In a week dominated by inflation figures, data from the US, UK, and China reaffirmed that price pressures continue to play a strategic role in shaping interest rate policy. The Federal Reserve is maintaining a firm stance despite mounting political pressure, while the Bank of England faces growing concerns over stagflation. In China, domestic spending remains subdued, even as GDP growth exceeded expectations. Meanwhile, Donald Trump is escalating his trade war and intensifying pressure on Fed Chair Jerome Powell. The ECB has opted to pause for now, but the outlook remains politically and economically uncertain.

United States

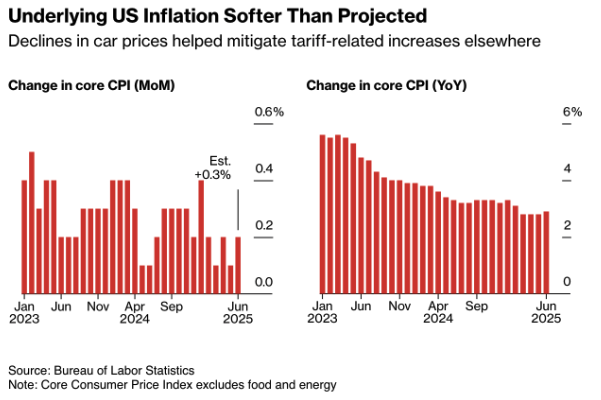

Core inflation in the US (excluding food and energy) rose by 0.2% month-on-month in June – coming in below expectations for the fifth consecutive month. Falling car prices helped keep overall inflation in check, but a broader rate-driven pattern is emerging: prices for toys, home appliances, and sporting goods recorded their fastest monthly increases in years.

Excluding auto components, core commodity prices rose by 0.55% month-on-month – marking the strongest increase since November 2021. This indicates that companies are beginning to pass on the cost of Trump’s recently heightened tariffs more aggressively. Nevertheless, the broader pass-through remains limited for now, as many firms are offsetting the impact through inventory accumulation or by accepting lower profit margins.

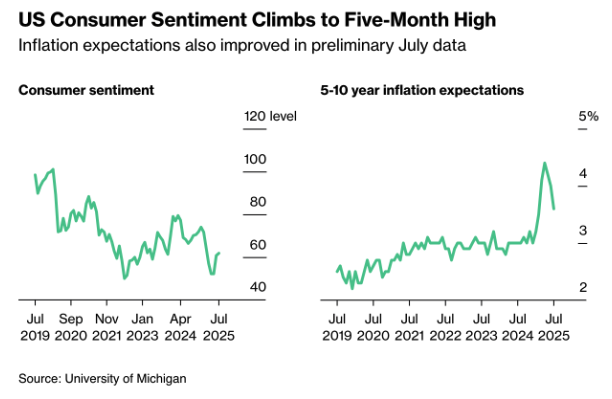

U.S. consumer confidence climbed to 61.8 in July, the highest level in five months, supported by easing inflation expectations and rising stock prices. According to the University of Michigan survey, consumers now anticipate prices to increase by 4.4% year-over-year – the lowest since February – while long-term inflation expectations declined to 3.6%.

Still, overall confidence levels remain below last year’s averages, and expectations for income growth and the labor market continue to lag. Notably, Republican and independent voters reported improved sentiment. However, the University of Michigan notes that confidence remains fragile and could quickly deteriorate in response to new tariff announcements or renewed inflationary pressures – limiting the sustainability of the recent rebound.

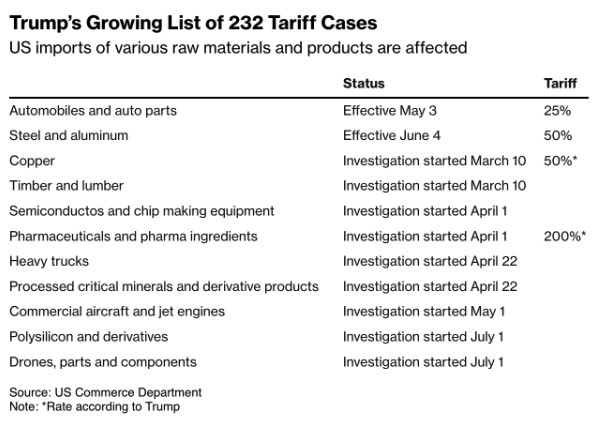

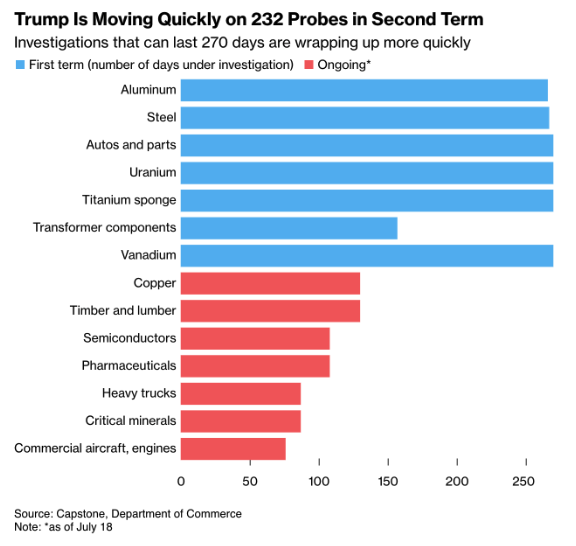

Meanwhile, Donald Trump is intensifying his trade offensive. Starting August 1, industry-specific tariffs will be introduced on top of existing country-specific levies. The rollout begins with a 50% tariff on copper, and will later extend to pharmaceuticals, semiconductors, timber, critical minerals, and potentially commercial aircraft components. This move follows a temporary delay from the original July 1 deadline, which had offered markets some breathing room. The European Union, however, is actively working toward a resolution and remains “confident” in reaching an agreement.

The tariffs fall under Section 232 of the Trade Expansion Act and are being justified on national security grounds. In some sectors, they could impact as much as 30% to 70% of total imports. For pharmaceuticals, Trump has announced a phased approach, with potential tariffs reaching up to 200% on both generic and brand-name drugs.

Meanwhile, companies in the tech and auto industries are sounding the alarm over rising costs and supply chain disruptions. Apple, Tesla, and Ford have all publicly expressed concerns about the potential impact.

The cumulative impact of these tariffs is expected to be inflationary heading into the fall, creating a significant challenge for monetary policy. A rate cut by the Federal Reserve in July now appears highly unlikely, with market expectations shifting toward September. The Fed’s message remains one of caution: “Wait and see.”

This uncertainty is compounded by escalating political attacks on Fed Chair Jerome Powell. This week, Donald Trump publicly accused Powell of potential fraud, using the $2.5 billion renovation of the Fed’s headquarters as a pretext. Powell defended himself in writing, and Fed Governor Waller attributed the cost overruns to cumulative inflation since 2017.

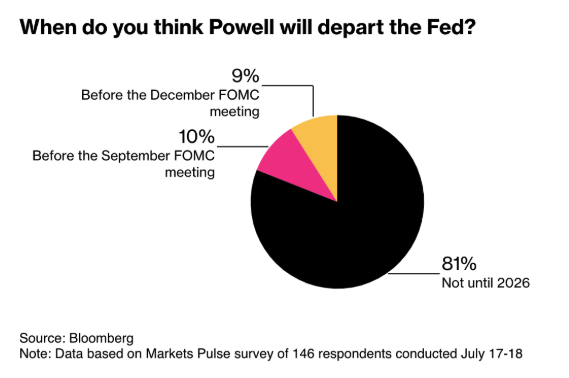

Rumors of Powell’s potential early departure triggered brief market volatility on Wednesday. According to a Bloomberg survey of 146 investors, the majority still expect Powell to complete his term through May 2026. However, analysts warn that a forced exit could trigger a 40-basis-point spike in 30-year Treasury yields and a 4–6% decline in the U.S. dollar.

Markets have already shown sensitivity to such speculation: a recent rumor that Trump might soon name a successor – creating a sort of “shadow Fed chair” – prompted the euro to strengthen by a full cent against the dollar.

Against this backdrop, Fed Governor Christopher Waller is visibly positioning himself as a potential successor to Powell. In the same Bloomberg survey, he was seen as the most credible candidate. On Friday, he called for an interest rate cut “as early as this month,” further cementing his role as a de facto shadow chair.

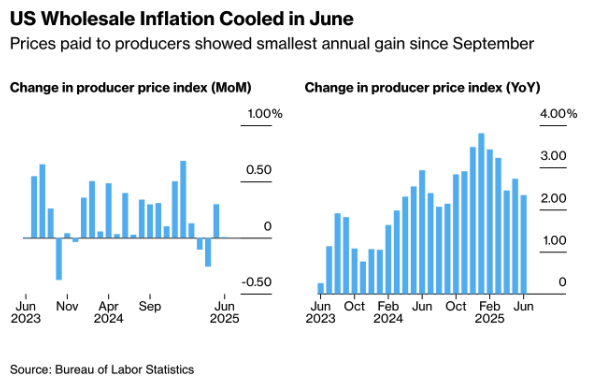

Turning to producer prices: despite rising input costs, tariff effects are only beginning to show.

U.S. producer prices (PPI) were unchanged in June compared to May, even with a 0.4% rise in durable goods prices and higher energy costs. On a year-over-year basis, wholesale inflation came in at 2.3% – the slowest pace since September. Core PPI, which excludes food, energy, and trade services, remained stable as well, rising 2.5% year-over-year.

A drop in service costs helped offset the overall index, largely driven by sharp price declines in travel-related categories: hotel accommodation prices fell by 4.1%, while airfares dropped 2.7%.

The data suggests emerging margin pressure among manufacturers, who appear to be passing on higher import tariffs to consumers only gradually. However, the report also indicates that tariff effects are beginning to filter through into prices for consumer goods and intermediate products.

These figures will feed into the Personal Consumption Expenditures (PCE) index later this month – the Fed’s preferred measure of inflation.

Eurozone

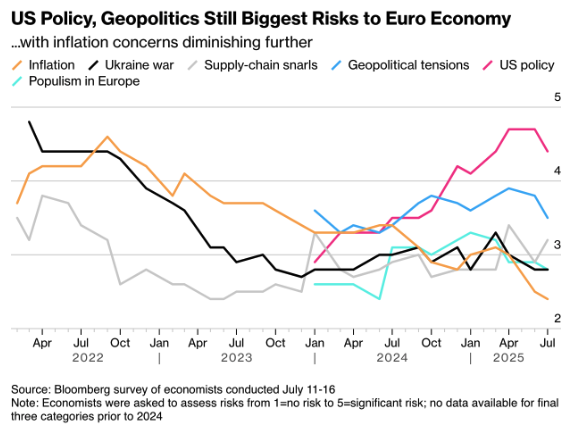

As expected, the European Central Bank left interest rates unchanged in July. According to a Bloomberg survey, 47% of economists anticipate one additional rate cut in September, while 21% expect the next move to come in December. Notably, half of the respondents believe the ECB could pause for up to three meetings without markets assuming that the easing cycle is over.

However, uncertainty is rising. ECB Executive Board member Isabel Schnabel described the bar for another rate cut as “very high,” while Olli Rehn and François Villeroy de Galhau warned that inflation may undershoot the target – suggesting a growing divergence within the Governing Council.

The euro has gained 12% against the dollar so far this year and is now trading around $1.16. ECB Vice President Luis de Guindos recently called $1.20 a potential pain threshold, although most analysts emphasize that the pace of appreciation matters more than the absolute level.

Geopolitical risks also cloud the outlook. A comprehensive trade agreement with the United States remains elusive, while Donald Trump has threatened to impose 30% tariffs on European imports – a move that could further complicate monetary and trade policy.

United Kingdom

UK inflation unexpectedly accelerated in June, rising to 3.6% year-on-year (up from 3.4% in May) – the highest reading since January 2024. The increase surprised both markets and the Bank of England.

The rise was driven by higher food prices (+4.4%) and persistently elevated services inflation (+4.7%), the latter fueled in part by wage pressures following April’s increases in the minimum wage and income tax.

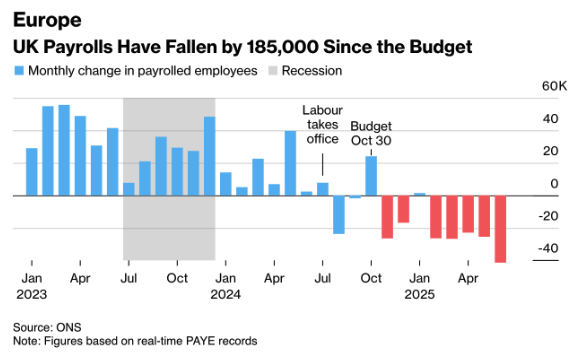

At the same time, labor market indicators continue to soften, with unemployment ticking higher – adding to the stagflationary concerns facing the Bank of England as it navigates its next policy steps.

Markets continue to price in a first interest rate cut by the Bank of England on August 7, but expectations for further easing have softened. The implied rate cut for 2024 has narrowed from 53 basis points to 49.

The combination of stubborn inflation and a weakening labor market is heightening concerns about stagflation – a scenario that policymakers are finding increasingly difficult to dismiss.

China

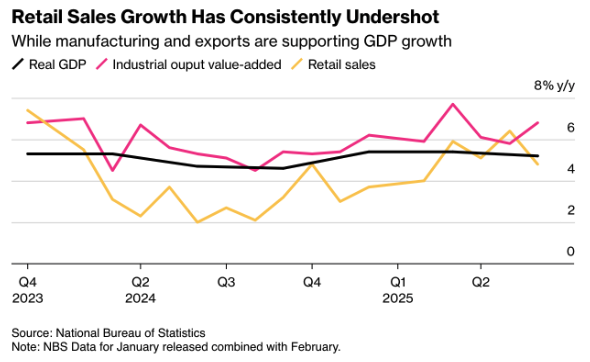

China’s economy grew by 5.2% year-on-year in the second quarter, slightly beating expectations (consensus: 5.1%) and following 5.4% growth in Q1. The expansion was largely driven by robust industrial production and resilient exports, despite a steep 24% decline in shipments to the United States. So far, the negative impact of Trump’s tariffs has been offset by frontloading and redirecting trade flows to alternative markets.

However, signs of domestic weakness are becoming more pronounced. Retail sales rose by just 4.8% year-on-year in June – well below expectations. Notably, spending declined in categories such as alcohol, cosmetics, and hospitality. Only government-subsidized purchases of electronics and furniture offered limited support.

In contrast, industrial production rose by 6.8% year-on-year, fueled by a strong rebound in manufacturing, which expanded by 7.4%. However, this supply-side momentum stands in stark contrast to weak domestic demand, raising concerns about a growing structural imbalance in the economy.

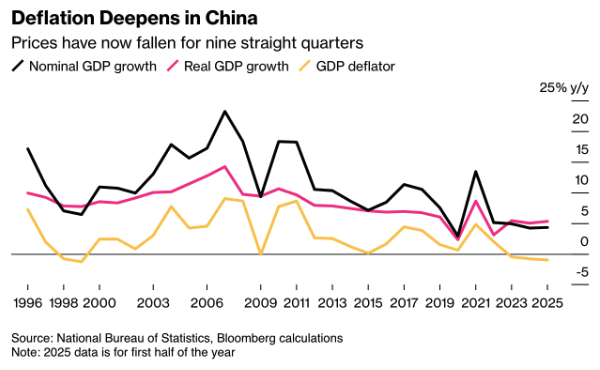

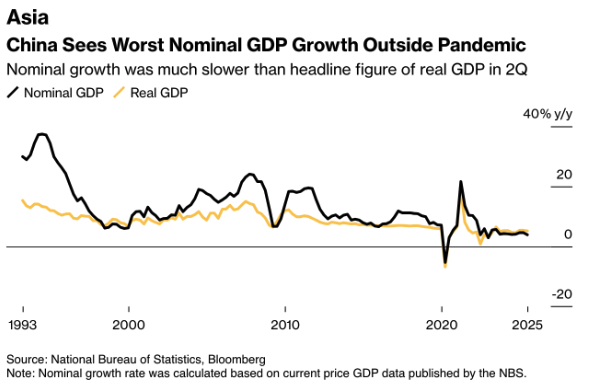

The GDP deflator – a broad measure of overall price trends – declined for the ninth consecutive quarter, marking the longest stretch of deflation since records began in 1993. (See chart: Deflation Deepens in China – NBS/Bloomberg.) This persistent deflationary trend is eroding corporate margins and weakening consumption dynamics. It is being reinforced by excess capacity in the manufacturing sector and a continued decline in housing prices.

Despite government support measures – including subsidies funded by ultra-long-term government bonds – consumer spending remains subdued. The share of consumption in GDP growth declined from over 60% last year to 52% in the second quarter, while real estate investment contracted by 11.2% in the first half of the year.

Outlook: Analysts expect growth to slow to below 4.5% in the second half of 2025, partly due to the fading impact of frontloaded exports and the looming risk of renewed U.S. tariffs once the current surcharge moratorium expires in mid-August.

Looking Ahead:

The upcoming week will be driven by central bank signals and fresh data on consumer confidence, manufacturing activity, and capital investment. The ECB is expected to hold steady, but markets will be focused on any forward guidance. Fed Chair Jerome Powell speaks on Tuesday, and detailed economic data from both the U.S. and the U.K. could prove pivotal in shaping expectations for a potential rate move in September.

In China, despite robust GDP growth, deflationary pressures remain a key structural risk, underscoring the fragility of the domestic recovery.

United States

While headline inflation remained subdued in June, underlying data suggests that tariffs are beginning to filter through more broadly. Commodity categories such as white goods, furniture, and toys recorded their strongest monthly price increases in years, even as auto prices continued to decline.

In a speech on Tuesday, Fed Chair Jerome Powell addressed these developments against the backdrop of a divided Policy Committee. The key question: are we witnessing a one-off price shock, or the early signs of more persistent structural inflation?

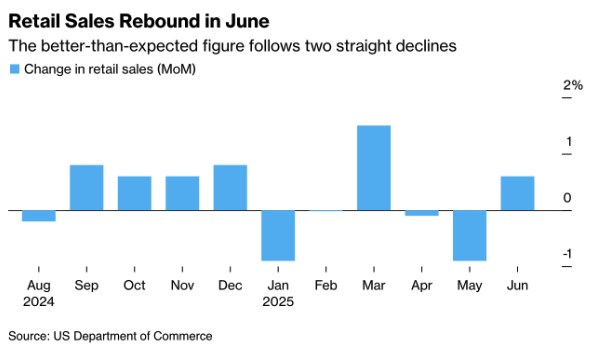

Retail sales data surprised to the upside, with gains recorded in 10 of 13 categories – indicating resilient consumer demand. Markets now turn to Friday’s release of durable goods orders. After two consecutive monthly declines, only a modest rebound is expected, which may reflect growing caution around business investment.

United States

The U.S. housing market continues to struggle under the weight of high interest rates and elevated home prices. Existing home sales, due Wednesday, are expected to decline further, reinforcing the sector’s sensitivity to monetary policy.

Markets remain focused on a potential first rate cut in September, but the path beyond that is far from clear. For the Federal Reserve, the key questions remain the sensitivity of services inflation to interest rates and the durability of current disinflation trends.

Eurozone

This Thursday’s ECB meeting will be closely watched. While no policy change is expected, President Lagarde’s tone will be critical in shaping market expectations for September and beyond. Last week’s Bloomberg survey revealed that market participants are divided over the timing of the next move, amid growing structural concerns around weakening external demand and a strengthening euro.

The ECB is widely expected to leave its key interest rate unchanged at 2.00% — the final decision before the summer break. A policy response to the threat of 30% U.S. tariffs is unlikely at this stage, as the economic impact remains uncertain.

The Governing Council is expected to once again flag growth risks as “tilted to the downside,” even as inflation remains close to target. The euro’s appreciation and ongoing uncertainty surrounding France’s fiscal position are also weighing on the medium-term outlook.

Markets are increasingly pricing in a possible rate cut in September, contingent on the ECB’s updated macroeconomic projections. With inflation near target but growth risks mounting, the outlook for further easing remains finely balanced.

United Kingdom

UK inflation unexpectedly rose to 3.6% in June, driven by higher food prices and persistently elevated services inflation – the latter reflecting continued wage pressures. At the same time, the labor market showed further signs of softening: the number of jobs has declined by 185,000 since the spring budget, and the unemployment rate edged up to 4.7%.

United Kingdom

The Bank of England remains under pressure. While a rate cut on August 7 still appears likely, the room for additional easing is narrowing.

Markets will be closely watching Thursday’s flash PMI releases. The services sector is expected to remain just above the 50 threshold – signaling modest expansion – while manufacturing continues to contract. On Friday, retail sales figures are due. After two consecutive monthly declines, a moderate rebound is anticipated, although margin pressure and subdued consumer confidence continue to weigh on the outlook.

China

Despite second-quarter GDP growth of 5.2%, keeping China on track to meet its annual target, underlying signals point to persistent weakness. Nominal GDP growth slowed to just 3.9% – the lowest reading outside the pandemic since 1993 – highlighting the structural nature of the country’s deflationary pressures.

Industrial production and exports continue to support China’s growth, but retail sales declined again in June. The contribution of consumption to GDP growth fell to 52%, while overall price levels remain under pressure.

Deflationary dynamics persist, prompting the People’s Bank of China to maintain a cautious stance. Broad interest rate cuts have been avoided, with policymakers instead favoring targeted stimulus through structural credit channels. On Monday, markets expect the Loan Prime Rate to remain unchanged.

Japan

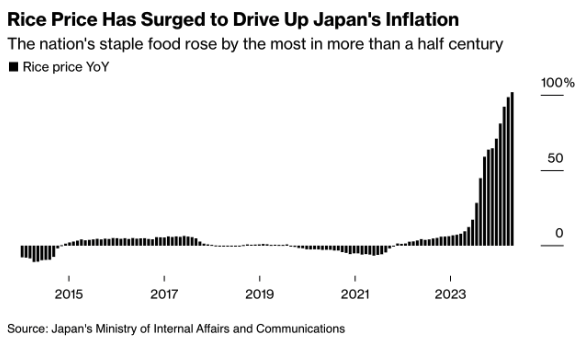

Inflationary pressures in Japan are building, driven in part by the sharpest rise in rice prices in decades. The Bank of Japan is expected to revise its inflation forecasts at the upcoming policy meeting.

However, whether this leads to a policy shift remains uncertain. Growth momentum remains tepid, and the recent appreciation of the yen adds a layer of complexity to the BoJ’s decision-making.

Macro-economic agenda upcoming week:

Monday

CH – Loan Prime Rate

Tuesday

AUS – RBA meeting minutes

US – Fed Chair Powell Speech

Wednesday

US – Existing Home Sales

NL – Consumer Confidence

Thursday

DE – GfK Consumer Confidence. HCOB manufacturing PMI flash

UK – S&P global manufacturing PMI flash, S&P Global Services PMI Flash

EU – Deposit Facility Rate, ECB interest rate decision, ECB press conference

Friday

UK – Retail sales MoM

DE – Ifo business climate

US – Durable goods orders MoM