The past week was marked by a series of inflation and growth figures that confirmed the picture of a cooling yet still resilient global economy. While China’s growth slowed to its lowest pace in a year, inflation in the UK and the US continued to ease, further increasing the pressure on central banks to end their tightening cycle.

China

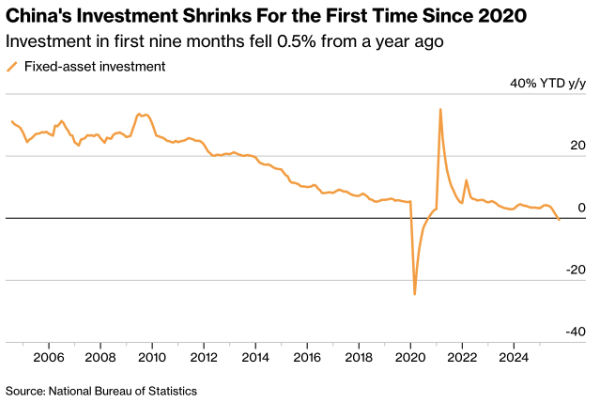

The Chinese economy grew by 4.8% year-on-year in the third quarter, slightly stronger than expected, thanks to exceptionally strong exports. Yet this growth conceals a deeper problem: domestic investment contracted for the first time since 2020, falling 0.5% in the first nine months of the year. The chart “China’s Investment Shrinks for the First Time Since 2020” (source: National Bureau of Statistics) underscores how the ongoing property crisis and weak private demand expose the structural vulnerabilities of the economy.

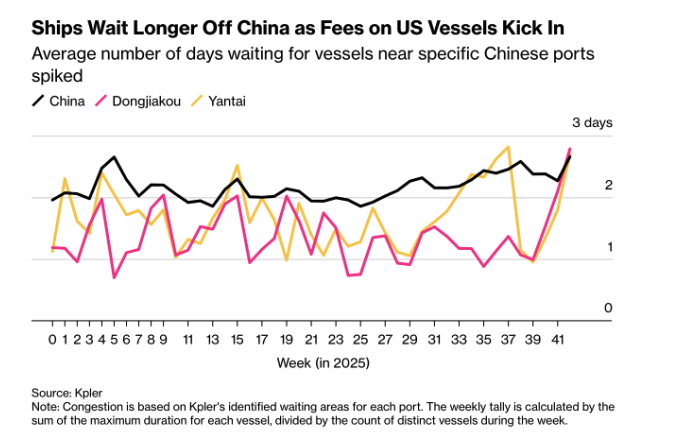

At the same time, trade is stalling amid rising tensions with the United States. New port surcharges on American vessels have led to the longest waiting times of the year at Chinese ports. The congestion reflects how geopolitical friction is once again disrupting global logistics and underscores that China’s growth still depends on external demand in an increasingly hostile trade environment.

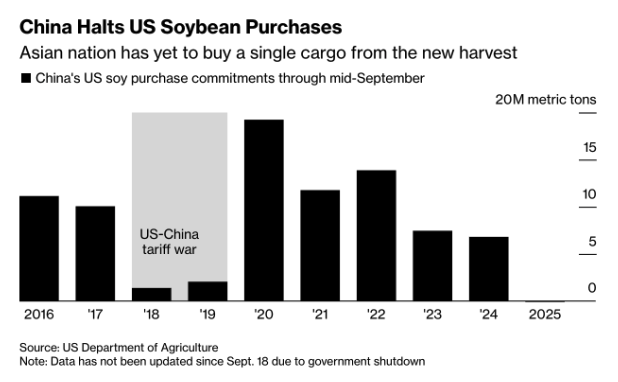

Tensions between China and the United States also appear to be easing after news that Beijing will once again purchase “substantial” quantities of American soybeans. The announcement, following talks between Treasury Secretary Scott Bessent and Vice Premier He Lifeng in Malaysia, suggests that both countries are seeking to stabilize their trade relationship. The decision comes at a crucial moment for American farmers, who have been hit hard in recent months by the absence of Chinese purchases.

The chart “China Halts US Soybean Purchases” shows how imports of American soybeans have almost completely stopped since the summer, with not a single shipment from the new harvest taken so far (source: US Department of Agriculture). A resumption of imports may offer temporary relief, but the structural shift is clear: China is increasing its reliance on suppliers such as Brazil while boosting domestic production to reduce exposure to future geopolitical pressure.

Eurozone

Christine Lagarde’s speech confirmed that the ECB is, for now, content with the current rate level. She noted that inflation is moving toward 2% and that further easing will only be considered if growth weakens further. Consumer confidence in the euro area improved slightly from -12.2 to -11.6, supported by lower energy prices and a stable labor market. In Germany, the HCOB Manufacturing PMI remained at 46.9, signaling that the industrial recession continues despite some easing in supply chain pressures.

Tensions between China and Europe over technology are rising after Wingtech Technology warned of financial damage following the Dutch government’s seizure of its chip subsidiary Nexperia. In its quarterly report, the company stated that if it does not regain control over Nexperia by the end of 2025, revenue, profit, and cash flow will come “under temporary downward pressure.”

Although Wingtech reported year-on-year revenue growth of 12.2% in its semiconductor division in the third quarter, the company emphasized that the impact of the dispute with The Hague is difficult to quantify. The Dutch intervention followed U.S. pressure to prevent Nexperia – a supplier to companies including Volkswagen – from continuing to operate under Chinese influence.

The issue strikes at the heart of the global technology race. Beijing warned that the decision threatens the stability of global supply chains, while The Hague described it as an attempt at “constructive dialogue.” The affair illustrates how national security considerations increasingly collide with industrial interests – and how Europe has unintentionally become a frontline in the technological power struggle between Washington and Beijing.

France

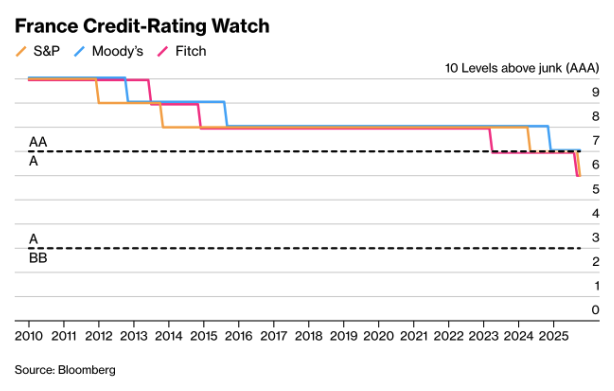

Moody’s downgraded France’s credit outlook from stable to negative, citing growing political fragmentation and the government’s inability to implement structural reforms. The move follows earlier downgrades by S&P, Fitch, and DBRS, underscoring mounting concerns over the country’s 5.4% of GDP budget deficit and rising debt ratio.

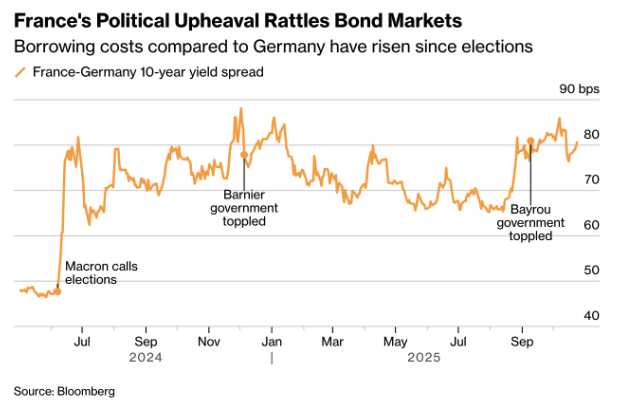

Prime Minister Sébastien Lecornu is attempting to reach a new budget compromise after suspending the pension reform, but divisions within parliament complicate any effort toward fiscal consolidation. French bond yields continued to rise, with the spread against Germany widening to 81 basis points – the highest level in nearly two weeks. Pressure on the government is increasing to reduce the deficit to a maximum of 4.8% by 2026, in line with calls from the Banque de France to stabilize the debt.

(Charts: “France Credit-Rating Watch” and “France’s Political Upheaval Rattles Bond Markets” – source: Bloomberg)

United Kingdom

Inflation in the UK fell more sharply than expected in September to 2.8% year-on-year, with core inflation at 3.8% – the lowest level in two years. Retail sales rose 0.5% month-on-month, indicating a cautious rebound in consumer activity. The composite PMI held steady at 51.1, just above the contraction threshold. The combination of lower inflation and moderate growth supports the outlook that the Bank of England will keep rates unchanged until early 2026.

Japan

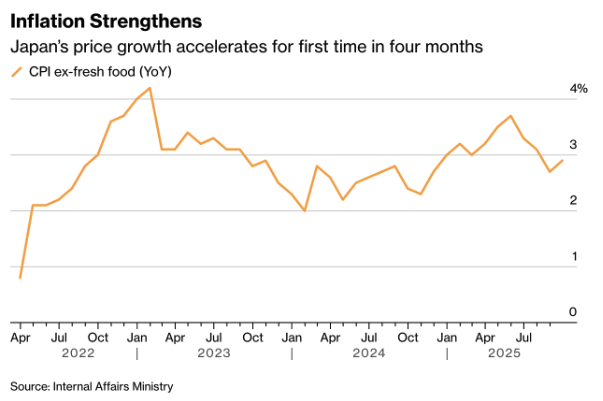

Japan’s trade balance showed a surplus of ¥675 billion in September, supported by export growth of 4.6% year-on-year, while imports stagnated. CPI remained stable at 2.6% year-on-year, marking the ninth consecutive month that inflation has stayed above the Bank of Japan’s target. Pressure on the central bank to take further steps toward policy normalization in November is therefore increasing.

United States

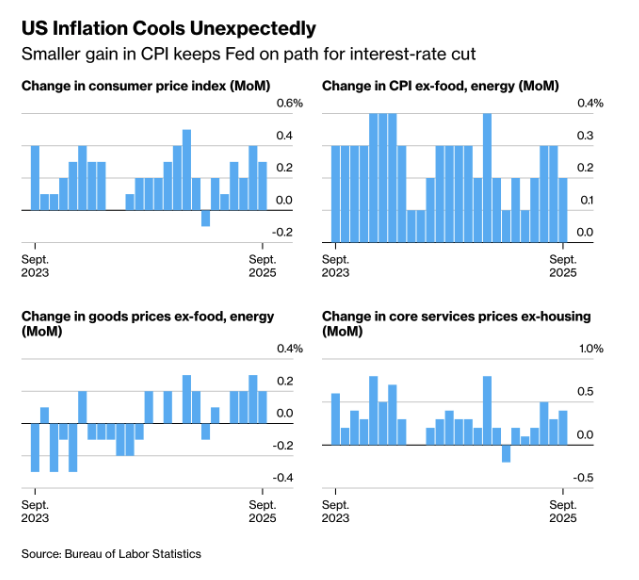

US inflation came in lower than expected in September, significantly raising the likelihood of another rate cut by the Federal Reserve. Core CPI rose only 0.2% month-on-month and 3.0% year-on-year, the smallest monthly increase in three months. Headline inflation also held at 3.0%, below the forecast of 3.1%. In particular, rent and other service costs weakened, with “owners’ equivalent rent” increasing by just 0.1%, the slowest pace since early 2021.

Goods prices were mixed: cheaper used cars and lower insurance premiums offset higher prices for clothing and household items, partly due to President Trump’s recent tariffs on consumer goods. Despite limited price pressures, the Fed remains alert to potential pass-through effects from tariffs in the months ahead. The data gained extra significance as, due to the government shutdown, it was the only official dataset released this month.

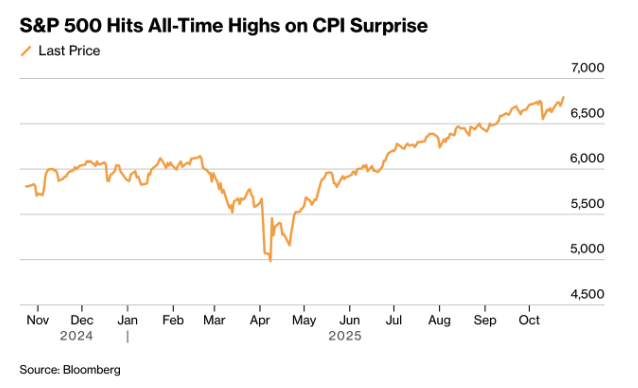

The S&P 500 rose nearly 1% and briefly broke through the 6,800-point mark after US inflation data came in lower than expected. The chart “S&P 500 Hits All-Time Highs on CPI Surprise” (source: Bloomberg) illustrates the market’s relief: weaker price pressures increase the likelihood of additional rate cuts by the Federal Reserve.

Investors see the Fed’s focus shifting from inflation to employment. Analysts note that the board under Jerome Powell appears willing to implement further easing as long as the labor market continues to cool without a sharp downturn. Two-year Treasury yields fell slightly to 3.48%, while the dollar weakened. Market sentiment remains cautiously optimistic, with at least one more rate cut expected before the end of the year.

Commodities – Coffee futures hit record highs amid tariffs and supply concerns

Another notable development this week was the surge in coffee prices to a new record in New York, with arabica futures climbing to $4.38 per pound, an increase of more than 50% since August. The chart “Coffee Prices Keep Climbing Due to Low Stocks, Brazil Drought” shows how a combination of low inventories, drought conditions in Brazil, and US import tariffs of 50% is putting additional pressure on the market.

Due to the introduction of tariffs, trade between the US and Brazil has almost come to a standstill, while Colombia also risks being hit by new duties. Exchange inventories have now fallen to their lowest levels since early 2024, and roasters in the US report holding only minimal stock. The market is therefore completely out of balance: there is coffee, but in the wrong place. As long as trade remains stalled, consumers around the world will continue to face record prices at the counter.

For the coming week

The week ahead will be dominated by interest rate and growth decisions, with a series of key releases from the US, Europe, and Japan. While inflation continues to cool globally, concern is growing that economies are slowing too sharply. The Fed, ECB, and BoJ will all meet in a week that could set the tone for policy heading into year-end.

North America

Markets are focused on the Federal Reserve’s rate meeting on Wednesday. After September’s inflation surprise, the Fed is expected to cut rates by 25 basis points, to a range of 4.75–5.00 percent. Investors will pay close attention to Powell’s remarks, which may hint at a second cut in December.

On Thursday, preliminary third-quarter GDP figures are due, with economists expecting growth of 1.8 percent quarter-on-quarter, a clear slowdown from 2.8 percent in Q2. Durable goods orders on Monday are expected to have fallen slightly by 0.5 percent month-on-month, while core PCE inflation on Friday is estimated at 0.2 percent month-on-month, consistent with the cooling trend that gives the Fed room to ease.

The softer US inflation figures for September have strengthened expectations of another rate cut by the Federal Reserve. Investors are pricing in a 25 basis point reduction, while some voices within the Fed are calling for a temporary halt to balance sheet reduction to limit liquidity risks. The focus is clearly shifting toward the labor market, where signs of cooling are becoming more evident.

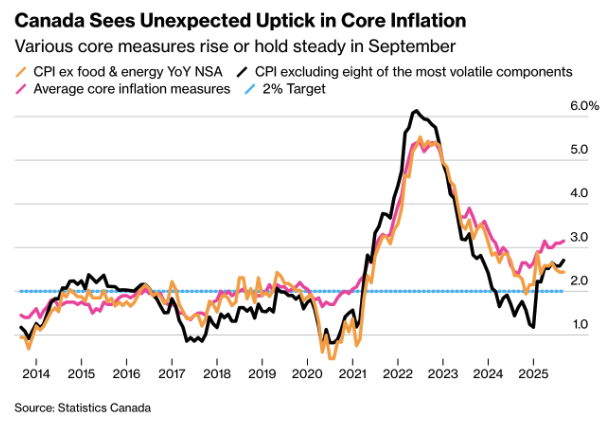

In Canada, easing is also expected. The Bank of Canada is projected to lower its policy rate to 2.25 percent, despite an unexpected uptick in core inflation. The chart “Canada Sees Unexpected Uptick in Core Inflation” (source: Statistics Canada) shows that the various core measures remained stable to slightly higher in September, averaging 3.15 percent. Still, the central bank sees enough room to support the slowing, tariff-hit economy. Upcoming GDP figures are likely to confirm that third-quarter growth remains weak.

Eurozone – ECB under pressure from slowing growth

On Thursday, the European Central Bank will also decide on policy. The consensus expects no new rate cut but does anticipate a dovish tone from Christine Lagarde, given the weak growth outlook. Preliminary GDP growth for Q3 is projected at just 0.1 percent quarter-on-quarter, while inflation is expected to fall from 2.9 to 2.6 percent year-on-year.

German figures reflect the broader picture: GDP is likely to shrink by 0.2 percent quarter-on-quarter, and preliminary inflation is set to decline to 2.3 percent year-on-year. The combination of falling prices and stagnant growth reinforces expectations that the ECB may have to cut rates again in December.

Japan – BoJ remains cautious

The Bank of Japan will close the week with its long-awaited policy decision on Thursday, bringing months of speculation about further normalization to a temporary pause. Most economists expect the central bank to keep rates unchanged, especially now that Prime Minister Sanae Takaichi, a strong advocate of monetary easing, has consolidated her position.

Attention will nevertheless focus on the voting split within the nine-member policy board after the unexpected division seen in September. The BoJ’s new quarterly economic outlook and accompanying policy statement may offer hints about the likelihood of a rate move later this year.

The chart “Inflation Strengthens” (source: Internal Affairs Ministry) shows that Japanese inflation accelerated for the first time in four months, increasing pressure on the BoJ.

Australia – inflation data to guide RBA policy

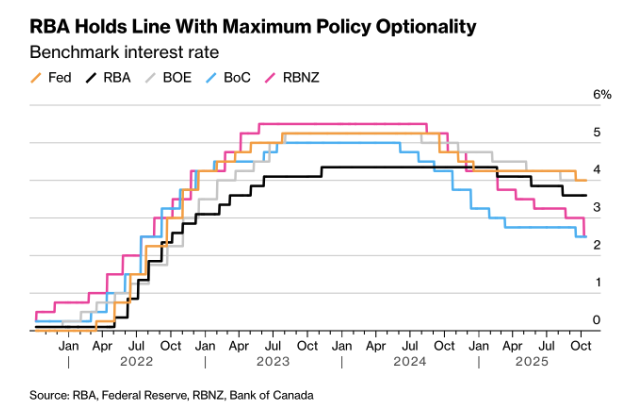

In the final week of October, attention shifts to Australia, where third-quarter inflation figures will be key for the Reserve Bank’s (RBA) policy decision on November 4. Although overall price pressures have eased, services inflation and goods prices remain stubbornly high, making the central bank cautious about further easing.

The chart “RBA Holds Line With Maximum Policy Optionality” (source: RBA, Federal Reserve, RBNZ, Bank of Canada) shows that the RBA is keeping its policy rate steady while deliberately maintaining maximum flexibility to tighten again if price pressures re-emerge. The upcoming inflation release will therefore be crucial in determining whether Australia has truly reached the end of its tightening cycle.

Macro-economic agenda for upcoming week:

Monday

DE – Ifo Business Climate

US – Durable goods orders MoM

Tuesday

DE – GfK Consumer Confidence

Wednesday

JPN – Consumer Confidence

US – Fed Interest Rate Decision, Fed Press Conference

Thursday

JPN – BoJ Interest Rate decision

DE – GDP Growth Rate QoQ/YoY Flash, Inflation Rate YoY Prel

EU – GDP Growth Rate QoQ/YoY Flash, Deposit Facility Rate, ECB interest Rate Decision, ECB Press Conference

US – GDP Growth Rate QoQ Adv

Friday

CH – NBS Manufacturing PMI

EU – Inflation Rate YoY Flash

US – Personal Spending MoM, Core PCE Price Index MoM, Personal Income MoM