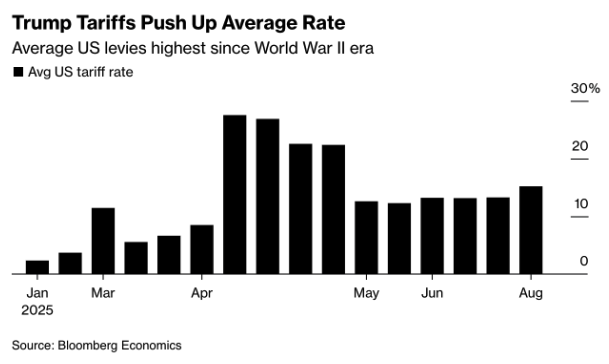

On Thursday evening, President Trump officially unveiled a new set of tariffs, pushing the average U.S. import duty up to 15.2% – the highest level since World War II. The chart Trump Tariffs Push Up Average Rate clearly illustrates the rapid escalation in tariff levels following the implementation of his so-called “reciprocal levies.”

The EU, Japan, and South Korea will now face a baseline tariff rate of 15%, while other countries – including Canada, China, and Taiwan – are being hit with significantly higher rates. Notably, the 35% tariff on Canadian exports, despite the USMCA exemption, is escalating tensions between the two neighbors. Taiwan and South Africa will be subject to tariffs of 20% and 30% respectively, while Thailand, Indonesia, and Vietnam face rates between 19% and 20%.

The timing and breadth of these measures are weighing heavily on global market sentiment. Stock indices in the U.S. and Europe declined, Asian markets fell for the sixth consecutive day, and the currencies of key trading partners – particularly the Taiwanese dollar and Korean won – came under renewed pressure.

Despite earlier rounds of negotiations, uncertainty remains high. Sector-specific tariffs on pharmaceuticals, semiconductors, and critical minerals have yet to be announced. As Bloomberg Economics previously noted, these tariffs are expected to both dampen U.S. growth and push up inflation, further weakening global demand.

Eurozone

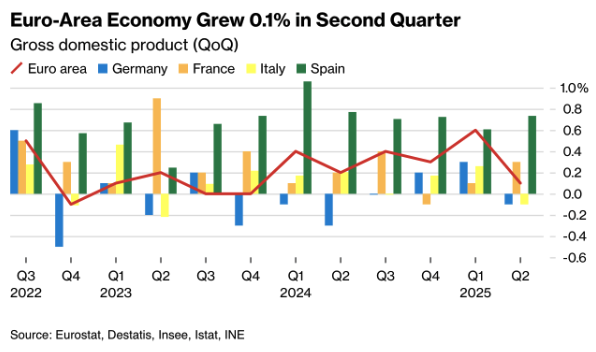

The second quarter brought a clear reality check: economic growth stalled, following a modest +0.6% expansion in Q1. Germany remains the weak spot, slipping into a -0.1% contraction, while Spain posted growth of 0.6%. France and Italy managed to stay just above zero.

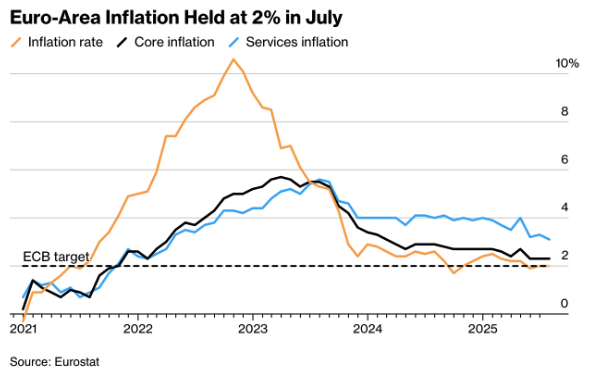

Inflation data for July came in exactly as expected, with headline inflation at 1.9% and core inflation at 2.3%. This gives the European Central Bank room to hold its policy rate steady at 2%. President Lagarde stressed that any decision on further easing will be deferred until September, pending new economic projections. The ECB’s tone remains cautious: while it sees continued effects from earlier rate cuts, it also warns of headwinds from a stronger euro and the potential fallout from new U.S. tariffs.

Eurozone

Irish Central Bank Governor Gabriel Makhlouf, a member of the ECB’s Governing Council, emphasized this week that there is no justification for another interest rate cut in the near term. He stated that eurozone inflation has now stabilized and that growth remains “largely in line with expectations.”

Makhlouf noted that policy has entered a phase “where we can calmly wait and see whether new data justify a change in course.” His comments echoed those of ECB President Christine Lagarde, who left interest rates unchanged last week for the first time in over a year.

Makhlouf also highlighted the short-term relief offered by the recently concluded 15% trade agreement between the U.S. and the EU, which reduces uncertainty for now. However, he warned that the lack of detail and the unpredictable nature of U.S. policy could still weigh on eurozone growth.

Asia and China

China offered temporary relief to global supply chains with a sharp rise in rare earth magnet exports to the U.S., which jumped from 46 tons in May to 353 tons in June. While this eases short-term tensions in critical value chains, structural deflationary pressures persist: nominal GDP growth in Q2 came in at just 3.9%.

In Japan, the new trade agreement with the U.S. – which lowers tariffs from 25% to 15% – has given the Bank of Japan more policy flexibility. While interest rates were held steady, the likelihood of a rate hike later this year (either in October or January) has now risen to 80%.

Outlook for This Week

After a week dominated by growth figures, labor market data, and inflation, the focus in the coming days will shift to a second tier of indicators: factory orders, service sector activity, and trade balances. These data points will be crucial in either confirming or challenging the narrative that the global economy is losing momentum under the weight of tariffs and heightened uncertainty.

United States – Orders and Services

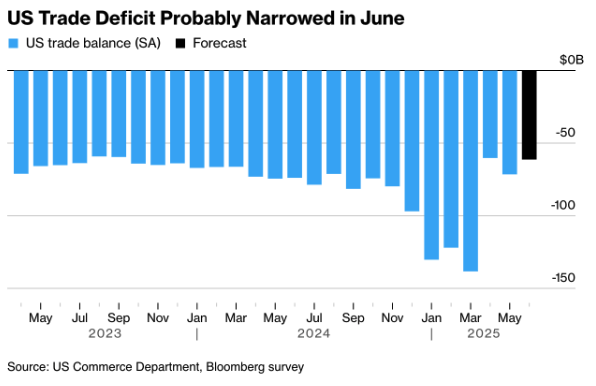

Following a heavy macroeconomic week, the U.S. calendar looks relatively lighter, but markets will be watching closely for updates on trade and services. On Tuesday, the June trade balance will be published. As illustrated in the chart US Trade Deficit Probably Narrowed in June, analysts expect a further reduction in the deficit. Preliminary data suggest that imports declined for the third consecutive month – marking a notable reversal from the first quarter, when many companies ramped up purchases in anticipation of higher tariffs.

United States

In addition to the trade data, this week brings the release of the ISM Services PMI—a key indicator for assessing whether the largest sector of the U.S. economy is faring better than manufacturing, which posted its sharpest contraction in nine months in July.

Following last week’s disappointing jobs report and the Fed’s decision to keep interest rates unchanged, speeches from Fed officials will be closely scrutinized. Markets will be particularly attentive to any policy signals and updates regarding the vacant FOMC seat left by Adriana Kugler’s resignation on Friday—a position that could be strategically filled by the White House ahead of 2026.

Eurozone

On Wednesday, eurozone retail sales data will offer a fresh read on consumer resilience. After stagnation in Q2, markets are eager to see whether household spending is still providing a buffer for the economy. The consensus points to a modest rebound—likely too limited to offset ongoing industrial weakness and the broader uncertainty stemming from trade tensions.

Switzerland

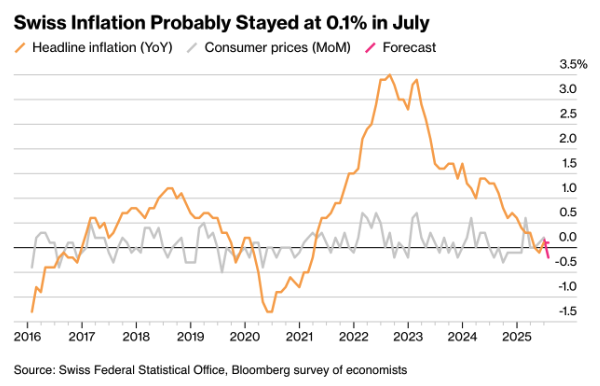

Following Trump’s surprise announcement of 39% tariffs, all eyes in Switzerland will be on Monday’s market open and the publication of key economic indicators. July inflation is expected to hold steady at 0.1%, as illustrated in the chart Swiss Inflation Probably Stayed at 0.1% in July. The Swiss manufacturing PMI will also be released, offering insight into whether industrial sentiment remains resilient in the face of new external pressures.

Eurozone

This week, attention in the eurozone turns to industrial production and trade figures from the four largest economies – Germany, France, Italy, and Spain. These data could prompt revisions to the preliminary GDP estimate for Q2, which showed meager growth of just 0.1% (see chart Euro-Area Economy Grew 0.1% in Second Quarter).

The numbers underscore that while the region is technically still expanding, it is doing so precariously – balancing on a knife’s edge amid weak demand, external pressures, and lingering industrial stagnation.

Trade balances – Germany, China, and Australia

On Thursday, the focus will shift to the international arena. Trade data from Australia and China will show how the new tariff pressure is affecting export flows. Chinese export figures in particular will be closely monitored: another contraction would confirm that the global economy is slowing down further. Germany will report its trade balance on the same day; export pressure is expected to be more noticeable there due to the recent rise of the euro and deteriorating sentiment.

United Kingdom – Bank of England decides

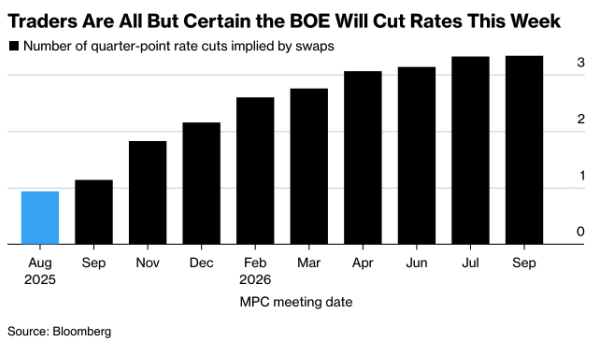

The Bank of England is set to cut interest rates by 25 basis points to 4% on Thursday. The central bank is thus sticking to its quarterly easing cycle, despite inflation reaching a 17-month high in July.

The chart Traders Are All But Certain the BOE Will Cut Rates This Week shows that the market has now fully priced in this move. The emphasis is clearly on the weakening economy: after two quarters of contraction and rising unemployment, the impact of substantial tax increases and rising minimum wages outweighs the temporary upturn in price pressure.

Governor Andrew Bailey has stressed that the recent inflation surprise is “temporary” and that restoring economic growth is now the central priority. However, the Bank of England remains cautious in its forward guidance. Further rate cuts will only be considered once there is greater clarity on wage growth and inflation expectations.

Markets will also be watching closely for the BoE’s updated economic forecasts and any signals regarding the pace of quantitative tightening heading into September. With long-term UK gilt yields beginning to show signs of stress, expectations are rising that the Bank may tread more carefully in reducing its balance sheet.

Japan

Japan will wrap up the week on Friday with household spending figures—a key indicator of domestic demand. These data will offer fresh insight into internal consumption dynamics, particularly as the Bank of Japan re-evaluates the timing of a potential rate hike later this year in light of easing trade-related risks.

Macro-ecomomic agenda for upcoming week:

Monday

US – Factory order MoM

Tuesday

US – ISM Services PMI

Wednesday

EU – Retailsales MoM

Thursday

AUS – Balance of Trade

CH – Imports YoY, Exports YoY, Balance of Trade

DE – Balance of Trade

VK – BoE Interest Rate Decision

Friday

JPN – Household Spending