United States

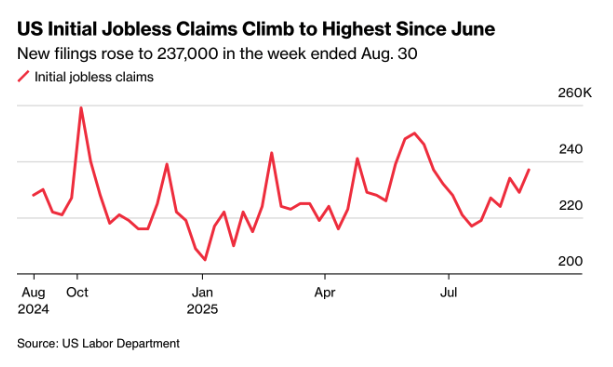

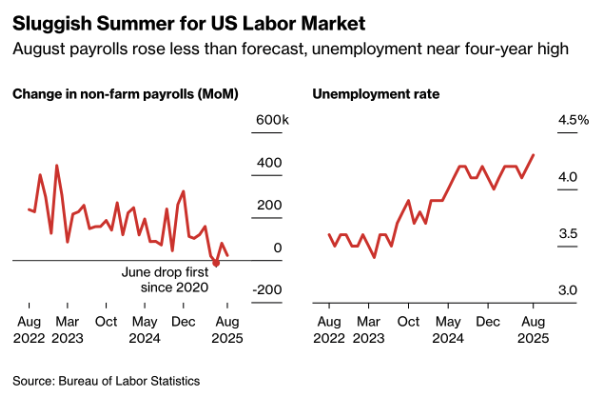

The US labor market showed renewed weakness in August, heightening concerns about a downward spiral. Only 22,000 jobs were created, far below the expected 75,000, while earlier months were revised lower. June even registered net job losses – the first decline since late 2020. The unemployment rate rose to 4.3%, its highest level in nearly four years.

Shifting dynamics

Average job gains over the past three months have slowed to just 29,000, the weakest stretch since the pandemic. Without hiring in healthcare, total employment would have contracted in three of the past four months. Declines were concentrated in manufacturing, government, financial services, and professional business services.

The participation rate edged up to 62.3%, but both long-term and permanent unemployment returned to levels last seen in 2021. Meanwhile, average wages increased by 0.3% month-on-month and 3.7% year-on-year, pointing to subdued wage pressures.

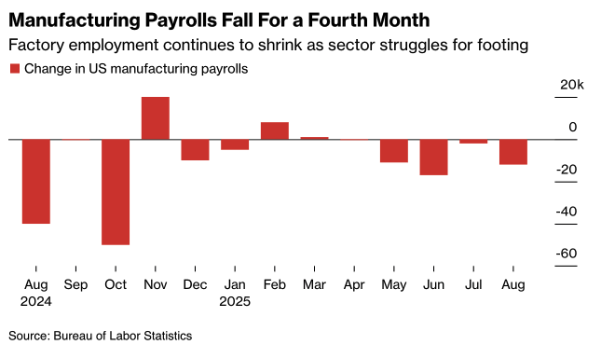

Industry in recession

The much-touted industrial renaissance under President Trump has, for now, given way to job losses. Manufacturing payrolls declined by 12,000 in August and are down nearly 80,000 over the past year. This marks the fourth straight month of contraction — the longest streak since 2020 (chart: Manufacturing Payrolls Fall for a Fourth Month).

The ISM surveys paint a similar picture: US manufacturing has been in contraction since March. Executives cite tariff uncertainty as a key factor, weighing heavily on both exports and investment.

Political dimension

The weak labor figures come at a politically sensitive moment. President Trump has tied his economic strategy to import tariffs, promising that new factories will soon generate jobs. So far, however, this has translated into capital spending by firms such as Apple, Ford, and AbbVie rather than job creation. At the same time, the Bureau of Labor Statistics is under fire: Trump dismissed its commissioner after the sharp downward revisions and appointed a close ally, raising questions about the agency’s independence.

Fed – pressure to ease

The Federal Reserve faces a stark dilemma. The labor market is clearly weakening, yet inflation remains above 2% and could rise further due to tariffs. Even so, markets are almost fully pricing in a quarter-point rate cut at the September 16–17 meeting, with futures now anticipating three cuts in total this year.

Diane Swonk of KPMG warned that “the cracks in the labor market are widening – a quarter-point cut is inevitable.” Barclays has raised its forecast to three reductions (September, October, December). New York Fed President John Williams spoke of “gradual cuts over time,” while Chicago Fed President Austan Goolsbee struck a more cautious note, preferring to wait for the September inflation report.

Political pressure is also intensifying: Trump is pushing for aggressive cuts, and his nominee for the Fed Board, Stephen Miran, may argue for a 50 basis-point move. Still, the consensus view remains that the Fed will stick to a path of 25 bp per meeting.

Eurozone

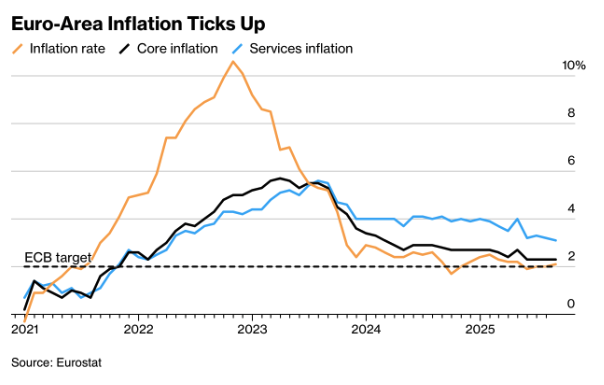

In Europe, the data continues to look more resilient. Inflation edged up to 2.1% in August, while core inflation held steady at 2.3% (chart: Euro-Area Inflation Ticks Up). Price dynamics therefore remain close to target.

ECB officials, including Primoz Dolenc and Isabel Schnabel, stress that there is little justification for further rate cuts at this stage. As Dolenc put it: “No major shifts in either direction – we are awaiting the September projections.”

The ECB meeting on September 11 is expected to deliver no changes, with the deposit rate staying at 2%. Still, divisions within the Governing Council remain: Lithuania’s Gediminas Šimkus suggested that a rate cut in December could be considered if inflationary pressures continue to ease. For now, the prevailing message is one of cautious optimism, with policymakers awaiting the September forecasts.

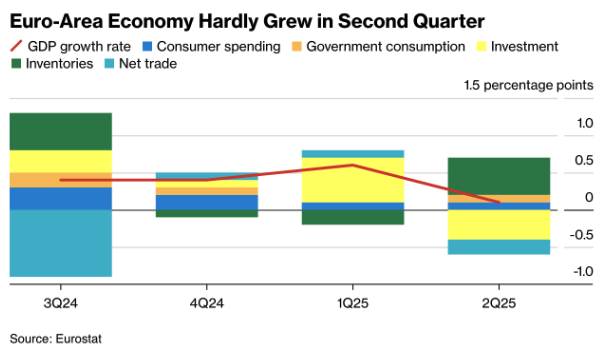

Meanwhile, the eurozone economy barely expanded in the second quarter, growing just 0.1% quarter-on-quarter after a stronger 0.6% in Q1. The modest gain was driven entirely by inventories along with government and household spending, while both investment and net trade detracted from growth (chart: Euro-Area Economy Hardly Grew in Second Quarter).

According to Eurostat, rapid inventory accumulation contributed 0.5 percentage points to second-quarter growth. Without this effect, the eurozone economy would have contracted. Analysts do not expect a strong rebound in Q3.

The figures arrive just ahead of the ECB meeting, where policymakers are expected to keep rates unchanged once again. Inflation remains close to 2%, while labor costs rose 3.9% year-on-year, a slightly slower pace than in Q1. This suggests the ECB is close to its price stability target, which could leave room for another rate cut later this year depending on the fallout from US tariffs.

US–EU tech conflict

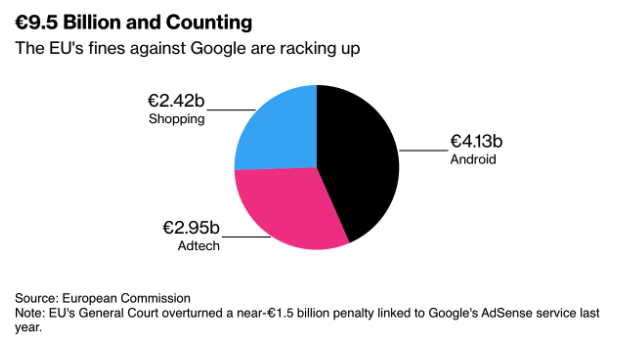

Tensions between Washington and Brussels escalated after the European Commission fined Google €2.95 billion for abuse of dominance in advertising technology. This brings total EU penalties against the company to almost €10 billion (chart: EU Fines Against Google Are Racking Up).

President Trump responded sharply, threatening a new Section 301 investigation into the EU – a move that could pave the way for retaliatory tariffs. He argued that US tech firms are being unfairly targeted by European rules and fines, warning that “the American taxpayer will not accept this.”

The dispute comes against the backdrop of worsening US-EU trade relations, already strained by reciprocal tariffs on industrial goods. At the same time, the US Department of Justice is pursuing its own case that could force Google to divest parts of its advertising technology business.

Australia & Asia

Australia’s economy grew 0.6% quarter-on-quarter and 1.8% year-on-year in Q2, the fastest pace in almost two years. The upturn was driven by household consumption and higher government spending, even as investment remained weak. The rebound eases pressure on the Reserve Bank of Australia to cut rates further, though growth momentum is still fragile.

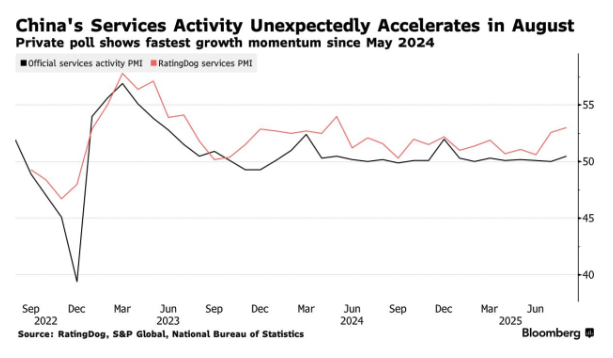

China’s services sector registered its strongest expansion since May 2024 in August. The RatingDog/S&P Global Services PMI rose from 52.6 to 53.0, beating expectations of 52.5. The summer season boosted activity in tourism and entertainment (chart: China Services PMI).

New orders in China rose at the fastest pace in over a year, but profitability remains squeezed. Input costs increased, while companies were unable to fully pass these on to customers. Profit margins have been under pressure since late 2023.

The divide within the Chinese economy remains stark: services are buoyed by seasonal demand, while industry and real estate continue to struggle with structural weaknesses. The official non-manufacturing PMI edged up only slightly to 50.3, and the housing market endured one of its worst months on record. Industrial activity stayed in contraction, though private surveys pointed to modest expansion.

Elsewhere in Asia, South Korean inflation eased to 1.7%, its lowest in nine months, giving the Bank of Korea more policy space. Japan, meanwhile, delivered no major surprises this week.

Conclusion: Australia surprised on the upside, but across the rest of Asia the picture remains mixed.

United Kingdom

UK house prices slipped unexpectedly by 0.1% m/m in August to an average of £271,079, partly offsetting July’s 0.5% gain. Analysts had expected a modest rise. On an annual basis, prices are still up 2.1%, though that is down from 2.4% in the previous month (chart: UK’s Housing Market Is Coming Under Pressure).

The weakness in the housing market reflects several factors: demand was pulled forward by higher transaction costs (including a rise in stamp duty), supply has increased, and concerns are mounting about further tax hikes in the autumn budget. Affordability also remains a major challenge, with mortgage payments now absorbing around 35% of first-time buyers’ disposable income — well above the long-term average of 30%.

Even so, there were signs of resilience. Mortgage approvals rose to 65,352 in July, the highest in six months, while the average mortgage rate declined to 4.28%, the lowest since early 2023. Still, the combination of elevated housing costs, rising fixed expenses, and political uncertainty continues to weigh on the market.

Beyond housing, the construction sector remained weak: the PMI climbed from 44.3 to 45.5 in August, but stayed far below the 50 threshold, signaling deep contraction. In contrast, services showed renewed momentum, with the all-sector PMI rising to 52.8 — the strongest reading since September 2024.

Meanwhile, the Bank of England remains divided. The recent rate cut, which took borrowing costs to their lowest in two years, underscored worries about slowing growth. Yet stronger service activity offers a counterweight, highlighting the difficult policy trade-offs ahead.

Oil – price drop ahead of OPEC+ talks

Oil prices fell to their lowest level since May, with WTI sliding 2.5% to below $62 per barrel and down 3.3% for the week (chart: WTI Crude Futures). Since the start of the year, prices have already dropped about 14%, driven by higher output and mounting concerns over a global surplus.

In the run-up to the September 7 OPEC+ meeting, Saudi Arabia is pressing for further production increases in an attempt to offset lower prices with higher volumes. Analysts, however, caution that such a move risks deepening the surplus.

Downward pressure is being reinforced by additional supply from non-OPEC+ producers, notably Brazil and Guyana. At the same time, the weakening US economy is clouding demand prospects. Geopolitical tensions – including US pressure on buyers of Russian oil and new tariffs on India – are adding to the uncertainty.

China – trade and inflation under scrutiny

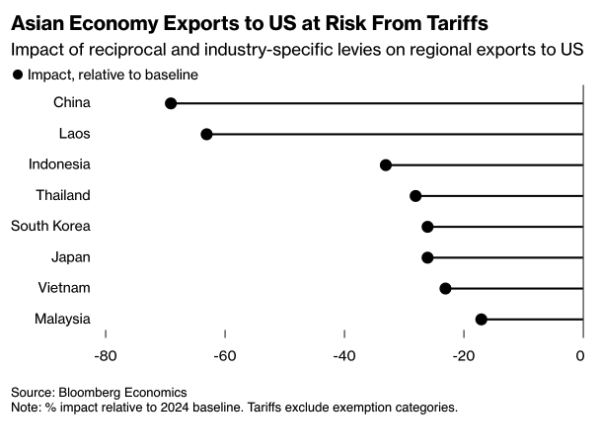

Attention in Asia this week will be on China, where August trade data are expected to show export growth slowing to the weakest pace in three months, largely due to a sharp drop in shipments to the US (chart: Asian Economy Exports to US at Risk From Tariffs). The figures will highlight the external strain created by Trump’s tariffs.

Inflation data from China will follow on Wednesday: CPI is expected to dip back into disinflation at -0.2% y/y, while producer prices are forecast to fall -2.9%, marking the 35th straight month of deflation. This has fueled calls for so-called anti-involution measures, with Beijing seeking to curb production capacity to support prices.

Elsewhere in the region, Japan is likely to confirm resilience in its Q2 GDP, India is seeing inflation accelerate toward 2%, and New Zealand will publish a new PMI on Friday after July’s rebound. In Australia, consumer and business confidence will be in focus.

Germany – trade balance

German trade data, due Monday, are expected to show a slight improvement in the surplus thanks to higher export volumes. Still, fragile global demand and US tariffs continue to weigh. The key question is whether July’s export stabilization marks the start of a trend or proves temporary.

United States – labor market, inflation, and sentiment

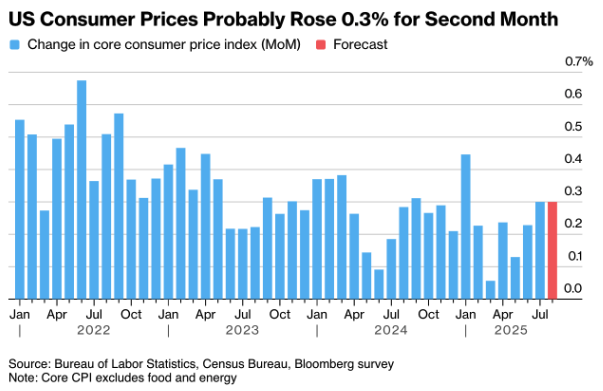

In the run-up to the Fed’s September 16–17 meeting, attention will turn to Tuesday’s inflation report. Core CPI is expected to rise another 0.3% m/m in August, stalling progress toward the 2% target (chart: US Consumer Prices Probably Rose 0.3% for Second Month).

Economists are watching closely to see how far higher import tariffs are being passed on to consumers. So far, many firms have held back on price increases to protect demand, putting further pressure on margins.

The Bureau of Labor Statistics will also release its annual payroll benchmark, which is expected to bring additional downward revisions — suggesting the labor market had already started to cool before the latest weak readings.

On Thursday, the CPI report will be decisive for the Fed. Headline inflation is expected at 3.1% y/y (down from 3.2%), with core at 3.5%. These figures come as the central bank is already under pressure to cut rates following the disappointing labor data.

On Friday, the University of Michigan consumer sentiment index is due, with expectations for a drop toward 65, reflecting the combined impact of inflation and labor market weakness.

Eurozone – ECB in the spotlight

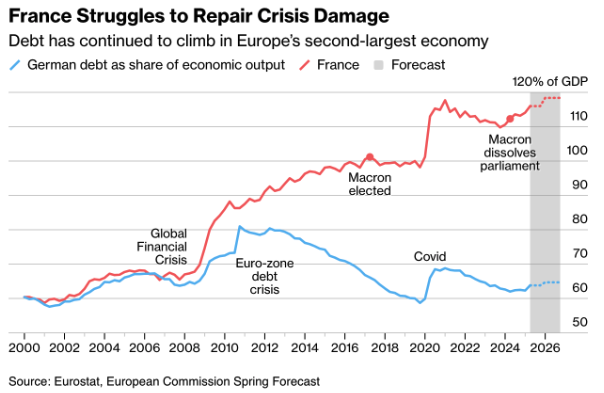

Thursday’s ECB meeting is likely to keep the deposit rate unchanged at 2%. Attention will be less on inflation – which remains close to target – and more on the political unrest in France.

This week’s meeting is of great importance for the ECB, which serves as the first line of defense in any potential debt crisis. Markets will be watching President Lagarde’s remarks for signals on possible support mechanisms should the situation in France deteriorate further.

The timing is delicate: the new forecasts coincide with a trade deal with the US that locks in 15% tariffs on European goods, with potential consequences for both growth and inflation. For now, markets expect policy silence. Officials already agreed in July to remain “deliberately vague” about the next step.

With the Fed preparing to cut rates next week, attention is shifting to the divergence in monetary policy across the Atlantic. The strategic risk for Europe lies in mounting political instability in France, which is adding pressure to the bond market even as the country’s debt ratio continues to rise (chart: France Struggles to Repair Crisis Damage).

In the UK, July GDP data will be released on Friday. After the rebound in June, economists expect growth to have stalled, underlining the fragility of the economy at the start of the third quarter.

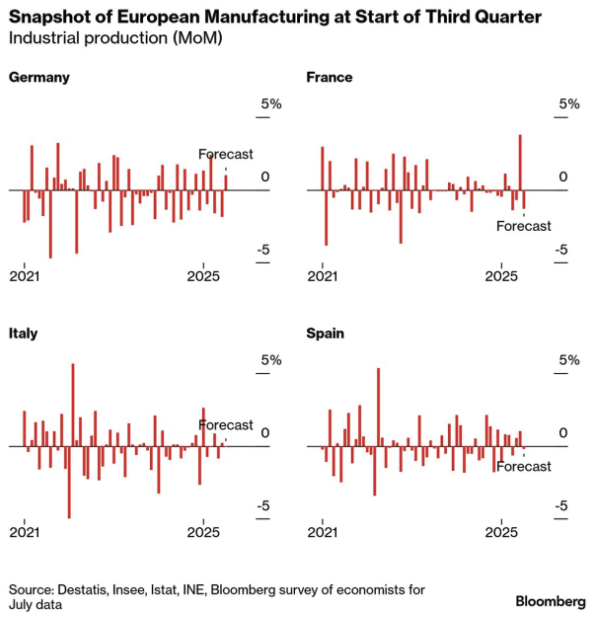

In the eurozone, attention will turn to the manufacturing sector. Germany reports industrial production and export figures on Monday, followed by factory data from France on Tuesday and from Italy and Spain on Wednesday. Any recovery is expected to be modest, underscoring the structural weaknesses facing European industry.

Macro economic agenda for upcoming week:

Monday

CH – Balance of Trade, Imports/Exports YoY

DE – Balance of trade

Tueday

AUS – Westpac Consumer Confidence Change, NAB Business Confidence

US – Non Farm Payrolls Annual Revision

Wednesday

CH – Inflation Rate YoY

US – PPI MoM

Thursday

EUR – ECB Interest Rate Decision, Deposit Facility Rate, ECB Press Conference

US – Inflation Rate YoY/MoM, Core Inflation Rate MoM/YoY

Friday

UK – GDP MoM

US – Michigan Consumer Sentiment