United States

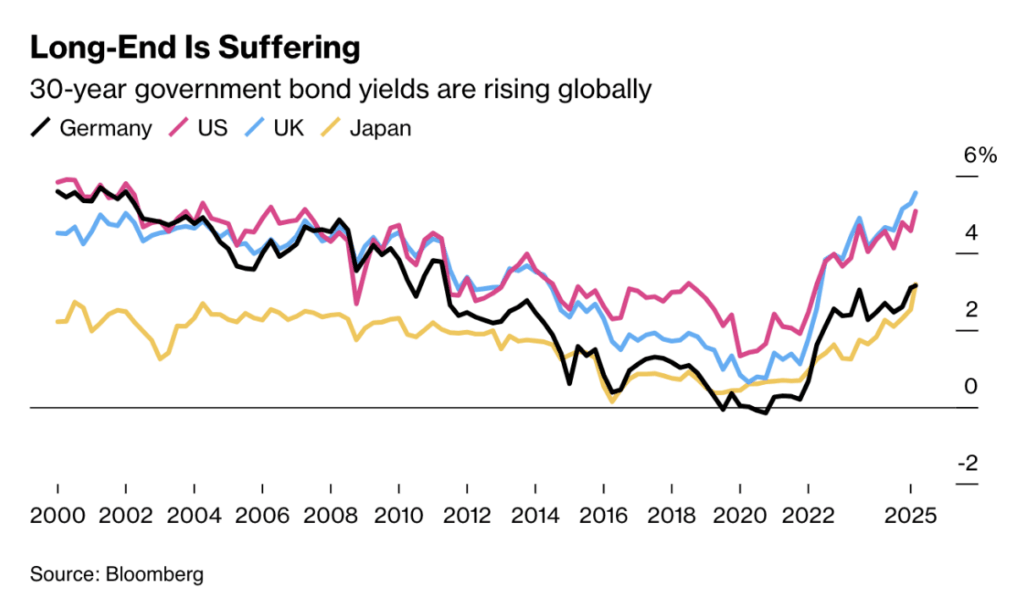

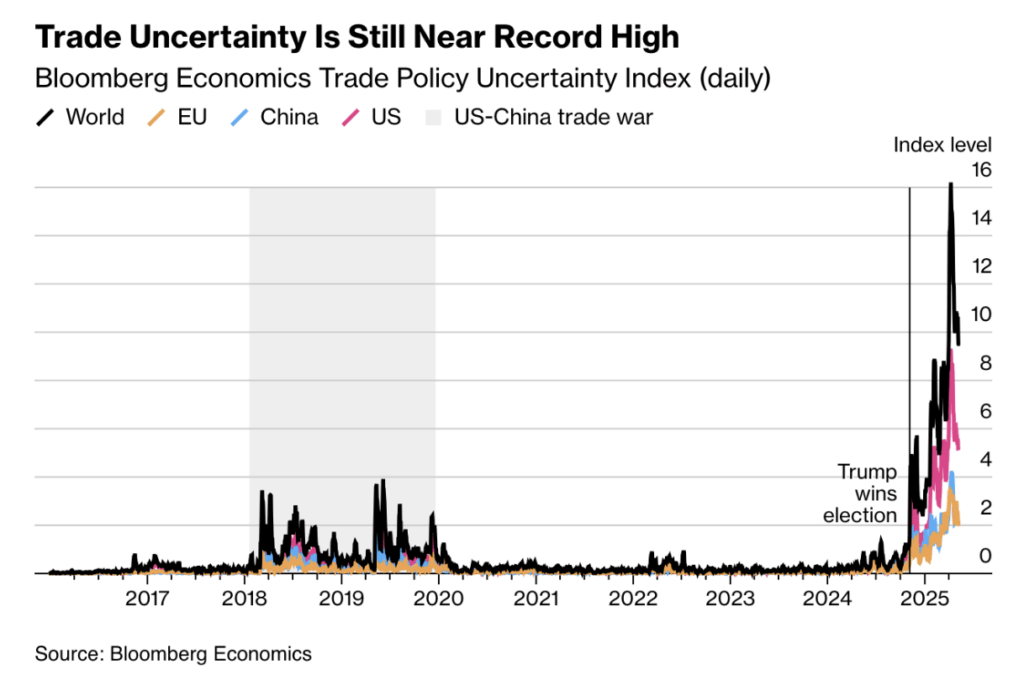

While Trump grabbed headlines late last week with a new tariff threat—proposing a 50% levy on EU goods and 25% on foreign smartphones—the broader issue of the U.S. budget also returned to the spotlight on Friday. Long-term U.S. interest rates edged slightly lower following comments by Treasury Secretary Scott Bessent on Bloomberg TV, while renewed trade tensions pushed the dollar back up toward the upper end of the 1.13 range.

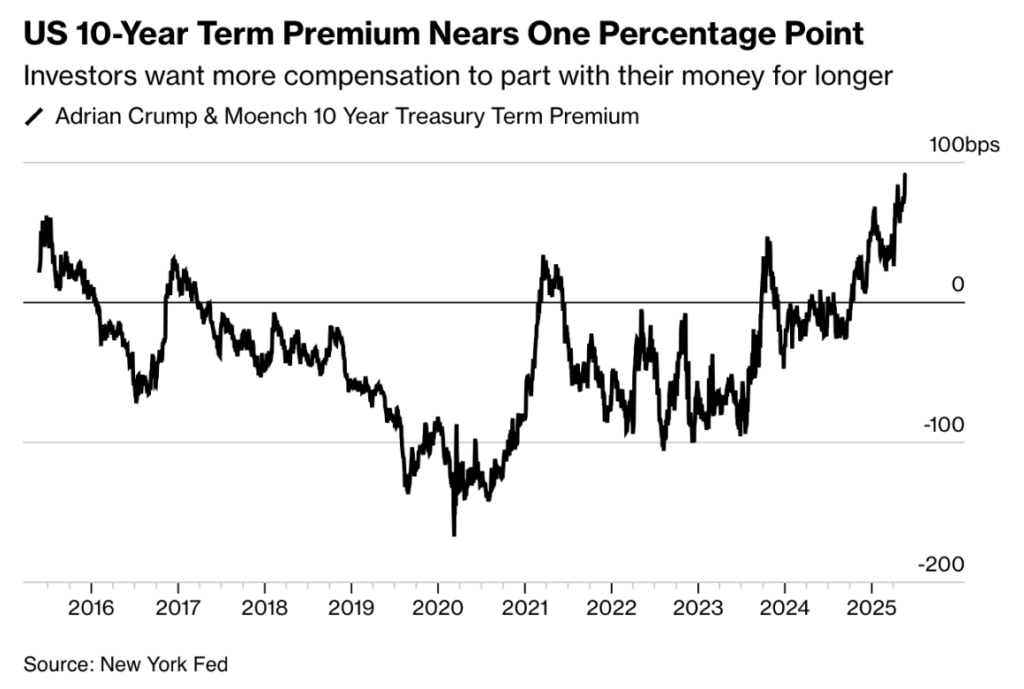

Bessent suggested that the deregulation of capital requirements for banks—specifically the Supplementary Leverage Ratio (SLR) applied to Treasury holdings—could be rolled out as early as this summer. Such a move would allow banks to hold more government bonds, boosting demand for long-term Treasuries. This appears increasingly necessary at a time when the dollar, and dollar-denominated debt, are coming under pressure.

“We are very close to a change,” Bessent said.

Consequences and Market Response

If the proposed policy change goes through, demand for long-term Treasuries could increase, easing upward pressure on interest rates over time and helping to flatten the yield curve.

Still, the market remains cautious. Bessent attempted to calm concerns by arguing that budget deficit projections are “distorted by overly pessimistic growth forecasts,” and that higher import tariffs would soon generate additional revenue. However, analysts—like JPMorgan’s Priya Misra—remained skeptical:

“Ultimately, it’s about fundamental supply and demand, and the economy. That puzzle hasn’t been solved yet.”

Fed Signals Steady Rates

Federal Reserve officials continue to strike a measured tone. “We don’t want short-term inflation expectations to spill over into the long term,” said St. Louis Fed President Alberto Musalem on Friday.

His outlook: interest rates are likely to remain at their current levels for now. He estimates the probability of a return to pre-pandemic interest rate levels at just 20%.

US-China – Tariff Cut Signals Thaw

The biggest surprise of the week came out of Geneva: the U.S. and China agreed to mutually reduce tariffs. U.S. tariffs on Chinese imports will drop from 145% to 30%, while Chinese tariffs on U.S. goods will fall from 125% to 10%. A newly formed negotiating team will work toward a more comprehensive agreement over the next three months.

Treasury Secretary Scott Bessent described the move as “a strategic decoupling, not a full one.” Notably, the agreement only covers bilateral tariffs—it does not apply to broader levies on commodities, technology, or other sectors.

Market Reaction and Outlook

Markets rallied on the news: the S&P 500 rose 3%, the yuan gained 0.5%, and both oil prices and bond yields moved higher. The EUR/USD also climbed, as the trade truce eased global uncertainty—for now.

Still, not all tensions are resolved. Targeted tariffs on sectors like semiconductors, pharmaceuticals, and steel remain in place. The road to full normalization is anything but straightforward.

Europe – Confidence Continues to Erode

This week’s data from Europe delivered a clear message: confidence is slipping. Preliminary consumer confidence fell further to -14.2, while the manufacturing PMI remained stuck at a weak 45.9. The services sector fared slightly better, with a PMI of 52.3—just managing to stay in expansion territory.

Europe – ECB Pushes Back on Inflation Spillover Fears

Trump’s threat to impose 50% import tariffs on all EU goods starting June 1 is stirring growing concern in Frankfurt. While the ECB does not officially respond to trade policy, several board members have warned about potential second-round inflation effects and a decline in business confidence across Europe.

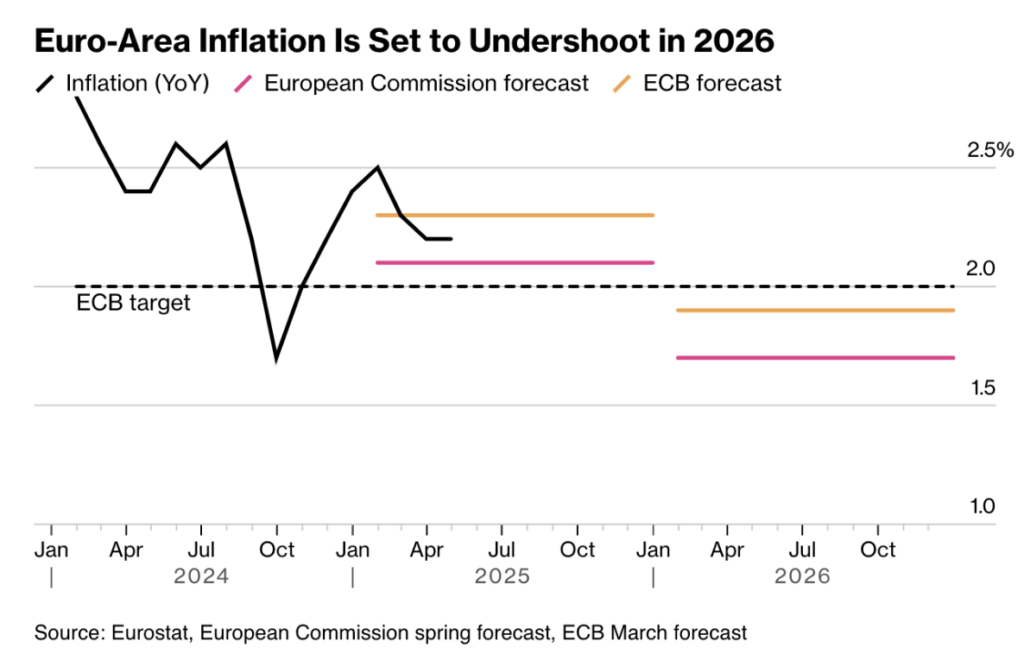

The idea that U.S. inflation will automatically spill over into Europe? According to ECB Chief Economist Philip Lane, that notion is “not well founded.” Speaking in Florence on Friday, he emphasized that inflation in the eurozone is “under our control” and not tied to U.S. price dynamics.

And if the U.S. ends up tightening policy more aggressively in response to its own inflation? Lane argued that such a move would likely slow the global economy and could actually drive European prices lower—especially through weaker export demand and dampened economic activity. His remarks were a clear response to fears that Trump’s tariffs might fuel inflation in the U.S. but could, paradoxically, prove deflationary for Europe.

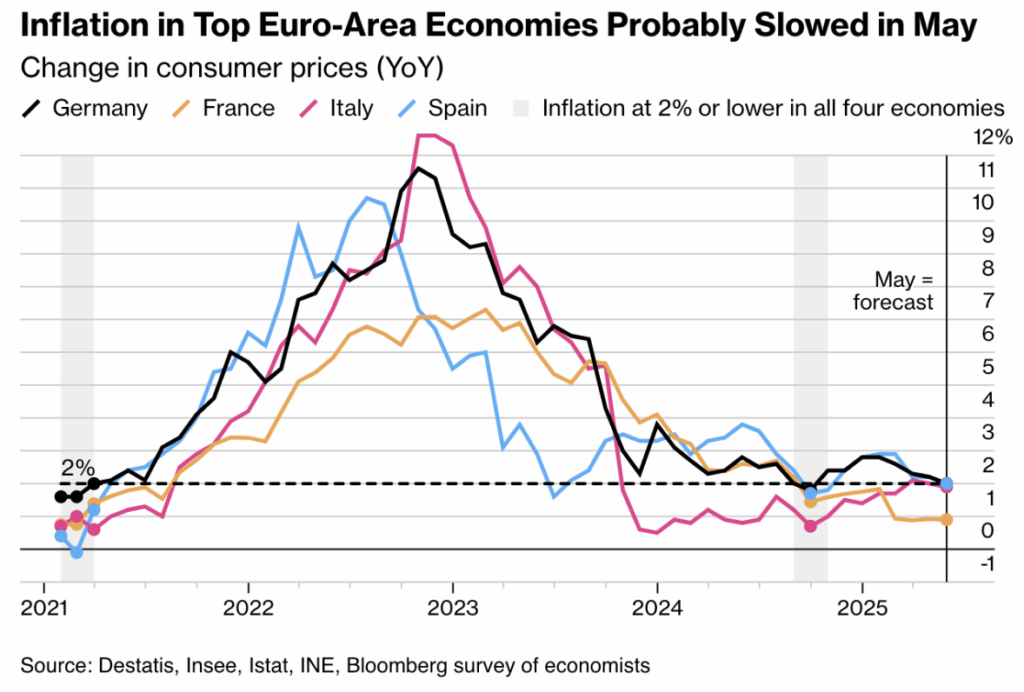

Lane’s comments come at a pivotal moment for the ECB. Inflation in the eurozone briefly reached 2.2% in April, but economists expect it to fall back below 2% in May. The European Commission this week forecast an average inflation rate of just 1.7% for 2025, and the ECB is also anticipating inflation to remain below target in 2026.

ECB Signals More Easing Ahead

“Interest rates may need to remain mildly supportive to prevent inflation from falling too low,” said Belgian central banker Pierre Wunsch. Another rate cut is already on the table for June, and markets are now even pricing in a possible ninth cut later this year.

Despite a stronger euro and falling energy prices, the inflation outlook remains more complex than it appears.

ECB Executive Board member José Luis Escrivá noted on Wednesday that the euro’s recent appreciation is “not a normal reaction” in the current market environment. Typically, geopolitical tensions or trade uncertainty would trigger a flight to the U.S. dollar—yet this time, the opposite is occurring.

Escrivá also highlighted that declining energy and commodity prices will likely put additional downward pressure on inflation in the near term. These dynamics will be reflected in the ECB’s updated growth and inflation forecasts, set to be released alongside the next rate decision on June 5. A 25 basis point cut — marking the eighth in this cycle — now appears all but certain.

But the ECB isn’t ruling anything out. “We present multiple scenarios,” said Escrivá, “because the impact of Trump’s tariffs is complex and difficult to calibrate.” Whether or not Europe responds with countermeasures will significantly influence how tariffs affect import prices, consumer confidence, and industrial supply chains.

One key message: the current disinflation trend could continue—or abruptly reverse—depending on developments in energy supply or wage dynamics. As a result, the ECB is leaving the door open, both for further easing and for a more cautious approach if circumstances shift.

United Kingdom – Inflation Surprises, Rate Cut Delayed

UK inflation came in higher than expected in April, with headline CPI at 3.3%. Services inflation remains particularly stubborn at 5.5%. Bank of England Governor Andrew Bailey called the figures “uncomfortable” and signaled caution around the timing of future rate cuts.

Adding to the mixed picture, retail sales disappointed on Friday, falling 0.4% month-over-month—a sign of weakening consumer demand. Markets have now pushed back expectations for the first rate cut, shifting the likely timing from August to September.

China – Industry Steady, Consumers Wary

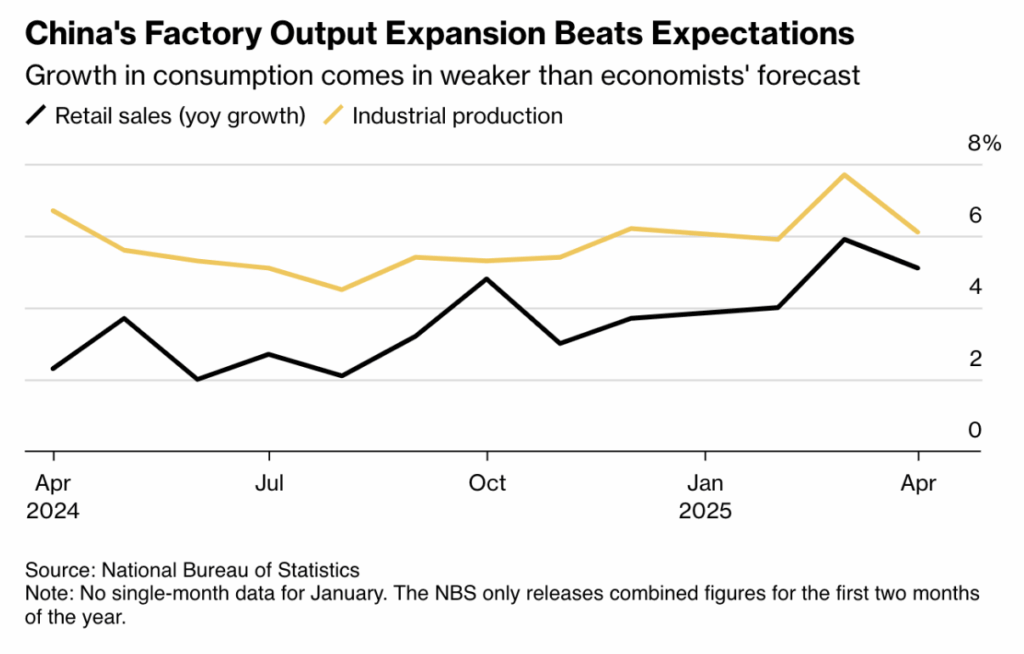

April’s data paints a mixed picture of China’s economy—showing resilience in industry but ongoing weakness in consumer demand. Industrial production rose by a stronger-than-expected 6.1% year-on-year, supported by a rebound in exports to Europe and Southeast Asia following the temporary easing of trade tensions with the U.S.

On the domestic front, however, momentum is fading. Retail sales grew by 5.1%, missing expectations and slowing from March’s pace. Car sales were particularly weak, rising just 0.5% after a 5.5% increase the previous month.

Despite government subsidies on new electronics and furniture, consumer sentiment remains fragile. Households continue to prioritize saving and paying down debt—a reflection of lingering caution after years of real estate instability and deflationary pressures.

The property sector remains a major drag: home prices declined again in April, and investment in real estate continued to contract. While the overall unemployment rate edged down slightly to 5.1%, youth unemployment remains high, with many young people still unemployed or underemployed.

Infrastructure investment remained stable, supported by increased government bond issuance. However, manufacturing investment showed signs of slowing—likely a reflection of caution amid ongoing geopolitical uncertainty. Both Bloomberg and Citi expect that additional stimulus measures will be needed in the second half of the year.

Despite gains in industrial output and exports, concerns persist about the uneven nature of China’s recovery. Both Goldman Sachs and ING have slightly raised their growth forecasts, yet they still fall short of Beijing’s 5% target. The general expectation is that more support—either from the PBoC or through fiscal measures—will be needed, especially if consumer spending fails to rebound soon.

For global markets, this translates into continued pressure on the yuan, a deflationary tilt from China, and limited support for global demand from the world’s second-largest economy.

The Week Ahead – Markets on Edge

Markets are running on tension. After weeks dominated by geopolitics, interest rate speculation, and policy uncertainty, fundamentals return to the spotlight: consumer confidence, spending, and inflation. The outlook: a week of directional signals, precisely because underlying trends are pulling in opposite directions. The key question—can consumers stay resilient in the face of growing headwinds?

Europe – All Eyes on Inflation and Lagarde

On Monday, ECB President Christine Lagarde will speak—a pivotal moment for markets. Her tone could prove decisive: will she stay the course on a June rate cut, or will escalating U.S. trade threats weigh more heavily in the ECB’s risk calculus?

On Friday, preliminary German inflation data for May will be released—a crucial data point for the ECB’s policy path. A drop toward 2% would further justify upcoming rate cuts. Germany’s GfK consumer confidence index is also due Tuesday, where modest optimism is expected following recent stabilization in energy prices.

Inflation figures from France (Tuesday), and from Spain and Italy (Friday), will add to the picture. If all four of the eurozone’s largest economies report inflation below 2%, it would mark the first time since 2021 this threshold is met—strengthening the case for the ECB to proceed with easing. This would reinforce market expectations for a rate cut at the June 6 meeting.

United States – Key Data to Clarify the Fed Outlook

A wave of U.S. economic data this week could bring clarity to the Federal Reserve’s policy trajectory.

On Tuesday, durable goods orders will be released—an important indicator of whether businesses are still investing despite uncertainty around tariffs and interest rates. Thursday brings the second estimate of Q1 GDP, offering further insight into the strength of the U.S. growth path.

The Fed will release the minutes from its early May FOMC meeting on Wednesday. Markets expect to see growing divisions within the central bank: inflation remains stubbornly high, while economic momentum appears to be weakening.

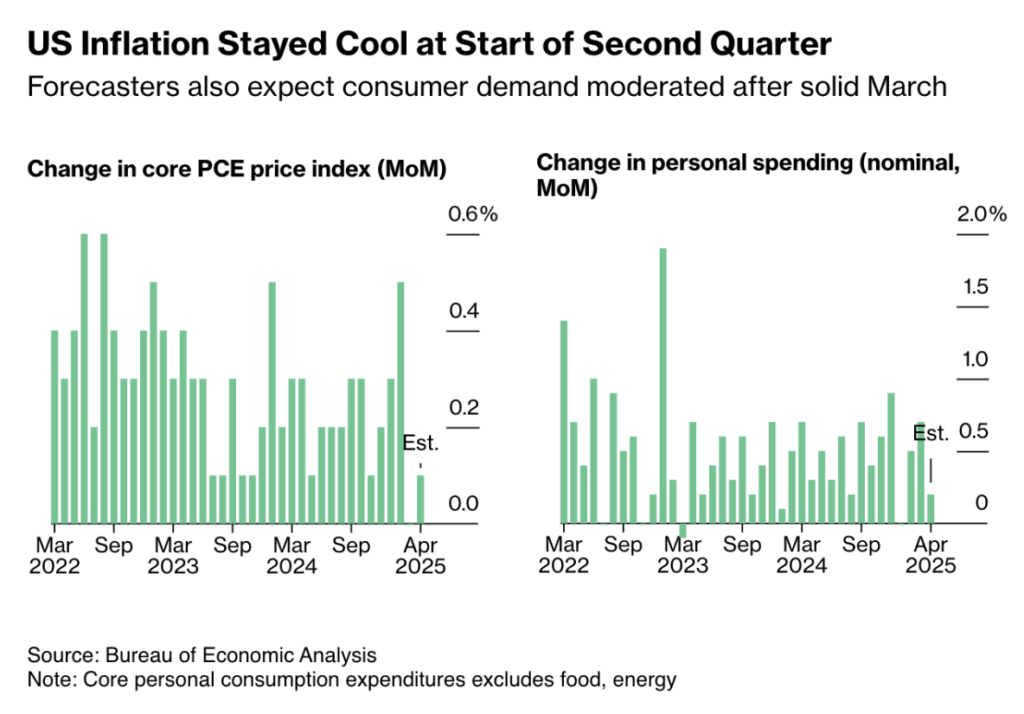

The spotlight shifts to consumers on Friday, with data on personal spending, incomes, and the Core PCE index—the Fed’s preferred inflation gauge. Core PCE inflation is expected to have risen just 0.1% in April, signaling easing price pressures. Still, analysts caution that the full impact of Trump’s new tariffs won’t show up until May or June.

For now, the Fed is likely to stay on hold, especially with the labor market continuing to show resilience.

Regional Fed officials, including John Williams and Neel Kashkari, are scheduled to speak this week, with Fed Chair Jerome Powell delivering a speech at Princeton on Sunday. Their tone will be closely watched by markets. Any suggestion of a slower path toward rate cuts would likely bolster the U.S. dollar.

Asia – Focus on Confidence, Production, and Policy

On Thursday, Japan will release its consumer confidence data. A slight improvement is expected, though sentiment remains below historical norms. The yen continues to trade weak, but with domestic demand still subdued, the Bank of Japan is unlikely to tighten policy anytime soon.

Friday brings a slew of Japanese data, including unemployment, retail sales, and inflation. Inflation is expected to hold steady around 2.3%, keeping pressure for policy shifts minimal. Still, the BoJ will be watching closely for signs of domestic weakness, especially as exports slow and industrial output softens.

In China, April’s industrial profit figures are due Tuesday. Deflationary pressures and trade uncertainty are likely to weigh on results.

Also on Friday, South Korea and Japan will publish industrial production data, with a risk of contraction in both. Meanwhile, the central banks of South Korea and New Zealand are set to announce policy decisions this week—both are seen as potential candidates for a 25 basis point rate cut.