Eurozone

The tone within the ECB shifted noticeably this week. Christine Lagarde indicated that the new projections are likely to turn slightly more positive again, as the euro area has proven more resilient than feared despite US tariffs.

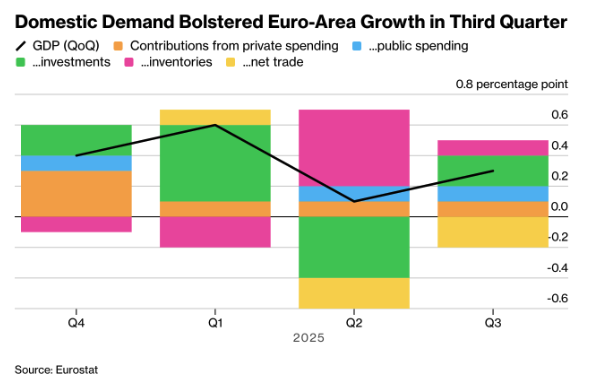

The chart on third quarter GDP growth shows that domestic demand is doing most of the heavy lifting. Growth came in at 0.3 percent quarter on quarter, higher than previously estimated. This strengthens the conviction within the Governing Council that the current level of interest rates remains appropriate for the time being.

Remarks from Simkus and Schnabel reinforced this picture. Both see little room for further rate cuts, pushing market expectations toward a possible rate hike next year. The rise in European government bond yields reflects this repricing, as investors increasingly price out additional easing.

The core message is that the ECB feels comfortable with the current policy framework. Growth is holding up, inflation is close to target, and the focus is shifting from easing toward maintaining existing conditions.

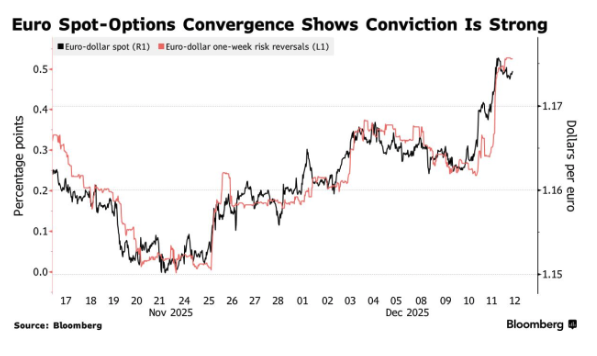

Options traders expect the euro to receive additional support around next week’s ECB meeting. The chart on positioning shows the largest concentration of options clustered around 1.18 dollars per euro, with expiries falling exactly around the rate decision on December 18 and 19. This suggests the market is positioning for further upside once the policy divergence with the Fed is confirmed.

The euro is already trading at its highest level in more than two months following the Fed’s third rate cut and relatively hawkish signals from the ECB. Options sentiment has turned the most positive in almost three months, while the price of volatility around the meeting has risen sharply.

Hedge funds are leading the demand, using both vanilla and exotic options that benefit from a stronger euro. The underlying message is that investors are increasingly positioning for sustained policy divergence between the ECB and the Fed as a driver of further euro appreciation.

United States

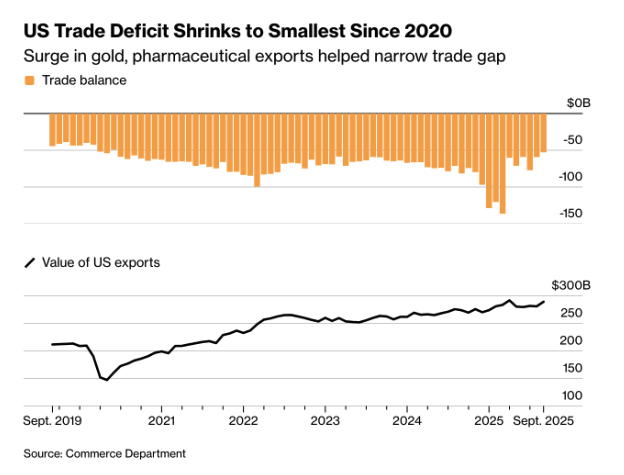

The US trade deficit narrowed sharply and unexpectedly in September to 52.8 billion dollars, the lowest level since 2020. The chart shows that the decline was driven by a strong increase in exports, while imports rose only modestly.

Higher exports of gold and pharmaceutical products ensured that net exports made a positive contribution to third quarter GDP growth. At the same time, volatility remains elevated due to tariff measures, keeping monthly figures uneven and difficult to interpret.

The Federal Reserve cut interest rates by 25 basis points, despite visible divisions within the committee. The economic projections and the press conference made clear that the Fed is navigating a difficult trade off between a cooling labor market and inflation that is not yet moving convincingly toward target. The lack of recent data due to the earlier government shutdown remains an additional complicating factor.

Wage pressures in the US eased further in the third quarter. The Employment Cost Index rose 3.5 percent year on year, the slowest pace in four years. The chart on US labor costs shows that both wages and benefits are clearly cooling.

The figures confirm that the labor market is losing momentum. Fewer vacancies, more layoffs and a decline in voluntary job switching point to weakening bargaining power for workers. Younger employees in particular saw the sharpest slowdown in wage growth.

For the Federal Reserve, these are important signals. Cooling labor costs support the view that inflationary pressure from the labor market is easing further, creating room to loosen policy without reigniting a wage price spiral.

New data on jobless claims underline that the US labor market continues to cool, but with significant noise. Initial claims rose by 44,000 last week to 236,000, the largest week on week increase since the start of the pandemic.

The chart on US jobless claims shows how strongly the data tend to fluctuate around Thanksgiving. Both initial and continuing claims have been unusually volatile in recent weeks. Adjusted for seasonal effects, levels remain within this year’s range, but close to the upper end.

The four week average edged higher toward 217,000, confirming that the pace of layoffs is slowly picking up. Combined with earlier signals of fewer vacancies and lower voluntary job switching, this points to a labor market that is losing momentum further. For the Fed, this fits the picture of a gradual cooling, with downside risks to employment increasing but without signs of an abrupt deterioration.

China

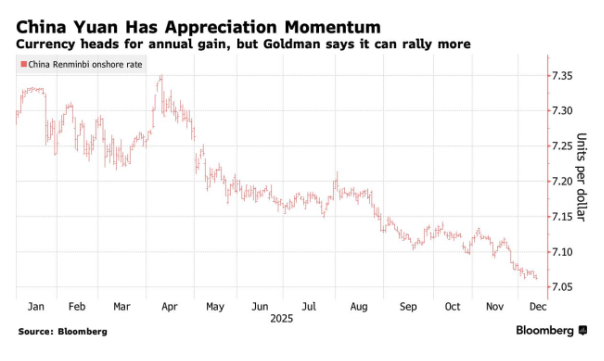

Goldman Sachs argues that the yuan is significantly undervalued and is likely to appreciate more strongly over the coming years than the forward market currently implies. According to the bank, the currency is around 25 percent too cheap based on fundamental models, despite the risks stemming from weak domestic growth and deflationary pressure.

The chart on the estimated fair value of the yuan highlights the size of the gap between the current level near 7.0 per dollar and the level Goldman considers justified based on productivity trends and current account dynamics. At the same time, forward contracts for end 2026 price in only limited appreciation.

The recent strengthening of the daily fixing by the central bank points to a preference for gradual and controlled appreciation. Combined with a large trade surplus and rising international pressure, this continues to form the foundation for a stronger yuan, even if the pace remains measured.

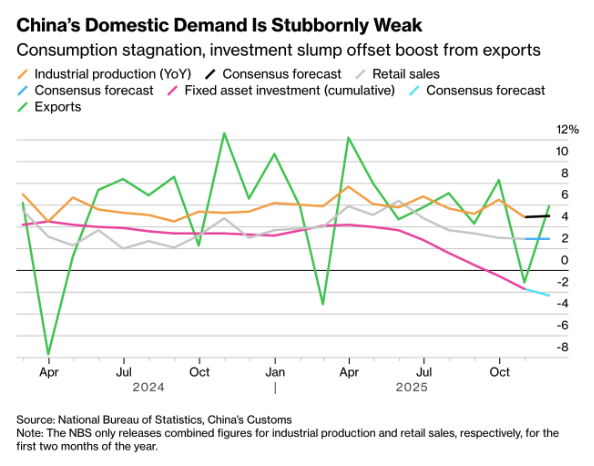

New data for November confirm that domestic demand remains weak despite solid export performance. The chart on China’s domestic demand shows that consumption is barely picking up and investment is coming under further pressure, leaving external demand as the dominant driver of growth.

Retail sales rose only modestly, while fixed investment contracted sharply again due to the ongoing property correction and continued caution among companies. Industrial production continued to grow, but only marginally faster than in October, despite the recent export rebound.

Overall, this underlines that the economic recovery remains uneven. Dependence on external demand is increasing, which raises pressure on Beijing to step up efforts to stimulate domestic consumption and investment in 2026.

China and Europe

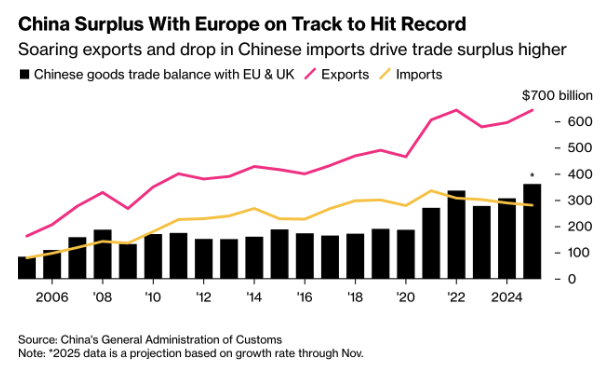

Tensions between China and Europe are rising rapidly as trade imbalances widen. The chart on China’s trade surplus with the EU shows it moving toward a record close to 300 billion dollars, as Chinese exports to Europe continue to increase while imports lag behind. Goods affected by US tariffs are increasingly being redirected toward the European market.

The second chart highlights the structural nature of this problem. Chinese exports of industrial goods continue to grow, while imports of comparable products have been stagnating for some time. This increases pressure on European industries, particularly in sectors such as automobiles, chemicals and capital goods.

European leaders are now openly talking about a breaking point. The combination of weak domestic demand in China, an undervalued yuan and an export driven growth model increases the likelihood of trade measures from Brussels. The debate is shifting from dialogue toward protection, with potentially significant consequences for growth, employment and the euro area’s trade policy in the coming years.

United Kingdom

The focus this week is on the Bank of England’s rate decision, with Governor Andrew Bailey’s vote seen as decisive. After previously opting to hold rates steady, economists now unanimously expect him to support a rate cut to stimulate the weakening economy.

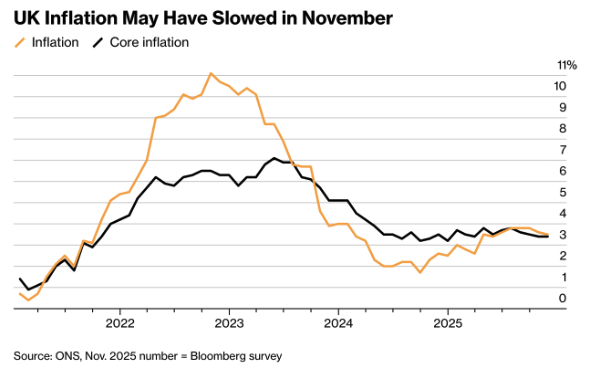

The chart on UK inflation suggests that price pressures likely eased further in November toward 3.4 percent, the lowest level in six months. While this remains clearly above the 2 percent target, it confirms the downward trend. Wage data and inflation figures ahead of the decision will therefore be crucial in balancing cooling growth against still elevated price pressures.

Australia

In Australia, the RBA left rates unchanged, keeping the policy rate steady at 3.6 percent. The statement was cautious and left little room for further easing. New data on business confidence and the labor market confirmed that the economy is slowing, but without signs of a sharp downturn. The labor market remains relatively resilient, giving the central bank room to stay on hold.

Market reaction continued to focus on shifting rate expectations. Investors have moved further away from the idea that 2025 will quickly be dominated by rate cuts. The rates market is gravitating toward a scenario in which the easing cycle has reached its endpoint and the next move is more likely to be tightening rather than loosening.

Looking ahead to next week

The coming week brings a concentrated flow of macro data that should help shape expectations for growth, inflation and monetary policy into 2026. With several central bank decisions, new inflation prints and a broad set of labor market and confidence indicators, the data will clarify whether the global economy is stabilising or cooling further.

Japan

The Asian week is framed at both ends by the Bank of Japan. On Monday, the Tankan survey is released first and is expected to show a slight improvement in sentiment among large industrial firms. This would leave the index at a relatively high level for a ninth consecutive quarter, pointing to continued resilience on the corporate side.

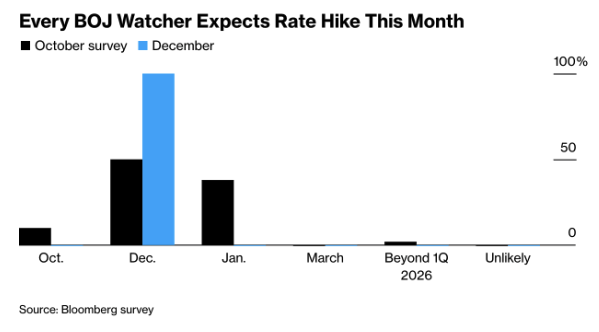

The chart on expectations around the BoJ decision shows that the market has positioned almost unanimously for a rate hike later this week. Policymakers have sent multiple signals over recent months to prepare investors for such a move.

On Friday, the rate decision itself follows, with a hike to 0.75 percent becoming increasingly likely. This would mark the first move since January and underscores that Japan is cautiously continuing its policy normalisation, while other central banks in the region are moving in the opposite direction.

China

New data for November are expected to once again point to weak domestic demand. The decline in fixed asset investment is set to deepen further, mainly due to the ongoing downturn in the property sector. The chart on China’s domestic demand highlights how shrinking investment and stagnating consumption continue to weigh on the economy, despite support from exports.

Retail sales and industrial production are likely growing at their slowest pace in at least a year. This keeps the recovery uneven and heavily dependent on external demand, increasing pressure on Beijing to step in on the domestic side of the economy.

Australia

In Australia, the focus is on consumer confidence. The Westpac index will show whether households are adjusting to higher interest rates and slowing labor market momentum. After the recent repricing of rate expectations, markets will be watching closely to see whether sentiment stabilises enough to support consumption.

United Kingdom

The UK faces an exceptionally busy week. Labor market data and preliminary PMIs provide an initial read on economic momentum, followed by inflation figures and the Bank of England’s rate decision. The key question is whether cooling growth creates sufficient room to soften the restrictive stance, or whether persistent price pressures and wage dynamics continue to force caution. Retail sales toward the end of the week will indicate how resilient the consumer remains.

Germany and euro area

German PMIs, the Ifo business climate and consumer indicators will help shape the outlook for European growth. The main focus, however, is the ECB decision. Rates are expected to remain unchanged, with attention shifting to the messaging during the press conference. Markets will watch closely for signals on the balance between cooling inflation and persistent economic weakness, as the debate continues to move from easing toward maintaining the current stance.

United States

The United States delivers a broad set of data covering the labor market, retail sales, inflation and income. Non farm payrolls and the unemployment rate will set the tone for growth momentum, while CPI and core PCE will guide views on inflation dynamics. The key question is whether further cooling becomes visible without a sharp deterioration in the labor market. That will determine how much room the Fed sees to ease policy further in 2025.

Macro economic agenda for the coming week

Monday

JPN – Tankan Large Manufacturing Index

CH – Industrial Production YoY, Retail Sales YoY

Tuesday

AUS – Westpac Consumer Confidence Change

UK – Unemployment Rate, S&P Global Manufacturing/Services PMI Flash

DE – HCOB Manufacturing PMI Flash

US – Non Farm Payrolls, Building Permits Prel, Housing Starts, Unemployment Rate, Retail Sales MoM

Wednesday

JPN – Balance of Trade

UK – Inflation Rate YoY

DE – Ifo Business Climate

US – Retail Sales MoM

Thursday

NL – Unemployment Rate

UK – BoE Interest Rate Decision

EU – ECB Interest Rate Decision, Deposit Facility Rate, ECB Press Conference

US – Core Inflation Rate YoY/MoM

Friday

JPN – Inflation Rate YoY, BoJ Interest Rate Decision

DE – Gfk Consumer Confidence

UK – Retail Sales MoM

US – Personal Income MoM, Core PCE Price Index MoM/QoQ Final, Existing Home Sales