Good morning,

After weeks of mounting tension, a moment of relief has arrived. The United States and China have reached a temporary trade truce, prompting a recovery in the markets and a brief cooling in geopolitical tensions. Yet beneath the surface, unease is growing. The U.S. has now officially lost its AAA credit rating—Moody’s, the last of the major agencies to hold out, has finally issued a downgrade. Fiscal policy appears rudderless, and Trump continues to advance his agenda.

In Europe, the ECB is maintaining composure, Russia’s economy is cooling, and the UK is experiencing an unexpected peak—perhaps just the calm before the storm.

United States

The U.S. economy sent mixed signals this week. Inflation remains stubborn, rising 0.4% month-over-month, with core inflation at 0.3%. Retail sales stalled, and consumer confidence slipped. While Powell is officially holding a wait-and-see stance, market sentiment suggests the Fed has little room to ease in the near term.

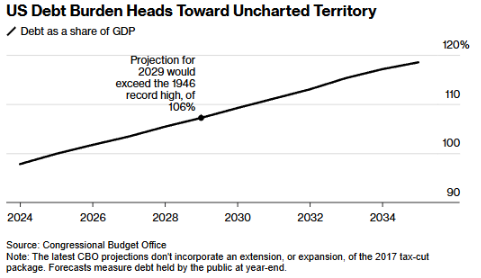

Meanwhile, political dysfunction took center stage. Moody’s stripped the U.S. of its final AAA rating, citing structurally high deficits, a dysfunctional budget process, and mounting interest costs. The timing couldn’t have been more symbolic: at the same moment, Trump’s own budget bill was rejected by members of his own party. Four hardline Republicans blocked the proposal, arguing the spending cuts didn’t go far enough. The House remains deeply divided, and the administration looks increasingly paralyzed.

Another key concern is the rising national debt. The outlook for the U.S. debt position has turned negative, with interest costs climbing sharply. In the coming years, Trump will need to refinance large portions of government debt that were originally issued at near-zero interest rates—now at significantly higher costs. Meanwhile, proposed tax cuts risk adding even more pressure to an already mounting debt burden.

As if that weren’t enough, Trump launched an attack on the pharmaceutical sector this week. In a surprising move, he announced an executive order to slash U.S. drug prices to match the lowest levels found globally. Markets reacted instantly—shares of major pharmaceutical companies tumbled. While analysts are warning of potential legal challenges, sentiment has already shifted. This feels like the opening salvo in a broader wave of re-regulation.

China

Beijing scored a clear geopolitical victory this week. At talks in Geneva, the U.S. and China reached a temporary trade truce: the U.S. reduced tariffs on Chinese goods from 145% to 30%, while China lowered its import tariffs to 10%.

A structured consultation channel will be established, led by Treasury Secretary Scott Bessent. On the surface, the deal appears reciprocal—but beneath it, China secured nearly all of its demands without offering concessions on state-owned enterprises, import quotas, or currency policy.

Xi Jinping’s strategy of quiet resistance and patient diplomacy has paid off. He avoided direct escalation, focused on strengthening the domestic economy, and ultimately secured a pause in the trade war without giving ground.

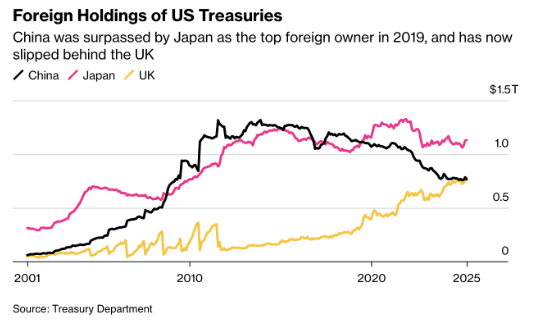

But China’s approach goes beyond diplomacy. A deeper shift is underway in global capital markets. According to the latest data from the U.S. Treasury Department, China sold $27.6 billion in long-term Treasuries in March. For the first time in over two decades, it has dropped to third place among foreign holders of U.S. debt, with $765 billion—just below the UK’s $779 billion. Japan remains the largest holder, with $1.13 trillion.

This isn’t a flight from the dollar, but a strategic repositioning. Analysts like Brad Setser interpret it as a targeted shortening of the duration of China’s U.S. Treasury holdings—a clear signal that Beijing wants to reduce its exposure to U.S. policy decisions. The shift comes at a time when Trump is once again leaning into protectionism and wielding America’s financial dominance as a political tool.

“This is not an exit from the dollar, but a deliberate unwinding of duration. A risk management strategy.”

— Brad Setser, Council on Foreign Relations

The combination of geopolitical restraint and strategic capital management underscores China’s long-term approach. While Washington chases short-term tactical wins, Beijing is focused on structural repositioning—and, for now, it appears to be paying off.

UK

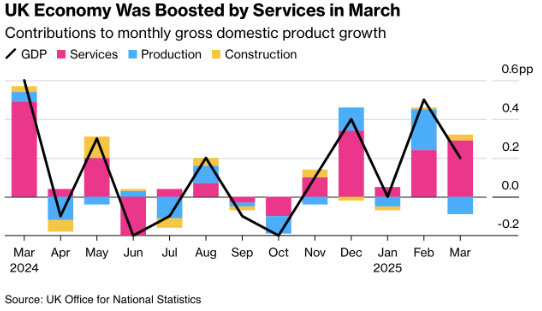

The UK economy grew by 0.7% in the first quarter—the strongest pace in a year and well above the Bank of England’s expectations. Much of the acceleration came from front-loaded production in February and March, as factories ramped up output to boost exports to the U.S. ahead of Trump’s looming tariff deadline. In March alone, GDP rose by 0.2%, defying earlier projections of stagnation. Growth was driven mainly by the services and construction sectors, while manufacturing contracted.

Business investment also bounced back, rising 5.9%, while consumer spending saw a modest increase. The pound briefly strengthened by 0.2% to $1.3289, and markets slightly dialed back expectations for Bank of England rate cuts—though a 25 basis point cut remains fully priced in.

Still, the momentum appears short-lived. Tariffs that took effect on April 2 hit harder than anticipated, and early April data already point to weakening sentiment: PMI surveys show the private sector contracting once again. At the same time, the economy faced a domestic shock. Labour’s first budget raised employer costs by £26 billion, the minimum wage jumped nearly 7%, and households are feeling the pinch from rising energy bills and higher local taxes.

Meanwhile, the labor market is starting to turn: April marked the third consecutive month of net job losses. The Bank of England is forecasting just 0.1% growth for the second quarter, with clear downside risks.

While this quarter provides a political boost for Labour, it may also prove to be the high point of the year. The combination of fiscal tightening and growing external uncertainty is once again weighing on the outlook for growth.

Europe

The ECB remains on track for a rate cut in June, but its tone remains deliberately cautious. Inflation held unexpectedly steady in April, yet continues its gradual decline toward the 2% target.

The real concern, however, lies beyond inflation. Growing trade uncertainty—particularly around Trump’s tariff policy—is starting to weigh noticeably on investment confidence and economic activity across the eurozone.

ECB Chief Economist Philip Lane announced this week that, in June, the central bank will publish alternative scenarios alongside its regular economic forecasts. As it did during the pandemic and following Russia’s invasion of Ukraine, the ECB believes current levels of uncertainty are too high for a single baseline scenario to offer sufficient guidance. These new projections will account for potential escalation or de-escalation in U.S. tariff policy and its effects on key European trading partners, such as China.

Irish central bank governor Gabriel Makhlouf also outlined three possible trajectories this week—ranging from a short-term tariff flare-up to a prolonged period of structural trade tension. The underlying message is clear: the ECB is preparing to stay flexible.

Lane also emphasized that, unlike the Federal Reserve, the ECB sees no need for a “dot plot” of individual policymakers’ rate expectations. He argued that such a tool would only create “unnecessary expectations” and could conflict with the ECB’s forward guidance, which is based on market-implied interest rates.

In short, the ECB is sticking with its established approach: cautious, scenario-driven, and politically attuned. A rate cut in June looks all but certain—but the path beyond that will be shaped more by geopolitics than by projections.

Russia

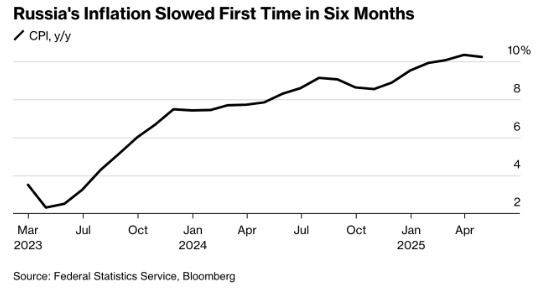

After six consecutive months of rising inflation, a shift has finally emerged: in April, annual inflation edged down to 10.23%. Some analysts expect it could drop below 10% as early as May. The combination of a strong ruble and a steep 21% policy rate is beginning to have an impact—perhaps more than intended.

The Russian economy is cooling rapidly. GDP grew just 1.4% year-on-year in the first quarter, a sharp slowdown from 4.5% in the previous quarter. On a quarterly basis, GDP actually contracted by 0.6% in real terms. Bloomberg expects the central bank may need to begin easing policy in the second quarter to avoid a recession. However, its options are limited: new sanctions from Europe, the risk of further escalation with the U.S., and a fragile ruble continue to pose significant threats.

Last Friday, Istanbul hosted the first diplomatic meeting between Russia and Ukraine since 2022. While no truce was reached, the two sides did agree to a prisoner exchange—a small but symbolic step forward.

Coming week:

We’re now nearing the midpoint of Trump’s 90-day tariff pause, but the calm is only surface-deep. Beneath the diplomatic de-escalation lies a growing sense of global unease. Next week’s data releases will be closely watched for clues about what’s really happening under the hood: from Chinese manufacturing and UK inflation to PMIs and financial stability indicators across Europe.

Markets are searching for direction—is this just a brief pause, or the early signs of a deeper, more structural shift?

China

Monday kicks off with key data on retail sales, industrial production, and unemployment. A modest recovery in consumer spending is expected, while manufacturing is likely to show signs of softening—reflecting the temporary shock from the brief imposition of 145% U.S. tariffs in early April. Investors will be watching closely for indications that China’s economy is starting to slow under the weight of growing external uncertainty.

Real estate figures are also in focus. A further drop in property investment would signal that a broader recovery in the construction sector remains out of reach for now. Meanwhile, markets are speculating that the People’s Bank of China may cut both the one-year and five-year loan prime rates later in the week—signaling that Beijing is prioritizing growth over currency stability.

Australia

Tuesday’s spotlight will be on the Reserve Bank of Australia’s interest rate decision. Markets are widely expecting a 25 basis point cut to 3.85%, driven by cooling inflation and the temporary easing of trade tensions following the U.S.–China truce.

United States

While no major macroeconomic data is scheduled next week, several important indicators will still offer insight into the U.S. economy. On Thursday, the May PMIs will be released—providing the first real snapshot of business activity following the expiration of the tariff deadline. Expectations point to continued weakness in manufacturing, with a slight pickup in the services sector.

Also on Thursday, data on existing home sales will be published. The key question: does the housing market still have momentum in the face of rising interest rates and growing economic uncertainty?

Markets will be closely watching remarks from Fed officials Jefferson, Williams, Musalem, and Hammack. The Fed has kept a relatively low profile following the softer inflation data, but even a subtle hint of easing could reignite market speculation. On Friday, new home sales data will be released and are expected to show a decline—suggesting that this key sector may also be starting to weaken.

Beneath next week’s economic indicators lies a broader, more complex narrative: Trump’s vision for the global economy is becoming clearer, but not more coherent. He aims to isolate China while simultaneously demanding greater access to its markets. He’s pressuring allies like the UK to exclude China from their supply chains, while offering only vague tariff agreements in return—lacking any real framework or consistency.

From Europe’s perspective, Washington is pushing for a structural realignment of global trade, but without providing actual structure. Meanwhile, Beijing is responding with calm resolve. Xi Jinping’s diplomatic outreach to Latin America, Southeast Asia, and soon Europe is designed to strengthen partnerships and pull countries away from the U.S. The message is unmistakable: those who distance themselves from China should be prepared for consequences.

European leaders are walking a fine line. EU Commissioner Valdis Dombrovskis described U.S. tariffs as “economically damaging, including for the U.S. itself,” while emphasizing that strategic autonomy is no longer a luxury, but a necessity.

Meanwhile, Trump continues to generate confusion. From AI deals in the Middle East and new export restrictions targeting Huawei, to sudden demands on European pharmaceutical and semiconductor sectors—his actions span multiple fronts, yet lack a coherent strategy.

For markets, this introduces a new kind of risk: noise. It’s not any single policy move that’s most threatening, but rather the sheer unpredictability of it all.

Europe – Gauging Confidence, Testing Stability

This will be a pivotal week for the eurozone, focused on three key themes: sentiment, scenarios, and stability. On Monday, the European Commission will release its spring forecasts, revising growth expectations in response to the ongoing global trade tensions. Tuesday brings consumer confidence data, followed by Thursday’s PMIs for manufacturing and services. These May figures are particularly important—they mark the first real test of sentiment since the easing of trade tensions. If there’s no visible improvement, it could point to deeper, structural growth weakness.

On Wednesday, the ECB will publish its Financial Stability Review, and on Thursday, the minutes from the April 17 meeting will be released. These are expected to shed light on core concerns such as geopolitical risks, slowing inflation, and uncertainty around the future path of interest rates. Chief Economist Philip Lane is scheduled to speak twice during the week, and ECB President Christine Lagarde voiced cautious optimism over the weekend: “Inflation is falling, purchasing power is rising. But uncertainty from Washington is weighing on confidence.”

On Friday, Eurostat will release data on wage negotiations—a new variable closely watched by the ECB. If wage inflation remains above 4%, the trajectory for interest rates beyond June is unlikely to follow a smooth downward path.

UK

On Wednesday, the UK will release April CPI data. The headline inflation rate is expected to rise to 3.3% year-on-year—the highest in over a year—driven largely by increases in regulated energy tariffs.

The key focus, however, will be on services inflation. The Bank of England is closely monitoring domestic price pressures, and services inflation remains persistently high at around 5%.

Friday brings a key test on the consumption front: retail sales. Following the export-driven surge in Q1, the spotlight now shifts to domestic demand. The question is whether consumers can withstand the pressure of rising costs and higher household charges. A weak retail figure would strengthen the case for a rate cut in August—but if inflation proves sticky, that timeline could be pushed further out.

Japan

Japan will release its trade balance on Wednesday, followed by inflation data on Friday. Consumer prices are expected to remain steady at 3.5%—well above the Bank of Japan’s target, but not high enough to trigger policy tightening.

Meanwhile, the yen remains under pressure, largely due to the persistent interest rate differentials. Unless those gaps are addressed, Japan’s currency is unlikely to see relief.

Macroeconomic calendar for the week ahead:

Maandag

CH – Retail sales YoY, Industrial production YoY

Dinsdag

AU – RBA interest rate decision

EUR – Consumer Confidence flash

VS – Fed speeches

Woensdag

JPN – balance of trade

VK – Inflation rate YoY

Donderdag

DE – HCOB manufacturing PMI Flash, Ifo Business Climate

VK – S&P Global Manufacturing PMI Flash, Services PMI Fash

VS – Exisiting home sales

Vrijdag

JPN – Inflation Rate YoY

VK – Retail Sales MoM