Last week’s new figures depict a world where fragile growth and geopolitical tensions are holding each other in check. Some trade balances are improving, but largely because imports are shrinking. Manufacturing and services show little momentum, and central banks are treading carefully – in some cases to an extreme, as in the United Kingdom.

United States

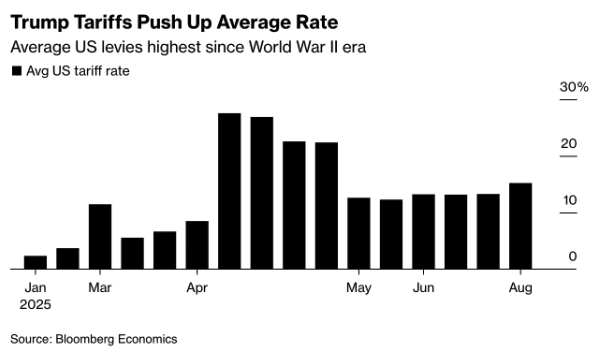

President Trump’s latest round of tariffs took effect on Thursday, lifting the average U.S. import duty to 15.2% – the highest level since World War II (see graph: Trump Tariffs Push Up Average Rate). The EU, Japan, and South Korea now face 15% tariffs on cars, among other products, while other countries are seeing steeper increases: Switzerland’s rate has risen to 39%, and India’s has doubled to 50%.

Trump insists the tariffs will revive U.S. manufacturing and narrow the trade deficit, but critics warn of inflation and supply shortages. Early indicators point to slowing growth, weaker employment data, and softening consumer spending. With 62% of voters opposing the tariff policy and legal challenges on the horizon, the administration’s trade gamble is facing tests on both economic and political fronts.

The U.S. trade deficit narrowed by 16% in June to $60.2 billion – the lowest level since September 2023. The improvement was driven primarily by a third consecutive monthly decline in imports, following a Q1 stockpiling surge ahead of the tariff increases. While this may provide a short-term boost to GDP, it also signals weakening domestic demand.

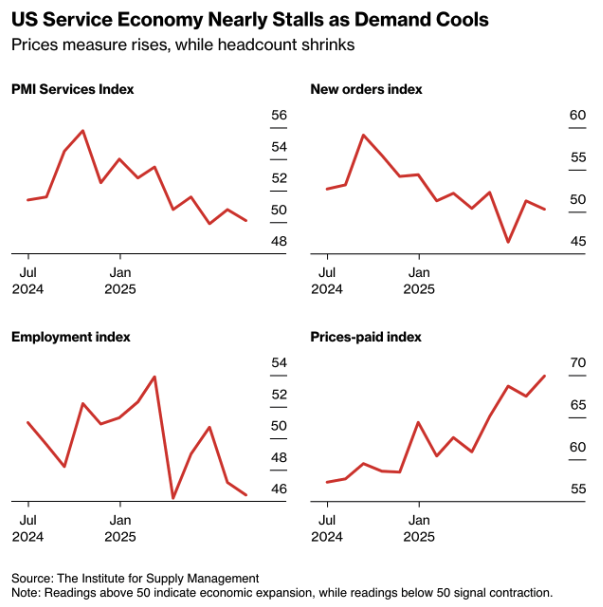

In services, the ISM index slipped to 50.1 in July (see chart: US Service Economy Nearly Stalls as Demand Cools), undershooting expectations of 51.5 and down from 50.8 in June. Businesses reported slowing demand and rising input costs, prompting some to cut jobs.

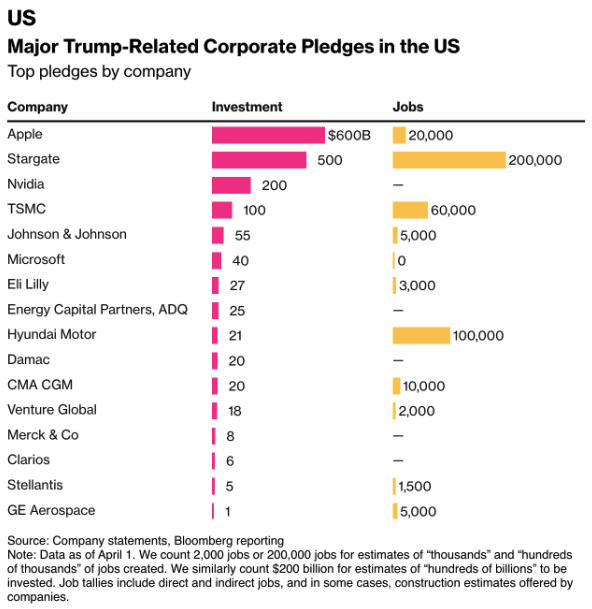

Trump has once again rattled the global semiconductor market by announcing a 100% tariff on chip imports, with exemptions for companies making substantial investments in U.S. production. Standing in the Oval Office alongside Apple CEO Tim Cook, the president secured a pledge for an additional $100 billion in domestic manufacturing. This move puts Apple in line with industry heavyweights such as TSMC, Nvidia, and Samsung, which have together committed over $1 trillion in U.S. investments since Trump took office. While markets were reassured by the broad exemptions, the looming threat of tariffs on nearly all electronics containing chips remains – a potential game changer for global supply chains.

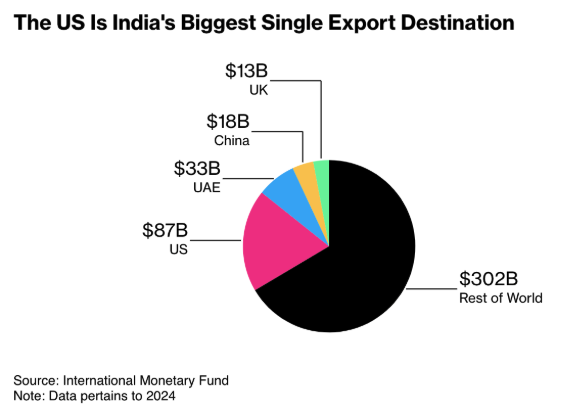

Trump has sharply escalated trade tensions with India by doubling the previously announced 25% tariff on Indian goods to 50%, citing New Delhi’s continued purchases of Russian oil. The increase, set to take effect within 21 days, comes on top of earlier “reciprocal” tariffs and, according to Bloomberg Economics, poses a direct threat to nearly 1% of India’s GDP. The impact will be felt most in labor-intensive sectors such as textiles, jewelry, footwear, and agriculture, but also in pharmaceuticals – a sector that sends more than $10.5 billion in exports to the U.S. annually. The chart The U.S. Is India’s Biggest Single Export Destination highlights India’s vulnerability to U.S. trade sanctions: the U.S. is by far its largest market, meaning that any escalation could have significant economic and political repercussions.

Eurozone

Eurozone retail sales rose by 0.3% m/m and 3.1% y/y in June, slightly exceeding expectations. Growth was driven by non-food and automotive purchases, but this momentum was not enough to offset ongoing industrial weakness.

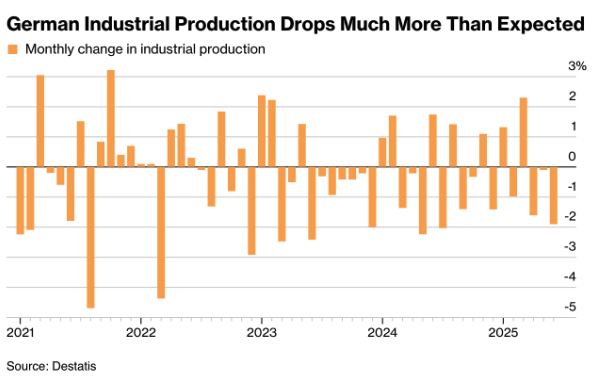

That weakness was once again apparent in Germany, where industrial production dropped by 1.9% m/m in June – a far steeper decline than the 0.5% fall expected.

This drop brings German industrial output to its lowest level since the pandemic in 2020 and raises the risk that the country’s Q2 contraction will be deeper than previously estimated.

United Kingdom

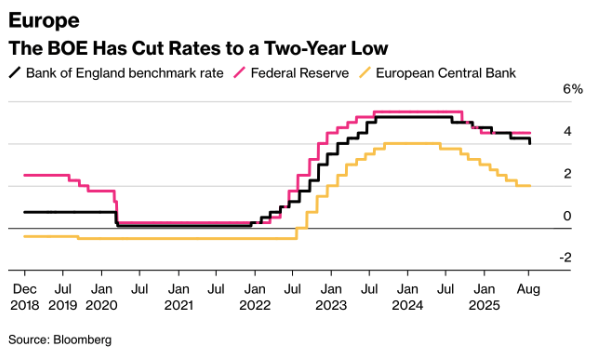

The Bank of England lowered interest rates by 25 basis points to 4.0% – the lowest level in more than two years (see chart: The BOE Has Cut Rates to a Two-Year Low).

The decision followed an unprecedented process: a 4–4 deadlock in the first round of voting, resolved only after a second vote that produced a narrow 5–4 majority. Policymakers weighed the risk of inflation moving back toward 4% against signs of a weakening labor market. Governor Bailey cautioned that cutting rates too quickly or too sharply could be risky, making another reduction this year less likely.

Switzerland

Since Thursday, Switzerland has been subject to the highest U.S. tariffs of any developed economy – a 39% surcharge on exports to the U.S., covering everything from luxury watches to Nespresso capsules. Only gold and pharmaceuticals are exempt for now, but President Trump has already hinted at tariffs of up to 250% on medicines in the near term.

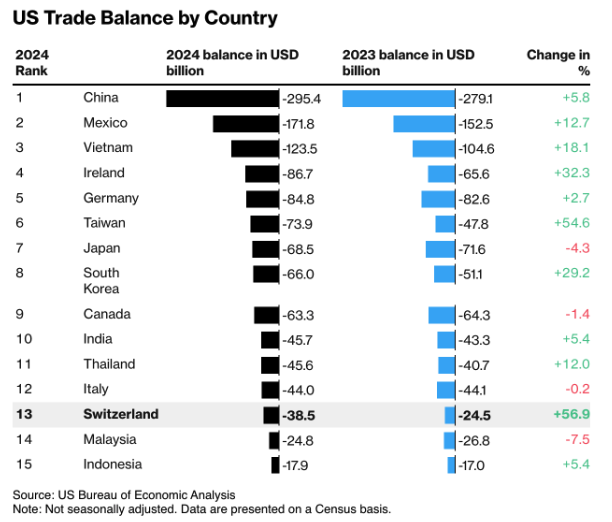

The move came after an unsuccessful emergency visit to Washington by President Karin Keller-Sutter, who failed to secure a meeting with Trump and returned without an agreement. U.S. frustration over Switzerland’s $38.5 billion trade surplus in 2024 (see chart: US Trade Balance by Country) proved decisive. The new tariffs could put as much as 1% of Swiss GDP at risk over the medium term, with the brunt likely to be felt in export-heavy sectors such as pharmaceuticals, medical technology, and luxury watches.

Political reactions in Bern range from calls for countermeasures – such as canceling the order for 36 F-35A fighter jets – to appeals for renewed negotiations. Meanwhile, the Swiss franc has fallen to its lowest level since June, and industry group Swissmem has warned that without swift government support, companies risk losing market share in their largest export market outside Europe.

Trade

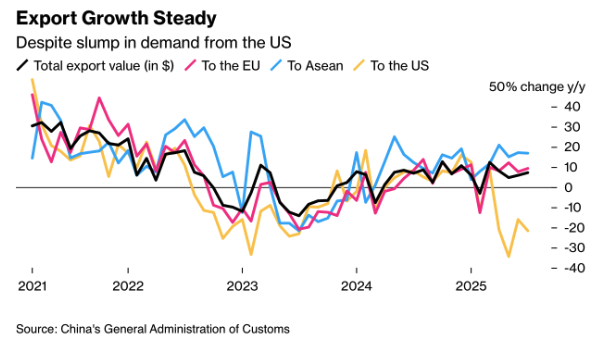

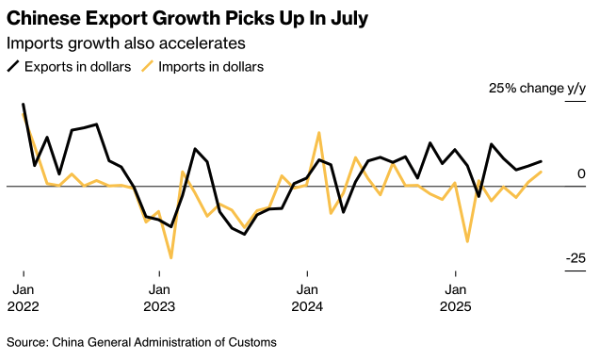

China surprised in July with export growth of 7.2% y/y to $322 billion, marking the strongest increase since April.

Growth came in well above expectations and followed an upward revision for June to +5.9%. The momentum was entirely driven by markets outside the U.S.: exports to the EU rose 9.3%, while shipments to ASEAN countries jumped nearly 17%, more than offsetting a fourth consecutive month of double-digit declines to the U.S. (see chart: Chinese Export Growth Picks Up in July).

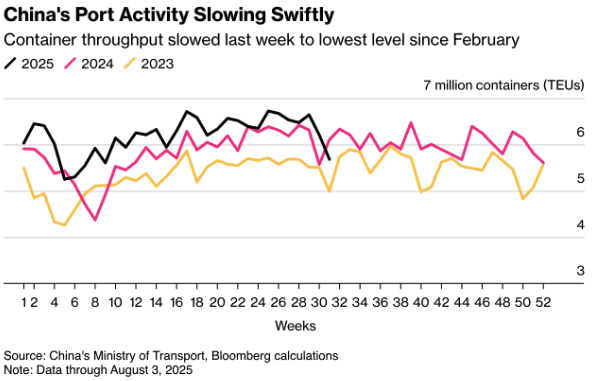

This resilience comes despite elevated U.S. tariffs and is partly supported by a weaker yuan against many non-USD currencies, as well as aggressive price competition from Chinese producers. Still, risks are building: Washington is threatening additional tariffs on goods re-exported via third countries, while high-frequency data indicates that container throughput at Chinese ports has fallen to its lowest level since February (see chart: China’s Port Activity Slowing Swiftly). With a trade surplus of $98.2 billion, the sector’s contribution to GDP remains strong, but heightened tariff uncertainty could significantly slow momentum in the second half of the year.

Looking ahead:

United States

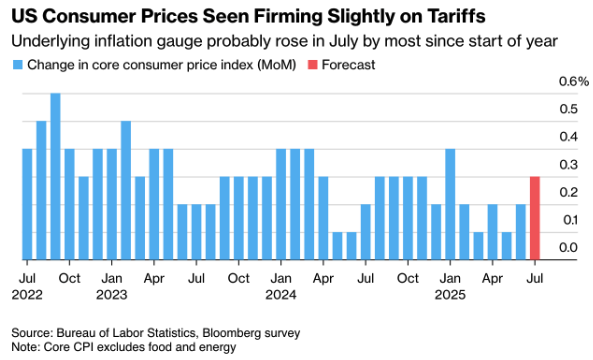

The key focus this week will be Tuesday’s inflation release. Core CPI is expected to rise by +0.3% m/m – the largest monthly increase since the start of the year – while headline CPI is likely to be contained at +0.2%, reflecting lower gasoline prices (see chart: US Consumer Prices Seen Firming Slightly on Tariffs).

Higher import tariffs are beginning to feed through into categories such as home furnishings and recreational goods, though core services inflation remains moderate for now. On Wednesday, remarks from Federal Reserve officials will be closely watched for any indications of shifting interest rate expectations. Thursday brings the release of producer prices (PPI), followed on Friday by retail sales, which are expected to post solid headline growth on the back of strong auto sales and Amazon’s Prime Day. However, once adjusted for price increases, the underlying consumer momentum will be less impressive. Preliminary Michigan consumer sentiment may edge lower, reflecting rising price expectations and heightened trade uncertainty.

United Kingdom

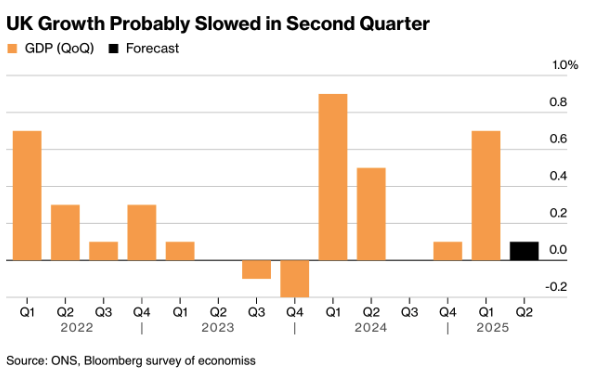

Following last week’s rate cut, Tuesday’s labor market report is expected to show a modest uptick in unemployment and a slowdown in private-sector wage growth. On Thursday, preliminary Q2 GDP figures will be published, with analysts forecasting a sharp slowdown after the strong start to the year (see chart: UK Growth Probably Slowed in Second Quarter). This combination of weaker growth and rising inflation risks underscores the difficult policy trade-offs facing the BoE.

Eurozone / Germany

On Tuesday, Germany’s ZEW index will be released, with further deterioration in investor sentiment expected after recent declines in industrial output. For the eurozone as a whole, Thursday will bring the second estimate of GDP and June industrial production, both of which are expected to remain weak.

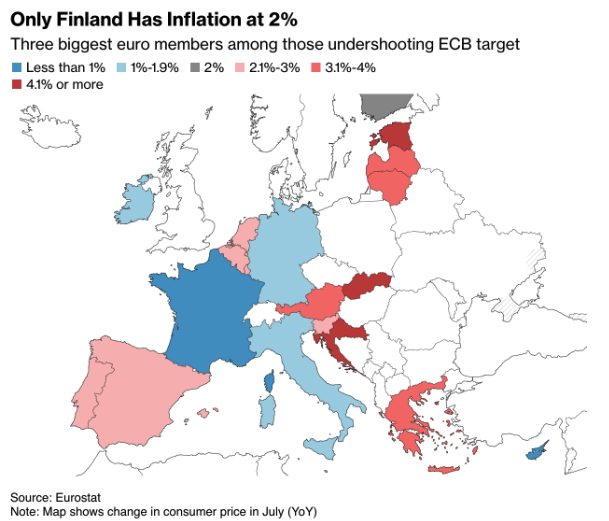

While headline inflation in the eurozone may average exactly the 2% target, the reality behind that figure is far from uniform (see chart: Only Finland Has Inflation at 2%).

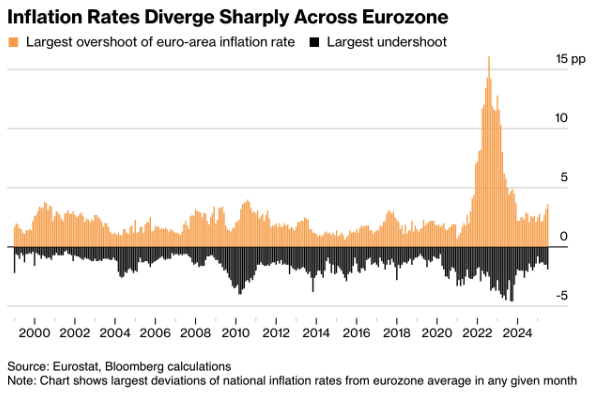

In July, only Finland matched the 2% target exactly, while major economies such as Germany, France, and Italy fell well short, and others came in significantly higher. The gap between the lowest and highest national inflation rates widened to 5.5 percentage points – up from an average of 3.6 percentage points in the period before the war in Ukraine (see chart: Inflation Rates Diverge Sharply Across Eurozone).

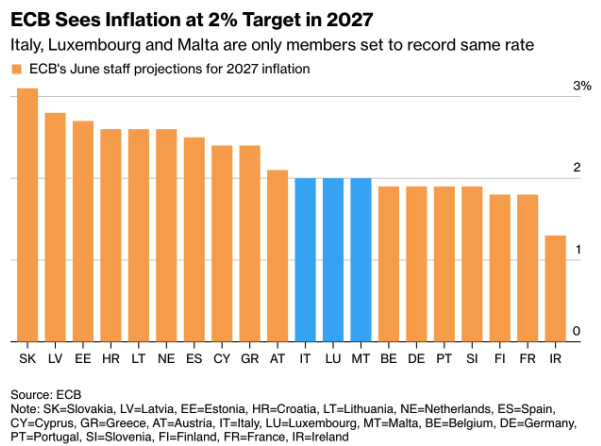

These divergent price trends make monetary policy particularly challenging to manage, especially with growth in the region still fragile and trade tensions on the rise. According to the latest projections, only a handful of countries – including Italy, Luxembourg, and Malta – are expected to meet the 2% target by 2027.

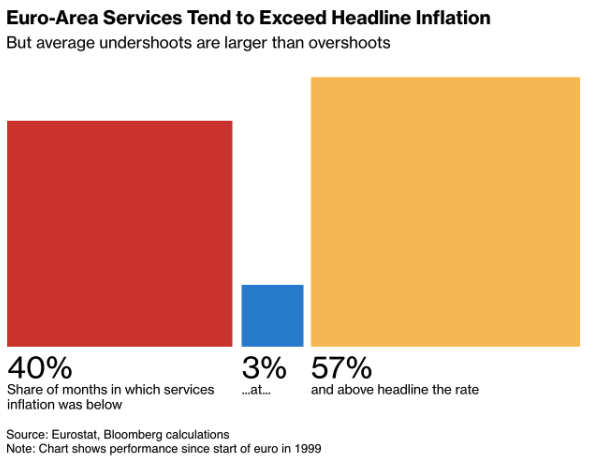

The composition of inflation is also a concern. For more than two years, service prices have risen faster than overall inflation, exceeding it by 1.1 percentage points in July – a gap partly driven by strong wage growth (see chart: Euro-Area Services Tend to Exceed Headline Inflation).

This persistent service inflation, combined with sharp geographical differences, is adding uncertainty to the outlook for price developments. Both downside risks – such as a stronger euro, cheaper imports, and weaker export demand – and upside risks – including supply chain disruptions, higher infrastructure and defense spending, and food price pressures from extreme weather – remain firmly in play.

Australia

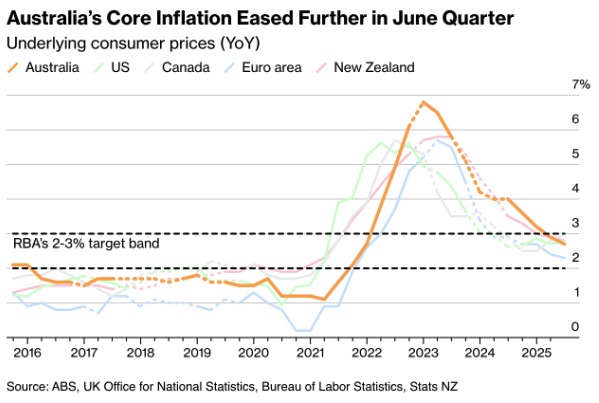

On Tuesday, the RBA is expected to cut its policy rate by a further 25 basis points – its third reduction this year – following another moderation in inflation during Q2 (see chart: Australia’s Core Inflation Eased Further in June Quarter).

That same day, the NAB Business Confidence survey will be released, followed by wage data on Wednesday and the employment report on Thursday. Together, these will provide a broad picture of economic momentum in the second half of the year.

Macro-economic agenda for upcoming week

Monday

–

Tuesday

AUS – NAB Business Confidence, RBA Interest Rate Decision

UK – Unemployment Rate

DE – ZEW Economic Sentiment Index

US – Inflation Rate MoM/YoY, Core Inflation Rate MoM/YoY

Wednesday

US – Fed Speeches

Thursday

UK – GDP Growth Rate QoQ/YoY Prel, GDP MoM

US – PPI MoM

Friday

JPN – GDP Growth Rate QoQ Prel

CH – Retail Sales YoY, Industrial Production YoY

US – Retail Sales MoM, Michigan Consumer Sentiment Prel