The week was marked by weak trade data and a further cooling in both consumer and business confidence. Central banks struck a cautious tone: no new policy moves, but clear signals that the easing cycle is nearing its end. Political tensions in Washington and fiscal strains in Europe remained background risks for the markets.

Eurozone

Retail sales in the eurozone fell by -0.2% month-on-month in August — less than expected, but still reflecting subdued consumer spending. Weak domestic demand continues to weigh on growth momentum, despite modest wage gains.

In her address to the European Parliament, Christine Lagarde said that inflation is “broadly under control” and that risks are “limited in both directions.” She reiterated that the 2% policy rate is “in a good position,” while stressing that policy remains data-dependent. Markets interpreted her remarks as mildly hawkish, prompting a small upward adjustment in rate expectations for December.

ECB officials Luis de Guindos, Philip Lane, and José Luis Escriva all emphasized this week that inflation risks in the eurozone are currently balanced. This strengthens the signal that rates are likely to stay at the current 2% level for the time being. According to Guindos, the present stance is “appropriate given both the inflation outlook and the policy transmission.”

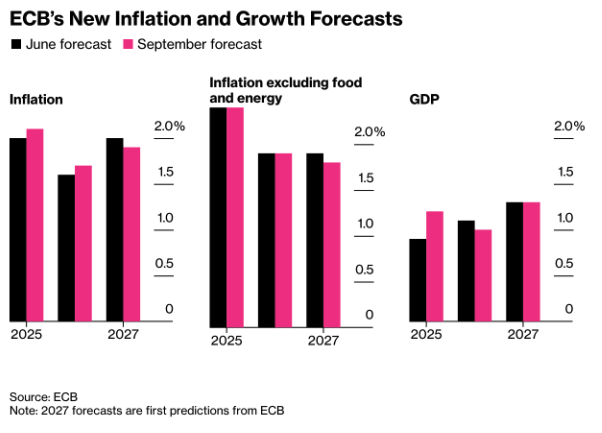

Lane described the monetary path as “open-minded,” noting that only clear deviations from the baseline scenario would justify further easing. The ECB’s latest projections foresee inflation at 1.7% in 2026 and 1.9% in 2027, while growth is expected to pick up slightly thanks to higher public spending in Germany and other member states.

(chart: ECB’s New Inflation and Growth Forecasts)

Germany’s trade surplus narrowed to €15.8 billion in August from €17.3 billion in July, as exports fell again. Shipments to Asia and the UK saw the sharpest declines.

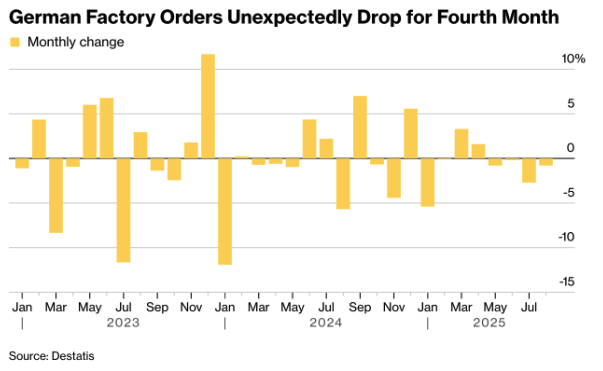

The country’s industrial sector remains under pressure. Factory orders dropped by 0.8% in August – the fourth consecutive monthly decline – defying expectations for an increase. Foreign demand weakened once more, while domestic orders rose slightly, partly due to one-off defense-related contracts.

(chart: German Factory Orders Unexpectedly Drop for Fourth Month)

According to Germany’s Ministry of Economic Affairs, the recent weakness could signal a bottoming-out in the industrial cycle, though structural issues remain persistent. Higher US tariffs and rising competition from China continue to weigh on exports, while businesses remain frustrated by the lack of a coherent economic strategy.

The Merz government slightly raised its 2025 growth forecast to +0.2%, marking a tentative recovery after two years of recession. Still, advisers warn that the rebound is unsustainable without reforms, and that the current debt expansion mainly fills budget gaps rather than fostering productive growth.

United States

The US trade deficit was virtually unchanged in August at -$67.1 billion. Exports declined slightly while imports held steady. Shipments of industrial goods and agricultural products were hit hardest by the trade dispute with China and the ongoing government shutdown.

Minutes from the latest FOMC meeting showed that several members are increasingly concerned about the cooling labor market, though most consider the current policy rate appropriate. A small minority argued for more easing should inflation continue to fall, but the overall tone remained balanced.

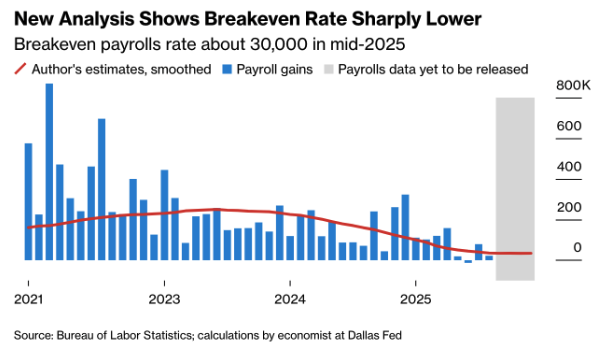

New research from the Federal Reserve Bank of Dallas suggests that the slowdown in the labor market may be less alarming than previously thought. Due to slower immigration growth, the number of new jobs needed to keep unemployment stable – the so-called breakeven payroll rate – has dropped sharply to around 30,000 per month, compared with roughly 250,000 in 2023.

According to the authors, this means the recent decline in employment does not necessarily signal weakness, but rather a labor market adjusting to slower population growth.

(chart: New Analysis Shows Breakeven Rate Sharply Lower – Breakeven Payrolls Rate About 30,000 in Mid-2025)

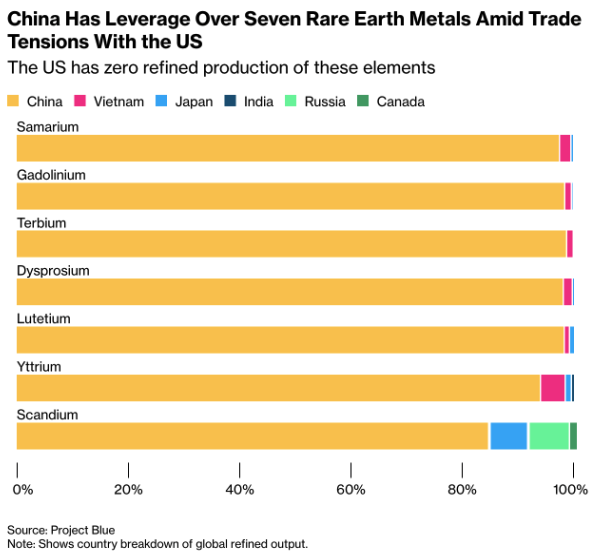

Trade tensions between the United States and China have flared up once again. President Trump announced a new 100% import tariff on Chinese goods starting November 1, alongside export restrictions on strategic software. The move followed a sharply worded Chinese letter to the WTO, in which Beijing threatened to impose its own export controls on rare earth materials.

The prospect of mutual export restrictions on technology and raw materials heightens the risk of a prolonged decoupling between Washington and Beijing – a shift that could disrupt industrial supply chains and put upward pressure on global inflation expectations.

The trade war has deepened further as China officially imposed export limits on rare earths, directly affecting the global semiconductor supply chain. The measure requires foreign firms to obtain licenses for products containing Chinese-origin materials.

In response, Trump’s 100% import tariff and new software export bans have intensified fears of technological fragmentation. Semiconductor producers and suppliers such as ASML face mounting costs and potential production delays, while the US itself lacks sufficient refining capacity.

These measures place additional strain on the global chip industry and raise the risk of prolonged disruptions in the supply of critical components.

(chart: Global Rare Earth Dependence – China’s Dominance in Semiconductor Supply Chains)

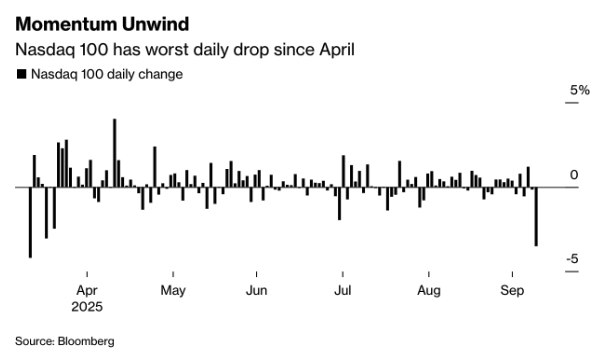

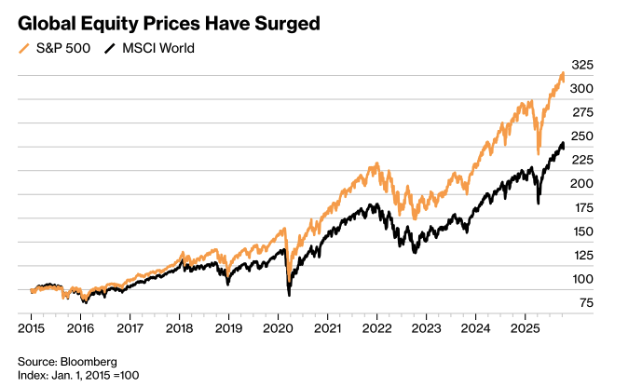

Markets experienced their most volatile week since spring. Trump’s threat to impose sweeping new tariffs on Chinese goods in November abruptly ended the rally that had driven equities higher in recent months. Both the S&P 500 and the Nasdaq 100 fell more than 2% over the week — their steepest decline since April — as risk appetite in equities and crypto evaporated rapidly.

(chart: Momentum Unwind – Nasdaq 100 Has Worst Daily Drop Since April)

The selloff was amplified by mounting doubts over the sustainability of high valuations, particularly in technology and AI sectors. Analysts warned that sentiment had become “too euphoric,” making markets vulnerable to sharp corrections even on minor setbacks.

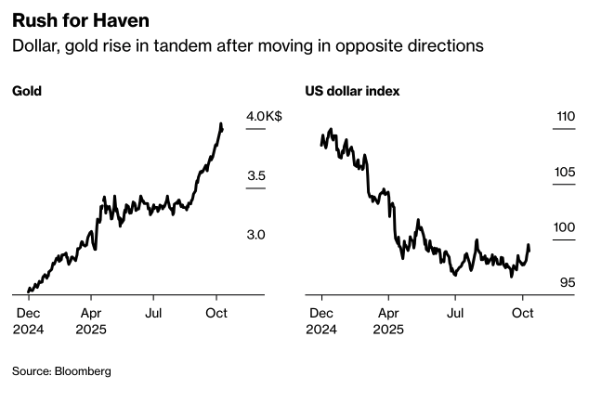

At the same time, capital flows shifted decisively toward safe havens. Gold surged 3% to above $4,000 per ounce, while the dollar also strengthened – a rare combination signaling broad risk aversion. The yield on 10-year Treasuries edged down slightly to 4.05%.

(chart: Rush for Haven – Dollar and Gold Rise in Tandem)

Japan

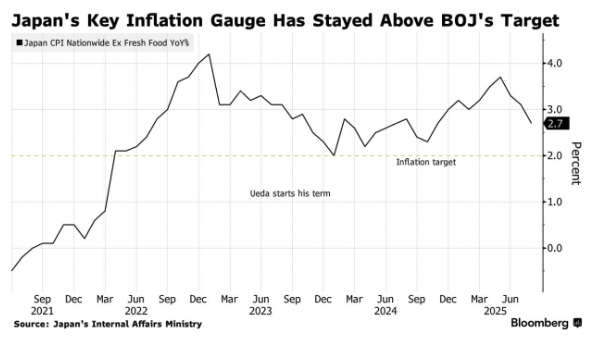

The political shift in Tokyo has made monetary policy more precarious. The victory of Sanae Takaichi increases political pressure on BOJ Governor Kazuo Ueda, who had been preparing to further normalize policy. As recently as last week, markets saw a 68% chance of a rate hike in October – a probability that has now fallen to about 20% following Takaichi’s win.

Still, inflation in Japan remains persistently above target. Core inflation (excluding fresh food) rose 2.8% year-on-year in August, marking more than three consecutive years above the 2% goal. This strengthens calls for continued policy normalization, though such moves are now politically more difficult.

Ueda’s main challenge now is to preserve the Bank of Japan’s independence without losing the confidence of either markets or politicians. Delaying further tightening could weaken the yen again, while moving too quickly risks straining relations with the new prime minister.

Oceania

In Australia, the Westpac Consumer Confidence Index was virtually unchanged (-0.1%), halting the previous improvement. Households remain pessimistic about their financial outlook despite lower mortgage rates.

In New Zealand, the Reserve Bank of New Zealand cut interest rates by 25 basis points to 2.75%, in line with expectations. The central bank cited a softer labor market and declining domestic demand but stressed that inflation expectations remain “stable.” The statement was widely seen as marking the end of the current easing cycle.

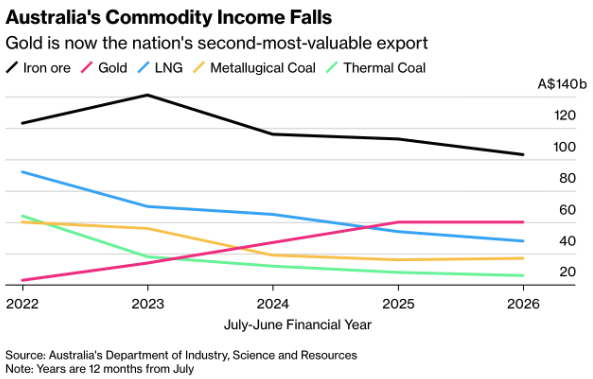

Australia’s economy is benefiting only partially from the global gold rally. According to the Ministry of Industry, gold – following its “extraordinary price surge” above $4,000 per ounce – is set to surpass LNG as the nation’s second-most-valuable export, just behind iron ore. However, this windfall only partly offsets falling revenues from other commodities.

(chart: Australia’s Commodity Income Falls – Gold Is Now the Nation’s Second-Most-Valuable Export)

At the same time, domestic sentiment remains gloomy. The Westpac Consumer Confidence Index fell in October to its lowest level in six months, as investors grow uncertain about whether the Reserve Bank of Australia will cut rates again this year. The combination of stubborn inflation and high borrowing costs continues to weigh heavily on household confidence.

(chart: Australian Consumers Are in Pessimistic Territory)

Outlook for the Week Ahead

In the coming week, markets will focus primarily on inflation, trade data, and signals from central banks. After weeks of geopolitical turbulence and disappointing growth indicators, attention is shifting back to hard data from China, the UK, and the US – while in Washington, the IMF and World Bank meetings are adding tension around valuations, debt levels, and geopolitical risk.

China

China kicks off the week on Monday with export, import, and trade balance data that will shed light on the impact of the recent US tariffs. Analysts expect exports to have fallen by roughly 5% year-on-year in September, while imports are seen improving slightly thanks to domestic stimulus. Inflation figures on Wednesday are likely to hover around 0.5% y/y, confirming persistent deflationary pressures.

Meanwhile, trade tensions are intensifying again: President Trump announced new 100% tariffs on Chinese goods and export restrictions on critical software. China responded with levies on US ships and curbs on rare earth exports. The tone between the two powers is once again hardening, raising the risk of a renewed trade war.

(chart: “Global Equity Prices Have Surged,” Source: Bloomberg – Index 2015 = 100)

Australia and Asia

On Tuesday, the minutes from the Reserve Bank of Australia will provide more insight into the bank’s balancing act between sluggish growth and persistent price pressures. The tone is expected to remain cautious, as policymakers aim to preserve flexibility for possible rate cuts later this year.

More broadly, the Asian week will revolve around trade, inflation, and policy direction. India will release inflation and trade data on Wednesday, while Singapore publishes its preliminary Q3 GDP estimate – likely showing a moderation after the strong expansion in Q2. Meanwhile, the Bank of Japan remains under political pressure to stay its course following the leadership change within the ruling coalition.

(chart: “Singapore’s Core Consumer Prices Rise at Slower Pace,” Source: Department of Statistics Singapore)

United Kingdom

The UK will release labor market data on Tuesday, followed by GDP figures on Thursday. The labor market continues to soften, with unemployment expected at 4.4%, while growth for August is likely to be flat or slightly negative. The Bank of England will watch these data closely to assess whether further rate cuts are warranted.

Eurozone

In the eurozone, the focus this week will be on confidence, industrial production, and credit ratings.

The ZEW sentiment index, due Tuesday, is expected to show a modest improvement after last month’s uptick in factory orders. However, confidence remains fragile amid geopolitical risks and weak global trade. On Wednesday, industrial production figures are anticipated to show a slight decline – particularly in Germany and Italy, where export exposure remains high.

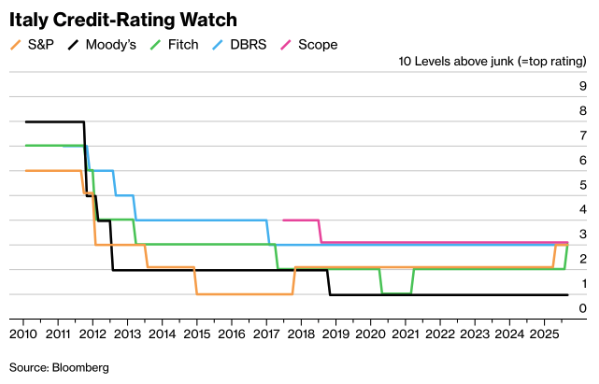

Italy’s credit rating will also draw attention. Rating agency Morningstar DBRS is set to review the country on Friday; an upgrade would give Italy its highest rating since 2018 from one of the five agencies used by the ECB for collateral assessments. Such a move could lower Rome’s borrowing costs and ease pressure on peripheral spreads across the eurozone.

(chart: “Italy Credit-Rating Watch,” Source: Bloomberg)

At the same time, investors will closely watch the appearances of Christine Lagarde and Andrew Bailey during the IMF meetings in Washington. Their remarks on debt dynamics and market valuations could help shape monetary policy direction in the months ahead.

United States

All eyes this week are on Jerome Powell’s speech on Tuesday and a series of key economic releases later in the week. Retail sales (Thursday) will reveal whether US consumers are holding up under higher prices, with a 0.3% m/m increase expected. Producer prices (PPI) are projected to cool slightly after August’s spike, while Friday’s housing starts and building permits are likely to show another decline.

Markets are hoping for confirmation that US inflation is structurally easing without pushing the real economy into a downward spiral – a balance that is becoming increasingly difficult for both the Fed and investors to maintain.

Macro-economic agenda for upcoming week:

Monday

CH – Exports YoY, Balance of Trade, Imports YoY

Tuesday

AUS – RBA Meeting Minutes, NAB Business Confidence

UK – Unemployment Rate

DE – ZEW Economic Sentiment

US – Fed Chair Powell Speech

Wednesday

CH – Inflation Rate YoY

Thursday

UK – GDP MoM

US – Retail Sales MoM, PPI MoM, Initial Jobless Claims, Fed Speeches

Friday

US – Housing Starts, Building Permits Prel