United States

The US economy remains shrouded in uncertainty as the government shutdown continues to delay key inflation and labor-market releases. October CPI was cancelled – on top of earlier missing reports – leaving the Federal Reserve in an unprecedented data vacuum at a moment when FOMC members are increasingly divided over the possibility of a December rate cut.

Private gauges such as ADP point to a cooling labor market, with slower wage growth and fewer job openings. Inflation expectations remain contained, offering potential room for policy easing once reliable data returns. The lack of visibility has kept the dollar stable, while Treasury yields edged lower.

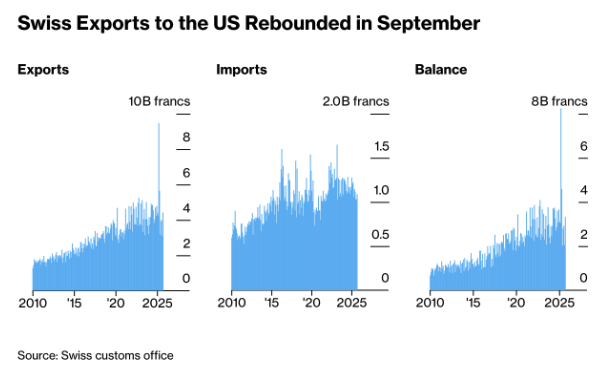

The US and Switzerland reached a provisional trade deal that cuts US import tariffs on Swiss goods – especially watches – from 39% to 15%. The move brings relief to Switzerland’s export industry, which has been under pressure from the unusually severe tariff regime introduced by the Trump administration.

In return, Swiss and Liechtenstein firms committed to invest roughly $200 billion in US manufacturing and R&D over the next five years, including in pharmaceuticals and machinery. The deal places Switzerland on equal footing with the EU, although the strong franc remains a competitive headwind. (Chart: “Swiss Exports to the US Rebounded in September” – source: Swiss Customs Office)

United States

The agreement follows months of intensive diplomacy since August and marks a breakthrough in the strained trade relationship between Washington and Bern. Implementation remains politically sensitive, especially because it includes a partial exemption for US agricultural imports from Swiss tariffs.

Within the Federal Reserve, divisions over the policy path are widening. Several officials warn that inflation could flare up again. Some members argue for caution, while others believe policy is hardly restrictive anymore and that further rate cuts would weaken the credibility of the 2 percent inflation objective. (Chart: “Fedspeak Index Near the Most Hawkish in a Month” sourced from Bloomberg Economics)

The probability of a rate cut in December has fallen from nearly one hundred percent to roughly fifty percent. Regional Fed presidents such as Jeff Schmid from Kansas City and Susan Collins from Boston stated openly that they oppose further easing, while the more dovish members stress that the labor market is becoming more fragile. The disagreement makes it increasingly difficult for Jerome Powell to maintain unity, and the December meeting risks becoming sharply polarised.

Consumer sentiment in the United States remains subdued as concerns about jobs and purchasing power rise again. Surveys from the University of Michigan and The Conference Board show that Americans remain negative about the economic outlook and President Trump’s policies. The Republican electoral loss underlines how the high cost of living and a cooling labour market weigh heavily on public confidence. (Chart: “American Consumers Are Anxious About Job Market” sourced from the University of Michigan and The Conference Board)

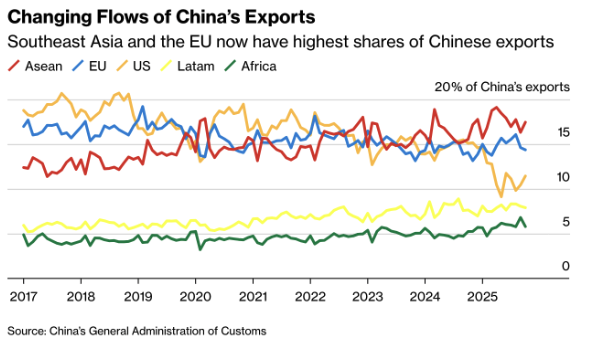

International trade continues to face pressure. US import volumes are moving lower toward the end of the year due to persistent tariff uncertainty and weaker consumption. China is redirecting a growing share of its exports toward Southeast Asia and the EU, which have now become its largest markets. This points to structural geopolitical shifts rather than temporary disruption. (Chart: “Changing Flows of China’s Exports” sourced from China’s General Administration of Customs)

Canada

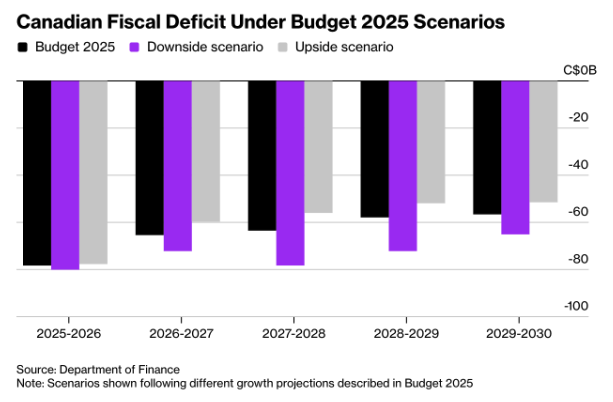

The Bank of Canada cut its policy rate by twenty five basis points to 2,25 percent at the end of October, even though there were internal discussions about postponing the move until there was more clarity on Prime Minister Mark Carney’s budget and the direction of US trade policy. The central bank views the new level as mildly supportive for growth, although it warns that monetary policy is close to its limits.

The minutes show that the cut was justified by ongoing labour market weakness, low growth and inflation near 2 percent. Policymakers also stressed that protectionist measures from the United States continue to damage sectors such as steel, timber and the automotive industry. (Chart: “Canadian Fiscal Deficit Under Budget 2025 Scenarios” sourced from the Department of Finance)

Recent data from Statistics Canada show signs of recovery. The economy added 66.600 jobs in October and the unemployment rate fell to 6,9 percent. The Bank of Canada remains cautious however, with underlying price pressure near 2,5 percent and a risk profile for the inflation outlook that it describes as wider than usual.

United Kingdom

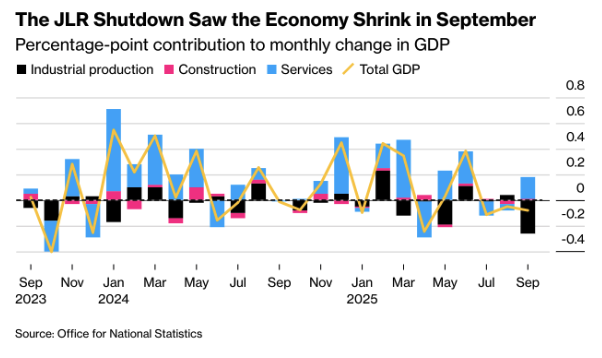

The British economy stalled in the third quarter with GDP growth of only 0,1 percent compared with 0,3 percent in the second quarter. The setback was largely the result of the cyberattack on Jaguar Land Rover, which caused motor vehicle production to drop by almost thirty percent in September, the steepest decline since the pandemic. Total industrial production fell by 2 percent and the services sector grew slightly by 0,2 percent. (Chart: “The JLR Shutdown Saw the Economy Shrink in September” sourced from the ONS)

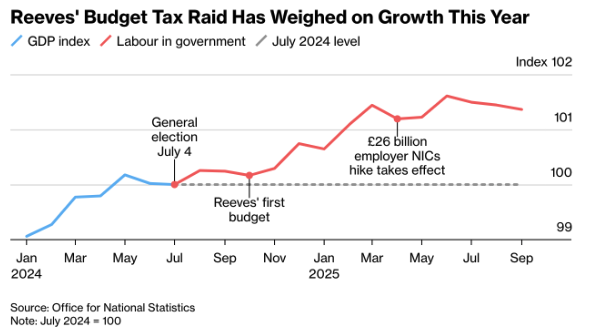

The stagnation coincides with growing uncertainty surrounding the budget of Labour minister Rachel Reeves. The prospect of higher taxes and weakening consumer confidence is prompting firms to delay investment, while unemployment has risen to its highest level since the pandemic. (Chart: “Reeves’ Budget Tax Raid Has Weighed on Growth This Year” sourced from the ONS)

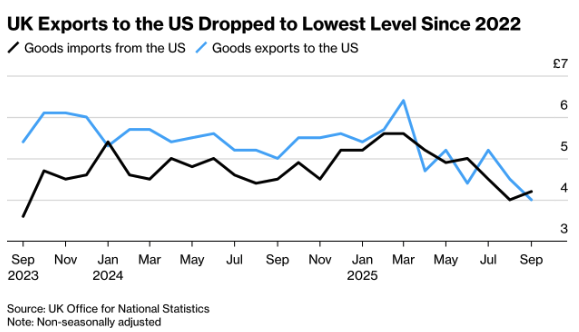

British exports to the United States fell by 11,4 percent to the lowest level since early 2022, partly due to the trade tariffs imposed by the Trump administration. (Chart: “UK Exports to the US Dropped to Lowest Level Since 2022” sourced from the ONS)

The weak growth backdrop and rising unemployment strengthen expectations that the Bank of England will deliver a first rate cut in December. The central bank has already indicated that inflation peaked below 4 percent, although domestic demand remains too fragile to point to a meaningful recovery.

Eurozone

Investor sentiment in Germany improved slightly according to the ZEW index, which rose from 46,2 to 48,9 in November, supported by stabilising energy prices and export orders to Asia. Industrial production across the eurozone remains weak. The September numbers showed a decline of 0,3 percent month on month. The fragile balance between tentative improvement and structural weakness continues to occupy the ECB.

In recent remarks, Isabel Schnabel and Luis de Guindos stressed that further rate cuts will only be considered once wage growth and core inflation move convincingly toward 2 percent. According to the ECB, this is not expected before the middle of 2026.

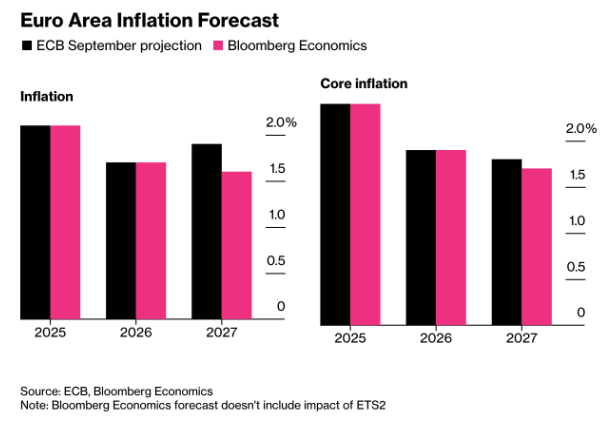

The delay of the new European emissions trading system known as ETS2 introduces a new risk for the eurozone inflation outlook. Without the mechanism, which from 2027 would add extra costs to fuels and transport, inflation risks drifting below the 2 percent target again. (Chart: “Euro Area Inflation Forecast” sourced from the ECB and Bloomberg Economics)

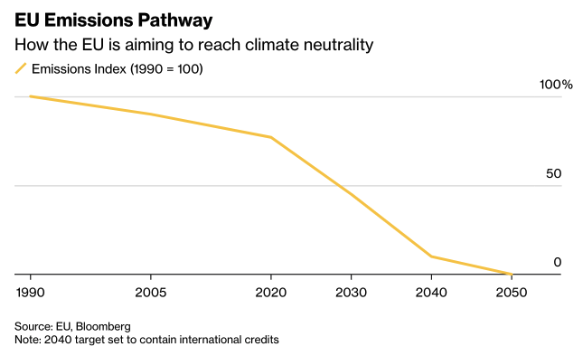

The European Central Bank had already outlined a subdued outlook in its latest projections with inflation expectations of 1,7 percent in 2026 and 1,9 percent in 2027. The delay of ETS2 could push these expectations even lower, especially since its price effects would now appear later, possibly in 2028. Analysts at Danske Bank and JPMorgan note that this increases the likelihood of another round of rate cuts in early 2026, particularly if growth weakens or inflation expectations drift further down. (Chart: “EU Emissions Pathway” sourced from the EU and Bloomberg)

China

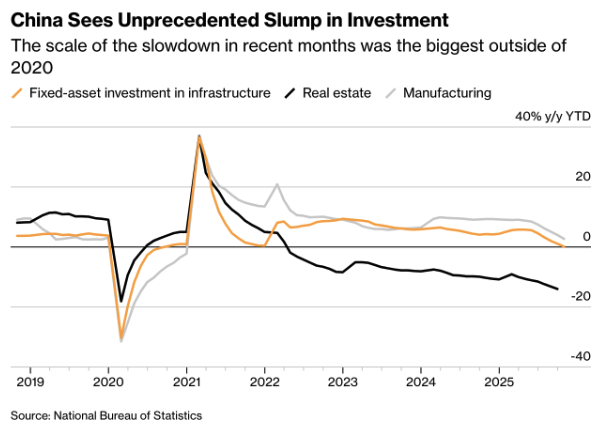

The Chinese economy is showing a troubling split. Consumer prices are edging higher, while investment activity is collapsing. Total investment fell by more than 11 percent year on year in October, the steepest drop since the first months of the pandemic in 2020. The decline hits a segment that represents almost half of China’s GDP and reinforces concerns about a broader slowdown in growth. (Chart: “China Sees Unprecedented Slump in Investment” sourced from the National Bureau of Statistics)

At the same time, a notable increase in the price of gold provided a temporary boost to inflation. The CPI category that includes gold and jewellery accounted for nearly half of the 1,2 percent rise in core inflation according to Goldman Sachs and Shenwan Hongyuan. In an ironic twist, gold is functioning not as a hedge against inflation but as a source of it. (Chart: “China’s Consumer Inflation Receives a Boost From Gold” sourced from the National Bureau of Statistics)

The coming week will focus on inflation, growth and confidence, the themes that continue to steer central bank policy in Asia, Europe and the United States. With key data from Japan, the United Kingdom and the United States, and remarks from both the RBA and the Fed, markets will once again have to judge whether the period of rate cuts is moving closer or drifting further away.

Asia

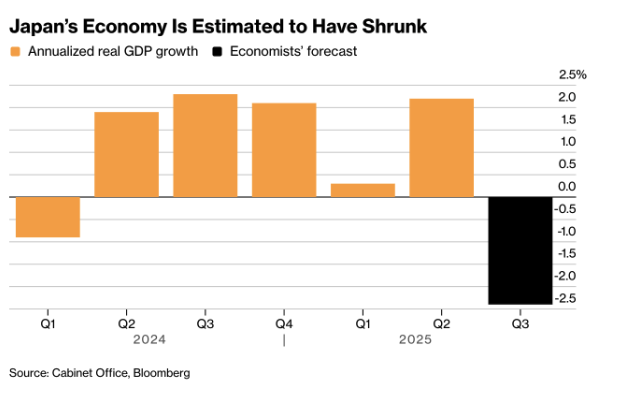

The Asian week begins with disappointing news. Japanese GDP figures are expected to show an annualised contraction of 2,4 percent in the third quarter, the first since early 2024. This gives Prime Minister Sanae Takaichi political room to prepare a substantial stimulus package later this month. (Chart: “Japan’s Economy Is Estimated to Have Shrunk” sourced from the Cabinet Office and Bloomberg)

Growth in Thailand is likely to slow to 1,7 percent year on year, weighed down by weaker tourism revenues and higher US tariffs. Japanese inflation remains above 2 percent, which moves the Bank of Japan closer to a possible rate increase. Elsewhere in the region, Australia will publish wage data on Wednesday and Indonesia is expected to leave its policy rate unchanged. China is likely to keep lending rates steady, underscoring the cautious and uneven nature of Asia’s recovery.

United Kingdom

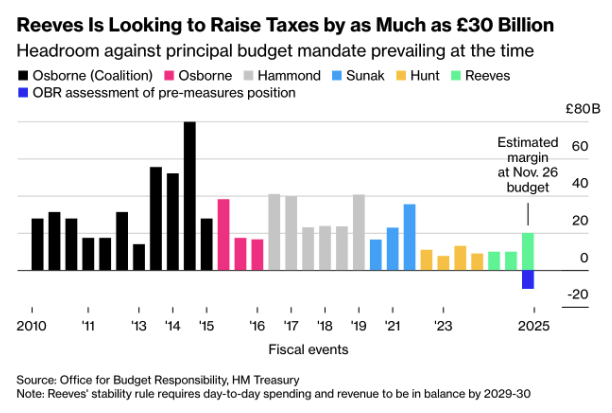

Inflation in the UK is expected to fall to 3,5 percent on Wednesday, the lowest level in five months. This would confirm that price pressures have passed their peak. Attention is now shifting to the budget statement from minister Rachel Reeves on 26 November, where she may announce up to thirty billion pounds in additional taxes. (Chart: “Reeves Is Looking to Raise Taxes by as Much as £30 Billion” sourced from the OBR and HM Treasury)

Eurozone

Speeches by ECB officials are scheduled this week, including Christine Lagarde and Joachim Nagel, which may offer more clarity on the policy direction for 2025.

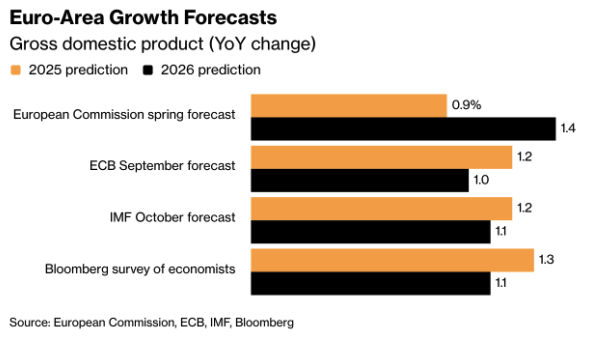

The outlook for the eurozone remains subdued. The slowdown in 2025 appears less severe than feared, although the recovery projected for 2026 already shows signs of weakening. The European Commission is likely to revise its earlier forecast of 0,9 percent GDP growth slightly upward, while the expectations for next year move closer to the 1 percent that the ECB already projected in September. (Chart: “Euro Area Growth Forecasts” sourced from the European Commission, ECB, IMF and Bloomberg)

Macro-economic agenda for upcoming week:

Monday

JPN – GDP Growth Rate QoQ Prel

Tuesday

AUS – RBA Meeting Minutes

Wednesday

JPN – Balance of Trade

UK – Inflation Rate YoY

US – Building Permits Prel, Housing Starts, FOMC Minutes

Thursday

EU – General Council Meeting

NL – Unemployment Rate, Consumer Confidence

US – Existing Home Sales

Friday

JPN – Inflation Rate YoY

UK – Retail Sales MoM, S&P Global Services/Manufacturing PMI Flash

DE – HCOB Manufacturing PMI Flash