The week was marked by Chinese trade figures, the UK labor market, and US inflation and consumption data. While IMF meetings in Washington were dominated by concerns over overvaluations and debt, the economic data portrayed a world that is gradually cooling but in which consumers and exporters remain surprisingly resilient.

China

China opened the week with stronger-than-expected trade figures. Exports rose by 8.3% year-on-year in September – the fastest pace since March – while imports increased by 7.4%, driven by stockpiling and higher raw material inflows. The trade surplus narrowed slightly to USD 90.5 billion as imports grew faster than exports. Despite the positive momentum, exports to the US remained under heavy pressure, confirming China’s shift in trade orientation toward Asia and South America.

Later in the week, inflation data followed: consumer prices were unchanged at 0.5% y/y, while producer prices fell by 2.3% y/y. The deflationary trend thus continues, increasing pressure on Beijing to deliver new domestic stimulus measures.

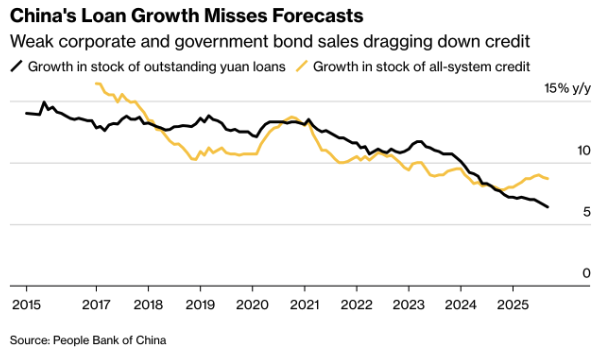

Chinese credit growth also disappointed again in September. Total new loans rose less than expected as government bond issuance slowed further and corporates remained cautious about new financing. Both households and firms showed little appetite for borrowing amid a weakening labor market and squeezed profit margins. The data confirm that monetary policy is reaching its limits, and additional fiscal support will likely be needed to sustain growth.

United Kingdom

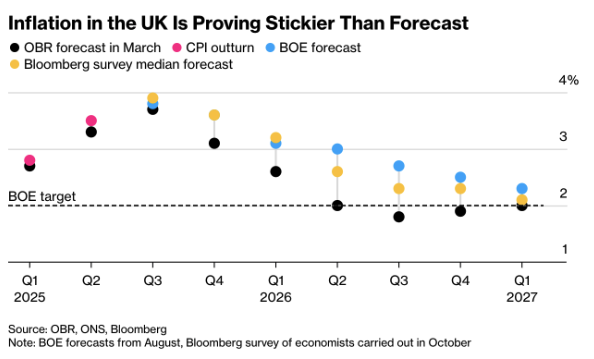

The British economy continues to teeter on the brink of stagnation. Unemployment inched up to 4.4%, while wage growth excluding bonuses slowed to 5.1% y/y. GDP growth for August came in at just 0.1% m/m, narrowly keeping the UK out of recession. For the Bank of England, this means interest rates can remain stable for now: inflation, at just over 3%, remains too high to justify easing, while growth is too weak to allow further tightening.

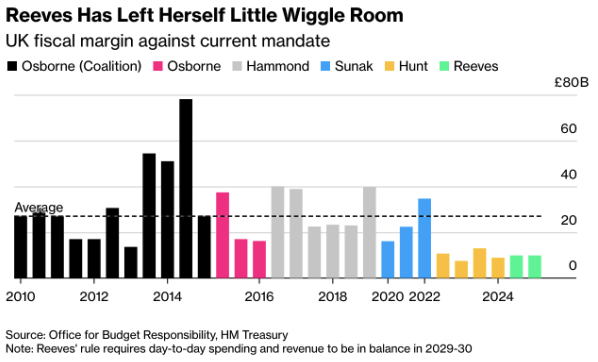

At the same time, Chancellor Rachel Reeves announced that the upcoming budget leaves little room for new policy initiatives. High interest expenses and rising debt are constraining the government’s fiscal flexibility, making spending cuts or tax increases all but inevitable. The fiscal framework for 2029–2030 requires that current spending and revenues be balanced, further tightening the squeeze on future investment.

(Chart: Reeves Has Left Herself Little Wiggle Room – Source: Office for Budget Responsibility, HM Treasury)

Eurozone

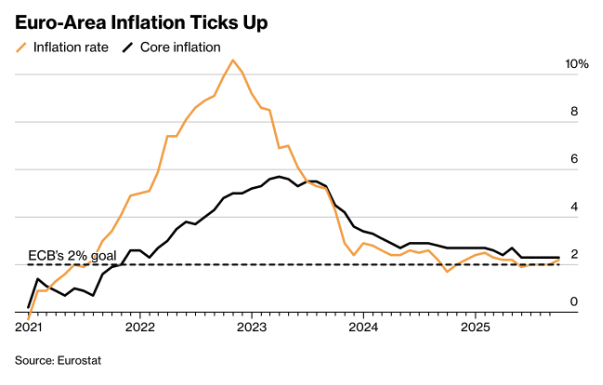

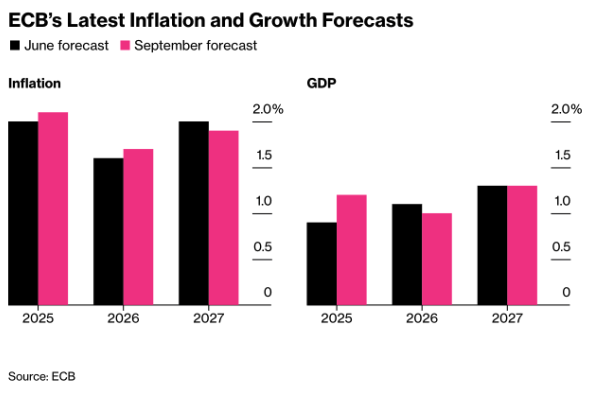

During the IMF meetings, ECB board members Pierre Wunsch and Martins Kazaks emphasized that current policy remains appropriate but that the Bank is alert to the risk of a prolonged undershoot of inflation.

Wunsch noted that small deviations from the 2% target are no cause for action: “We shouldn’t get nervous about a difference of 10, 20, or 30 basis points.” He described the recent cooling as a positive supply shock driven by lower energy prices – one the ECB should look through “symmetrically.”

Kazaks, however, warned that the Bank would step in if inflation were to remain structurally below 2%. For 2026, the ECB projects price growth of 1.7%, with a modest acceleration thereafter. According to him, a “meeting-by-meeting approach” remains the right path as long as inflation expectations stay anchored.

Both policymakers ruled out rapid rate cuts. The ECB aims to prevent temporary price weakness from turning into structurally low inflation – but is equally determined not to ease too early.

(Charts: “Euro-Area Inflation Ticks Up” – Eurostat; “ECB’s Latest Inflation and Growth Forecasts” – ECB)

Across the rest of the euro area, the picture remained broadly similar: minimal expansion, persistent pressure on the industrial sector, and relief that the ECB’s recent rate pause will likely be extended. Concerns over high valuations and rising public debt dominated discussions at the IMF meetings, dampening broader investor sentiment in Europe.

The European Union is attempting to safeguard its industrial base amid mounting pressure from the US and China. While both powers shield their markets and favor strategic sectors, Europe continues to struggle in crafting a coherent industrial policy. The European Commission is considering measures such as mandatory technology transfer for Chinese companies operating in the EU and preferential treatment for European firms in public tenders worth €2.5 trillion annually.

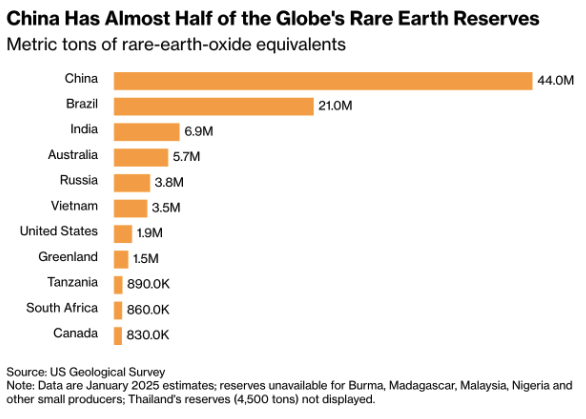

Former ECB President Mario Draghi warned that “inaction risks undermining not only our competitiveness, but our sovereignty itself.” Meanwhile, new data highlight the imbalance of power: China controls nearly half of the world’s reserves of rare earth elements – critical for batteries, wind turbines, and defense applications.

(Chart: “China Has Almost Half of the Globe’s Rare Earth Reserves” – Source: US Geological Survey, estimate as of January 2025)

United States

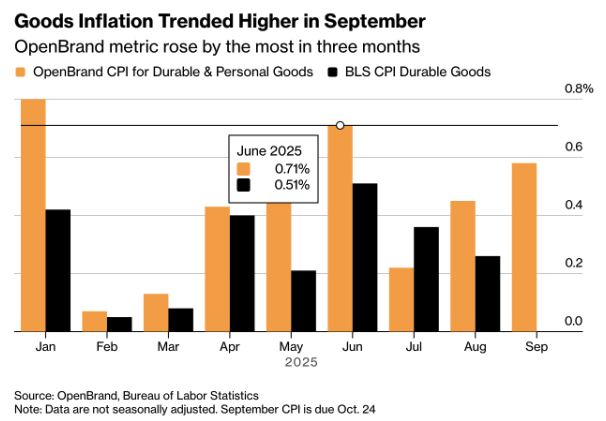

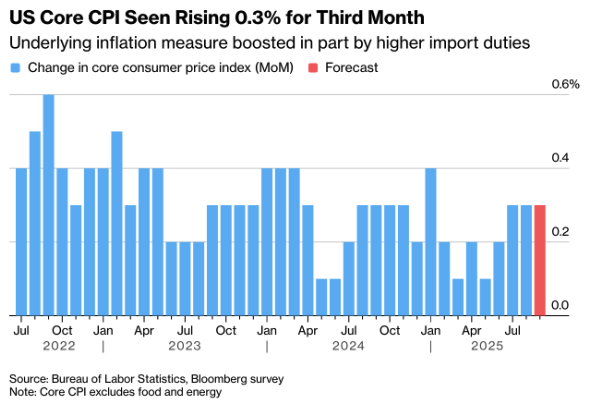

In the US, prices for durable consumer goods continued to rise in September. According to OpenBrand, goods inflation increased at the fastest pace in three months, driven mainly by higher prices for personal care products and communication equipment. PriceStats data also show that annual price growth for household goods and furniture has reached its highest level in two years. This indicates that underlying price pressures within the goods component remain stubbornly persistent despite weakening demand.

(Chart: Goods Inflation Trended Higher in September)

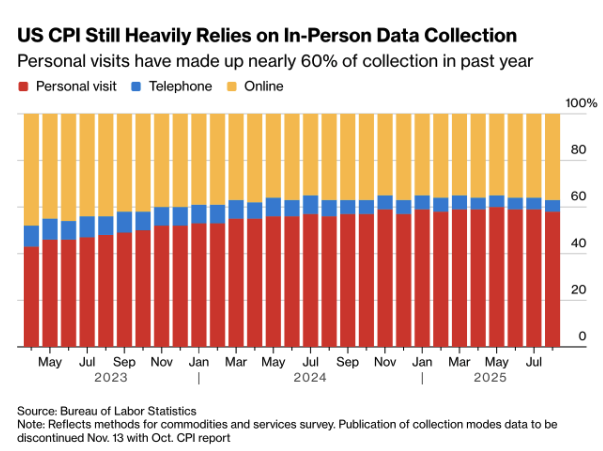

At the same time, concerns are mounting over the reliability of the inflation statistics themselves. The ongoing government shutdown is putting pressure on the work of the Bureau of Labor Statistics. Nearly 60% of US CPI data is still collected through in-person price sampling – a method that largely comes to a halt during a shutdown. As a result, there is a risk that the upcoming inflation release will be incomplete or delayed.

(Chart: US CPI Still Heavily Relies on In-Person Data Collection)

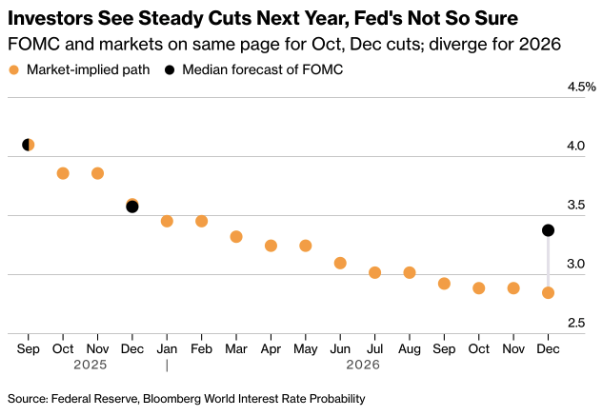

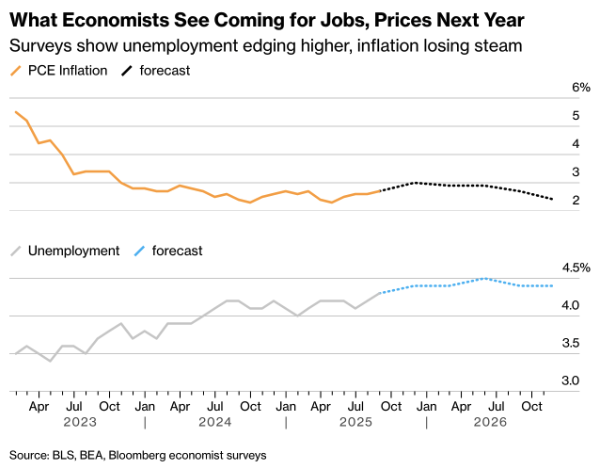

The Federal Reserve appears on track for an interest rate cut at the end of October, as the cooling labor market now outweighs lingering inflation concerns. According to Jerome Powell, the labor market balance risks tipping: “Further declines in job openings could soon translate into higher unemployment,” he said on October 14. His remarks were widely interpreted as confirmation that a 25-basis-point cut is imminent. Most traders now also anticipate a second move in December.

(Chart: Investors See Steady Cuts Next Year, Fed’s Not So Sure)

Still, divisions within the Fed are widening over what comes next. Eight of the nineteen policymakers expect no further rate cuts next year, fearing that persistent price pressures and new trade tariffs could reignite inflation. While markets anticipate a gradual downward rate path through 2026, several Fed members maintain a more neutral outlook. The ongoing government shutdown – which has halted the release of key economic data – further clouds the picture.

For now, the central bank remains committed to its data-dependent approach: a rate cut at the end of October appears all but certain, but the pace thereafter will depend on how quickly the labor market weakens without triggering another inflation rebound.

(Chart: What Economists See Coming for Jobs, Prices Next Year)

Canada

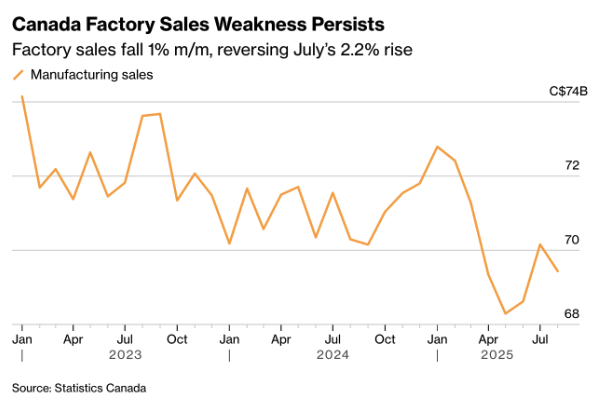

Canadian industrial activity weakened in August under the impact of US import tariffs. Factory sales fell by 1% m/m, while wholesale revenues declined by 1.2% – a smaller drop than feared but still a clear reversal after July’s 2.2% gain. The transport sector accounted for much of the weakness, with lower production of aerospace components and reduced vehicle and parts sales dragging the total down. The food and beverage industries also recorded declines. In real terms, factory sales decreased by 1.5% and wholesale sales by 1.3%.

One notable exception was the metals industry: aluminum sales surged by 45% despite US tariffs. The data highlight how Canada is being increasingly hit by trade disruptions with the United States and how fragile the manufacturing recovery remains.

(Chart: “Canada Factory Sales Weakness Persists” – Source: Statistics Canada)

Global Trade

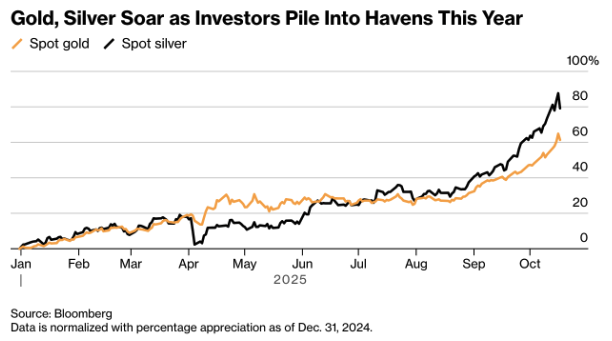

Global markets once again displayed their nervous temperament this week. Gold has risen more than 60% since the start of 2025, supported by central bank purchases and strong inflows into gold ETFs, while silver – after a spectacular surge above $54 per ounce – has sharply retreated. The flight to safe havens underscores how investors are hedging against geopolitical risks and persistent inflation uncertainty.

(Chart: Gold, Silver Soar as Investors Pile Into Havens This Year)

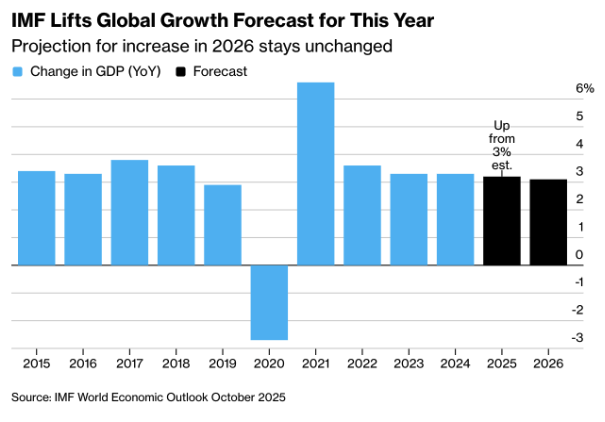

At the same time, the IMF raised its global growth forecast for 2025 but cautioned that the rebound is likely to be short-lived. The upgrade reflects a brief trade boost ahead of new tariffs and a weaker dollar that temporarily supports exports. Projections for 2026 remained unchanged, underscoring the Fund’s view that the global economy continues to face structural headwinds over the longer term.

(Chart: IMF Lifts Global Growth Forecast for This Year)

A shift is emerging in global trade patterns. Container flows between the US and Asia are set to shrink by nearly 3% this year – the steepest decline since the pandemic – while most other routes still show modest growth. The redirection of supply chains toward Latin America, Africa, and Southeast Asia points to a broader realignment of global trade under the strain of the highest US tariffs since the 1930s.

(Chart: Global Trade Is Downshifting, Not Stalling)

Outlook for the Week Ahead

The coming week will center on fresh inflation figures from the UK, Japan, and the US, as well as growth data from China that will shed more light on the global economic slowdown. Investors will be watching closely for signals from policymakers on the direction of monetary policy as inflation continues to ease worldwide, but growth remains unconvincing.

China

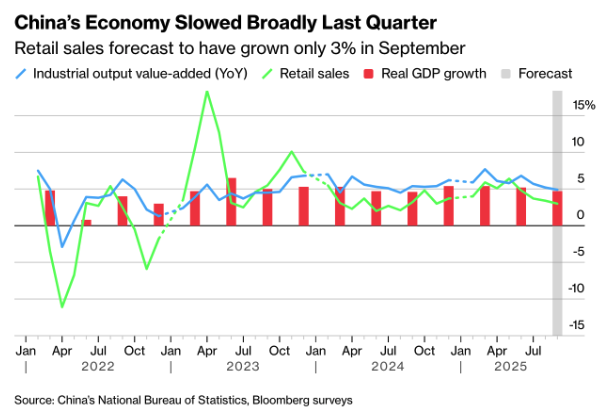

China will open the week on Monday with GDP, retail sales, and industrial production data for September. The economy is expected to have grown by 4.4% y/y in the third quarter, slightly below the 4.7% recorded in the previous quarter. Domestic consumption is likely to have expanded modestly by +3.9% y/y, while industrial output is projected to rise 4.5% from a year earlier. These figures will be crucial in assessing whether recent credit easing and tax cuts are sufficient to keep growth near the 5% target.

China’s economy likely grew 4.7% y/y in the third quarter – the slowest pace in a year. Exports remain strong, but domestic weakness in investment, industry, and consumption is weighing on momentum. Retail sales for September are expected to rise just 3% y/y, while industrial output climbs 5% – both the weakest readings of 2025.

The ongoing property crisis and foreign investor caution continue to undermine growth despite higher government spending and expanded local government lending. Beijing is under growing pressure to reorient the economy toward domestic consumption as structural headwinds – from debt burdens to deflation – become increasingly evident.

(Chart: China’s Economy Slowed Broadly Last Quarter – Source: NBS, Bloomberg)

Eurozone

The focus on Tuesday will be on Christine Lagarde’s speech, which may offer more clarity on the timing of future rate cuts. The ECB has signaled satisfaction with its current stance but is likely to emphasize that inflation is gradually moving toward the 2% target. On Thursday, preliminary consumer confidence data are due, expected to improve slightly from -12.2 to -11.8, supported by lower energy prices and a more stable labor market.

United Kingdom

The UK will release its inflation figures on Wednesday, with further cooling expected: CPI is projected at 2.8% y/y (down from 3.2% in August). Core inflation is seen easing toward 3.8%, increasing pressure on the Bank of England to begin monetary easing sooner.

On Friday, retail sales are due, expected to rise by 0.2% m/m, alongside the manufacturing and services PMI figures. The composite index is likely to hover around 51.0, just above the contraction threshold.

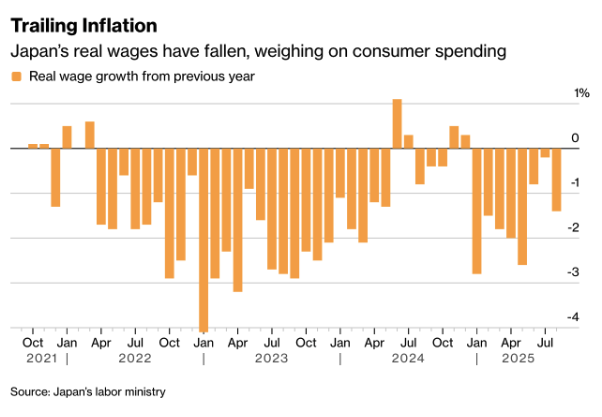

Japan

Trade data will be released on Wednesday, with exports forecast to grow by +4.5% y/y and imports to show a modest increase. On Friday, inflation figures will follow, with core CPI expected to remain stable around 2.6% y/y. The Bank of Japan will be watching these numbers closely ahead of next month’s policy meeting, as pressure mounts to begin winding down its ultra-loose monetary stance.

United States

In the US, the focus this week will be on inflation and the housing market. On Thursday, existing home sales are expected to fall to an annualized pace of 3.8 million – the lowest level in four months. Friday brings the CPI report, the key data release of the week.

Macro-economic agenda for upcoming week

Monday

CH – GDP Growth Rate YoY, Retail Sales YoY, Industrial Production YoY

Tueday

EU – ECB Lagarde Speech

Wedneday

JPN – Balance of Trade

UK – Inflation Rate YoY

Thursday

US – Existing Home Sales

EU – Consumer Confidence Flash

Friday

JPN – Inflation Rate YoY

UK – Retail Sales MoM, S&P Global Services/Manufacturing PMI

DE – HCOB Manufacturing PMI Flash

US – Core Inflation Rate YoY/MoM, Inflation Rate YoY/MoM,